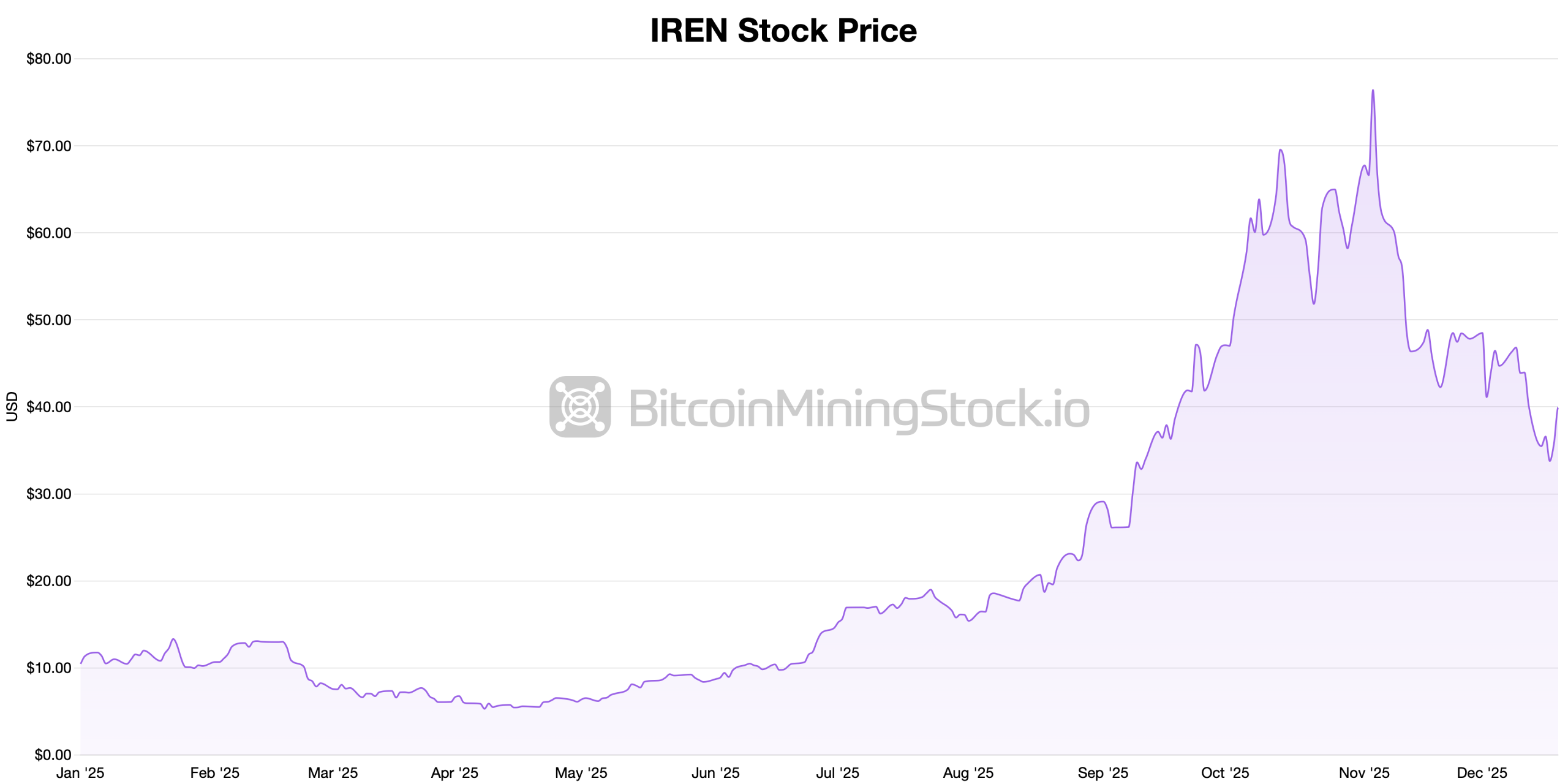

Bitcoin miners trading on U.S. exchanges had a solid Friday, keeping pace with the major U.S. stock indexes. IREN Limited, the largest publicly traded bitcoin miner by market cap at $11.31 billion, finished the session at $39.92, booking an 11.50% gain on the day. Over the past five trading days, the stock slipped 0.52%, but the bigger picture still steals the show, with shares up 306.51% year-to-date (YTD).

Applied Digital wrapped up Friday at $27.85 after tacking on a 16.52% gain for the day. Even so, the stock barely budged over the five-day stretch, easing just 0.03%. Zooming out, APLD is still having a banner year, up 264.52% YTD and carrying a market cap of about $7.8 billion. Just beneath APLD, Cipher Mining finished Friday at $16.21, chalking up a 6.99% gain on the day.

IREN YTD stats as of Dec. 20, 2025.

That pop didn’t fully erase the recent drag, with the stock still off 4.92% over the past five sessions. Still, CIFR has plenty to brag about on a longer horizon, with shares up 249.35% YTD and a market cap hovering around $6.4 billion. Riot Platforms Inc. wrapped up Friday’s session at $14.50, climbing 8.37% on the session. Across the five-day stretch, however, shares slid 5.22%. On a YTD basis, RIOT is still ahead 42.01%, with a valuation hovering around $5.39 billion.

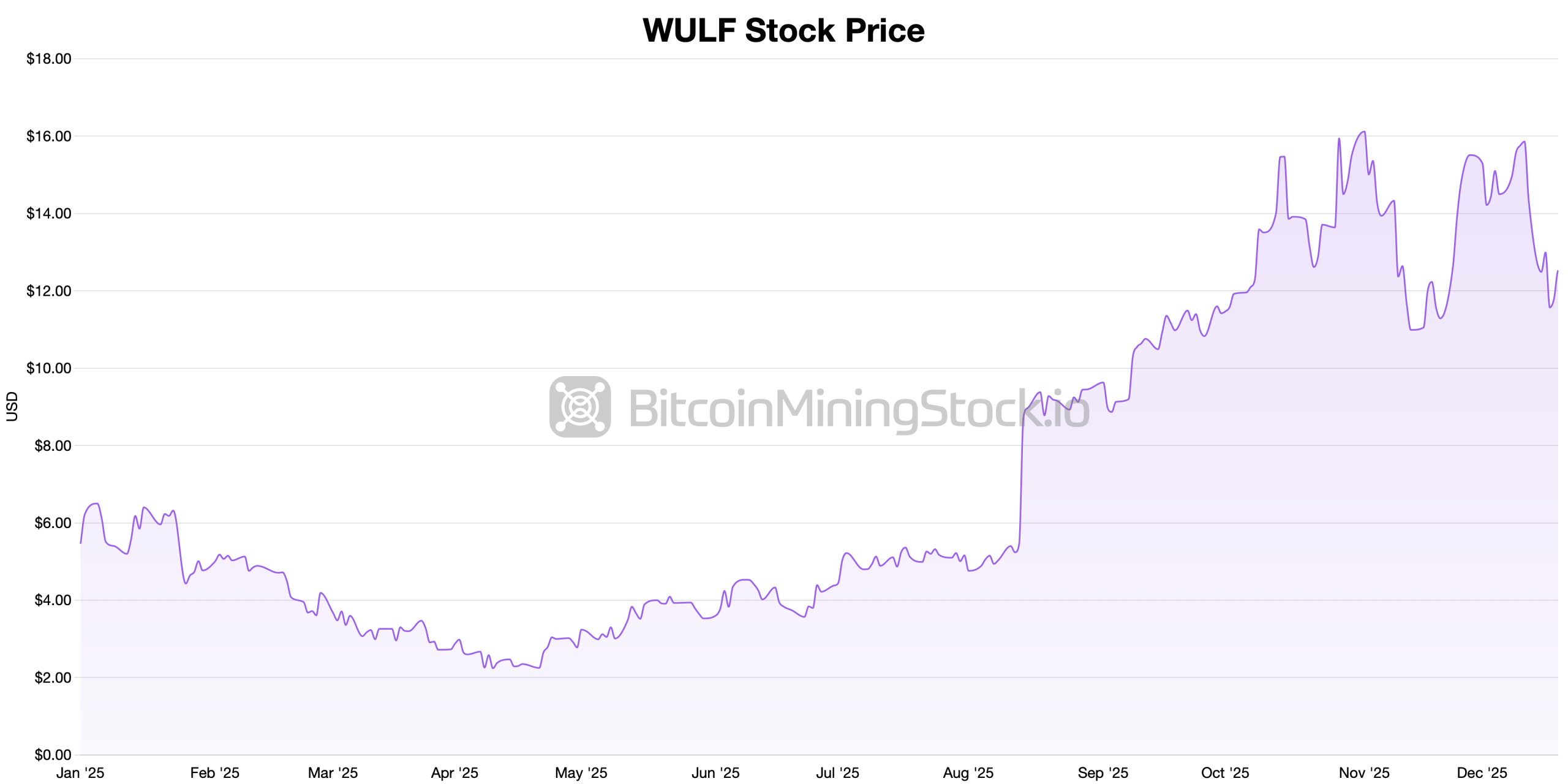

WULF YTD stats as of Dec. 20, 2025.

Terawulf Inc. ended the week at $12.52, closing Friday with a 6.19% gain. Short-term trading has been tougher, with the stock down 12.63% over the past five days. Even after that dip, WULF remains up 121.20% year to date and sports a market capitalization of roughly $4.89 billion as the last week of December approaches.

Also read: Bitcoin Futures and Options Positioning Suggests a Measured Reset Ahead

Rounding out the top ten, Core Scientific finished the week at $15.60, adding 7.14% on the day and lifting its year-to-date gain to 11.03%, with a market cap of roughly $4.84 billion. Hut 8 Corp. closed at $44.12 after jumping 14.33%, pushing its YTD return to 115.32% and valuing the miner at about $4.77 billion.

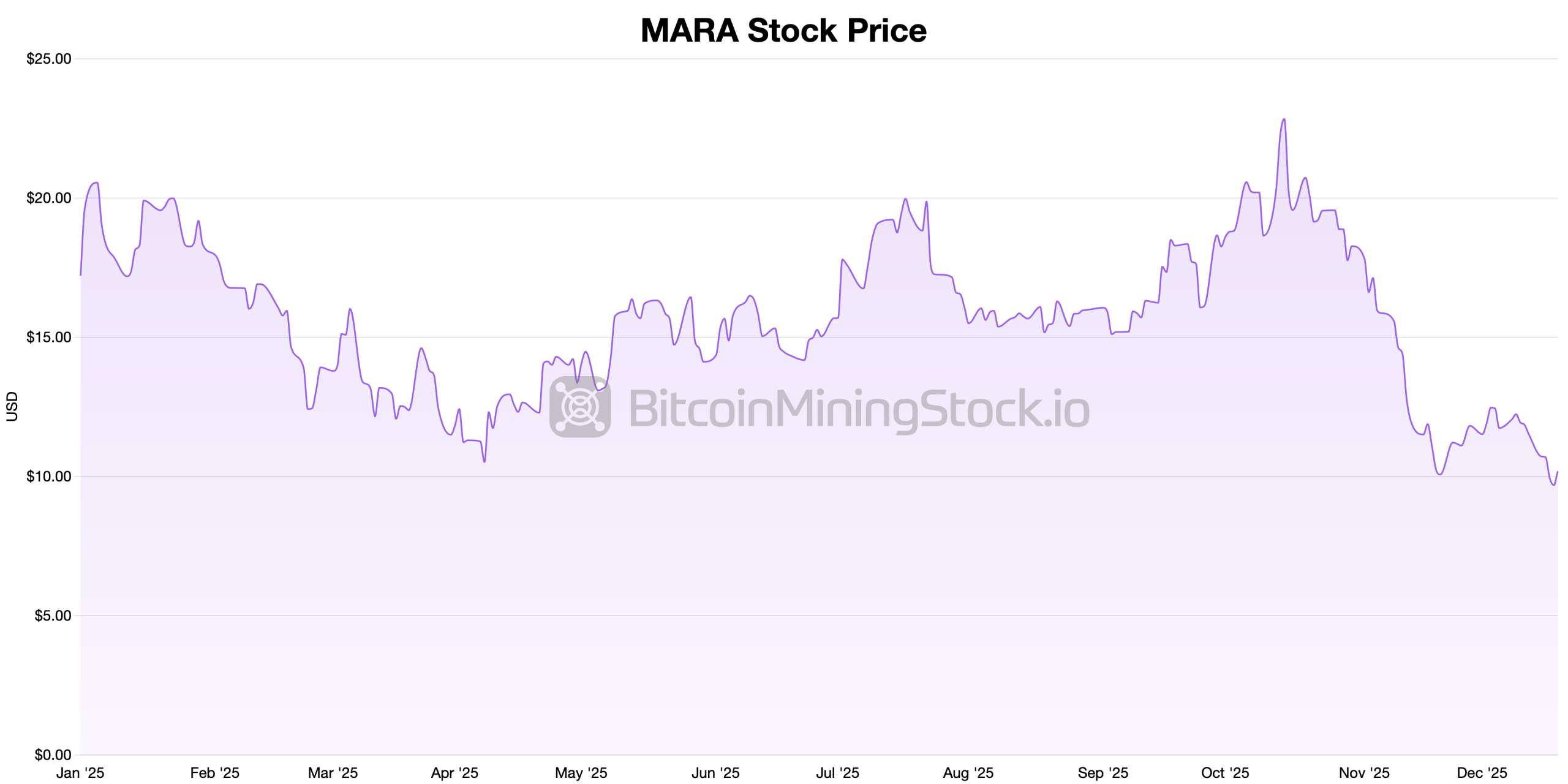

MARA YTD stats as of Dec. 20, 2025.

MARA Holdings wrapped up the session at $10.18, up 5.05% on the day but still down 39.29% since Jan. 1, with a market cap near $3.85 billion. Cleanspark Inc. ended at $12.03, advancing 7.41% and sitting 30.61% higher YTD, while Bitdeer Technologies Group closed at $11.01, gaining 9.99% on the day but remaining down 49.19% for the year, carrying a market valuation of approximately $2.3 billion.

Friday’s across-the-board gains put a neat bow on the year for publicly traded bitcoin miners, with most names heading into the final days of 2025 on a firm footing despite a few short-term stumbles. The contrast between choppy week-to-week trading and eye-catching YTD results shows investors continuing to favor scale, execution, and balance-sheet discipline as the calendar turns, even if not every miner makes it to the finish line unscathed.

The final week of December is likely to stay constructive but choppy, with thin holiday trading exaggerating moves while investors square books and lock in gains. As 2026 begins, attention should shift toward balance sheets, expansion plans, and bitcoin’s price action, setting the tone for which miners carry momentum forward and which ones face a reset.

- Why did bitcoin mining stocks rise on Friday?

Most miners moved higher alongside U.S. stock indexes as investors marked up equities ahead of year-end positioning. - Which bitcoin mining stocks led the gains?

Large-cap miners such as IREN Limited, Applied Digital, and Hut 8 posted some of the strongest single-day advances. - What should investors watch in the final week of December?

Thin holiday liquidity and book-closing activity could amplify price swings across mining stocks. - What factors matter most for bitcoin miners heading into 2026?

Balance sheets, expansion plans, and bitcoin’s price action are likely to guide performance early in the new year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。