Written by: Messari

Translated by: Glendon, Techub News

In the realm of mainstream cryptocurrency assets, few can spark as much widespread and profound debate as Ethereum. Bitcoin, as the leader of the cryptocurrency market, has established its dominant position with little controversy. However, the role of Ethereum remains far from a unified understanding. For some, Ethereum is the only credible non-sovereign currency asset aside from Bitcoin; for others, it is merely a business facing declining revenues and shrinking profit margins, constantly competing with faster and cheaper Layer 1 (L1) blockchains.

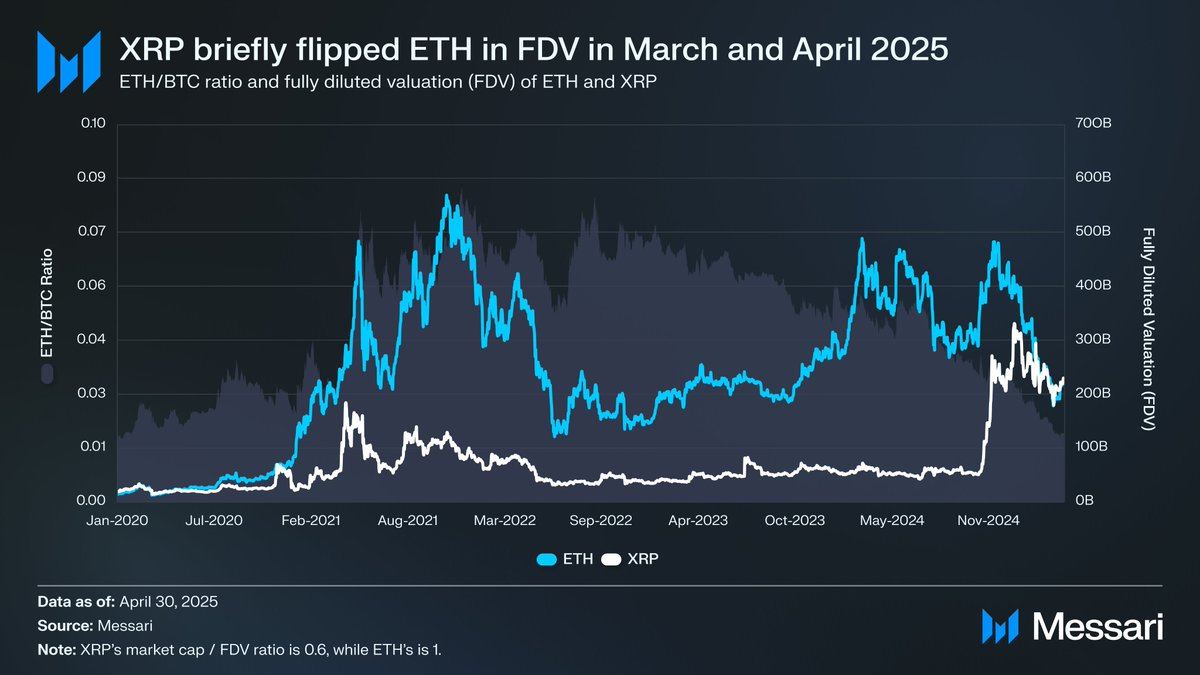

This intense debate seems to have reached a climax in the first half of this year. In March, the fully diluted valuation (FDV) of XRP briefly surpassed that of Ethereum (notably, Ethereum was in full circulation while XRP's circulating supply was only about 60%). Data from March 16 showed that Ethereum's FDV was $227.65 billion, while XRP's FDV reached $239.23 billion, a result that few could have predicted a year ago. Subsequently, on April 8, 2025, the ETH/BTC ratio fell below 0.02 for the first time since February 2020. This meant that all the excess performance Ethereum had accumulated relative to Bitcoin in the previous cycle had completely reversed. At that time, market sentiment towards Ethereum had plummeted to a multi-year low.

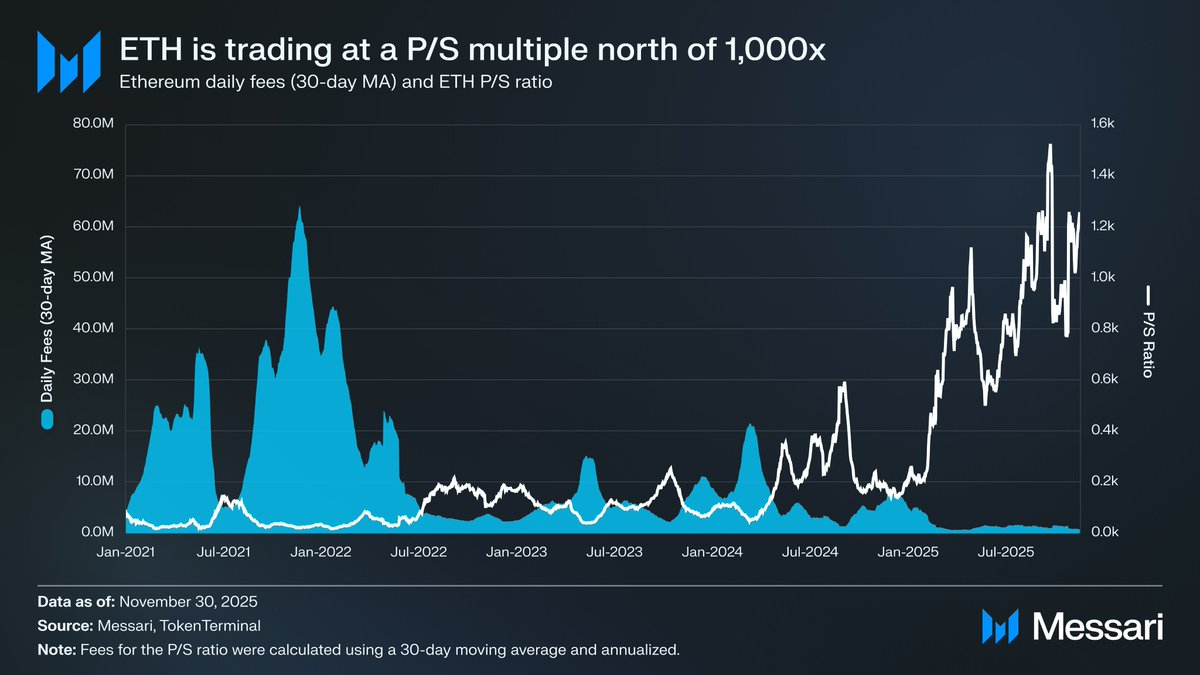

Worse still, the price trend is only part of Ethereum's issues. With the rise of competing ecosystems, Ethereum's share of L1 transaction fees has also been steadily declining. Solana regained its footing in 2024; Hyperliquid emerged in 2025. Together, these factors have pulled Ethereum's fee share down to 17%, ranking it fourth among L1 trading platforms, a stark drop from its previous top position a year ago. Although transaction fees are not the only metric for measuring a blockchain ecosystem, they clearly reflect the direction of economic activity, and the competitive landscape Ethereum faces today is the most intense in its history.

However, historical experience shows that significant reversals in cryptocurrency often begin at the most pessimistic moments. When Ethereum is viewed as a failed asset and discarded by the market, most of its so-called "failure factors" have already been digested by the market.

In May 2025, signs of optimism began to emerge. During this period, both the ETH/BTC ratio and the dollar price of ETH began to show significant reversals. The ETH/BTC ratio climbed from a low of 0.017 in April to 0.042 in August, a staggering increase of 139%; meanwhile, ETH itself rose by 191% during the same period, from $1,646 to $4,793. This upward momentum peaked on August 24, when the price of ETH reached $4,946, setting a new all-time high.

Following this repricing, Ethereum's overall trend significantly shifted towards a strong recovery. Changes in the leadership of the Ethereum Foundation and the launch of the Digital Asset Treasury (DAT) focused on Ethereum brought the certainty that had been missing for much of the previous year back to the market.

Before the upward trend began, the differences between Bitcoin and Ethereum in their respective ETF markets were particularly pronounced. In July 2024, when the spot Ethereum ETF was launched, the inflow of funds was weak. In the first six months, it raised only $2.41 billion, a figure that was undoubtedly disappointing compared to the record inflows seen in Bitcoin ETFs.

However, with Ethereum's recovery, concerns about ETF fund flows were completely reversed. Over the past year, the inflow into the Ethereum spot ETF reached $9.72 billion, while the inflow into Bitcoin ETFs soared to $21.78 billion. Considering that Bitcoin's market capitalization is nearly five times that of Ethereum, the difference in inflow amounts of only 2.2 times is far below market expectations. In other words, after adjusting for market capitalization, the demand for Ethereum ETFs has surpassed that of Bitcoin, which contradicts previous claims of institutional investors' lack of interest in Ethereum. At certain stages, Ethereum even completely outperformed Bitcoin. From May 26 to August 25, the inflow into Ethereum ETFs was $10.2 billion, exceeding Bitcoin's $9.79 billion during the same period, marking the first clear tilt of institutional investor demand towards Ethereum.

From the perspective of ETF issuers, BlackRock further solidified its dominance in the ETF market, holding 3.7 million ETH by the end of 2025, accounting for a staggering 60% of the total market share in the spot ETH ETF market. This figure represents a significant increase from 1.1 million ETH at the end of 2024, a growth of 241%, the highest annual growth rate among all issuers. Overall, the holdings of the ETH spot ETF by the end of 2025 amounted to 6.2 million ETH, approximately 5% of the total ETH supply.

Behind Ethereum's sharp recovery, a key development has been the rise of the Digital Asset Treasury (DAT) focused on Ethereum. DAT has created a stable and continuous source of demand for ETH that has never existed before, anchoring ETH in a unique way that no market narrative or speculative behavior can reach. If we view the price trend of ETH as a clear turning point, then the accumulation of DAT represents a deeper structural change driving this turning point.

These DATs have had a significant impact on the price of ETH. During 2025, they cumulatively purchased 4.8 million ETH, accounting for 4% of the total ETH supply. Among them, Tom Lee's Bitmine (code: BMNR) stood out. This company, originally a Bitcoin mining enterprise, began converting its treasury and capital into ETH in July 2025. From July to November, Bitmine purchased 3.63 million ETH, becoming the absolute leader in the DAT market, accounting for about 75% of all DAT holdings.

Despite the strong rebound of ETH, the upward momentum eventually cooled. As of November 30, the price of Ethereum had fallen from its August peak to $2,991, significantly below the historical high set in the previous cycle. Although Ethereum's current situation is far better than in April, this recovery has not completely eliminated the structural concerns that initially triggered bearish views. In fact, if anything has changed, it is that the debate surrounding Ethereum is more intense than ever.

On one hand, Ethereum exhibits many characteristics similar to Bitcoin in its rise as a currency asset. ETF fund inflows are no longer weak, and the digital asset treasury has become a continuous source of demand. Moreover, and more critically, an increasing number of market participants view Ethereum as distinctly different from other L1 tokens, with some now categorizing it alongside Bitcoin as an asset within the same currency framework.

On the other hand, the adverse factors that caused Ethereum's price to drop earlier this year have not been alleviated. The core fundamentals of Ethereum have not fully recovered. Its share of L1 transaction fees continues to be squeezed by strong competitors like Solana and Hyperliquid. The underlying trading activity remains far below the peak levels of the previous cycle. Even during the months when Ethereum's price was rising the strongest, a considerable portion of holders viewed this upward trend as an opportunity to sell for liquidity rather than a validation of its long-term monetary theory.

The core focus of this debate is not whether Ethereum has value, but how the asset ETH can derive value from Ethereum's success.

In the previous cycle, the prevailing view was that the value of ETH would directly stem from Ethereum's success. This is the argument of "Ultrasound Money": Ethereum would possess such high utility that it would burn a large amount of ETH, thereby providing a clear and mechanically enforced source of value for the asset.

Currently, we can confidently judge that the previously anticipated scenario will not occur. Ethereum's transaction fees have plummeted sharply, and there are currently no signs of recovery. Its two key growth engines—real-world assets (RWA) and institutional investors—primarily use the dollar as their base currency asset, rather than Ethereum's native asset.

In this situation, the value trajectory of ETH will depend on its ability to indirectly derive value from Ethereum's success. However, this indirect benefit model is fraught with uncertainty. It relies on the hope that as the importance of the Ethereum system increases, more users and capital will view ETH as a cryptocurrency and a store of value.

But unlike the direct, mechanical accumulation of value, this indirect benefit phenomenon does not have an inevitability of occurrence. It entirely depends on the support of social preferences and collective beliefs. This is not a significant flaw in itself, as Bitcoin's value accumulation is also based on such factors. However, it does mean that the appreciation of ETH is no longer linked to Ethereum's economic activities in a deterministic way.

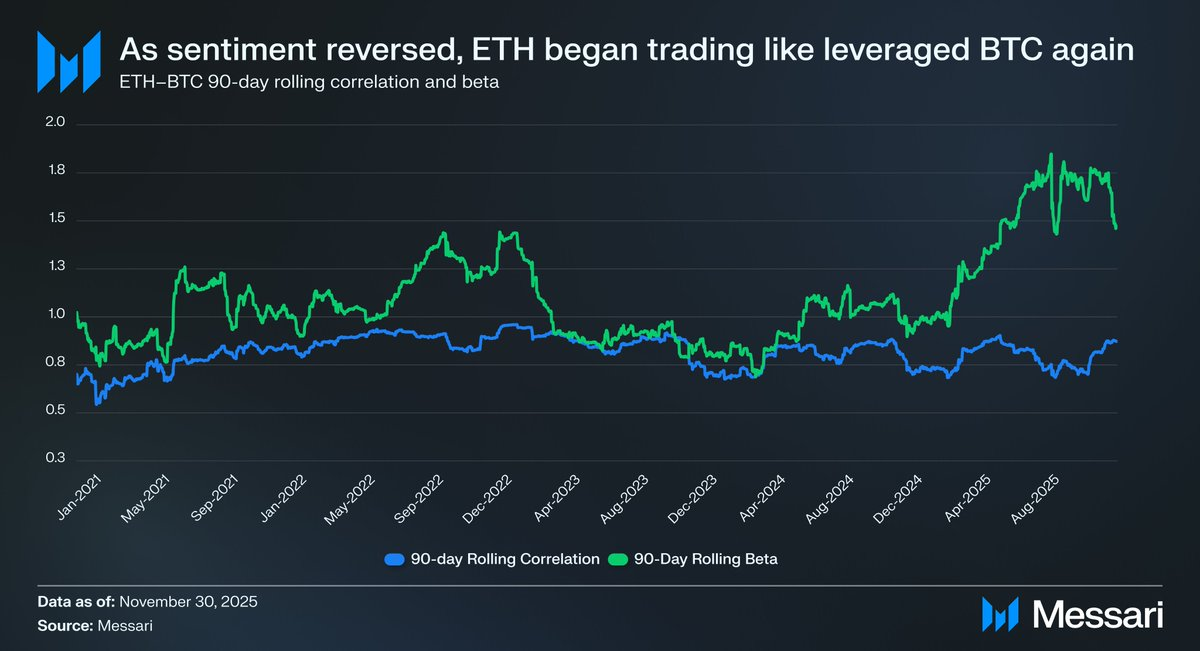

All of these circumstances bring the focus of the debate surrounding Ethereum back to its core contradictions. ETH may indeed be accumulating a certain monetary premium, but this premium is always lower than that of Bitcoin. The market once again views ETH as a leveraged extension of BTC's monetary theory, rather than an independent currency asset. Throughout 2025, the 90-day rolling correlation between ETH and BTC remained in the range of 0.7 to 0.9, while its rolling beta coefficient soared to multi-year highs, at times even exceeding 1.8. This indicates that ETH's price movements are more aggressive than BTC's, but still highly dependent on BTC's performance. (Techub News Note: The higher the beta value of Ethereum relative to Bitcoin, the stronger its price volatility sensitivity to Bitcoin, which may lead to increased risk transmission, as Bitcoin, being the market benchmark, will have its price fluctuations more significantly transmitted to Ethereum.)

This is a subtle yet crucial distinction. The monetary correlation that Ethereum currently exhibits is rooted in the fact that Bitcoin's monetary narrative remains solid. As long as the market firmly believes that Bitcoin is a non-sovereign store of value, there will inevitably be some market participants willing to extend that belief to Ethereum. If Bitcoin continues its strong performance in 2026, Ethereum has a complete opportunity to follow along a relatively straightforward path.

Moreover, the Ethereum DAT market is still in the early stages of its lifecycle. So far, these DATs have primarily driven the accumulation of ETH through common stock issuance. However, in the context of a renewed cryptocurrency bull market, these entities can draw on strategies to expand Bitcoin exposure, exploring additional capital formation avenues such as convertible bonds and preferred stock.

Taking DATs like BitMine as an example, they can raise a range of low-interest convertible debt and high-yield preferred capital, using the proceeds directly to purchase ETH, which can then be staked for ongoing returns. Under reasonable assumptions, staking income can partially offset fixed interest and dividend expenses, allowing the treasury to continuously accumulate ETH in a favorable market environment while increasing balance sheet leverage. Assuming a full recovery of the Bitcoin bull market, this potential "second life" of Ethereum DATs is expected to provide additional support for maintaining a higher beta value of ETH relative to BTC in 2026.

Conclusion

Ultimately, the market continues to closely associate Ethereum's monetary premium with Bitcoin's monetary premium. At present, Ethereum has not yet become an autonomous currency asset with independent macro foundations; on the contrary, it is gradually becoming a secondary beneficiary of Bitcoin's monetary consensus. Its recent recovery merely reflects that a small number of investors are willing to view Ethereum as a substitute for Bitcoin rather than as a typical L1 token. Nevertheless, even with Ethereum's relative strength, market confidence in Ethereum is inextricably linked to the ongoing strength of Bitcoin's own narrative.

In short, the monetization narrative of ETH is no longer fragmented, but it is far from being definitively concluded. Given the current market structure and the rising beta value of ETH relative to BTC, if Bitcoin's core logic continues to play out, ETH may experience meaningful appreciation, and the structural demand from DATs and corporate treasuries provides real upside potential. But ultimately, Ethereum's monetary trajectory in the foreseeable future still depends on Bitcoin. Unless Ethereum can demonstrate lower correlation and beta values (which it has never achieved over a longer time span), its premium will continue to fluctuate in the shadow of Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。