原文标题:《单日交易量近百亿美元的代币,竟然来自 Cardano?》

原文作者:Eric,Foresight News

近日,一个于月初在 Bitget、Binance、OKX、Bybit 上线现货或合约的代币 NIGHT 24 小时全网交易量超过了 90 亿美元,接近 100 亿美元。Bybit 甚至依靠 NIGHT 在 24 小时内的现货交易量上超过了 Binance。

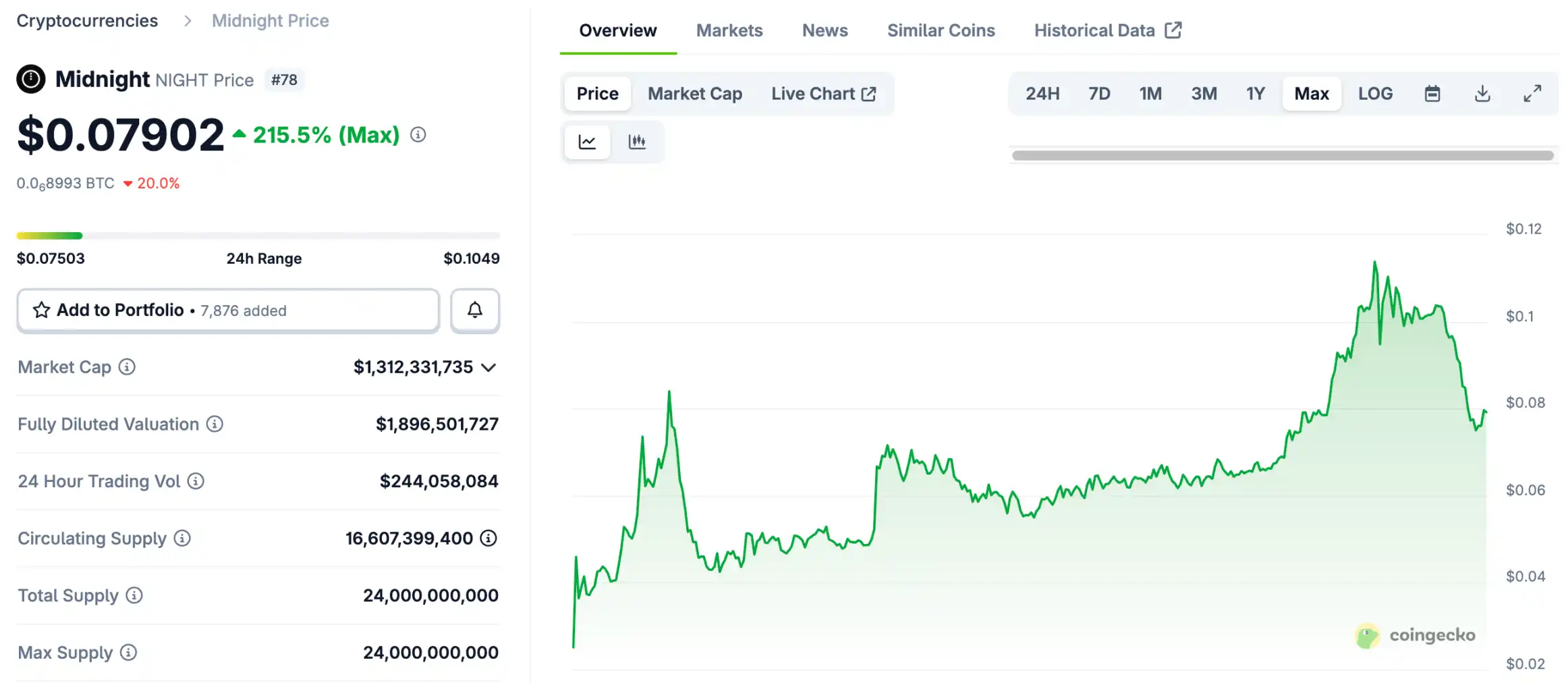

NIGHT 于 12 月 9 日正式推出,据 CoinGecko 数据,该代币价格从最初的 0.025 美元左右经过不到两周的时间涨至近 0.0114 美元,涨幅超 3 倍,其 FDV 也一度超过了 25 亿美元,可以排进市值榜前 50 之列。截至撰文时,NIGHT 价格已经回落至 0.08 美元附近。

能同时上线前几大交易平台的代币能有如此表现称不上出乎意料,但有意思的是,NIGHT 是 Cardano 隐私侧链 Midnight 的代币。一个同时贴有「Cardano」和「隐私」标签的项目能有如此爆发力是真的出乎了大多数人的意料。

Midnight「贵」在哪里?

Midnight 是 Input Output Global(IOG,即 Cardano 母公司)开发的一条以「可编程数据保护」为核心卖点的侧链。它把零知识证明(ZKP)做成了一套开箱即用的 TypeScript API,让 Web2 开发者不必学习密码学就能在链上实现「选择性披露」。整个网络以 Cardano 为共识底座、以 Halo2 为 ZK 后端,采用双代币模型(NIGHT+DUST),目标是先把企业最在意的「数据可用不可见」落地,再逐步扩展到 DeFi、RWA、链上合规身份等场景。

整体看来没有什么特别之处,隐私技术采用了 ZKP,但并非原生地保护隐私,而是将隐私功能变成可选项以应对实际的需求。

IOG 最早公开开发 Midnight 的计划是在 2022 年 11 月,但直到近两年之后的 2024 年 10 月才推出测试网。这确实是 IOG 的风格,从其宣布 Cardano 将引入智能合约到真正实现就过去了接近 5 年,直到 2021 年 9 月才拥有智能合约功能,牛市的黄花菜都凉了。

今年 5 月,Midnight 成立基金会,由波卡开发团队 Parity 的前首席财务官 Fahmi Syed 担任主席,预示着 TGE 已经走出了第一步。就在官宣基金会成立的两天后,Cardano 创始人 Charles Hoskinson 就公布了向 8 条主要区块链上 3700 万地址空投代币的计划,并表示空投仅面向散户,不会有 VC 参与该项目。

或许真正点燃市场情绪的就是 Midnight 的「大撒币」。除了空投之外,Midnight 还与 Binance、OKX 以及 Bybit 合作分发了近 30 亿枚 NIGHT。这种大手笔与最近流行的 ICO 模式大相径庭,引发了市场不错的反响。

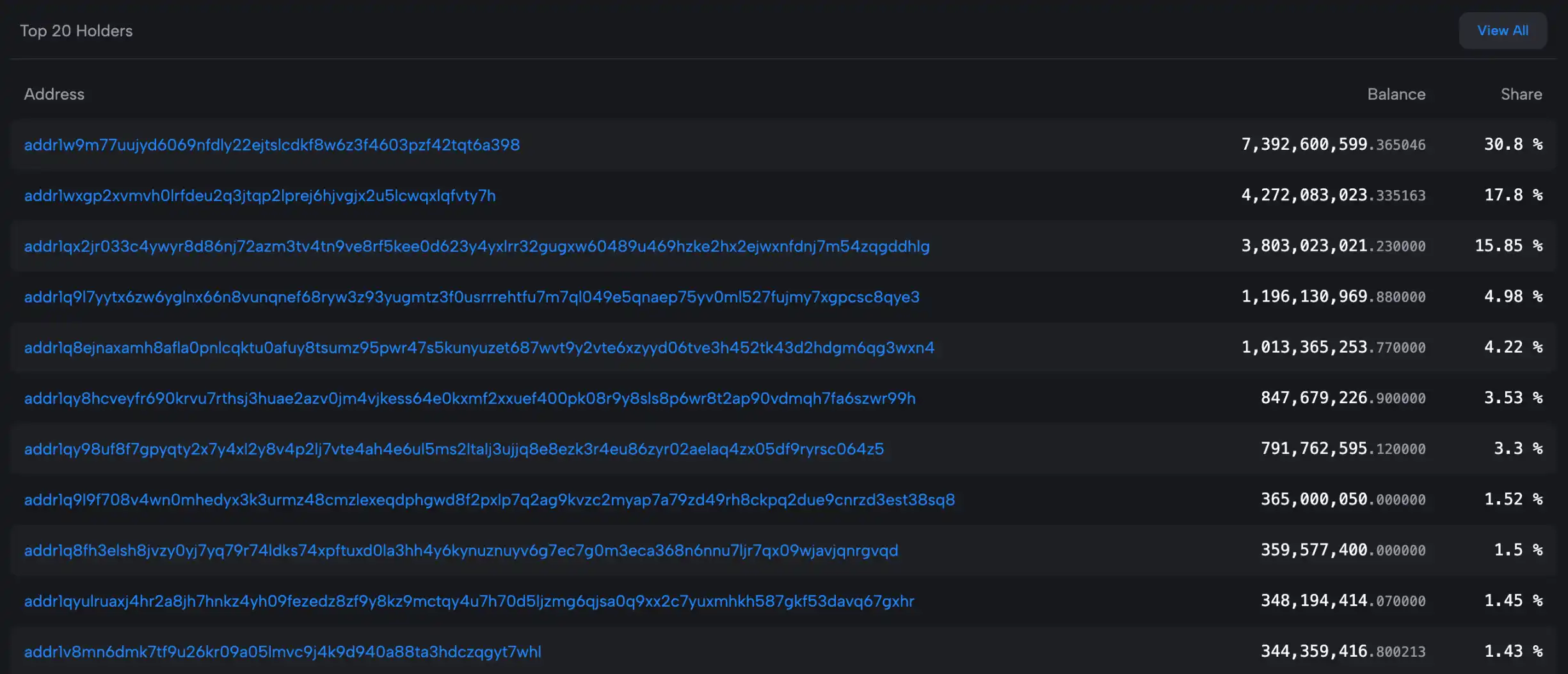

从区块浏览器来看,NIGHT 的前几持币地址除了前三可能属于 IOG 或者 Midnight 基金会的地址之外,剩余地址的持仓还算分散。据官网提供的数据,笔者估算 NIGHT 自身的空投、与交易平台合作的活动等分发的代币接近总量(240 亿枚)的近 1/3,确实可以算是大手笔。

Midnight 的代币并非只有 NIGHT 一种,而是采用了「NIGHT+DUST」的双代币模式。这种罕见的设计并非出于什么「奇思妙想」,而是可以保证符合监管要求。NIGHT 可用于参与网络治理、激励以及生成另一种代币 DUST,NIGHT 本身与隐私无关,支持链上审计。

由持有 NIGHT 生成的 DUST 则是用于支付交易费用,类似 Gas 的角色。此外,DUST 也会被用于支付隐私费用,即如果想为链上的交易添加可选的隐私功能,则需要支付 DUST 作为费用。DUST 会随着出块自动分发至 NIGHT 持有者账户且会随着时间「衰减」以防止恶意囤积和网络攻击。

如此,Midnight 的「股权」NIGHT 不参与链上交易费用的支付,而仅仅作为治理代币存在以及生成真正链上燃料的 DUST。DUST 本身作为「可再生资源」,因为由 NIGHT 生成且会随着时间不断减少,就监管政策而言会被视为一种资源而非一种资产,可以满足各地的监管要求。

Cardano 明年将为链上生态投入重金

根据 Cardano 的路线图,明年将是全面推动链上活跃度的一年。

首先作为基础的,是 Cardano 将进行网络升级,将吞吐量提升至 1000 至 1 万 TPS 通过并行块处理和分层结构实现垂直扩展,同时保持安全性和去中心化。之后就是本文的主角 Midnight 的主网上线,Cardano 认为 Midnight 的推出会通过其可选的隐私功能带来更多的 DeFi 活动和 TVL。此外,Cardano 财库将会拨款支持 USDT、USDC 等主要稳定币在 Cardano 上的原生发行。

最后一点,也是笔者觉得最重要的一点,就是 Cardano 计划将重心放在互操作性,但并非简单的跨链,而是让其他链的用户可以通过消耗源链的 Gas 代币直接与 Cardano 上的 DApp 交互。

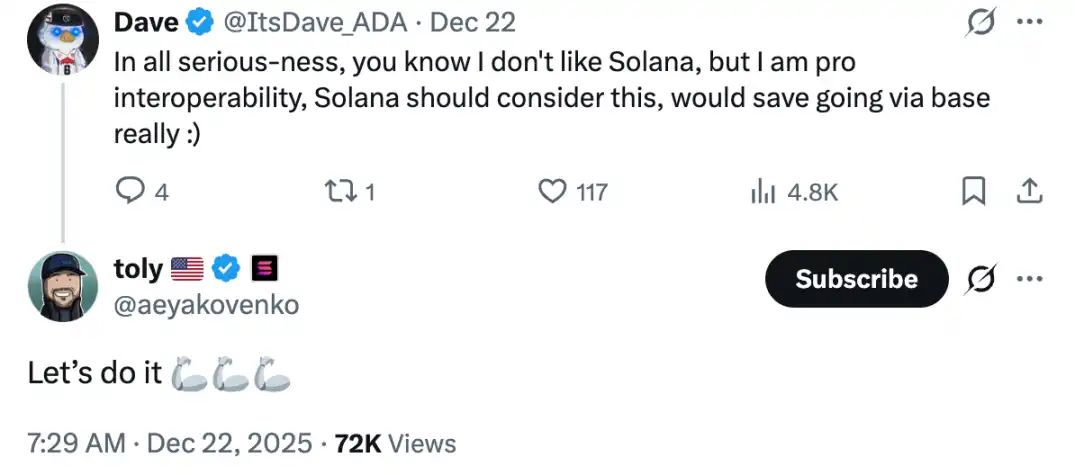

上周,Cardano 通过 Fluid 实现了 BTC 与 ADA 之间的原子交易,并非通过跨链桥、封装代币或中心化的托管,而是直接通过底层脚本对脚本的交易,这也某种程度上得益于 Cardano 本身也是 UTXO 的账本模型。两天前,Cardano 的权益池运营者在 X 上与 Solana 联创的互动也证实了这个发展方向。

与战略和产品计划配套的,则是资金的投入。Cardano 基金会计划提高 12% 的营销预算,并在 TOKEN2049、Consensus 等活动上「露露脸」,Venture Hub 也将投资 200 万枚 ADA,支持初创企业和生态项目。此外,Cardano 基金会将计划向链上的 DeFi 注入数千万枚的 ADA 来提高流动性以吸引机构的参与。

如此看来,推动 NIGHT 的价格上涨可能只是 Cardano 为一系列计划端上的开胃菜,2026 年说不定真的可以关注一下这个在 2017 年就上线主网的,已经几乎被 Web3 主流市场遗忘的项目。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。