Original Title: "Why Will Market Sentiment Completely Collapse in 2025? | Interpretation of Messari's 100,000-Word Annual Report (Part 1)"

Original Source: Merkle3s Capital

This article is based on Messari's annual report released in December 2025, The Crypto Theses 2026. The full report exceeds 100,000 words, with an official reading time of 401 minutes. The information in this article is for reference only and does not constitute any investment advice or invitation. We do not take responsibility for the accuracy of the content, nor do we bear any consequences arising from it.

Introduction | This is the worst year for sentiment, but not the weakest year for the system

If we only look at sentiment indicators, the crypto market in 2025 could almost be sentenced to "death."

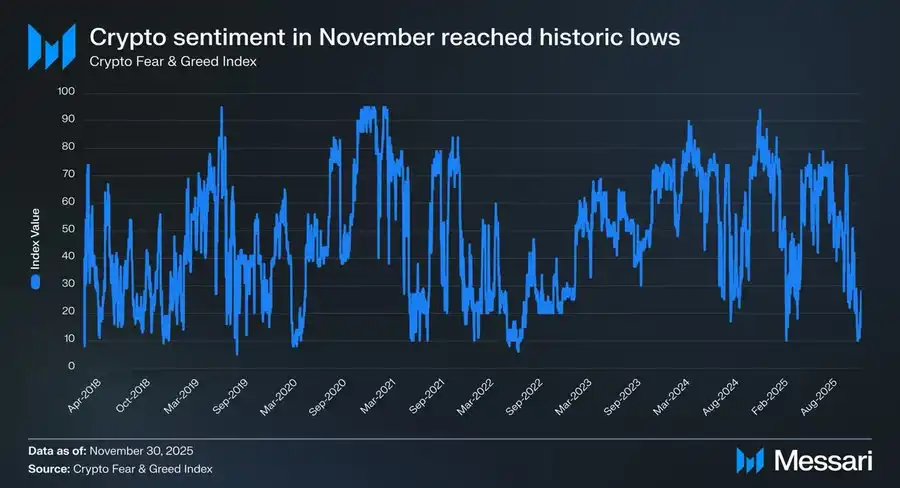

In November 2025, the Crypto Fear & Greed Index fell to 10, entering the "extreme fear" zone.

Historically, there have been very few moments when sentiment has dropped to this level:

- March 2020, liquidity crunch triggered by the global pandemic

- May 2021, leveraged liquidations

- May–June 2022, systemic collapse of Luna and 3AC

- 2018–2019, industry-wide bear market

These periods share a commonality: the industry itself was failing, and the future was highly uncertain.

However, 2025 does not fit this characteristic. There were no major trading platforms misappropriating user assets, no Ponzi schemes worth hundreds of billions of dollars dominating the narrative, the total market cap did not fall below the previous cycle's peak, and the scale of stablecoins reached an all-time high, with regulatory and institutional processes continuing to advance.

On the "factual level," this is not a year of industry collapse. However, on the "emotional level," it may be the most painful year for many practitioners, investors, and long-time users.

Why Did Sentiment Collapse?

Messari provides a striking comparison at the beginning of the report:

If you were involved in crypto asset allocation from an office on Wall Street, 2025 might be the best year since you entered the industry. But if you were staying up late on Telegram or Discord, monitoring the market and searching for Alpha, this might be the year you most miss the "old days."

The same market, two almost completely opposite experiences. This is not a random emotional fluctuation, nor a simple bull-bear switch, but a deeper structural misalignment: the market is changing participants, but most people are still participating in the new system with old identities.

This is not a market review

This article does not intend to discuss short-term price trends, nor does it attempt to answer the question of "will it rise next?"

It is more like a structural explanation:

- Why, while the system, capital, and infrastructure are continuously strengthening,

- does market sentiment slide toward historically low points?

- Why do many people feel they "chose the wrong track," yet the system itself has not failed?

In this 100,000-word report, Messari chooses to start from a very fundamental question: If crypto assets are ultimately a form of "money," then who deserves to be treated as money?

Understanding this is the prerequisite for understanding the complete collapse of market sentiment in 2025.

Chapter One | Why Is Sentiment So Abnormally Low?

If we only look at the results, the sentiment collapse in 2025 is almost "incomprehensible."

In the absence of trading platform failures, systemic credit collapses, or core narrative bankruptcies, the market has provided sentiment feedback close to historical lows.

Messari's judgment is very direct: this is an extreme case of "sentiment being severely decoupled from reality."

1. Sentiment indicators have entered the "historically abnormal range"

The Crypto Fear & Greed Index falling to 10 is not an ordinary pullback signal.

In the past decade, this value has only appeared in a few rare moments, and each time it has been accompanied by real and profound industry-level crises:

- Breakdown of the funding system

- Collapse of the credit chain

- Market doubts about "whether the future exists"

But these problems did not occur in 2025.

There were no failures of core infrastructure, no mainstream assets liquidated to zero, and no systemic events sufficient to shake the legitimacy of the industry. Statistically speaking, this sentiment reading does not match any known historical template.

2. The market has not failed; what has failed is the "personal experience"

The collapse of sentiment does not stem from the market itself, but from the subjective experiences of participants. Messari repeatedly emphasizes a neglected fact in the report: 2025 was a year where institutional experiences were far better than retail experiences.

For institutions, this was an extremely clear, even comfortable environment:

- ETFs provided low-friction, low-risk allocation channels

- Digital Asset Trusts (DAT) became stable, predictable long-term buyers

- Regulatory frameworks began to clarify, and compliance boundaries gradually became visible

But for many participants under old structures, this year was exceptionally harsh:

- Alpha significantly decreased

- Narrative rotation failed

- Most assets underperformed BTC in the long term

- The relationship between "effort" and "results" was completely broken

The market did not reject people; it simply changed the reward mechanism.

3. "Not making money" is misinterpreted as "the industry is failing"

The true trigger of sentiment is not the price drop, but the cognitive dissonance. In past cycles, the implicit assumption in crypto was that as long as one was diligent, early, and aggressive enough, they could achieve excess returns.

But 2025 systematically broke this assumption for the first time.

- Most assets no longer gained premiums for "storytelling"

- L1 ecosystem growth no longer automatically translated into token returns

- High volatility no longer meant high returns

The result is that many participants began to develop an illusion: if I didn't make money, then the entire industry must be in trouble. Messari's conclusion is precisely the opposite: the industry is becoming more like a mature financial system, rather than a machine that continuously generates speculative dividends.

4. The essence of sentiment collapse is identity misalignment

Considering all phenomena, Messari provides only one implicit answer: the collapse of sentiment in 2025 is essentially an identity misalignment.

- The market is shifting towards "asset allocators," "long-term holders," and "institutional participants"

- But many participants still exist as "short-term Alpha seekers"

When the system's reward logic changes, and the way of participation does not adjust in sync, sentiment is bound to collapse first. This is not a personal capability issue, but the friction cost of switching roles in the era.

Summary | Sentiment Does Not Tell You the Truth

The market sentiment in 2025 truly reflects the pain of participants, but does not accurately reflect the state of the system.

- Sentiment collapse ≠ industry failure

- Intensified pain ≠ value disappearance

It merely indicates one thing: the old ways of participation are rapidly becoming ineffective. Understanding this is the prerequisite for entering the next chapter.

Chapter Two | The True Root of Sentiment Collapse: The Monetary System is Failing

If we only stay at the market structure level, the sentiment collapse in 2025 is still not fully explained. The real issue is not:

- Alpha has decreased

- BTC is too strong

- Institutions have entered

These are merely surface phenomena. Messari's deeper judgment in the report is: the collapse of market sentiment fundamentally stems from a long-ignored fact — the monetary system we are in is continuously pressuring savers.

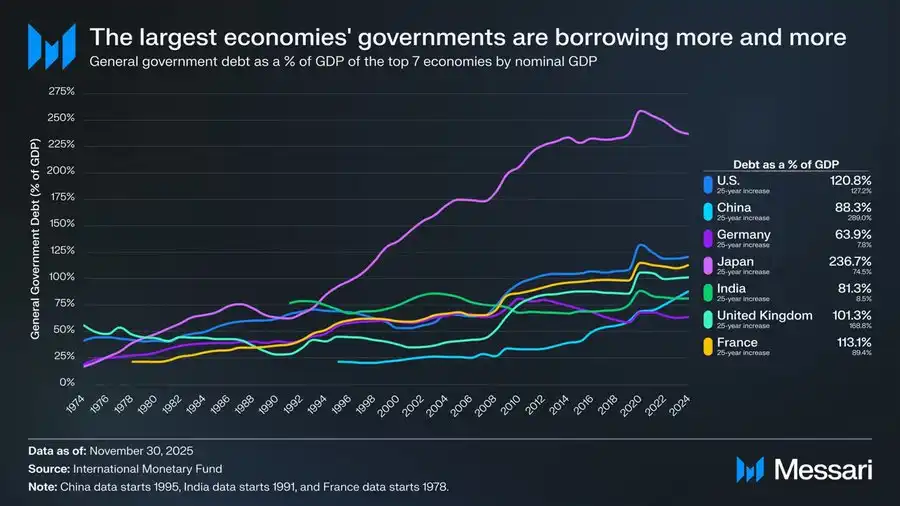

A chart that must be acknowledged: Global government debt is out of control

This chart is not a macro background decoration, but the logical starting point for the entire Cryptomoney argument.

Over the past 50 years, the ratio of government debt to GDP in major global economies has shown a highly consistent and almost irreversible upward trend:

- United States: 120.8%

- Japan: 236.7%

- France: 113.1%

- United Kingdom: 101.3%

- China: 88.3%

- India: 81.3%

- Germany: 63.9%

This is not the result of governance failure in any one country, but a common outcome across systems, political structures, and stages of development. Whether in democratic countries, authoritarian states, or developed economies and emerging markets, government debt has long outpaced economic growth.

What this chart truly indicates is not "high debt," but "savings being systematically sacrificed"

When government debt grows faster than economic output, the system can only maintain stability through three means:

- Inflation

- Long-term low real interest rates

- Financial repression (capital controls, withdrawal restrictions, regulatory interventions)

Regardless of which path is taken, the ultimate cost will be borne by the same group of people: savers. Messari uses a very restrained but weighty statement in the report: When debt grows faster than economic output, the costs fall most heavily on savers. Translated, it means: when debt outpaces growth, savers are destined to be the sacrificed party.

Why Did Sentiment Collapse Concentrate in 2025?

Because 2025 was the year when an increasing number of participants first clearly realized this fact.

Before this:

- "Inflation is just temporary"

- "Cash is always safe"

- "Fiat currency is stable in the long run"

But reality is continuously denying these assumptions.

When people discover:

- Working hard ≠ wealth preservation

- The act of saving itself is continuously shrinking

- The difficulty of asset allocation has significantly increased

The collapse of sentiment does not stem from Crypto, but from the erosion of confidence in the entire financial system. Crypto is merely the place where this shock is first perceived.

The significance of Cryptomoney is not "higher returns"

This is also a point that Messari repeatedly emphasizes but is easily misinterpreted. Cryptomoney does not exist to promise higher returns.

Its core value lies in:

- Predictable rules

- Monetary policy not subject to arbitrary changes by a single institution

- Assets can be self-custodied

- Value can be transferred across borders without permission

In other words, what it offers is not a "money-making tool," but: the re-empowerment of individuals with monetary choice in a high-debt, low-certainty world.

The collapse of sentiment is, in fact, a form of "awakening"

When you place this debt chart alongside the market sentiment of 2025, you will find an counterintuitive conclusion: the extreme pessimism of sentiment does not indicate industry failure, but rather that more and more people are beginning to realize that the problems of the old system are real.

The problem with crypto has never been "uselessness." The real issue is: it no longer generates easy excess returns for everyone.

Summary | From Sentiment to Structure, and Then to Money Itself

This chapter addresses a fundamental question: why, in the absence of a systemic collapse, does market sentiment fall to historical lows? The answer is not in the candlestick charts, but in the monetary structure.

- The collapse of sentiment is a superficial phenomenon

- The paradigm shift is a process

- The imbalance in the monetary system is the root cause

And this is precisely why Messari chose to start the entire report from "money" rather than "applications."

Chapter Three | Why Only BTC is Treated as "Real Money"

If you've read this far, it's easy to have a question: if the problem lies in the monetary system, then why is the answer BTC and not something else?

Messari's judgment in the report is exceptionally clear: BTC is no longer in the same competitive dimension as other crypto assets.

1. Money is not a technical issue, but a consensus issue

This is the first key to understanding BTC. Messari repeatedly emphasizes a fact that engineers often overlook: Money is a social consensus, not a technical optimization problem. In other words:

- Money is not about "who is faster"

- Not about "who is cheaper"

- Not about "who has more functions"

But about who is long-term and stably considered a store of value. From this perspective, Bitcoin's victory is not mysterious.

2. Three years of data have already written the answer on the face

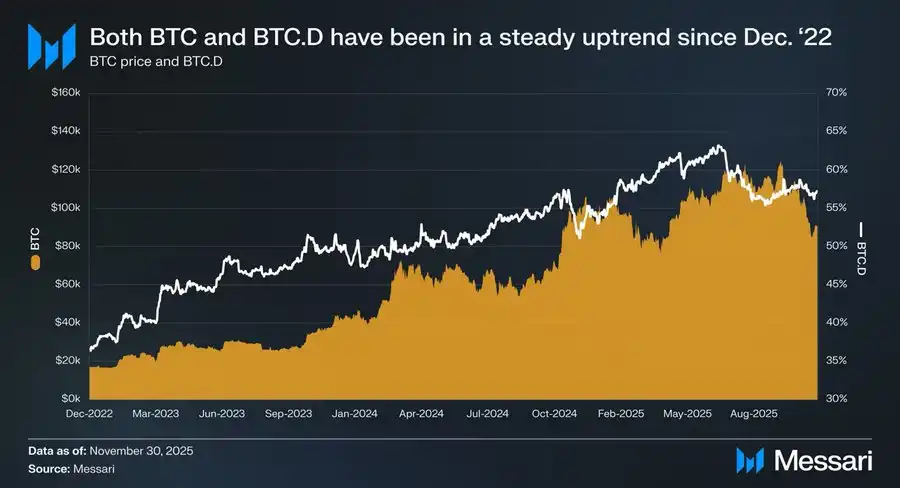

From December 1, 2022, to November 2025:

- BTC increased by 429%

- Market cap rose from $318 billion to $1.81 trillion

- Global asset ranking entered the top ten

More importantly, the relative performance: BTC.D rose from 36.6% to 57.3%. In a cycle where "theoretically altcoins should soar," funds continued to flow back to BTC. This is not a random result of a market cycle; it is the market reclassifying assets.

3. ETFs and DATs essentially "institutionalize consensus"

Messari's evaluation of ETFs is very restrained, but the conclusion is significant. Bitcoin ETFs are not simply "new buying power"; they fundamentally change: who is buying + why they are buying + how long they can hold.

- ETFs turn BTC into a compliant asset

- DATs make BTC part of corporate balance sheets

- National reserves elevate BTC to the level of "strategic asset"

When BTC is held by these roles, it is no longer: "a high-volatility risk asset that can be discarded at any time," but rather: a monetary asset that must be held long-term and cannot be easily mismanaged. Once money is treated this way, it is hard to revert.

4. Why BTC becomes "boring," the more it resembles money

This may be the most counterintuitive point of 2025:

- BTC has no applications

- No narrative rotation

- No ecological stories

- Not even "new things"

But precisely because of this, it meets all the characteristics of "money":

- Does not rely on future promises

- Does not need a growth narrative

- Does not require a team to continuously deliver

It just needs to not make mistakes.

And in a high-debt, low-certainty world, "not making mistakes" itself is a scarce asset.

5. BTC's strength is not the market's failure

Many people's pain comes from an illusion: "BTC's strength indicates something is wrong with the market." Messari's judgment is exactly the opposite: BTC's strength is the market becoming more rational.

When the system begins to reward:

- Stability

- Predictability

- Long-term credibility

Then all strategies relying on "high volatility for high returns" will become increasingly painful. This is not a problem with BTC; it is a problem with the way of participation.

Summary | BTC Did Not Win; It Was Chosen

BTC did not "defeat" other assets. It was simply validated by the market in an era where the monetary system is continuously failing as:

- The asset that needs the least explanation

- The asset that relies the least on trust

- The asset that requires no future promises

This is not the result of a market cycle, but a form of role confirmation.

Chapter Four | When the Market Only Needs One "Money," the Story of L1 Begins to Fail

After confirming that BTC has been chosen by the market as the "main Cryptomoney," an unavoidable question arises: if money already has an answer, what is left for Layer 1? Messari does not provide a direct conclusion, but after reading this part, a trend becomes very clear: the valuation of L1 is being forced to shift from "future narratives" back to "real constraints."

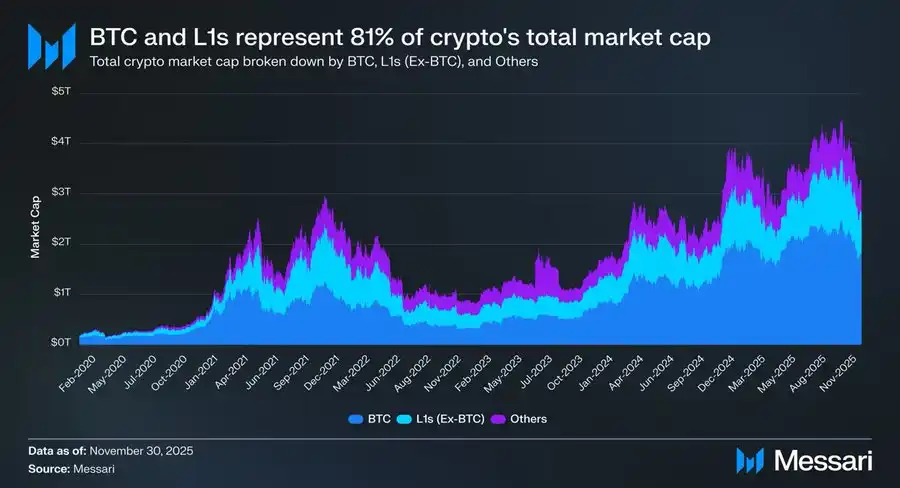

1. A cruel but real fact: 81% of market cap is in the "money" narrative

As of the end of 2025, the total market cap of the crypto market is approximately $3.26 trillion:

- BTC: $1.80 trillion

- Other L1: approximately $0.83 trillion

- Other assets: less than $0.63 trillion

In total, about 81% of the market cap of crypto assets is priced by the market as "money" or "potential money." What does this mean? It means that the valuation of L1 is no longer based on the pricing logic of "application platforms," but rather on "does it qualify to become money."

2. The problem is: most L1s do not qualify

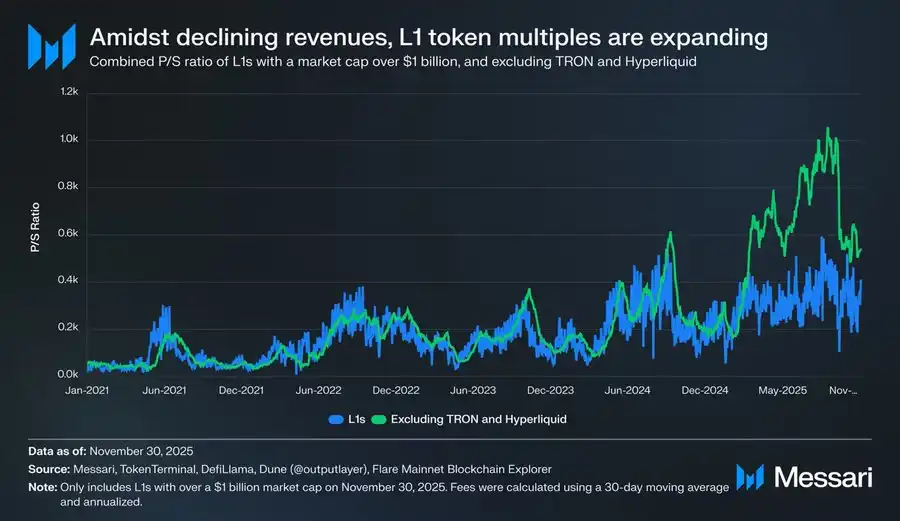

Messari provides data that is very direct and very harsh.

After excluding exceptional cases like TRON and Hyperliquid with abnormally high revenues:

- Overall revenue of L1 continues to decline

- But valuation multiples are continuously rising

The adjusted P/S ratios are as follows:

- 2021: 40x

- 2022: 212x

- 2023: 137x

- 2024: 205x

- 2025: 536x

Meanwhile, total revenue of L1 during the same period:

- 2021: $12.3 billion

- 2022: $4.9 billion

- 2023: $2.7 billion

- 2024: $3.6 billion

- 2025 (annualized): $1.7 billion

This is a discrepancy that cannot be reasonably explained by "future growth."

3. L1 is not "undervalued," but "reclassified"

Much of the pain comes from a misunderstanding: "Is L1 being wrongfully killed by the market?" Messari's judgment is exactly the opposite: the market is not wrongfully killing L1, but is reducing their "monetary imagination space."

If an asset:

- Cannot store value stably

- Cannot be held long-term

- Cannot provide certain cash flow

Then it ultimately has only one pricing method: high beta risk asset.

4. The example of Solana actually explains everything

SOL is one of the few L1s that outperformed BTC in 2025. But Messari points out a devastating fact:

- SOL's ecological data growth increased by 20-30 times

- Its price only outperformed BTC by 87%

In other words: to achieve "significant excess returns" in front of BTC, L1 needs an order of magnitude level ecological explosion. This is not a matter of "not trying hard enough"; the return function has already been rewritten.

5. When BTC becomes "money," the burden on L1 becomes heavier

This is a structural change that many people do not realize. Before BTC had a clear monetary status:

- L1 could tell the story of "becoming money in the future"

- The market was willing to pay in advance for this possibility

But now:

- BTC has already been established

- The market is no longer willing to pay the same premium for "the second money"

Thus, L1 faces a more difficult question: if you are not money, then what exactly are you?

Summary | The Problem with L1 is Not Competition, but Positioning

L1 did not "lose to BTC." What they lost is:

- In the dimension of money

- The market no longer needs more answers

Once the "money narrative" is lost, all valuations must reaccept the constraints of reality.

This is the direct source of the emotional collapse of many participants in 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。