随着2025年收官,传统金融机构与加密领域的意见领袖(KOL)纷纷发布对2026年的展望。市场共识正在凝聚:一个由机构资本、清晰监管和真实效用驱动的“结构性牛市”阶段或将开启,而市场的权力结构与价值逻辑也正在经历深刻重构。

一、机构视角:押注“以太坊之年”与结构性慢牛

以渣打银行(Standard Chartered)为代表的传统金融机构,正在以更精细的框架评估加密资产,其预测的调整本身即是市场成熟的信号。

1. 渣打银行:下调价格目标,但强化以太坊领跑预期

● 渣打银行数字资产研究主管Geoffrey Kendrick近期明确表示,尽管下调了以太坊(ETH)的绝对价格预测,但仍预计2026年将成为“以太坊之年”。

● 该行将ETH在2026年底的目标价从12,000美元下调至7,500美元,但对2028年及以后的长期目标更为乐观,新增了2030年40,000美元的预测。这一调整主要基于比特币整体表现不及预期,拖累了以美元计价数字资产组合的前景。

● 然而,渣打认为以太坊相对于比特币的基本面正在改善,预期ETH/BTC汇率将逐步回升。

其核心论据在于以太坊的结构性优势:在

1. 稳定币、现实世界资产(RWA)代币化和去中心化金融(DeFi)领域的主导地位;

2. 网络交易量因稳定币转移而创下新高;

3. 以及通过Fusaka等升级持续提升基础层容量。

4. 渣打预计,到2028年,稳定币和RWA市场规模可能扩大至2万亿美元,而其中大部分活动将在以太坊网络上处理。

2. 头部机构的共识:告别狂热周期,迎接价值整合

多家顶级投资机构的2026年展望报告呈现出高度一致的脉络,不再聚焦短期炒作,而是洞察行业的根本性转变。

● 灰度(Grayscale) 将2026年定义为 “机构时代的黎明” ,认为市场正从“散户周期”向“机构资本主导”转型,其驱动力在于宏观环境对稀缺数字资产的需求以及监管清晰度的提升。

● a16z 则跳出价格讨论,关注下一代加密产品如何被真实采用,提出了包括AI代理上链(KYA)、质押媒体、RWA加密原生化在内的17个落地方向。

● Bitwise 的态度最为乐观,认为由ETF资金(华尔街)和交易平台持仓(散户)构成的“双轮驱动”为牛市奠定了基础,并预测比特币将再创新高,且其波动率可能低于英伟达股票。

● Galaxy 和 VanEck 的预测则相对审慎。Galaxy指出市场不确定性高,比特币期权定价显示未来可能走向分化。VanEck则认为2026年更可能是“震荡之年”,市场波动性已降低,建议通过定投方式配置比特币。

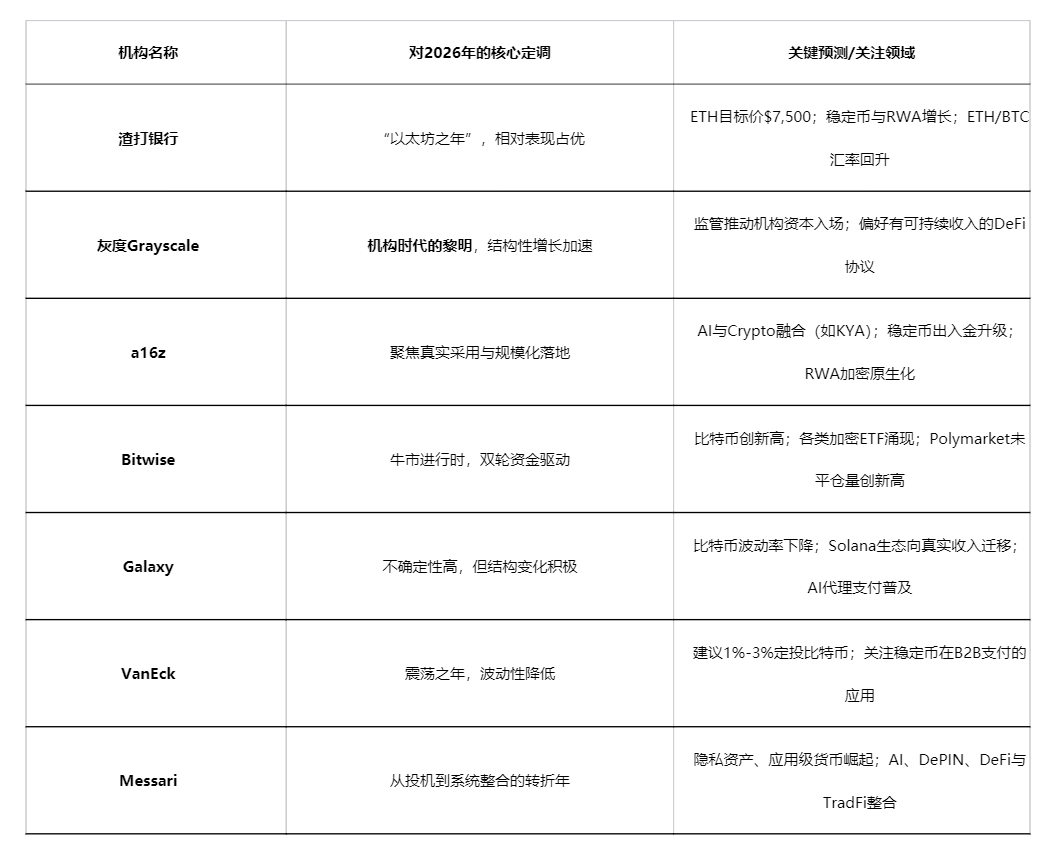

下表汇总了主要机构对2026年核心趋势的判断:

二、KOL洞察:趋势分化下的生存策略

相较于机构的宏大叙事,身处市场一线的KOL们提供了更具体、更多元的趋势判断和生存指南。

1. 核心赛道:AI、预测市场与基本面的回归

多位KOL指出,2026年的机会将出现在能够产生真实现金流或解决实际需求的领域。

● AI与区块链的融合 被多次提及。XHunt & Biteye创始人@DeFiTeddy2020认为,AI Agent与区块链的结合是确定性机会之一。Theory Ventures的Tomasz Tunguz预测,企业对AI代理的投入将首次超过人力成本。

● 预测市场 被寄予厚望。吴说主编Colin Wu和KOL加密猴哥@monkeyjiang都认为,随着2026年世界杯等大事件到来,预测市场(如Polymarket)可能迎来爆发。

● 回归基本面 成为共识。投资人@0xJeff指出,加密叙事退潮,项目是否可持续、是否真的创造价值成为新的评判标准。DeFi OG陈默@cmdefi则认为,行业将进入“代币利益绑定”时代,只有那些能将代币价值与协议收入、网络效应强绑定的项目才有未来。

2. 警惕风险与拥抱变化

KOL们也普遍提示了潜在风险。@DeFiTeddy2020提醒需要关注可能出现的7个黑天鹅事件。Real Vision创始人Raoul Pal建议投资者拉长周期、持有优质资产,并避免“借用信念”进行投资。这些观点共同指向一个更复杂、更专业的市场环境,要求参与者从“广撒网博趋势”转向“精准深度研究”。

三、权力转移:KOL、流动性与新价值框架

2025年的市场经历了一场静默的权力转移,深刻影响着2026年的游戏规则。

1. KOL:从传播者到“市场判断节点”

顶级加密KOL的影响力已在速度、信任和行动导向上超越传统财经媒体。他们不再是简单的信息搬运工,而是在信息过载时代为用户提供筛选、加工后的“观点”和“结论”的关键判断节点。市场定价越来越快地响应KOL的解读,形成了“谁先讲清楚故事,谁就影响定价”的新逻辑。然而,这种影响力正在经历残酷的内部筛选,依赖情绪煽动的“喊单型”KOL生命周期缩短,而提供可验证、有方法论支撑的“研究型”KOL正建立起长期的信任复利。

2. 流动性悖论与价值评估框架重塑

市场呈现出矛盾的流动性图景:比特币ETF等带来巨量机构资金,但除了比特币、以太坊及少数资产外,大多数山寨币陷入流动性枯竭。这由四重力量驱动:

● 机构资金受合规限制,形成只流入头部资产的“闭环”。

● 2021年高估值项目的代币进入解锁期,形成持续卖压(高FDV陷阱)。

● 散户行为“极化”,要么囤积比特币/以太坊,要么投机高波动的Meme币,中间地带的山寨币被抛弃。

● 全球资本在不同风险资产间竞争,加密市场并非唯一目的地。

在此背景下,旧的叙事逻辑(如DeFi、GameFi)可能失效,新的价值评估框架必须回归本质:

● 基本面:关注项目的真实收入和实际效用,而非单纯市值。

● 机制面:审视价值捕获能力,即协议产生的收入是否有清晰路径回馈给代币持有者。

● 趋势面:寻找 “足够新”和“自下而上” 的机会,而非被机构预设的叙事。

四、总结展望

综合机构与KOL的展望,2026年的加密市场轮廓逐渐清晰:它既非简单的狂热牛市再现,也非一潭死水。

这一年,以太坊凭借其在稳定币、RWA和DeFi的生态基本盘,有望在相对表现上领跑。AI与区块链的融合、预测市场、RWA等需要真实效用支撑的赛道将获得更多关注。同时,市场参与者必须正视流动性高度分化、权力向专业KOL转移、价值评估体系重塑的深层结构变化。

最终,随着监管框架的完善(如美国Clarity Act)和机构资本的深入,加密市场正告别草莽时代,步入一个以价值发现和长期资本为特征的新阶段。对于投资者而言,深度的行业研究、对项目基本面的苛刻审视,以及适应新权力结构的思维方式,将比追逐短期热点更为重要。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。