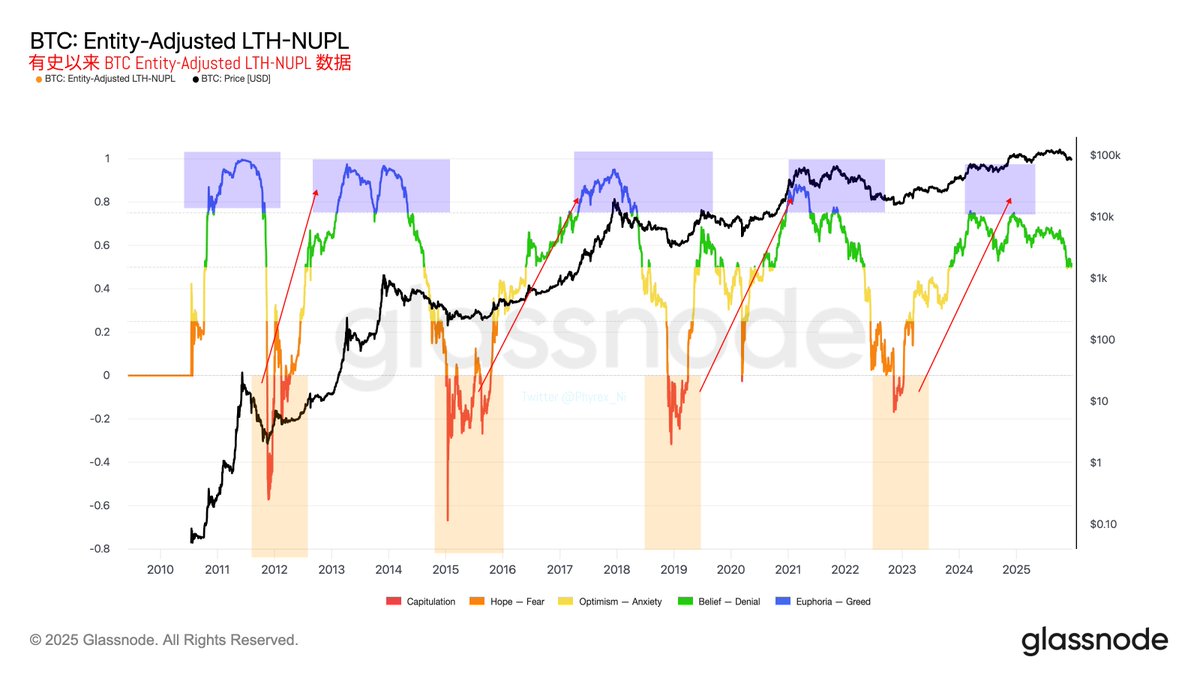

对于牛市和熊市的判断,现在市场的分歧其实已经不大,越来越多的小伙伴开始认为已经进入熊市。但从我更偏好的长期持有者情绪与恐慌指标来看,目前仍然处在绿色区间(信念–怀疑),而“怀疑”本身,正好对应了当下市场的主流态度。

从更细分的数据来看,最近确实已经有短暂进入黄色区间(乐观–焦虑)的情况,如果价格继续下行,情绪进一步走弱是可以预期的。但至少从长期持有者的行为来看,他们并未表现出典型熊市中那种系统性撤退或恐慌性抛售。

同时,我们也看到交易所 $BTC 存量仍在下降,说明愿意被卖出的筹码在减少,更多 BTC 被转移到长期持有状态,高净值资金仍在持续吸筹。很多小伙伴会问,既然买入行为持续存在,为什么价格还在下跌?原因在于当下的买入更多是被动、配置型的买入,它改变的是供给结构,而不是短期价格。

交易所储备下降本身是一个偏长期、偏结构性的信号,意味着未来供给冲击在减弱,但短期价格依然主要由宏观环境、杠杆资金、流动性和情绪所主导。说人话,交易所存量下降,一方面是抛售意愿降低,另一方面是越来越多投资者选择退出短期博弈,但这并不意味着日内交易对价格的影响在减弱。

从换手率数据来看,市场中仍然存在大量日内交易行为,价格主要由这部分短期资金反复博弈决定,而长期资金已经逐步退出定价权。这也是当前阶段市场流动性看似存在、但实际有效流动性持续下降的重要原因。

@bitget VIP,费率更低,福利更狠

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。