作者:Frank,PANews

2025年,对于加密世界的公链赛道而言,是极具戏剧性与分水岭意义的一年。如果说2024年是各路新公链凭借高额空投预期和宏大叙事争奇斗艳的“狂欢夜”,那么2025年则是狂欢之后“梦醒时分”。

当潮水退去,流动性收紧,曾经被繁荣表象掩盖的真实数据开始浮出水面。我们看到了“冰火两重天”:一边是二级市场价格的普遍腰斩和TVL增速的显著放缓,另一边却是链上费用收入与DEX交易量的逆势激增。

鲜明的反差揭示了残酷的真相,市场不再为单纯的“叙事”买单,资金正在向具备造血能力和刚需场景的头部协议集中。

PANews数据团队全面统计了26条主流公链的2025年核心数据,从TVL、币价、费用收入、活跃度到投融资情况,我们试图透过这些冰冷的数字,还原公链市场在这一年经历的“挤泡沫”过程,并寻找那些在寒冬中依然能够构筑起坚实护城河的真正赢家。

(数据说明:TVL、稳定币、融资及费用情况等数据采用Defillama,日活和日交易量数据来源于Artemis及链上信息、代币价格及市值数据采用Coingecko数据作为来源。数据周期为2025年1月1日至12月16日。)

TVL众生相:增速断崖式下跌,DeFi 正在经历“去杠杆”阵痛

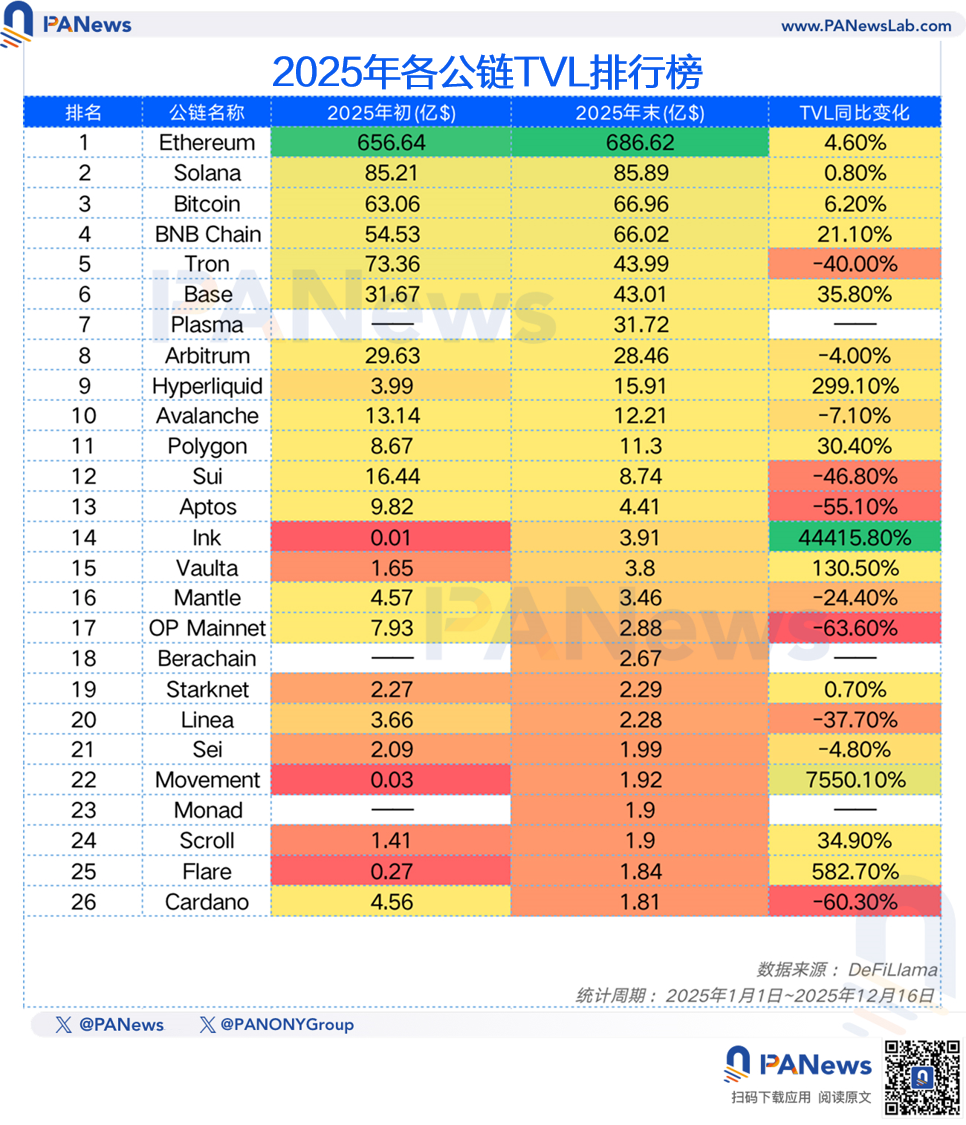

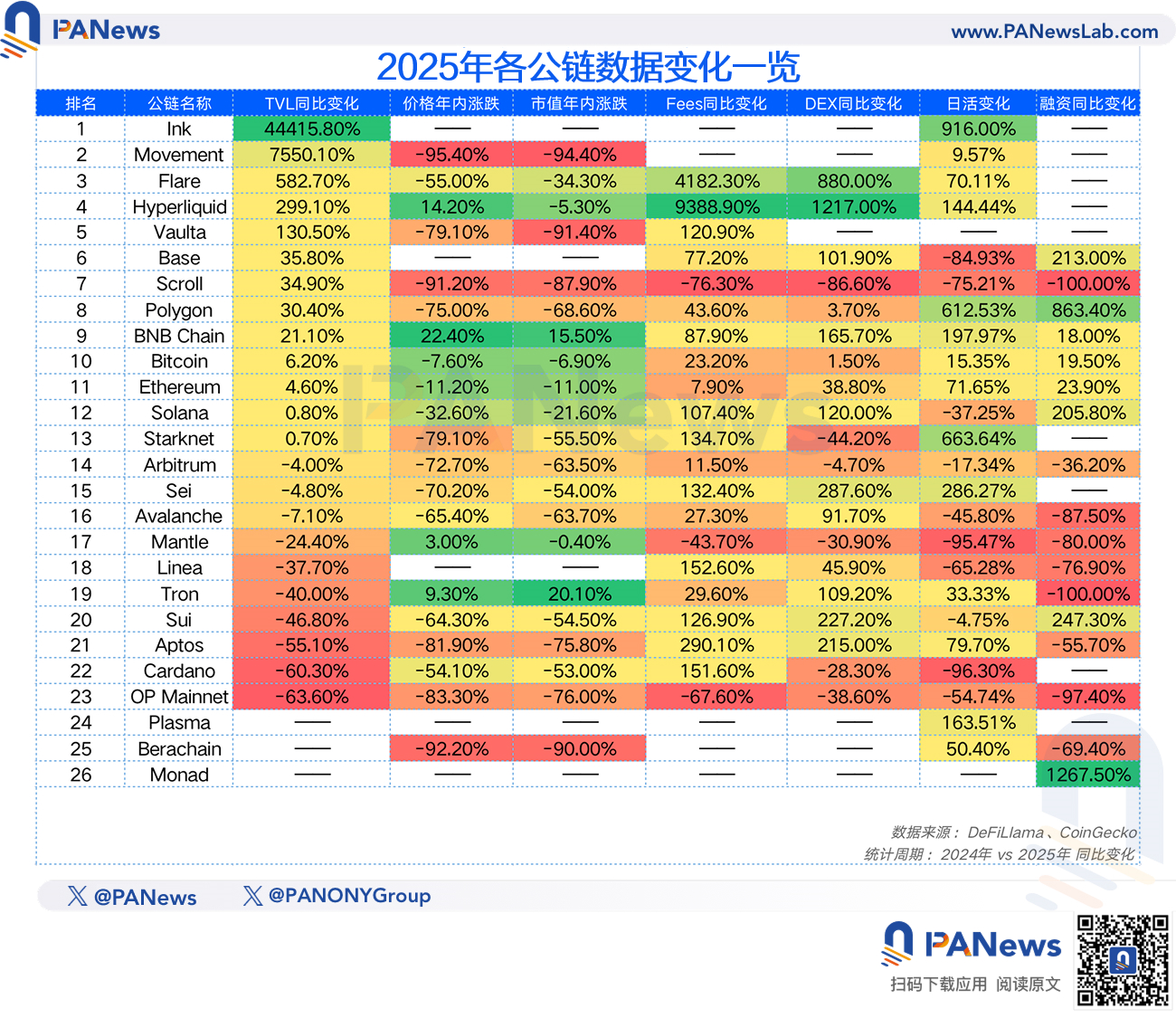

从衡量公链繁荣度最重要的指标TVL来看,今年头部公链总体略有增长,但增速放缓。PANews统计的26个主要公链的TVL总额今年增长了5.89%,其中还有5个新晋入选的公链,在初期的数据为0。此外,只有11个公链的TVL实现了正增长,占比约为42%。相比之下,2024年所统计的22条主流公链的年度TVL总增长为119%,增长比例达到78%。

TVL数据的增速放缓也体现出整个加密市场浓浓的寒意。但这并不意味着2025年就是完全平淡的一年,从总体行业的TVL来看,全网在10月份的TVL高达1680亿美元,较年初的1157亿美元也有45%的增长。只是在10月之后因市场行情的暴跌,带动整个市场的TVL规模急转直下。一部分是因为各个公链基础代币价格下跌,另一部分则是市场在避险情绪下,不少资金选择撤出DeFi体系的结果。

而在排名前十的公链中,Hyperliquid显然是2025年的赢家,相较其他公链个位数的增长,Hyperliquid的TVL在今年实现了299%的增长。而Solana则成了最为失意的那个,增长只有0.8%,随着MEME币市场的冷却,这个公链巨头似乎正迎来危机。此外,在统计的26条公链当中,Flare的增长率超过582%,成为增长最快的公链。OP Mainnet的TVL则下降了63.6%,成为下滑最严重的公链。

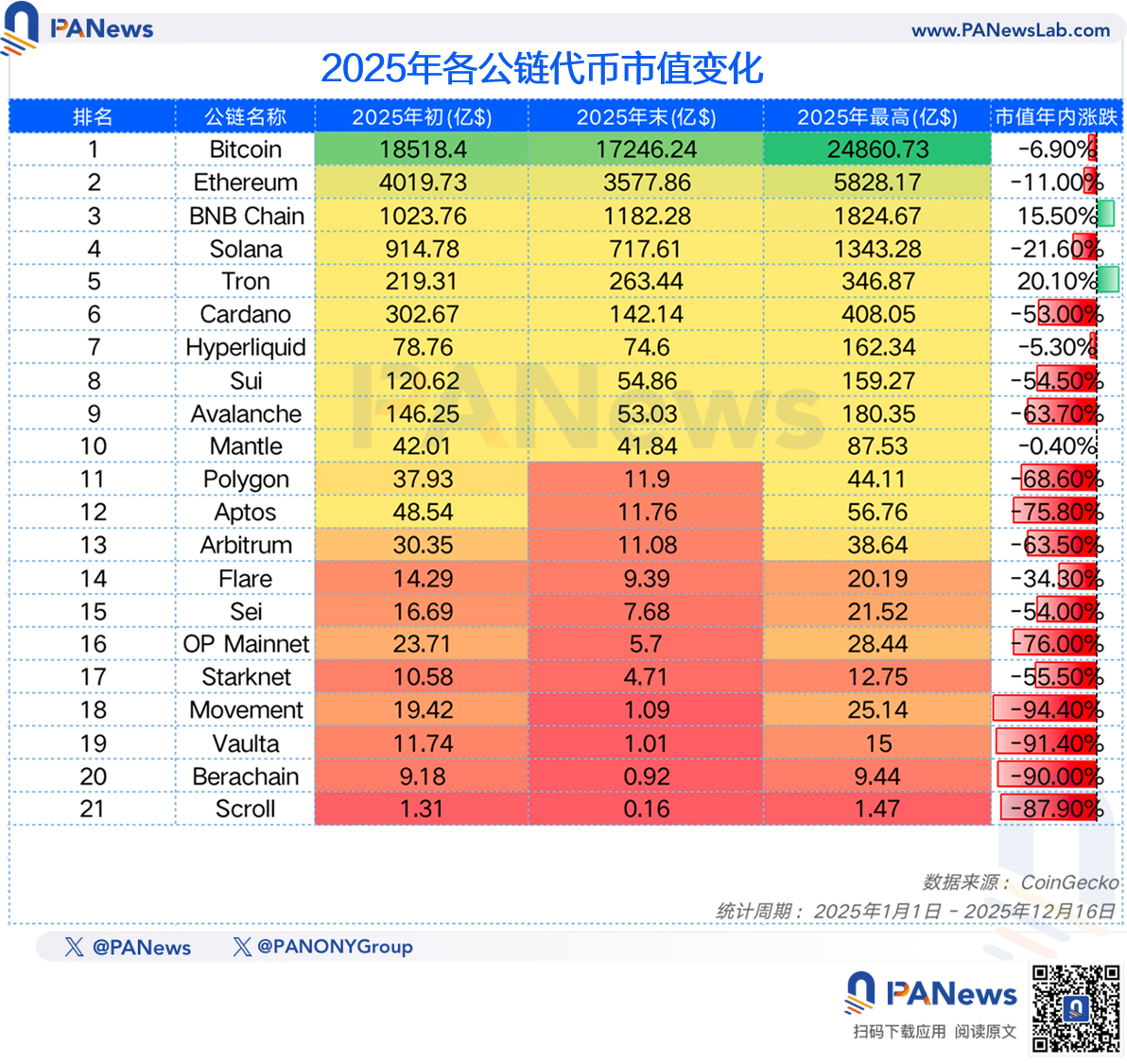

价格平均腰斩50%,市场不再为新公链买单

价格方面,这些主流公链今年的最终表现同样差强人意。相比年初的价格,这26个公链的代币价格平均下跌了50%。其中,Movement 代币价格下跌95%、Berachain 代币价格下跌92%、Scroll 则下跌91%。这些新晋公链并没能得到市场的认可。

在统计的公链当中,今年以来只有BNB Chain(22%)、Hyperliquid(14.2%)、Tron(9.30%)Mantle(3%)这4个公链实现价格上涨,其余都是下跌状态。

不过,TVL和价格这两项数据的背后的变化主要受到加密市场流动性变化的影响。对公链的生态发展指标进行分析之后,又是另一番图景。

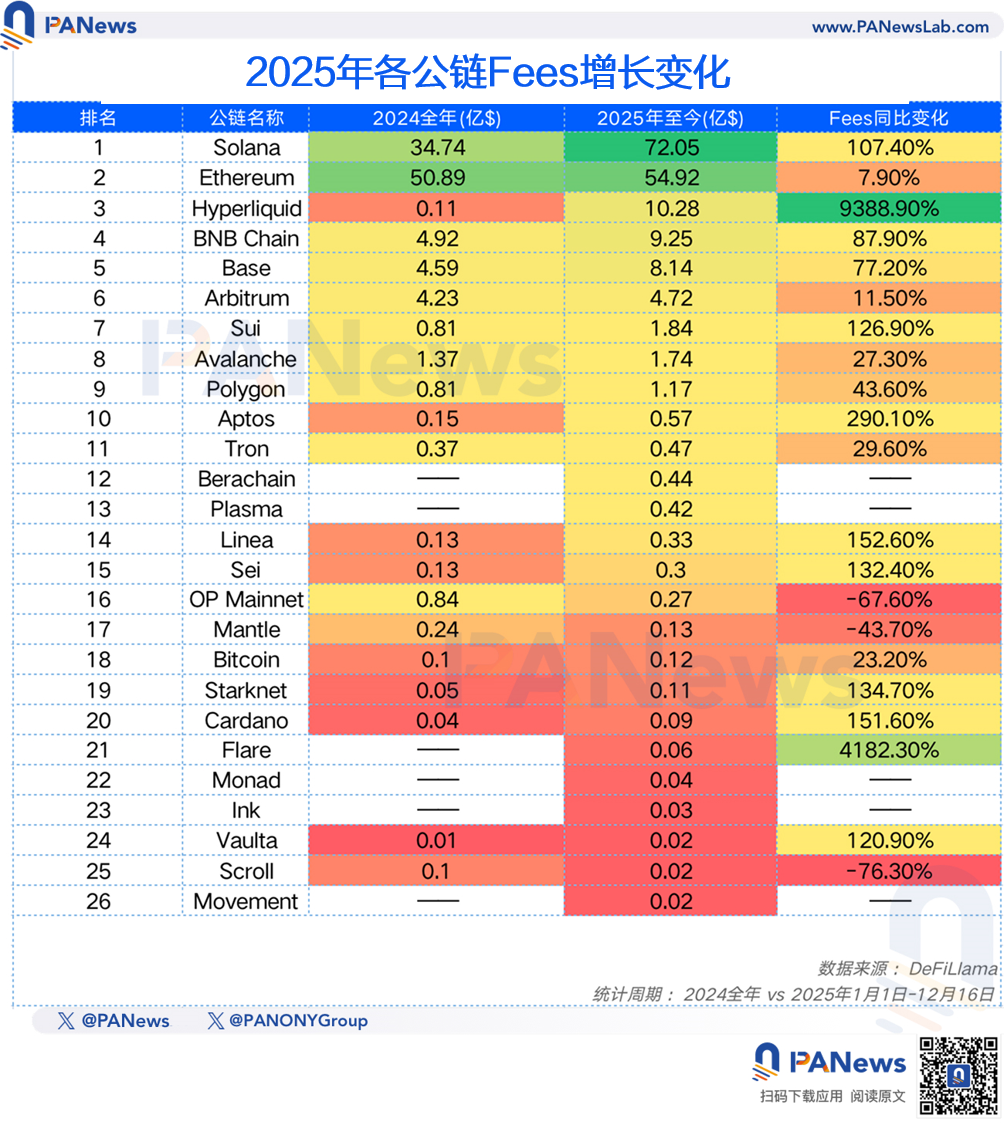

协议收入井喷,公链集体迈向“造血”新阶段

在链上费用产生方面,所统计的这些公链在2024年全年共产生了104亿美元的链上费用,而在2025年这个数值则增长为167.5亿美元,总体增长60%。并且,除了OP Mainnet、Mantle、Scroll三个公链的费用处于下滑,其他的公链全部在2025年实现了增长。

费用增幅最大的仍是Hyperliquid(9388.9%),这也主要源于Hyperliquid在2024年底时刚刚上线,初始基数较小。此外,Solana的费用实现了107%的增长,BNB Chain为77%、Sui达到126%、Aptos为290%。可以说,2025年主流公链的创收能力得到了很大的提升。

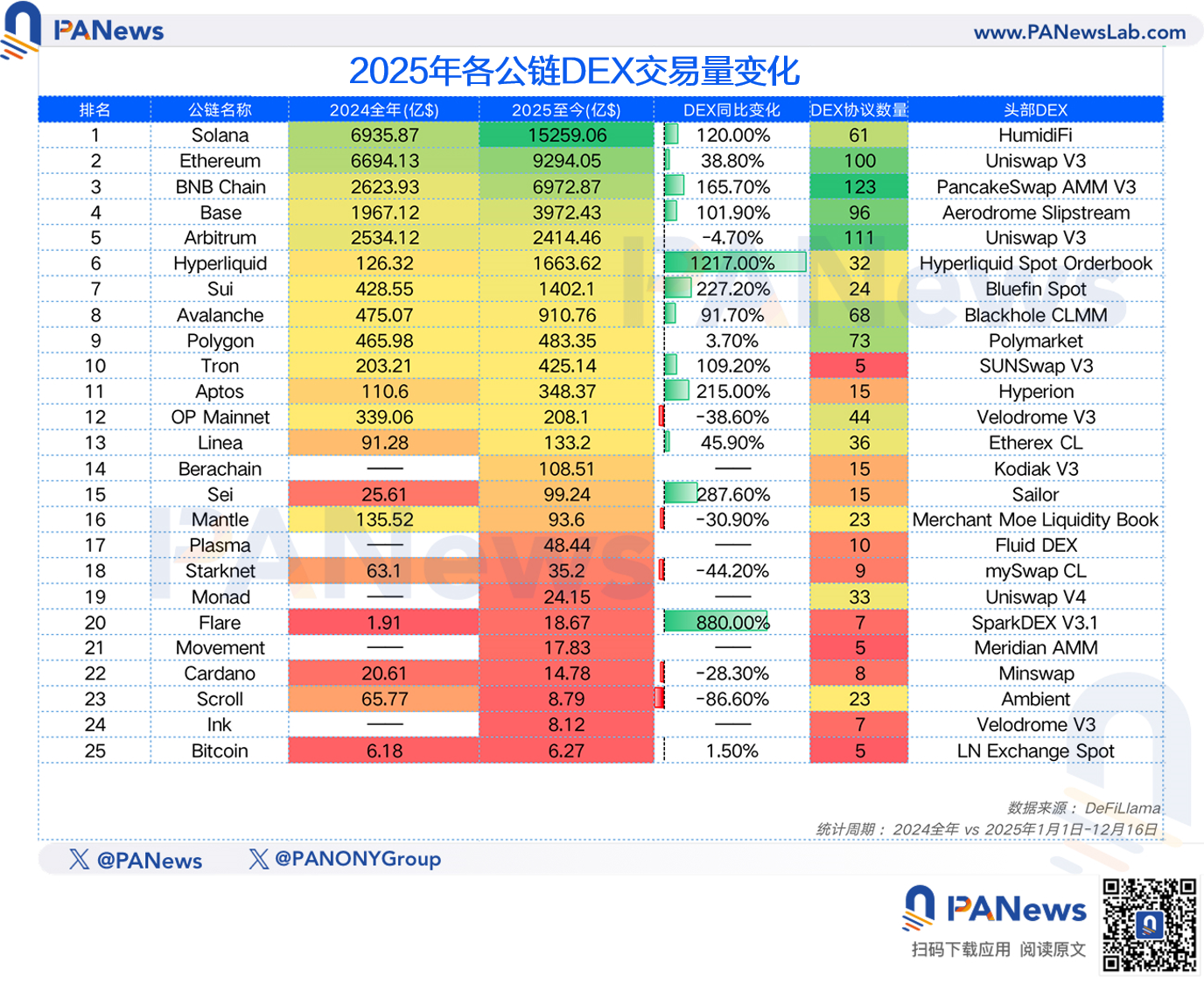

除此之外,在各个公链的DEX的交易量方面也总体实现了88%的增长,平均的增幅达到163%。其中,Solana更是完成对以太坊的逆袭,以1.52万亿美元登顶交易量最高的公链,BNB Chain也以6972亿的交易量紧紧跟随以太坊,极有可能在2026年同样对以太坊完成反超。

Hyperliquid依旧是增长最快的,年度DEX交易增幅为1217.00%,Flare以880%的增幅排名第二。

当“空投猎人”散去,新公链用户留存难

日活数据方面,则呈现出喜忧参半的态势。

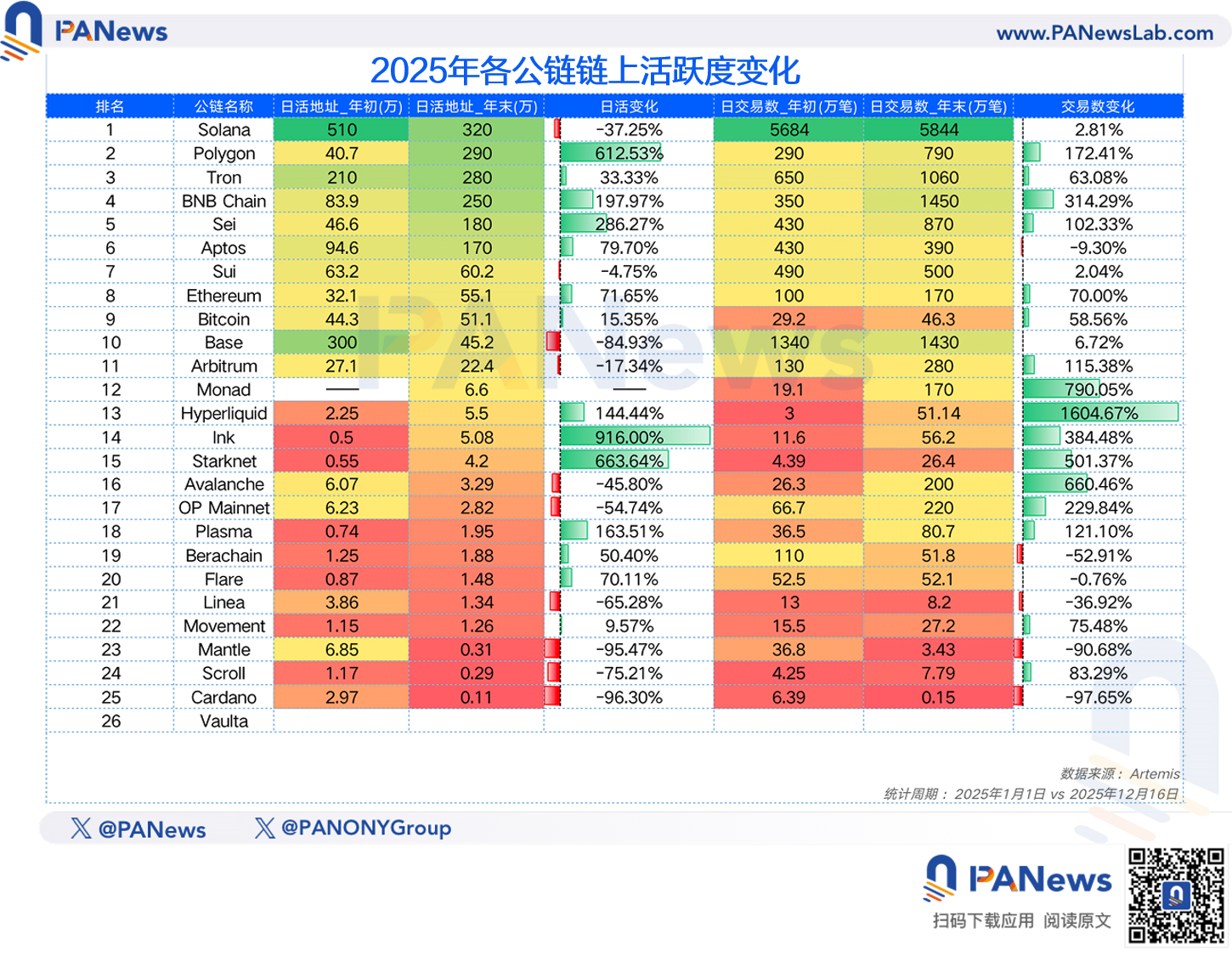

总体上这些公链的日活地址数从1486万增长到1760万,总体增幅达到18%。在市场低迷的状态下能达到这样的数据表现也算是一个相对较好的信号。

但另一方面,像Solana、Base、Sui等几个在过去最能代表散户活跃度的公链却都出现了不同程度的下滑,其中Base较年初的日活下降了84.9%,Solana下降了37%。而在近期,Polygon的日活地址数却迎来了指数级的增长,12月19日的日活地址数达到了290万,相比年初增长了612%,此外,BNB Chain、Sei、Aptos等公链的日活数量也实现了较大增长。

另外,在日交易笔数方面,这些公链在年末的交易量相比年初总体上也实现了33%的增长,这里BNB Chain的数据表现应该算最为亮眼的,从年初的350万笔增长至1450万笔,在规模和增幅上都表现出众。Solana虽然仍以5844万笔遥遥领先,不过全年仅实现了2.8%的增长,已显露疲态。

稳定币成2025年唯一的“全面牛市”

2025年的稳定币市场是全面爆发的一年,在公链的数据上看同样能够印证这一点。相比2024年,大多数公链的稳定币市值都实现了大幅增长,其中表现最突出的为当属Solana,年内稳定币市值激增196%,成为稳定币增幅最大的公链。以太坊和Tron作为稳定币的前两大公链,也分别保持了46%和37%的年内增长。除此之外,一些今年表现活跃的公链,如BNB Chain、Hyperliquid在稳定币上也实现了较大的增长。

生态融资:Polygon凭明星项目夺冠,以太坊、Solana热度不减

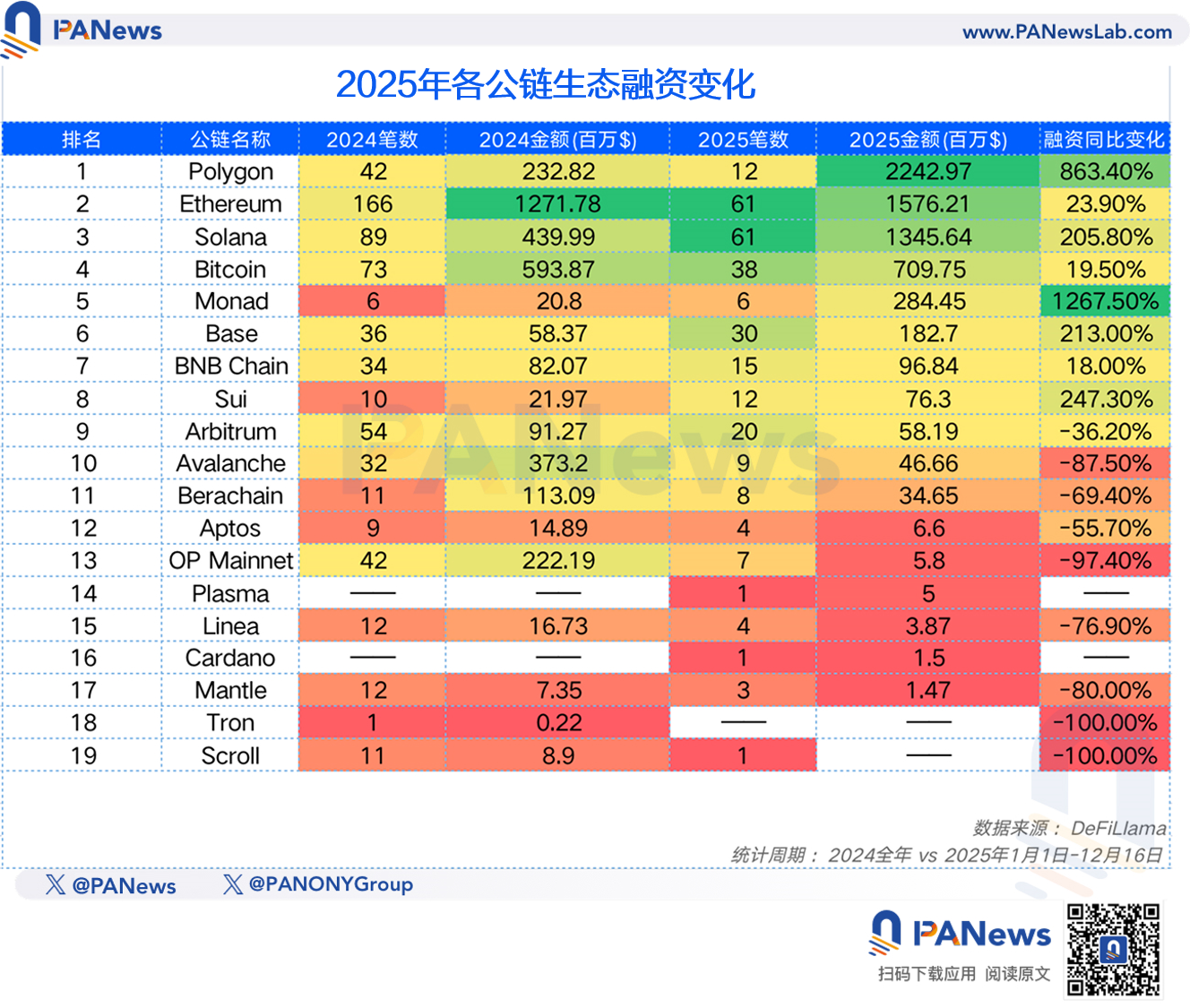

此外,还有个数据维度同样值得关注,那就是融资情况。2025年的加密行业在融资方面再创新高,PANews统计了6710条融资情况,并将这些融资事件按照所属的公链进行分类对比。从数据的结果来看,2025年这些公链的融资笔数有了大幅下降,从640笔降到了293笔。但总金额却从3.5亿美元增长至6.67亿美元,单笔平均融资金额从557万美元增长至2279万美元。这也侧面显示出,当下市场当中中小创业团队融资的难度可能更大,而资本则更愿意在一些明星项目身上投入更多资金。

在公链的分类上看,Polygon以22.4亿美元成为融资最多的公链,以太坊和Solana分别获得了15.7亿和13.4亿美元。不过Polygon之所以领衔融资榜,主要依靠的是Polymarket超过20亿美元的巨额融资。细看融资事件数量,主要的融资事件还是发生在以太坊、Solana、比特币以及Base生态当中。

以下为几个市场重点关注的公链的分析:

以太坊:轻舟已过万重山,基本面复苏与币价滞涨的“错位期”

作为公链龙头,以太坊在2025年的发展可以形容为“轻舟已过万重山”,在2024年经历了L2严重分流导致的生态数据停滞,市场价格徘徊不前之后。2025年的以太坊实际上在生态数据上有了较好的增长,尤其在DEX交易量(增长38.8%)、稳定币市值(增长46%)、链上活跃地址(增长71%)等方面,另外,在生态融资事件和融资金额方面也依旧领先绝大多数公链。从这些数据指标来看,以太坊主网的生态发展在2025年得到了复苏。

只不过,在价格和TVL数据方面,则受到整个市场回调的影响依旧止步不前。不过,相对于其他公链代币来说,以太坊的价格表现相对具有更强的韧性。

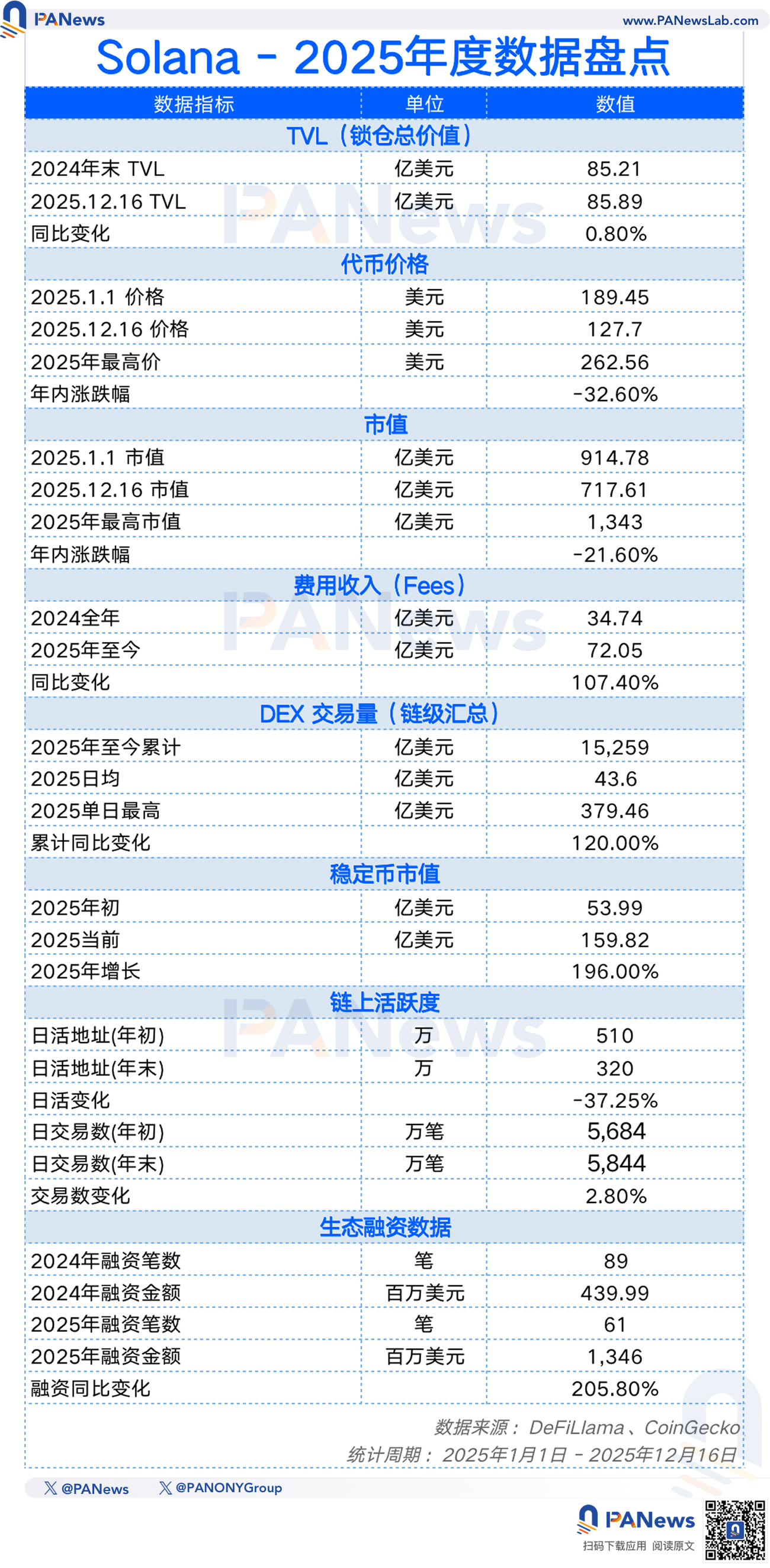

Solana:成也MEME败也MEME,繁荣泡沫破裂后的脆弱性显现

与2024年相比,Solana在2025年呈现出另一种状态:大起大落后暴露出的生态脆弱。在MEME市场在年初由盛转衰之后,Solana再未能走出更多叙事,反而是各个发射平台在MEME币赛道持续内卷。因此,虽然本年内在费用捕获、DEX交易量上都有了较大增长,但代币价格、年末的活跃用户和交易笔数都出现了严重下滑。这也从侧面说明,市场正在用脚投票,Solana的繁荣泡沫似乎已经被吹破。

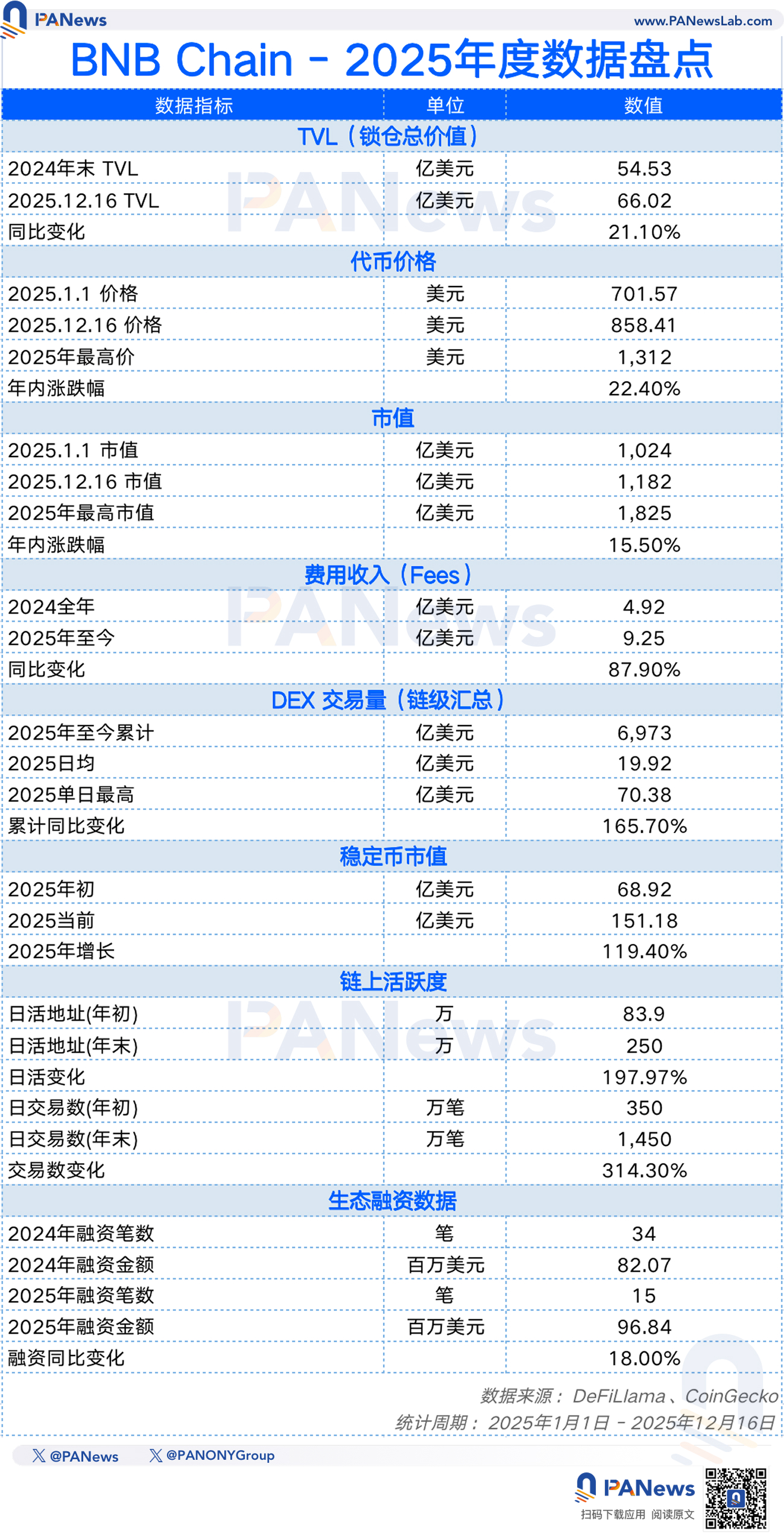

BNB Chain:从防御转为全面进攻,全维增长的“六边形战士”

BNB Chain在2025年实现了全面爆发,在所统计的所有数据维度当中都实现了正增长。尤其是费用收入、DEX交易量、稳定币市值、链上活跃度等方面几乎都是超过1倍以上的增长。这在整个公链市场低迷的状态之下是罕见的。

当然,这样的成绩与币安有着密不可分的关系。从CZ等高层主动下场参与营销,到推出币安Alpha已成为不少散户撸毛的“必修课”,再到Aster等新衍生品交易所狙击Hyperliquid。BNB Chain从2024年的反击已经转变为全面进攻,并且这样的攻势来势汹汹,对所有的公链来说,BNB Chain可能都已经成为绝对不能忽视的对手。

Hyperliquid:年度最大黑马,用“真实收益”给行业上了一课

与BNB Chain类似,Hyperliquid在2025年同样大放异彩,除了市值较年初略有下降(-5.3%)之外,其他的数据都是正增长,并且多个数据的增幅都是所有公链中最大的。

2025年,Hyperliquid的TVL排在全网第九、费用产生金额排名第三、DEX交易量第六、稳定市值排名第五。从这些指标的排位来看,Hyperliquid已经成为名副其实的主流公链,而作为这个市场的新人,取得这样的成绩显然是十分成功的。并且,它还是2025年极少数不依赖通胀激励就能通过真实收入养活整个生态的公链。

不过,Hyperliquid近期也遇到了强劲的对手追赶,Aster和Lighter等竞品的交易量已经逼近。不知不觉中,前一年还作为挑战者的Hyperliquid,2026年的主旋律可能就要转为守擂台了。

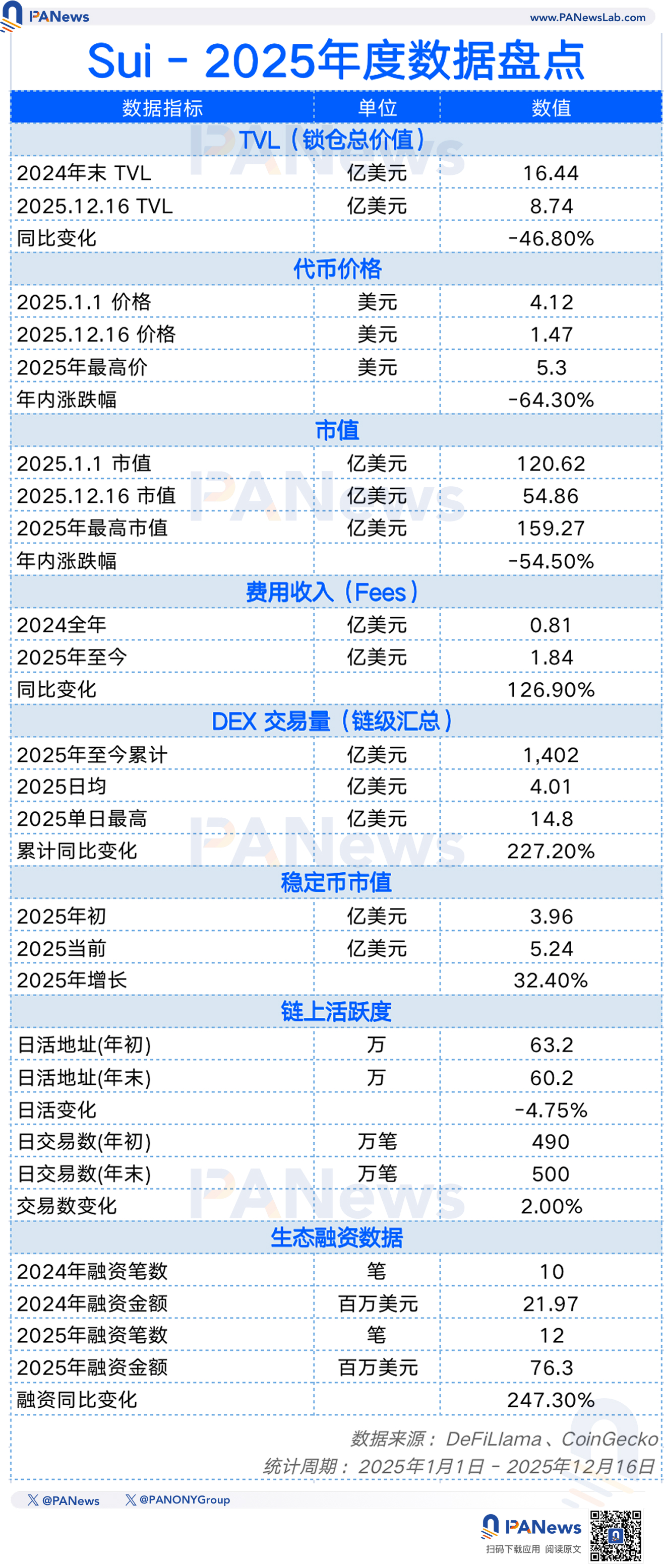

Sui:解锁压顶下的“深蹲”,亟待在泡沫破裂中重塑

作为2024年曾强势追赶Solana并被市场寄予厚望的新兴公链。Sui在2025年相对沉寂,在所有主流公链中,Sui的币价跌幅(-64%)、TVL跌幅(-46.8%)等数据都显示出来自市场的压力。这主要归因于2025年Sui进入了“密集解锁期”。早期投资者和团队的大量筹码进入市场,叠加整个市场遇冷,导致价格承压。

与此同时,生态的活跃度方面,日活数据和日交易笔数相较年初几乎持平,也反映出这一年内Sui的沉寂根源:缺少新的叙事,跟随MEME市场又未能彻底爆发。不过,从融资金额和DEX交易量等数据增幅来看,资本市场本质上并未彻底抛弃Sui,2026年可能是泡沫破裂后重塑的一年。

Tron:极致的实用主义者,深耕支付赛道的“现金流之王”

2025年的Tron的发展轨迹为公链市场树立了另一种叙事风格:借稳定币的东风,持续“闷声发财”。虽然在TVL、代币价格方面都有了一半左右的回撤,但Tron依靠着稳定币市场的稳定发挥,依旧产生了1.84亿美元的链上费用(增幅126.9%),DEX交易量扩张224%。对Tron来说,与其追逐热点找新的叙事,不如做好全球稳定币结算的基本功,这种务实的态度,也让它成为现金流稳定、用户粘性较强的公链。

回看2025年的公链江湖,这不仅是一份年度成绩单,更是公链发展众生相。

数据的红黑榜清晰地告诉我们:公链赛道“万马奔腾”的草莽时代已经结束,取而代之的是残酷的“存量博弈”与“寡头化”趋势。 无论是Solana在MEME潮退后的流量焦虑,还是Sui在代币解锁压顶下的价格阵痛,亦或是Movement、Scroll等新晋公链在二级市场的惨烈破发,都证明了依靠VC输血和积分PUA维持的虚假繁荣已难以为继。

然而,在满屏的下跌中,我们更能看到行业韧性的进化。BNB Chain凭借全生态的爆发式增长、Hyperliquid依靠极致的真实收益、以及Tron在支付赛道的务实深耕,共同指明了2026年的生存法则:活下来,不靠讲故事,而靠赚钱;不靠刷量,而靠真实用户。

2025年的寒意或许刺骨,但它成功挤掉了附着在公链身上多年的泡沫。对于即将到来的2026年,我们有理由相信,在这个更干净、更务实的地基之上,公链将不再仅仅是投机的赌场,而是真正成为承载大规模价值交换的全球金融基础设施。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。