作者:Eli5DeFi

编译:深潮TechFlow

随着加密行业迈向2026年,领先的研究机构逐渐达成共识:

“纯粹投机周期的时代正在远去。”

取而代之的是由流动性趋同、基础设施建设和行业整合驱动的结构性成熟,而非短期叙事主导的市场波动。

以下是主要加密研究机构对2026年展望的核心观点(省去你阅读几百页报告的时间):

核心摘要:

-

“周期之死”:研究机构一致认为,传统的4年减半投机周期正在逐渐消退。未来将由结构性成熟主导,价值将更多地聚焦于拥有收入共享模型的“所有权代币”(Ownership Coins)以及具有现实世界应用的项目,而非短期炒作的叙事。

-

“代理金融”(Agentic Finance)的崛起:主要机构(如 Delphi Digital、a16z、Coinbase)预测,人工智能代理(AI Agents)将成为主要的经济参与者。这将推动“了解你的代理”(Know Your Agent, KYA)身份协议和机器原生结算层的发展,这些技术超越了人类手动操作的能力。

-

超级应用的整合:随着美国监管逐渐明朗(Four Pillars、Messari等的研究),复杂的加密体验将被整合为用户友好的“超级应用”(Super-Apps)和支持隐私的区块链。这些技术将隐藏技术细节,推动大规模采用。

Delphi Digital 的观点:基础设施、应用与市场

Delphi Digital 的宏观假设基于“全球趋同”(Global Convergence)。他们预测,到2026年,全球央行的货币政策分歧将结束,转向统一的降息和流动性注入周期。美联储结束量化紧缩(QT)后,全球流动性改善将使黄金和比特币等硬资产受益。

2026年展望:

-

代理金融(Agentic Finance)

基础设施的重大扩展体现在“代理金融”的崛起。AI代理将不再只是聊天机器人,而是能够主动管理资本、执行复杂的去中心化金融(DeFi)策略,并在链上优化收益,无需人工干预。

-

社交交易与“Pump”经济

在消费者应用方面,Delphi 强调了像 @Pumpfun 这样的平台的粘性,并预测“社交交易”(Social Trading)的成熟。趋势将从简单的迷因币投机转向更复杂的复制交易层级,策略分享将成为一种代币化产品。

-

机构流动性

市场结构将因交易所交易基金(ETF)的进一步普及而发生变化。传统金融(TradFi)的流动性将进入加密市场,不再仅作为对冲工具,而是成为基于宏观流动性宽松驱动的标准投资组合配置。

点击查看完整报告:

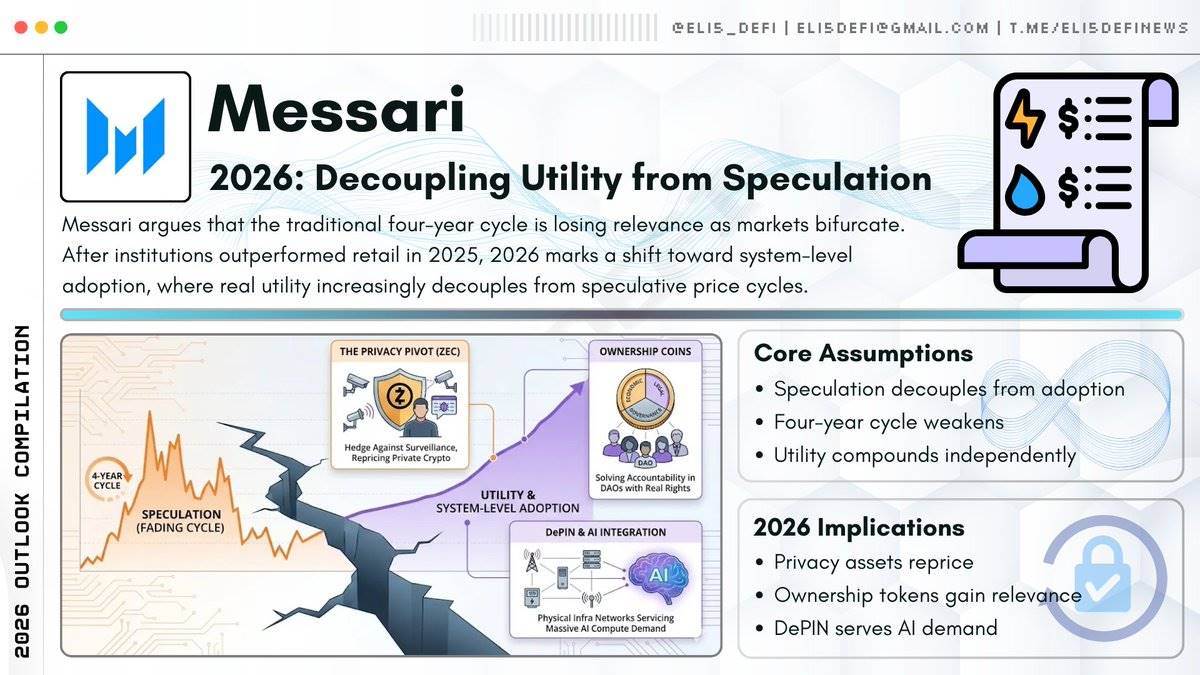

Messari:2026年加密行业展望——市场结构与实用性崛起

Messari 的核心论点是 “实用性与投机性的分离”。他们认为,传统的“四年周期”模型正在逐渐失去相关性,市场正在走向分化。他们假设,2025年是机构投资者胜出、散户投资者受挫的一年,而2026年将成为 “系统级应用” 的时代,而不仅仅是资产价格的投机游戏。

2026年展望:

-

隐私转向($ZEC)

Messari 提出了一个逆势增长的观点:隐私领域的复兴。他们特别提到 @Zcash(ZEC)等资产,不仅仅是作为“隐私币”,更是应对日益增加的监控和企业控制的必要对冲工具,并预测“隐私加密货币”将迎来重新定价的机会。

-

所有权代币(Ownership Coins)

2026年将出现一种新的代币分类——“所有权代币”(Ownership Coins)。这些代币结合了经济、法律和治理权利。Messari 认为,这些代币有望解决去中心化自治组织(DAOs)中的问责危机,可能催生出首批市值达到十亿美元的项目。

-

DePIN与AI集成

研究还深入探讨了 DePIN(去中心化物理基础设施网络)的潜力,预计这些协议将通过满足人工智能领域对计算和数据的巨大需求,在现实世界中找到市场契合点。

完整报告阅读:2026年加密行业报告

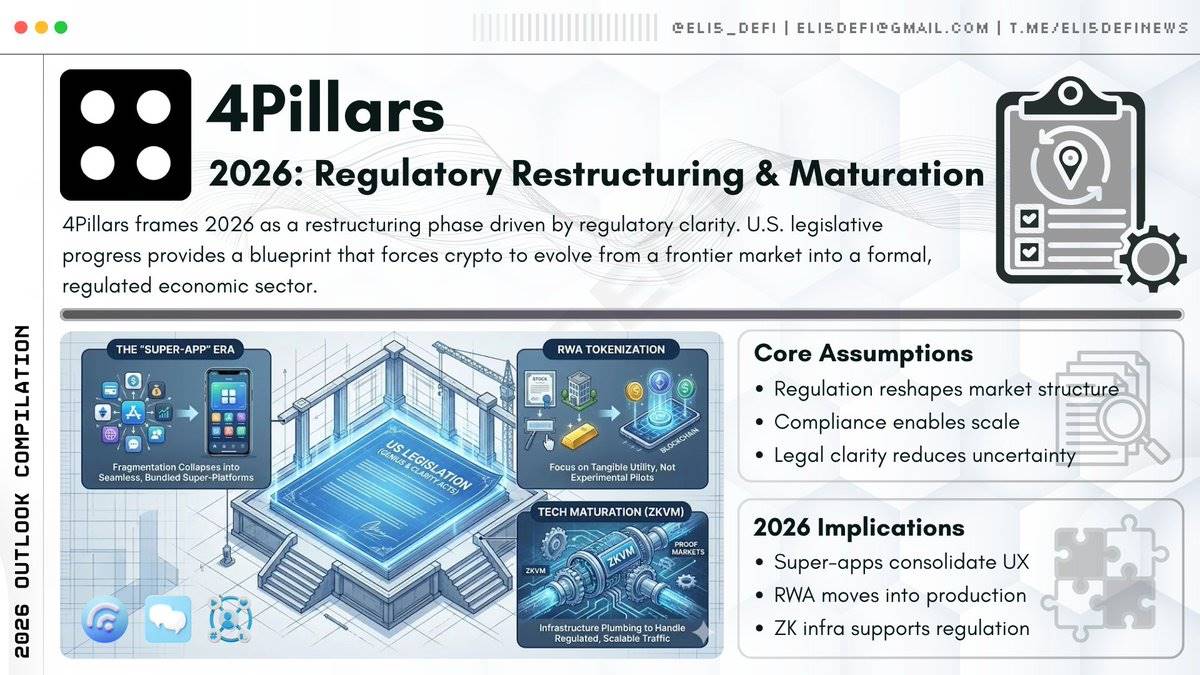

Four Pillars:监管重构与超级应用

Four Pillars 的2026年展望围绕 “监管重构” 展开。他们的核心假设是,美国的立法行动(特别提到 GENIUS 和 CLARITY 法案)将成为推动市场全面改革的蓝图。

这一监管的明晰将成为催化剂,促使市场从 “蛮荒西部” 的状态转变为正式的经济部门。

Four Pillars 的2026年展望

-

超级应用时代

Four Pillars 预测,当前零散的加密应用生态将逐渐整合为“超级应用”(Super-Apps)。这些平台将由稳定币驱动,集支付、投资和借贷功能于一体,彻底简化区块链的复杂性,提升用户体验。

-

RWA资产代币化

随着市场重组,股票及传统资产的代币化将成为趋势,但重点将放在实际的实用性上,而非试验性项目。

-

技术成熟化

在技术层面,报告强调零知识虚拟机(Zero-Knowledge Virtual Machines, ZKVM)和以太坊上的证明市场(Proof Markets)的重要性。它们被视为应对新兴监管机构流量规模的关键技术基础设施。

完整报告阅读:2026年展望:重构与百年视角

Coinbase:2026年加密市场展望——市场、监管与普及

Coinbase 的报告提出了 “周期之死” 的观点。他们明确表示,2026年将标志着传统比特币减半周期理论的终结。未来市场将由结构性因素驱动:包括对替代价值存储的宏观需求,以及加密行业作为中型另类资产类别的正式化。

2026年展望:

-

代币经济2.0(Tokenomics 2.0)

从“仅治理型”代币转向“与收入挂钩”的模式。协议将逐步引入代币回购销毁(Buy-and-Burn)或费用共享机制(符合新监管要求),以更好地将代币持有者的利益与平台的成功对齐。

-

数字资产交易2.0(DAT 2.0)

加密市场将迈向更专业化的交易模式,特别是“主权区块空间”(sovereign block space)的采购与交易。区块空间将被视为数字经济中的重要资源。

-

AI与加密的交集

Coinbase 预测,人工智能代理将大量利用加密支付通道,推动对“加密原生结算层”的需求。这些结算层能够支持机器之间的连续微交易,而传统支付系统无法满足这一需求。

完整报告阅读:2026年加密市场展望

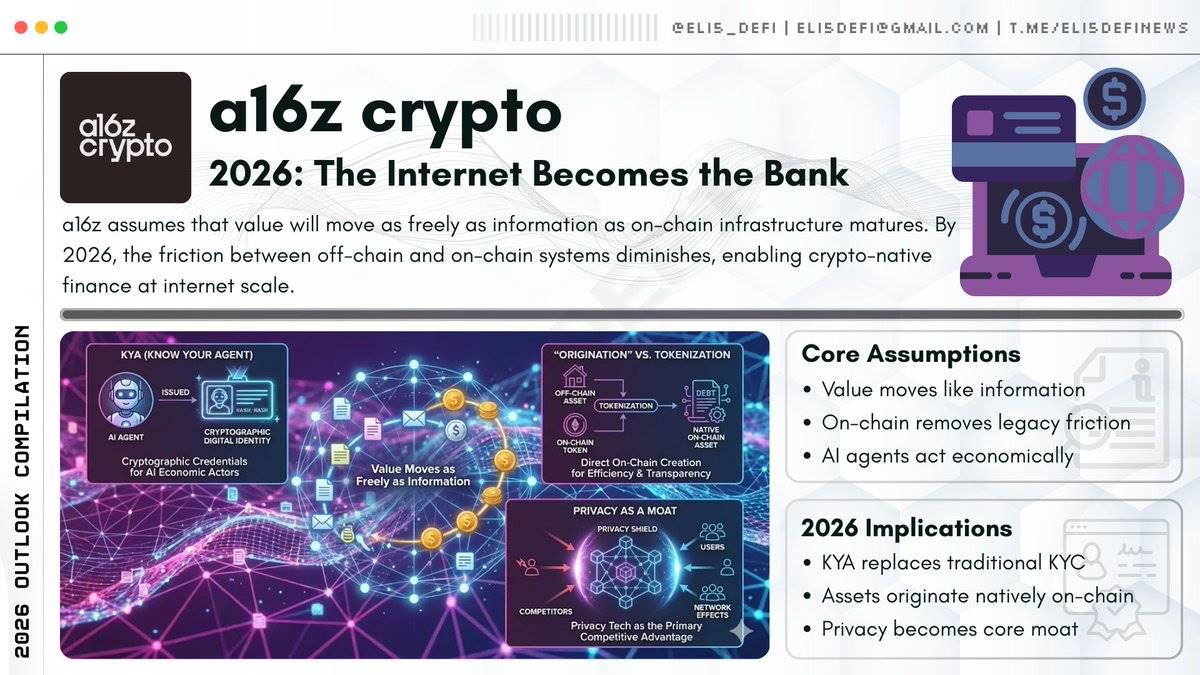

a16z Crypto:2026年展望——互联网原生金融与AI的未来

a16z Crypto 的展望基于一个核心假设:“互联网变成了银行”。他们认为,价值的流动将变得像信息一样自由。当前链上与链下世界之间的摩擦是主要瓶颈,而2026年将是通过更完善的基础设施消除这一障碍的一年。

a16z Crypto 的2026年展望

-

KYA(了解你的代理)

随着人工智能代理(AI Agents)成为主要的经济参与者,身份认证将从传统的 KYC(了解你的客户)转向 KYA(了解你的代理)。AI代理需要加密签名的凭证来进行交易,这将催生一个全新的身份基础设施层。

-

“资产起源”VS“资产代币化”

a16z 预测,市场将逐步从链下资产的代币化(例如购买国债并将其放到链上)转向直接在链上生成债务和资产。这种转变不仅能够降低服务成本,还能极大提升透明度。

-

隐私成为护城河

在开源代码普及的世界中,a16z 强调,隐私技术(尤其是保持状态隐私的能力)将成为区块链最重要的竞争优势。这将为支持隐私的区块链带来强大的网络效应。

-

全民财富管理

人工智能与加密支付通道的结合将使复杂的财富管理(如资产再平衡、税损收割)民主化,让普通用户也能享受到此前仅限于高净值人群的服务。

完整报告阅读:2026年加密行业大趋势

总结

2026年的加密行业展望显示,结构性成熟将取代投机性周期,由流动性趋同、监管明朗和基础设施驱动。

各大研究机构一致认为,价值将集中在结算层、聚合平台以及能够吸引真实用户和资本的系统中。

未来的机会将从追逐周期转向理解资金流向。2026年将回报那些在规模化中默默构建基础设施、分发能力和信任的项目。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。