Nic Carter’s long-form thread on X lays out a sobering case: while the exact timeline for a cryptographically relevant quantum computer remains uncertain, the window for Bitcoin to prepare is far shorter than many assume. Drawing on government standards, private investment trends, and recent advances in quantum error correction, Carter argues that preparation must begin well before any hypothetical “Q-day” arrives.

This latest assessment builds on Carter’s earlier warnings about Bitcoin’s quantum vulnerability, where he suggested a realistic threat horizon around 2035. In both analyses, the point is consistent: Bitcoin’s reliance on elliptic curve cryptography is not theoretically safe forever, and protocol upgrades, by design, move slowly.

What makes Carter’s argument resonate is not alarmism, but logistics. Migrating Bitcoin to post-quantum cryptography would require years of coordination, conservative design choices, and widespread user participation. Some specific coins, including long-dormant early-era holdings like Satoshi’s cache, may never move at all. That reality forces uncomfortable questions that bitcoiners would prefer to postpone.

In his latest post, Carter’s core warning is blunt: Bitcoin’s weakest link isn’t math, it’s momentum. Elliptic curve cryptography was never sold as immortal, and even Satoshi flagged upgrades as inevitable. The problem, as Nic Carter frames it, is that Bitcoin culture treats “not imminent” as “not urgent.” Quantum breakthroughs do not arrive with press releases, and assuming a polite, well-telegraphed runway is a luxury history rarely provides.

Betting Bitcoin’s future on the hope that progress stays linear is less cypherpunk and more wishful thinking. The harder truth is procedural, not technical. Even with a viable post-quantum signature in hand, Bitcoin would still face years of debate, delay, and careful foot-dragging before anything ships. As Carter put it, “changing Bitcoin is like steering an aircraft carrier,” a reminder that governance inertia is not a bug — until it is.

That glacial pace now collides with governments already planning to phase out quantum-vulnerable cryptography by the mid-2030s. His concern isn’t that Bitcoin can’t adapt, but that waiting until Q-day turns preparation into panic — and panic has never been Bitcoin’s best engineer.

Still, not everyone is buying Carter’s take. Bitcoin advocate and entrepreneur Zach Herbert offered a counterpoint, stating, “This is too sensationalist and panic inducing, even just the title of the post. Irresponsible with so many investors looking to you for guidance.”

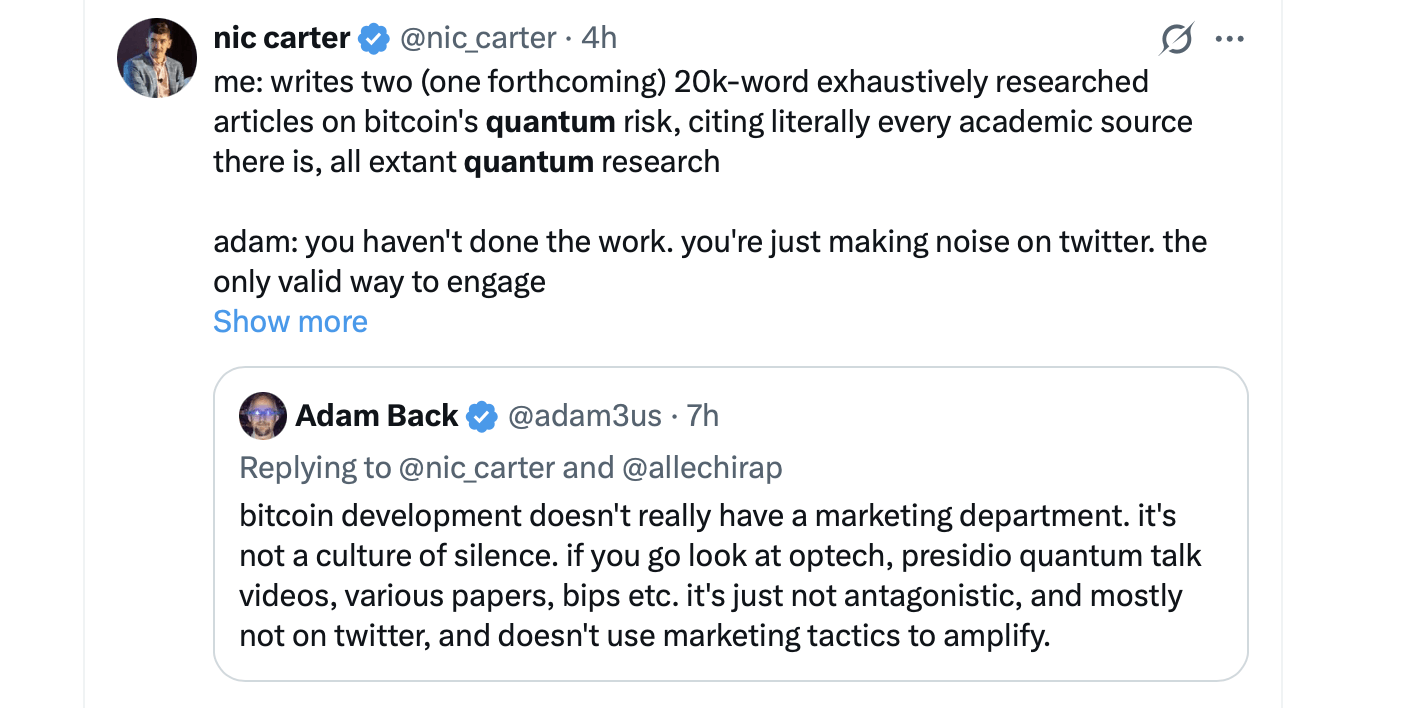

Carter replied:

“Denying that there’s a problem is irresponsible.”

Other prominent voices in the ecosystem have weighed in on the subject of quantum and Bitcoin, often agreeing on the stakes even when they disagree on tone. Taproot Wizard Eric Wall, a long-time Bitcoin researcher and investor, framed the issue bluntly: “The bitcoin quantum question is less so a question of technical feasibility… The actual bitcoin quantum question is just one of community response.”

Wall argues that Bitcoin’s defining feature is not code, but consensus, and that quantum risk represents the ultimate test of that social layer. In his view, panickers, skeptics, researchers, and strategists are all necessary ingredients of a healthy process — not signs of dysfunction.

That sentiment echoes comments from Bitcoin developer Jameson Lopp, who claimed on Sunday that he has spent more than a year publicly analyzing quantum risk. “No, quantum computers won’t break Bitcoin in the near future,” Lopp wrote in another post, adding that meaningful protocol changes and a mass migration of funds could easily take five to ten years. His conclusion: “hope for the best, but prepare for the worst.”

Others are more caustic. Paul Sztorc, the economist and developer behind Drivechain, criticized major Bitcoin development firms for what he views as complacency, arguing that institutional overconfidence poses risks of its own. While he agrees quantum computing is a concern, Sztorc suggests governance failures may be even more troubling.

Also read: Last Call for Gold and Silver? Veteran Analyst Warns 2026 Could Mark the Peak

Not everyone is eager to rush toward solutions. JAN3 CEO, Samson Mow, dismissed calls for immediate action as emotionally driven, likening them to past scaling battles. In his view, market fear is not a design flaw, and those who misunderstand Bitcoin’s resilience may simply exit early.

Zooming out further, philosopher and Bitcoin advocate Troy Cross offered a stark sociological observation: most investors admit they have no idea when or whether quantum computing becomes a threat — and likely won’t research it deeply enough to form strong opinions. That uncertainty, he notes, shapes market behavior as much as any technical development.

Taken together, these perspectives underline Carter’s core thesis. The quantum debate in 2025 is no longer fringe, theoretical, or dismissible. Governments are already planning transitions away from quantum-vulnerable encryption, while Bitcoin’s upgrade process remains deliberately cautious. That mismatch creates tension — and forces bitcoiners to confront how change happens in a system designed to resist it.

For now, no consensus exists on timing, mitigation, or governance. But the discussion itself signals maturity. Bitcoin has faced existential questions before, and survived them not by unanimity, but by argument, delay, and eventually, deliberate action. Quantum computing may be the next chapter — and possibly the hardest one yet.

- What is Nic Carter warning about?

Carter argues that quantum computing could eventually threaten Bitcoin’s cryptography and that preparation must start years in advance. - When could a quantum threat realistically emerge?

Carter and others suggest a possible window between 2030 and 2035, though timelines remain uncertain. - Can Bitcoin upgrade to resist quantum attacks?

Yes, but doing so would require complex protocol changes and a large-scale migration of funds over many years. - Is the Bitcoin community aligned on this issue?

No, but ongoing debate reflects a functioning governance process rather than panic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。