This report deeply integrates the forward-looking predictions from four authoritative institutions: Galaxy Research, Coinbase, a16z, and Grayscale, for the year 2026. The institutions believe that 2026 will mark the "industrialization of value" in the crypto economy. The market is undergoing a structural transformation: shifting from the retail-driven "halving cycle" to a formally established "sustained value growth model" led by global institutions.

I. Macroeconomic Landscape: The End of the Four-Year Cycle and the Beginning of the "Institutional Era"

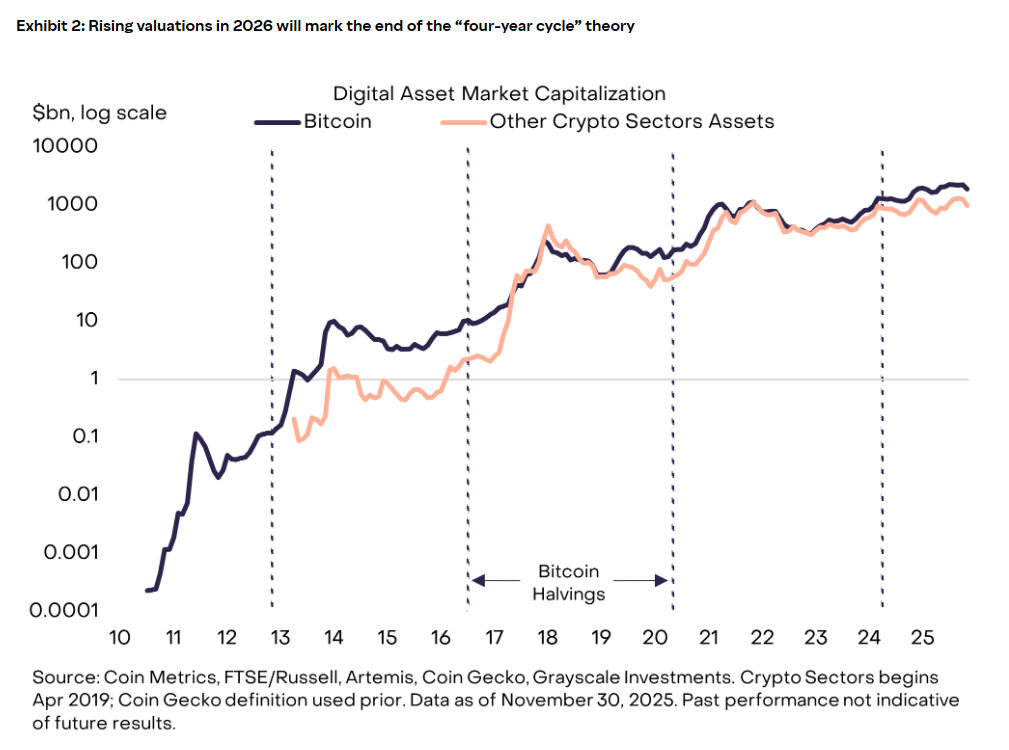

1. The Failure of Cycle Theory: Grayscale points out that due to the systematic allocation of institutional funds, the improvement of compliance frameworks, and the popularity of Bitcoin spot products, the traditional "halving-driven four-year cycle" may officially come to an end in 2026. The market will transition from explosive growth driven by retail to a more stable, long-term upward channel driven by institutional rebalancing.

2. The Game of Price and Rhythm:

- Grayscale expects Bitcoin to reach a historic high in the first half of 2026.

- Galaxy predicts it could reach $250,000 by the end of 2027.

- Coinbase compares the current phase to the early internet in 1996, suggesting we are at the starting line of a long bull market.

3. Milestone of Supply Scarcity: It is expected that the 20 millionth Bitcoin will be mined in March 2026. This transparent and certain scarcity supply mechanism further solidifies its status as "digital gold" amid the risks of fiat currency devaluation.

II. Regulatory Clarity and Institutional Entry: From Assets to Infrastructure

1. Policy Dividend Period: In 2026, legislation including the "GENIUS Act" and bipartisan-supported crypto market structure laws is expected to be officially implemented, establishing the legal identity of crypto assets in mainstream capital markets.

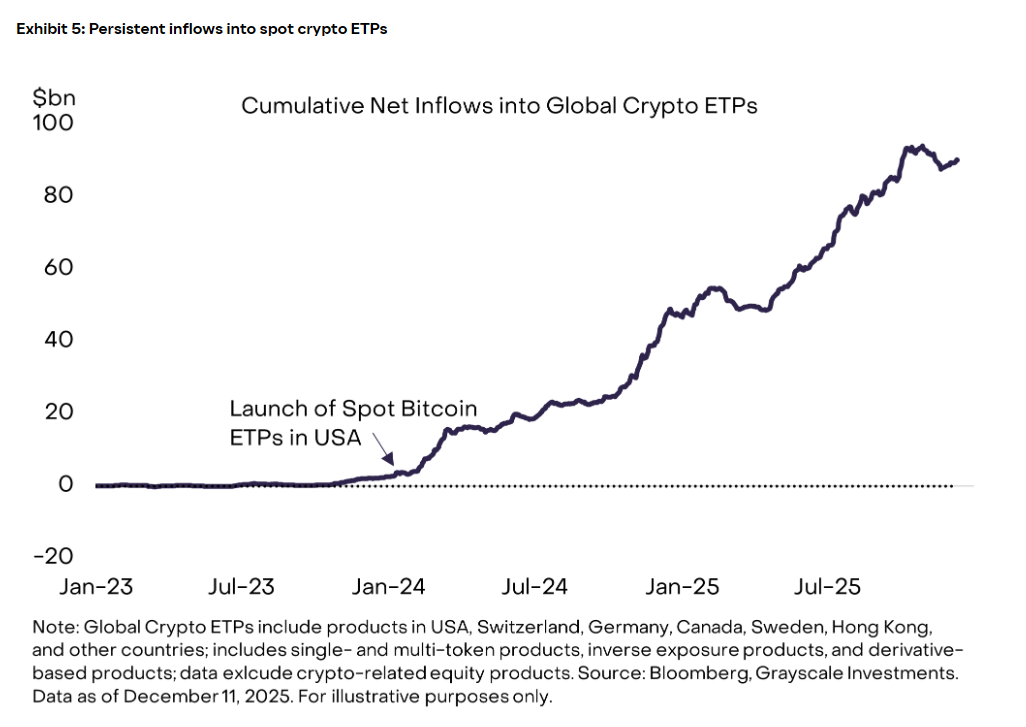

2. ETFs and Wealth Management: Currently, the proportion of crypto assets in the wealth managed by U.S. trustees is less than 0.5%. With due diligence completed, a significant influx of cautious institutional capital is expected in 2026, with cumulative net inflows into spot cryptocurrency ETFs likely to exceed $50 billion.

3. Product Diversification: The market will see the emergence of over 50 spot altcoin ETFs and various multi-asset, leveraged ETF products.

4. DAT 2.0 Model: Digital Asset Treasury (DAT) will evolve to focus on professional trading and procurement of sovereign block space, with block space being regarded as a core strategic material in the digital economy, equally important as electricity and computing power.

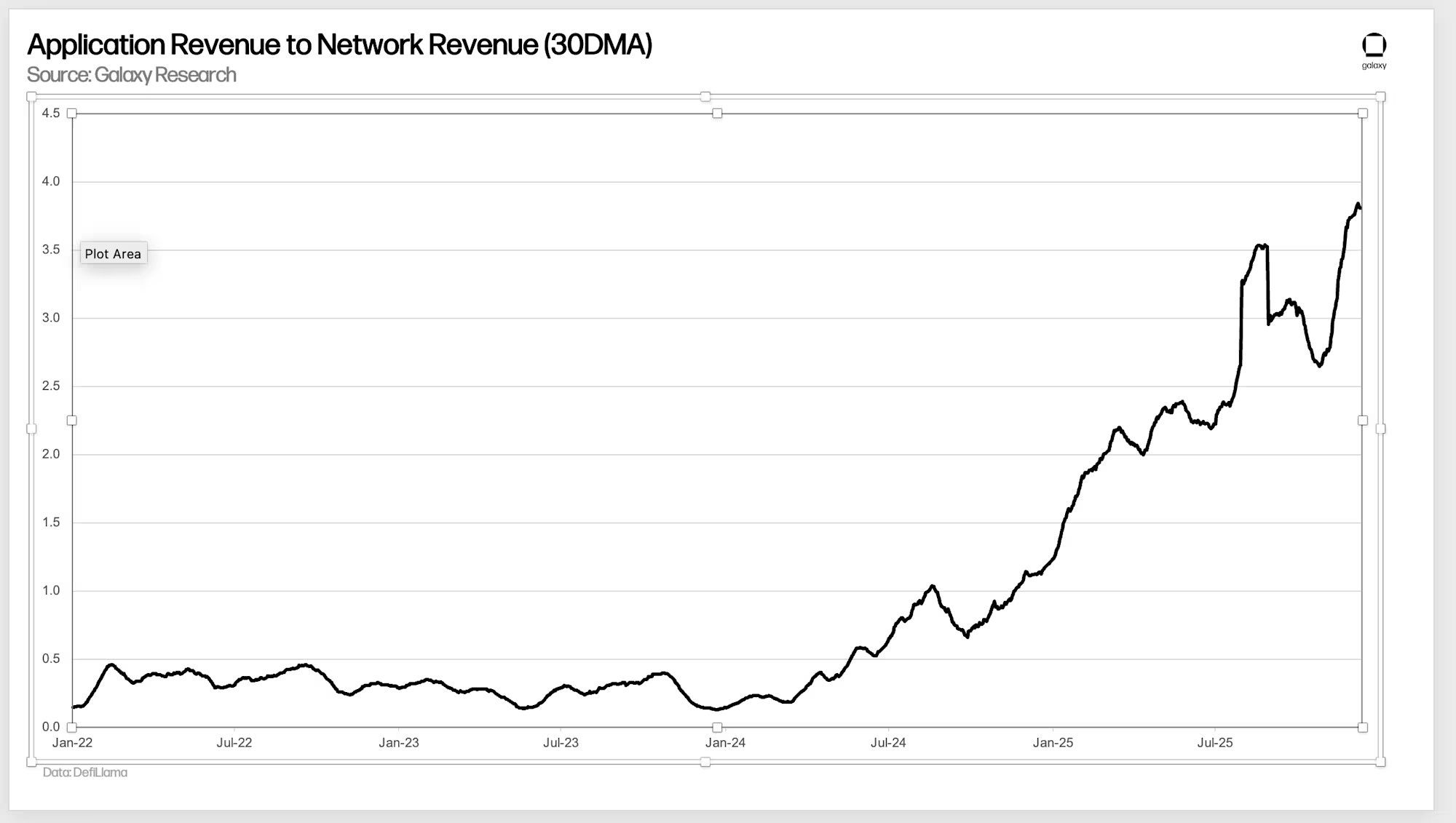

III. Technological Paradigm Shift: From Protocol Value to Application Premium

In 2026, blockchain infrastructure will transition from "big and comprehensive" to "specialized" and "application-oriented."

1. "Fat App" Hypothesis: Galaxy predicts that the ratio of application revenue to network revenue will double in 2026. Value capture is shifting from underlying protocols to the application layer, with at least one universal L1 embedding revenue-generating applications that direct value to native tokens.

2. New Landscape of Public Chain Competition:

- Solana's market capitalization in the internet capital market is expected to soar to $2 billion, completing its transformation from a traffic center to a value center.

- High-performance matrices: Sui, Monad, MegaETH, etc., will become the preferred base for financial-grade applications due to their architectural advantages in AI micropayments and high-frequency trading.

3. RWA 2.0 Explosion: The scale of tokenized assets is expected to grow a thousandfold in the coming years. By 2026, major banks and brokerages will begin to widely accept on-chain digital stocks and bonds as cross-border collateral.

IV. Integration of AI Agents and Crypto

Crypto technology will provide the necessary identity and payment infrastructure for AI agents, constructing an "agent economy."

1. From KYC to KYA: a16z emphasizes that "Know Your Agent" will become mainstream. Utilizing cryptographic signature credentials to establish a trustworthy identity system and collaboration protocols for AI agents.

2. Automated On-chain Settlement: The x402 standard will support high-frequency microtransactions between AI agents. Galaxy predicts that such automated payments initiated by AI will account for over 30% of the daily transaction volume on mainstream Layer 2 networks (like Base).

3. Decentralized AI Governance: In response to the trust crisis of centralized AI, protocols like Bittensor and Story Protocol will establish the sovereignty of AI model training and intellectual property protection through decentralized means.

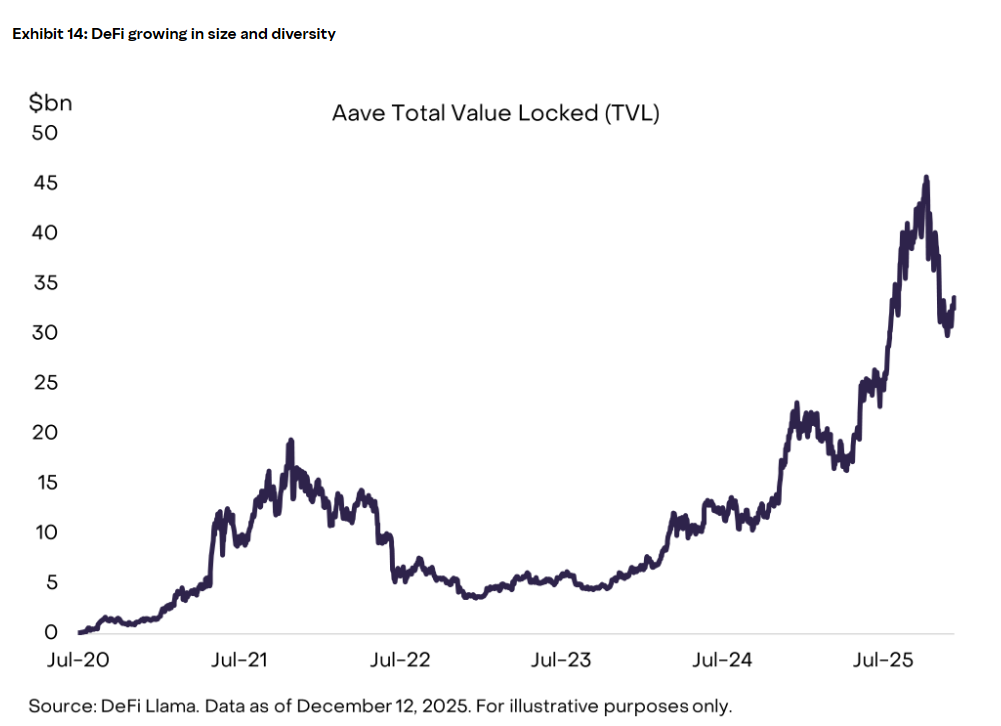

V. Deepening Applications of DeFi, Privacy, and Prediction Markets

1. Token Economics 2.0: DeFi protocols will completely bid farewell to the "mining coin model," shifting to a "cash flow valuation" model centered on fee sharing and buyback destruction. The total balance of the lending market is expected to exceed $90 billion.**

2. Unification of Privacy and Compliance: Privacy solutions will no longer be opaque but will become a necessity for mainstream financial access on-chain. The market value of privacy technology-supported assets is expected to exceed $100 billion by the end of 2026.

3. Normalization of Prediction Markets: The weekly trading volume of Polymarket is expected to continue exceeding $1.5 billion. Prediction markets will introduce decentralized governance and AI oracles to address the limitations of outcome determination.

4. The Rise of Fiat-Backed Assets: The settlement volume of such digital payment mediums is expected to surpass the ACH system. By 2026, at least one of the top three card organizations globally will process over 10% of cross-border settlement volume through such assets.

Conclusion

If the early crypto market was an isolated digital island, the crypto market in 2026 resembles a deep-water port fully integrated into the global trade network. High-performance public chains and AI agents provide the most efficient loading and unloading tools, while the regulatory framework establishes recognized port rules, and institutional capital is the ocean-going giant ship laden with cargo.

The great era of Crypto has fully begun. Will you navigate the waves or watch from the shore? Arm your investment toolbox; the countdown to the end of AICoin membership benefits for 2025 has begun. Start your professional investment journey now.

https://www.aicoin.com/zh-Hans/vip/chartpro

Original Links:

26 Bold Predictions for Crypto in 2026: Bitcoin, DeFi, Stablecoins, and AI | Galaxy

17 things we're excited about for crypto in 2026 - a16z crypto

2026 Digital Asset Outlook: Dawn of the Institutional Era | Grayscale

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。