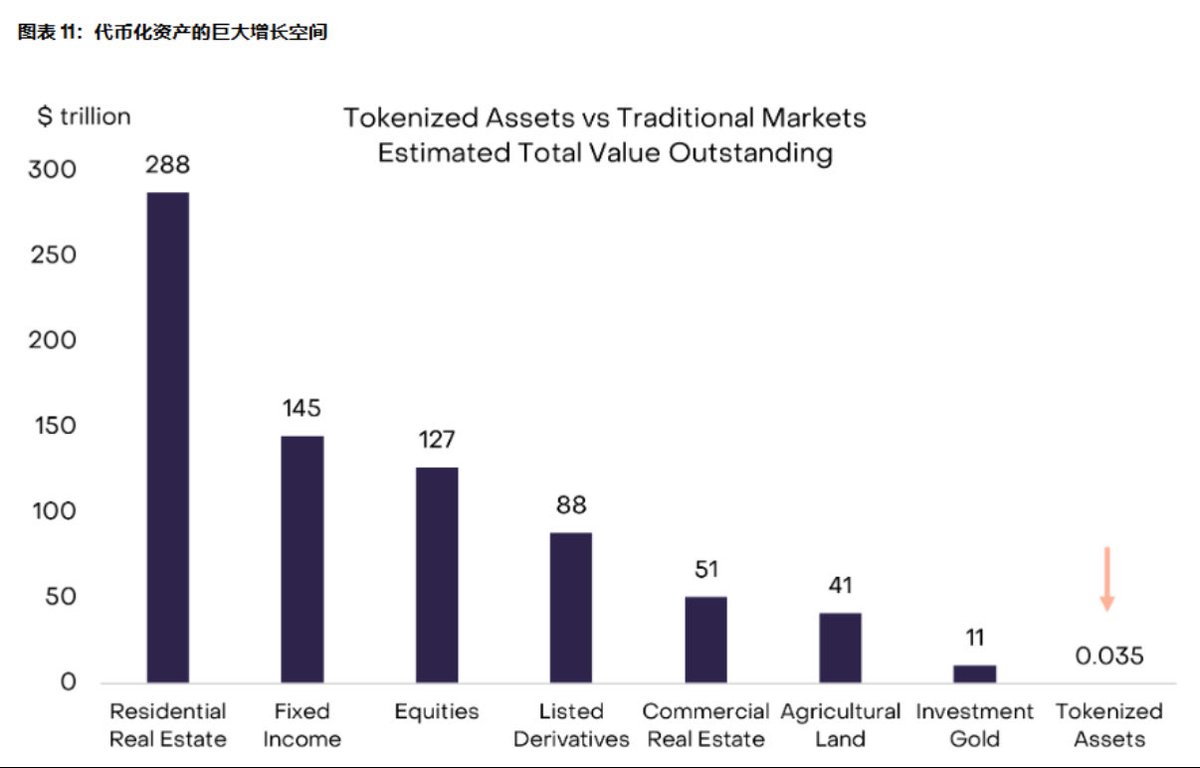

⚡ 看这张图,代币化资产规模,目前仅占全球股票和债券市场总市值的0.01%。

灰度认为,未来的资产代币化会增长100倍,这就是机会!

房地产、债券、股权、衍生品、土地,这些旧资产的共同特点:

体量大 → 无法高频流动

结构复杂 → 参与门槛高、摩擦成本高

结算缓慢 → 跨区域、跨制度成本极高

于是大量资产只能被锁在本地、锁在机构里,逐渐像滞销的房子一样,狗都不买。

因此 RWA 作为“效率替代品”的发生是必然事件——

就如同 ETF 没有消灭股票市场,只是简化了资产配置方式;

互联网没有创造信息,只是让信息从垄断走向低成本复制;

稳定币也没有取代美元,只是把美元从银行体系,直接搬进了 7×24 小时运行的全球网络。

当分割更细、结算更快、参与门槛更低成为默认选项时,资产迁移只是时间问题!

剩下的,无非是谁先铺好管道。

唯一的不稳定因素,就是关注明年 SEC 是否会开始对 RWA 有实质性的监管,我认为这是绝对这个赛道的胜负手!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。