On the 1-hour chart, bitcoin remains trapped in a low- volatility consolidation that reflects hesitation rather than conviction. Price action has rotated between roughly $88,000 and $89,500, with a brief push toward $89,349 swiftly rejected, a classic example of a short-lived breakout attempt that lacked follow-through.

Declining volume reinforces the idea that momentum has gone on an unscheduled break, suggesting participants are waiting for a catalyst rather than forcing direction. This kind of compression rarely lasts forever, and when it resolves, it tends to do so with attitude.

BTC/USD 1-hour chart via Bitstamp on Dec. 20, 2025.

Zooming out to the 4-hour chart, the structure looks notably healthier after a sharp liquidity-driven move lower found firm footing near $84,398. That level produced a decisive rebound accompanied by a pronounced volume spike, often associated with capitulation and short-term exhaustion. Subsequent candles show a steady recovery, with price now working its way back toward the upper resistance zone near $90,317, where prior wicks were rejected. The tone here is constructive, though resistance overhead remains very much awake and watching.

BTC/USD 4-hour chart via Bitstamp on Dec. 20, 2025.

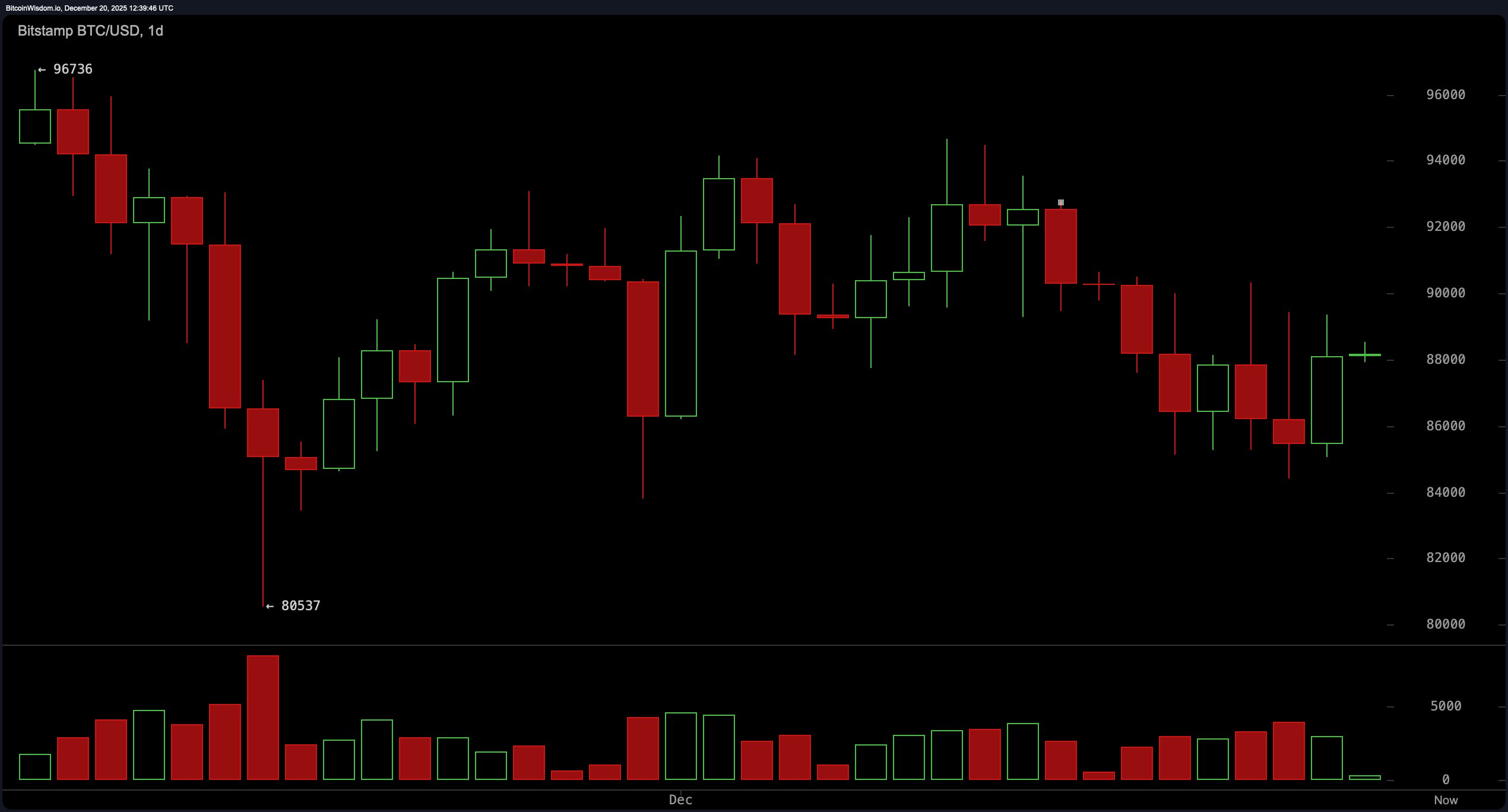

The daily chart adds context and a dose of realism. Bitcoin is still working its way out of a broader downtrend that dragged price from the $96,736 area toward the high $80,000s. A notable lower wick near $80,537 marked an important inflection point, followed by improving price behavior and stabilization around $87,500 to $88,500. Volume remains elevated, but the market has responded with recovery rather than continuation lower, hinting that longer-term participants may be quietly building positions while headlines argue loudly.

BTC/USD 1-day chart via Bitstamp on Dec. 20, 2025.

Momentum indicators paint a mixed but informative picture. The relative strength index ( RSI) at 44, Stochastic at 28, commodity channel index (CCI) at minus 53, and average directional index (ADX) at 26 all sit in neutral territory, confirming the absence of a dominant trend. The Awesome oscillator remains negative, while momentum (10) and the moving average convergence divergence ( MACD) histogram reflect improving internal pressure despite price hesitancy. This divergence between price and momentum is the kind of subplot technicians love, even if it keeps short-term traders on edge.

Moving averages (MAs), however, are playing the role of the strict chaperone. Price is trading below the exponential moving average (EMA) and simple moving average (SMA) across the 10, 20, 30, 50, 100, and 200 periods, from $88,174 on the shortest EMA to $108,023 on the 200-period SMA. That alignment reinforces the broader corrective structure and signals that any upside attempts will need persistence to overcome layered resistance. Bitcoin may be flirting with recovery, but the long-term trend is not ready to call it a comeback tour just yet.

Bull Verdict:

Bitcoin is showing early signs of structural repair rather than outright strength, but the groundwork is quietly being poured. The 4-hour chart’s rebound from the $84,398 area, paired with improving momentum (10) and a constructive moving average convergence divergence ( MACD) histogram, suggests downside pressure has meaningfully cooled. With the daily chart carving out a base between $87,500 and $88,500 and volume supporting recovery instead of continuation lower, the market looks increasingly comfortable absorbing supply. If consolidation resolves to the upside, it would signal that patience, not panic, is currently winning the argument.

Bear Verdict:

Despite the improving tone beneath the surface, bitcoin remains technically constrained by a wall of overhead resistance and a full stack of declining moving averages. Price is still trading below every major exponential moving average (EMA) and simple moving average (SMA) from the 10-period through the 200-period, keeping the broader trend firmly defensive. Neutral readings across the relative strength index ( RSI), Stochastic, commodity channel index (CCI), and average directional index (ADX) confirm that conviction is lacking, not building. Until price can decisively reclaim higher levels, the risk remains that consolidation resolves as continuation rather than reversal, reminding traders that hesitation can cut both ways.

- What is the current bitcoin price on Dec. 20, 2025?

Bitcoin is trading at $88,195, holding within a tight intraday range that reflects consolidation rather than trend conviction. - Why is bitcoin consolidating near $88,000?

Bitcoin price action is compressing due to neutral momentum indicators and declining volume, signaling market indecision ahead of a breakout. - What do technical indicators say about bitcoin right now?

Most oscillators, including the relative strength index ( RSI) and Stochastic, are neutral, while momentum (10) and the moving average convergence divergence ( MACD) show early internal improvement. - What are the key bitcoin levels traders are watching?

Traders are focused on resistance near $89,500 to $90,000 and structural support in the mid-$80,000 range based on recent chart behavior.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。