日本银行的加息对全球市场至关重要,因为这动摇了金融界最长期存在的一个固定因素:日本作为全球最便宜的资本来源。全体一致决定提高利率,标志着与数十年来超低和负利率政策的明确决裂,中央银行逐步接近更正常的货币政策基础。

日本经历了超过二十年的通货紧缩和温和增长的斗争,从1990年代末的零利率转向量化宽松、收益率曲线控制,最终实施负利率。这一政策旨在刺激需求和稳定通胀,但平稳的物价使得政策在其他中央银行转变后仍然保持宽松。

这一转变在疫情后逐渐形成,日元贬值、进口账单上升以及工资稳步增长,使得通胀长期高于日本银行2%的目标,足以让政策制定者相信这不是短暂的波动,为逐步退出紧急时期的货币政策铺平了道路。

改革的推动来自于日本银行内部,行长上田和夫于2023年上任,逐步引导银行远离黑田东彦留下的超宽松政策。作为一名学术经济学家,上田强调在通胀和工资增长证明其持久性后,恢复政策灵活性并缓解长期存在的收益率曲线控制和负利率带来的扭曲。

迄今为止,日本银行在上田和夫的正常化周期中已加息四次,最终在2025年12月19日将利率提高至0.75%。交易员通常对日本银行的加息感到不快,因为这威胁到市场上最受欢迎的现金机器之一:日元套利交易。

日本利率的上升提高了融资成本,冲击了货币市场,并增加了股票、债券和衍生品强制平仓的风险。即使是日本的温和收紧也可能压缩杠杆并动摇建立在多年廉价日元基础上的策略,但至少目前美国股市几乎没有反应。

日本银行的举动早有预兆,且没有惊喜因素或强硬言辞,交易员将其视为一次整齐的海外调整,而不是对美国流动性的打击。国内经济的强劲势头、对明年美国降息的预期以及年末的仓位调整都发挥了重要作用,使得尽管日本政策发生转变,股票仍然缓慢上涨。

加密货币也大多对日本银行的举动置之不理,因为加息已被完全定价,对近期全球流动性状况几乎没有影响。数据显示,加密经济在过去24小时内上涨了3.7%,比特币(BTC)在周五上涨了3.2%。山寨币的表现超过了领先的加密资产,以太坊(ETH)上涨了5.5%,瑞波币(XRP)上涨了6.6%,索拉纳(SOL)上涨了6%,而狗狗币(DOGE)以8%的涨幅领跑前十名。

目前,信息很明确:日本正在逐步摆脱数十年的政策时代,市场对此尚未感到焦虑。这与在决定前积累的悲观预测形成鲜明对比,可能一些交易员利用这种焦虑作为卖出恐慌而非政策的借口。随着日本银行的谨慎行动和投资者的充分准备,这一转变看起来更像是一次有序的调整,而非流动性恐慌。

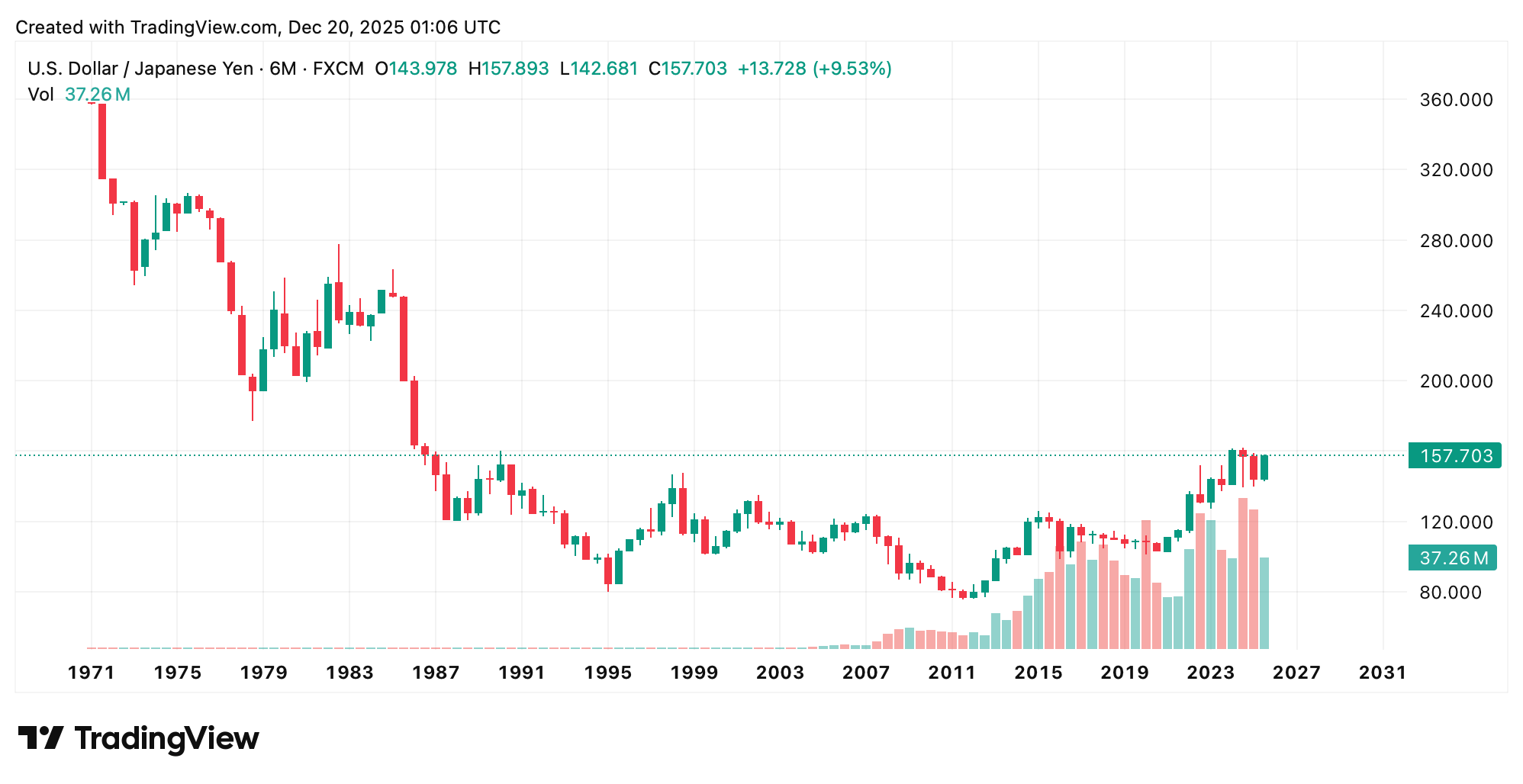

这种平静带有一个注脚。随着日本不断减少超便宜资金的供应,依赖于廉价日元融资的交易将面临压力。在过去五天中,日元对美元贬值约一个百分点,而在过去六个月中贬值约7.4%,同时日本国债收益率飙升至创纪录高位。

日本银行可能在谨慎行事,但日本作为全球最容易获得的免费资本的时代正在结束——市场不可能无限期地忽视这一点。

- 为什么日本银行提高利率?日本银行在通胀持续高于2%目标以及工资稳步增长的情况下提高了利率,使其能够逐步摆脱紧急时期的政策。

- 日本银行的加息对全球市场有什么影响?日本利率的上升使得日元融资成本增加,影响套利交易和全球流动性状况。

- 美国市场对日本银行的决定作何反应?美国股市对此基本不以为然,因为这一举动早有预期且没有政策冲击。

- 加密货币市场如何回应日本银行的加息?比特币和主要山寨币继续上涨,因为加息已被完全定价,并未改变近期流动性。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。