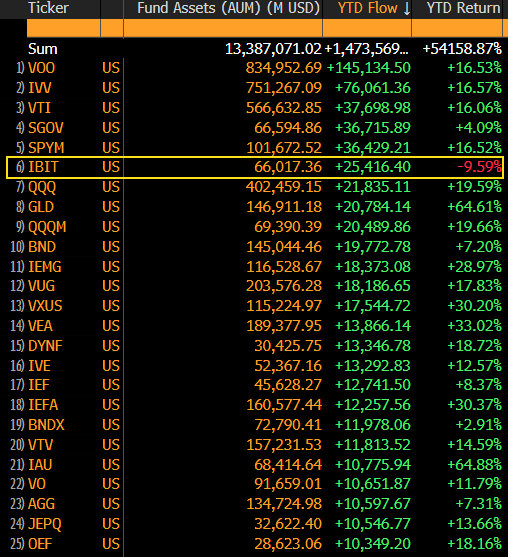

I just saw the data on the inflow rankings of US spot ETFs for 2025, where BlackRock's $BTC spot ETF $IBIT is the only one among the top 25 with a negative return for the year so far. Although 2025 is not over yet, next week marks the beginning of Christmas week, and from a trading perspective and capital rhythm, the opportunity for significant changes within the year is already very limited.

However, it is precisely because of the completely different situation compared to the other 24 products that it deserves more attention. Despite the negative returns, IBIT continues to see substantial net inflows, indicating that this capital is not speculating on short-term fluctuations but is instead making medium to long-term allocations.

In simpler terms, the funds flowing into IBIT are not concerned with short-term prices; they are using the ETF to incorporate BTC into their asset allocation framework. This indicates that institutional capital's logic for allocating to BTC has shifted from short-term trading to long-term strategic allocation.

In traditional markets, net inflows into ETFs are often strongly positively correlated with their performance, and this is generally true for other positive-yield products as well—better-performing products tend to attract more capital. However, IBIT has not seen a significant outflow of funds despite its negative returns, and it still ranks sixth for the year in terms of high net inflows, representing that the motivation for capital entering is not based on short-term profits but rather on assessments of long-term asset value and risk exposure.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。