作者:@aaronjmars

编译:深潮TechFlow

安德森·霍洛维茨基金(Andreessen Horowitz,简称 @a16z)正在经历一场根本性的转变。这个曾被视为硅谷顶尖风投公司的机构,正转型为一个更具雄心的组织——一个全面协调技术与政治现实的引擎。

2025年8月,最明显的信号出现了:Alex Danco(@Alex_Danco)加入 a16z,担任特约编辑(Editor-at-Large),负责领导整个公司的文字内容输出。这一任命并非简单的公关岗位。Danco将写作视为一种“权力转移技术”,认为合法性并非由机构单方面“赐予”,而是通过作者与读者之间的“共同启发”来实现。

然而,Danco 的加入只是这个庞大机器中的一部分。2025年11月,a16z发布了其《新媒体宣言》(New Media Manifesto),揭示了一个远超传统风投范畴的运营模式。该公司现在明确提出了一项名为“时间线接管”(Timeline Takeover)的服务——通过视频、播客、文章和社交媒体的协调内容,为投资组合公司实现“赢得一天互联网”的目标。

打造媒体机器:a16z的叙事革命

a16z正在构建一个复杂精密的媒体基础设施。由Erik Torenberg(@eriktorenberg)领导的新媒体团队汇聚了被称为“网络传奇”(online legends)的内部内容创作者、“前线部署的新媒体”人员(forward deployed New Media),这些人会在投资组合公司产品发布期间直接嵌入其中。此外,他们还建立了一个高影响力的人才网络,以放大选定的叙事。

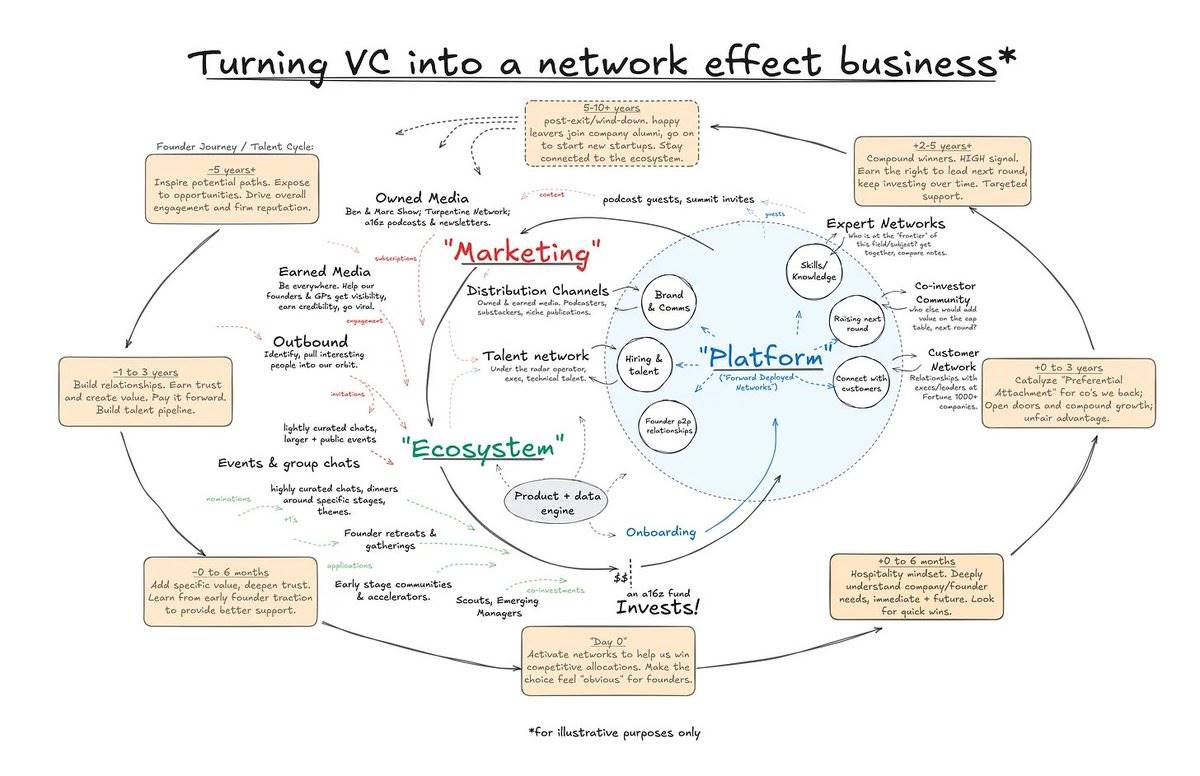

2025年10月,David Booth(@david__booth)加入a16z,担任合伙人兼生态系统负责人,专注于构建他称为“优先依附”(preferential attachment)机制的基础设施。这套机制旨在让资源、人才和关注度更倾向于流向a16z的投资组合公司,而非竞争对手。正如Marc Andreessen(@pmarca)在宣布Booth加入时所解释的那样,初创公司需要进入一个“资源不断积累的循环中……从合格的高管、技术员工,到未来的后续融资、品牌正向势能、公众认知、客户、营收,甚至在政府中的影响力”。

为了进一步强化其媒体布局,a16z 计划从 2026 年 1 月启动为期8周的新媒体奖学金项目(New Media Fellowship),用于培训运营者、创作者和叙事者,并将他们分配到投资组合公司。这不仅仅是咨询服务,而是一个专门为叙事战打造的平行人才管道。

a16z展现出的运营能力令人惊叹。团队每周通过多个渠道发布5次内容,运营着一个内部视频制作部门,受“新媒体传奇”如Mr. Beast启发并在现场训练。此外,他们还维系着“群聊、晚宴、活动以及隐藏网络”,帮助那些才华横溢且值得信赖的人彼此相遇。

其中一家投资组合公司展示了这一媒体机器的逻辑终点:DoubleSpeed(@rareZuhair)。这家公司利用人工智能控制数千个社交媒体账号,并确保这些账号的行为“尽可能像真人”。其宣传口号直白而大胆:“再也不用雇人了。”

推特前哨战

a16z的媒体基础设施建设可以追溯到2022年,当时该公司斥资4亿美元支持埃隆·马斯克(Elon Musk)收购推特(Twitter)。截至2024年9月,这笔投资据报道已损失2.88亿美元,但财务损失并非重点。Ben Horowitz(@bhorowitz)当时表示:“埃隆是我们所认识的,也是可能全世界唯一一个有勇气、智慧和能力解决这些问题,并打造出我们所有人期望且应得的公共空间的人。”

a16z迅速派遣人员嵌入推特团队。专注于加密领域的a16z普通合伙人Sriram Krishnan(@sriramk)公开宣布,他正在“与其他优秀人士一起临时协助埃隆·马斯克管理推特”,并表示:“我(以及a16z)相信这是一个极其重要的公司,能够对世界产生重大影响。”

预测市场的基础设施布局

然而,媒体机器只是a16z战略的一部分。Alex Danco在其文章《预测:后现代主义的继承者》中提出,预测市场代表了对文明基础的根本性重塑,其重要性可与现代主义和后现代主义相提并论。

2025年10月,a16z以50亿美元估值,联合领投了预测市场平台Kalshi的3亿美元D轮融资。合伙人Alex Immerman表示,预测市场有“机会成为未来最大且最重要的金融市场”。

a16z曾试图将其高管、Kalshi董事会成员Brian Quintenz(@CFTCquintenz)推举为美国商品期货交易委员会(CFTC)的负责人,该机构负责监管预测市场。然而,由于围绕利益冲突的重大争议以及包括Winklevoss兄弟在内的加密领域人士的反对,白宫于2025年9月或10月撤回了对Quintenz的提名。这一失败的提名既揭示了a16z在监管领域寻求影响力的野心,也暴露了其目前面临的局限。

与此同时,预测市场的交易量呈现爆发式增长。从2024年6月初到当年的大选周,交易量增长了42倍,Polymarket和Kalshi等平台的月度交易总额达到数十亿美元。在2024年大选期间,记者和华尔街交易员开始依赖预测市场,而这些市场的表现“超越了民调”,成为“全球可以借鉴的信号”。

当像Brian Armstrong这样的首席执行官开始在投资者沟通中基于市场信号提及特定加密货币时,这种反馈循环变得显而易见:市场不仅仅是预测工具,它们还在协调现实。

即便是 a16z 的市场设计专家 Scott Kominers(@skominers)也承认,“预测市场本身并不总是一个理想的信息聚合工具:即使是全球性的‘宏观’事件,预测市场也可能不够可靠;而对于‘微观’问题,预测池的规模可能太小,无法提供有意义的信号。”然而,Kalshi 的年化交易量已经扩大到超过500亿美元,自2024年初以来增长了25倍以上。在这种规模下,预测与协调的界限逐渐模糊。

政治版图的重构

Marc Andreessen 在2016年曾支持希拉里·克林顿,甚至在推特上发文表示“我支持她”("I'm with her")。然而到了2024年,他的立场发生了彻底转变。他与 Ben Horowitz 为支持特朗普的团体捐赠了超过500万美元,其中 Andreessen 单独向支持加密货币的政治团体捐赠了高达3350万美元,这一金额是他直接捐给特朗普的六倍以上。

Andreessen 表示,拜登政府提出对未实现资本收益征税的提案是“压倒骆驼的最后一根稻草”,因为这将迫使初创公司为估值增长缴税。他批评拜登政府推行“软性威权社会革命”,并指出政府对科技公司的直接审查压力。

这种协调行动深入到了更隐秘的层面。Andreessen 组织了 WhatsApp 群聊,这些群组成为“主流舆论的模因源头”,被形容为“地下出版物的现代版”(samizdat),推动了全国范围内的“氛围转变”(vibe shift)。这些加密且消息会自动消失的群组被称为“美国政治与媒体的暗物质”,在这里,“一场惊人的向特朗普的政治重心转移得以塑造和协商”。

现任 a16z 新媒体团队负责人 Erik Torenberg 在组织这些群组中起到了关键作用。这个负责协调 a16z “时间线接管”服务的人,同时也在协调塑造2024年选举话语的政治群聊。

a16z的合法性架构

a16z 将自己视为一个“合法性银行”(legitimacy bank),创业者可以“以信用方式提取合法性,或进行合法性存款”。这并非仅仅是比喻。在其文章《如何获得合法性》("How to be Legitimate")中,Alex Danco 和前微软高管 Steven Sinofsky 描绘了科技行业合法性塑造的历史——从20世纪60年代的特殊利益集团(Special Interest Groups),到80年代《PC Magazine》的权威评测,再到今天由协调影响力构成的生态系统。

核心洞察在于:一旦建立起合法性架构,你所销售的就不再是产品,而是对未来的愿景。正如 Sinofsky 所解释的,当微软向企业销售时,“他们只想听我的十年计划。”合法性源自于你能够“以可信的方式预测未来”的能力。

这正是 a16z 所构建的:通过掌控我们理解可能性所依赖的基础设施,来让某些未来看起来不可避免。

技术生态的融合

2025年4月,a16z正式与 Y Combinator 和多家人工智能公司共同推出了“美国创新者网络”(American Innovators Network),以“美国的小型科技生态系统”自居,声称引领下一次创新浪潮。他们的公开立场是:“如果某位候选人支持一个乐观的、以技术驱动的未来,我们支持他们。如果他们想要扼杀重要技术,我们反对他们。”

看看 a16z 已经构建的生态系统:

-

媒体基础设施:由 Torenberg 领导的新媒体团队提供“时间线接管服务”(timeline takeover as a service),内部制作能力,以及前线部署的叙事专家。

-

人才管道:通过新媒体奖学金(New Media Fellowship)培养嵌入投资组合公司的培训团队。

-

平台布局:投资 4 亿美元支持 Twitter/X,人员在过渡期间直接嵌入。

-

市场基础设施:作为 Kalshi(估值 50 亿美元)的主要投资者,以预测市场为协调机制下注。

-

协调网络:包括 WhatsApp 群聊、晚宴以及“让才华横溢且值得信赖的人彼此相遇的隐秘网络”。

-

政治联盟:与特朗普政府建立直接关系,政治捐款超过 4000 万美元。

-

试图影响监管:虽然 Quintenz 的提名失败,但彰显了其野心与当前的限制。

F1维修站理论

a16z 用 F1 赛车的隐喻来形容自己。普通合伙人(General Partners)是赛车手,但“比赛的胜负早在比赛开始之前就已决定,由那些设计出最佳底盘、雇佣顶尖工程师、训练维修团队并建立狂热粉丝群以维持赞助资金流入的团队决定。”

正如 David Booth 所写:“Adrian Newey 并没有赢得任何比赛,但他作为红牛车队的首席技术官(CTO)的到来,将他们从一个烧钱的中游车队转变为一个跨时代的世界冠军队伍。而未来十年的顶级风投公司不仅需要最好的‘车手’,还需要在他们‘赛道上的机器’上进行深思熟虑的投资。”

a16z 正在构建的机器拥有多个引擎:一个通过协调媒体制造合法性;一个通过预测市场协调资本和注意力;一个通过加密群聊和战略性捐赠协调政治结果;一个通过奖学金项目和“生态系统”基础设施协调人才流动。

这意味着什么?

当预测市场被机构广泛采用并与媒体机器整合时,它们将不再只是预测工具。市场会生成“一个比民调、评论员或头条新闻更有纪律性的实时概率”——而当记者、交易员和企业高管基于这些概率做出决策时,市场将变得自我实现。

根据 a16z 自身的框架,“预测”正逐渐成为后现代主义之后的新范式——一种组织人类注意力、资本和行动的新方式。a16z 已经布局在每一个关键节点:

-

他们投资设定赔率的平台;

-

雇佣决定哪些问题重要的媒体团队;

-

组织协调政治战略的群聊;

-

培养下一代企业所需的人才;

-

试图(虽暂时失败)将自己的人安插进监管机构。

这不是阴谋,而是由深谙“控制信仰基础设施比控制生产基础设施更有价值”这一真理的人设计的复杂制度。

Quintenz 提名失败表明,这一策略仍然存在局限性。来自加密行业内部的反对、对利益冲突的担忧以及复杂的政治因素,仍然能够阻止那些看起来过于明显的“监管俘获”行动。

但更广泛的机器仍在运转。新媒体团队持续扩张,预测市场不断增长,协调网络愈发深入,奖学金项目开始将经过培训的叙事专家安插到投资组合公司中。

这场游戏的目标并不是预测未来,而是构建决定哪些未来可被理解、哪些问题会被提出,以及哪些答案显得权威的基础设施。

a16z 正在公开地构建这一基础设施,并对他们正在做的事情展现出惊人的透明度——而大多数人还在争论预测市场是否“比民调更准确”。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。