| Hot News |

1: December 24, 21:30 - U.S. initial jobless claims for the week ending December 20 (10,000)

- Atlanta Fed expects Q4 performance growth

As we enter Christmas week, both gold and silver have reached historic highs, and even the U.S. stock market is in high spirits, while cryptocurrencies seem to lag behind, appearing quite desolate. Will Bitcoin still benefit from this year's Christmas market? In yesterday's reference strategy, the main idea provided was to focus on short positions, with the 3070 level being the entry point for short positions. We mentioned that the number of Bitcoin addresses has significantly decreased, indicating that short-term bearish sentiment has been well released. Funds increasing their holdings in ETH have also seen a rise in recent days, and both Bitcoin and Ethereum are expected to experience a decent rebound this week, but due to the new highs in gold and U.S. stocks attracting a lot of attention and liquidity, the crypto market appears less impressive. However, I believe there will still be a Christmas market; while we may not feast on the big gains, sipping some soup should not be a problem. The first image is for the Christmas holiday; don't come asking why Tommy didn't open the market then.

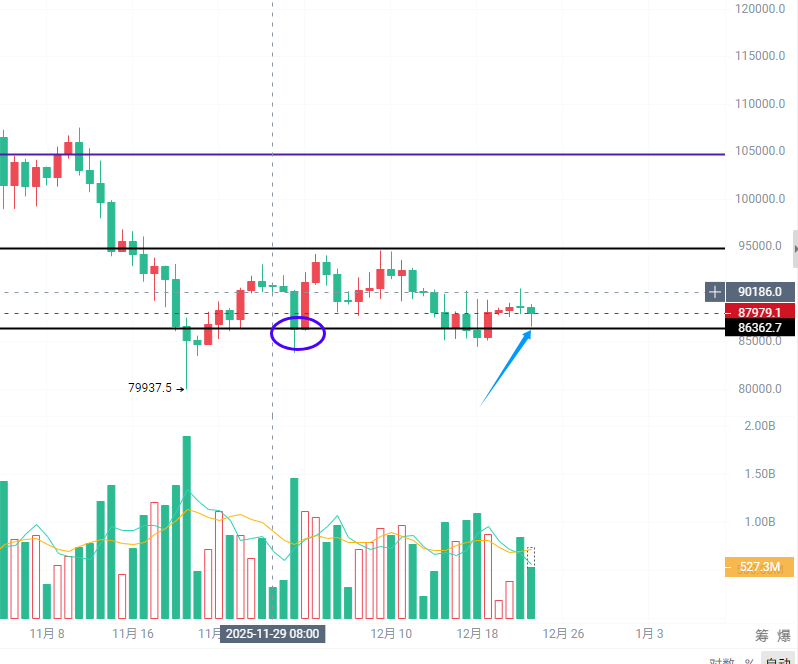

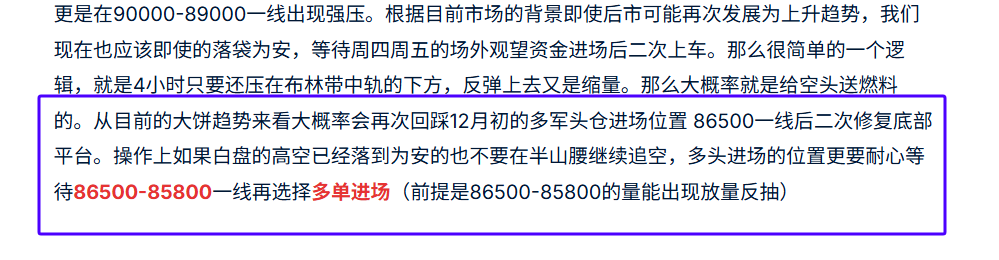

From a structural perspective, Bitcoin is still in a broad rhythmic oscillation market, with 87000 being a key watershed in the past couple of days. I estimate that a direction will be chosen in the next day or two; once it breaks upward, the only resistance level above is 92000 USD. If anyone wants to go long, consider entering conservatively at 86500 if it breaks below 87000 USD today, which we have repeatedly highlighted as a key defensive position. Also, set a stop-loss at the previous low. Clearly, this position is not suitable for shorting, as its risk-reward ratio is poor. Ethereum is similar; a 4-hour upward trend line has formed. As long as it does not effectively break below the 2900 level, the rebound will continue. The strong resistance level above is in the 3150-3200 range. Yesterday, it tested the 3070 resistance level. Theoretically, a rebound to the 3200-3300 USD range is quite hopeful. However, we need to be cautious of potential false breakouts at that time. (Key positions for top-bottom conversion have been repeatedly mentioned in previous shares)

Additionally,

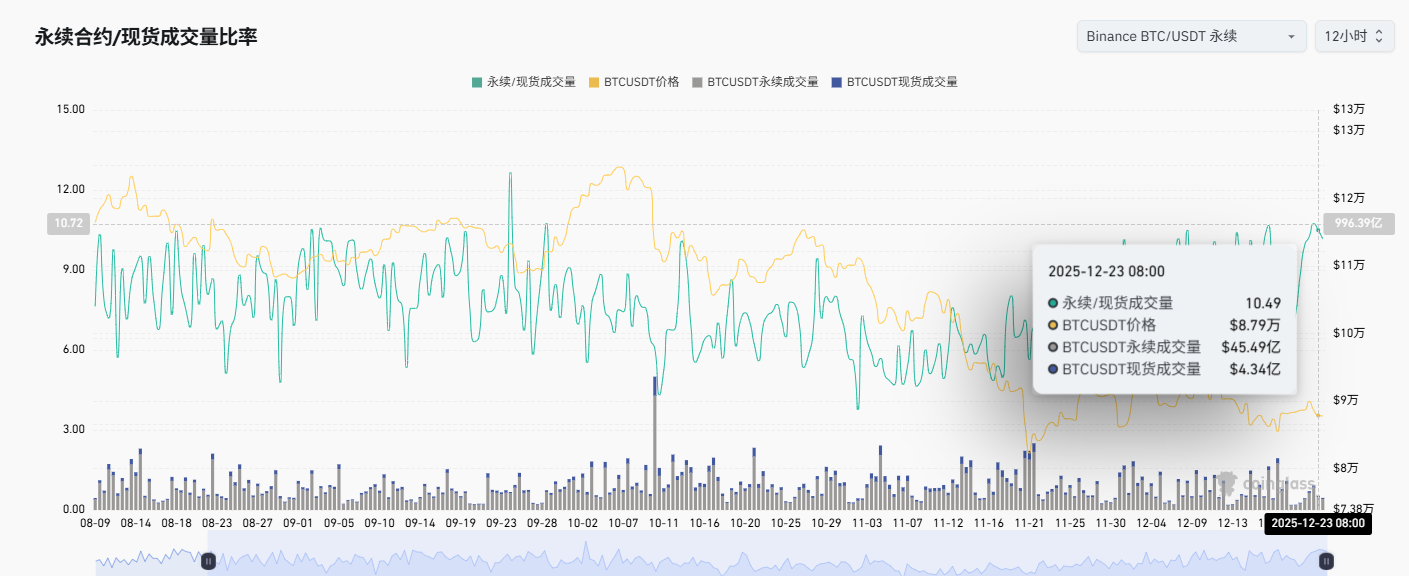

From other macro conditions, the weakening dollar and falling U.S. Treasury yields indeed provide a theoretically favorable environment for risk assets. However, the actual market choice has already given us the answer. Observing on-chain data, the recent ETF situation has shown significant divergence. Bitcoin ETFs recorded a net outflow of about 158.3 million USD, while Ethereum ETFs saw a net outflow of 76 million USD. In contrast, XRP and SOL ETFs experienced small inflows of 13 million USD and 4 million USD, respectively. This indicates that funds within the crypto market are undergoing some structural adjustments rather than an overall inflow. Last week, digital assets saw a total net outflow of 952 million USD, marking the first net outflow after four consecutive weeks of inflows. This suggests that institutions have been reducing their risk exposure to digital assets recently.

Looking back at history, in 2012 and 2016, Bitcoin surged by 33% and 46% during the Christmas period, while other Christmas periods performed generally. On average, from 2011 to now, Bitcoin's average increase during the festive period is only 7.9%. In summary, the Christmas market may have already started, but it has little to do with Bitcoin; gold, silver, and U.S. stocks are the main battlegrounds, while crypto is like a stepchild. Although panic sentiment has eased somewhat, it has a bit of a role, but I estimate it won't be much, so don't set your expectations too high. However, if we manage it well, we can still enjoy a good meal.

I am Tommy, bringing you the latest market interpretations and trading ideas every day.

The points are time-sensitive, and there may be delays in posting, so please refer to real-time market conditions. Lastly, everyone should remember the two key points I mentioned in my last article: focus on trial positions in the short term, and once we move out of our target range, it will be the last opportunity to make big gains before the end of the year. I am K-line Life Tommy, your real-time crypto steward.

For more related coin analyses, please follow the official account for details. ↓

Mainly focused on spot, contracts, BTC/ETH/ETC

Specializing in style: K-line trading

Original volume trading strategy.

Short-term wave highs and lows, medium to long-term trend positions, daily extreme pullbacks, weekly K-top predictions, monthly head predictions.

Official account QR code (K-line Life Tommy)

Warm reminder: The only official WeChat account at the end of the article is created by the author!!

Please be cautious in distinguishing between true and false, thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。