高盛对于部分投资者关于2026年的调查以及我个人的解读

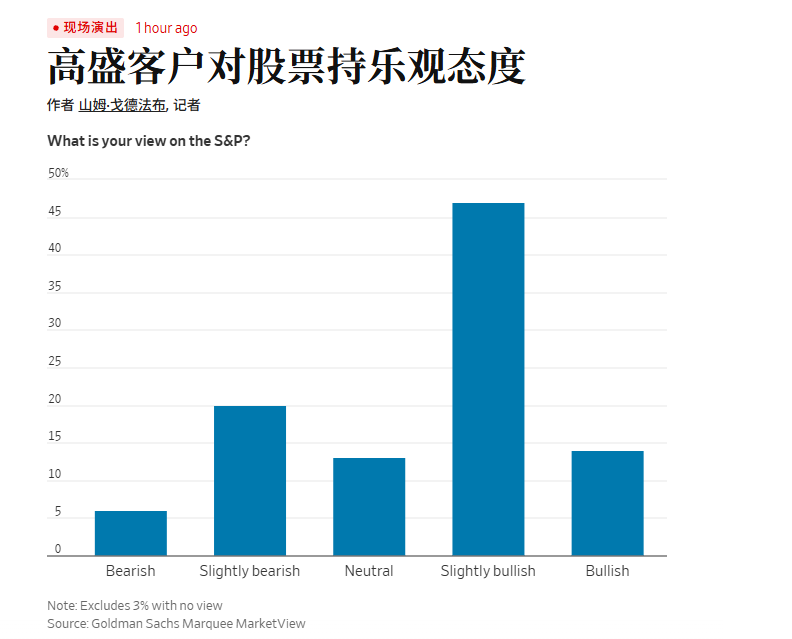

根据高盛最近的一项客户调查,投资者们对进入2026年的股市整体持乐观态度。47%的受访者表示他们对标准普尔500指数略微看好。而14%的人则表示完全看好。

这种乐观情绪也延伸至美国经济。85%的受访者预计明年实际GDP增长将达到1.5%至3.5%。对公司债券的情绪则更为谨慎,因为大多数人预计信用利差将扩大。

受访者普遍预计国债收益率将走低,并对人工智能投资持混合观点。

我的解读:

从正面效果来看,确实有61%的受访者认为2026年标普500起码是上涨的趋势,这就基本否认了投资者认为2026年可能会进入衰退的可能,但能明显看到有将近一半的受访者并不认为2026年会有非常大的上涨,很有可能是考虑到美联储的货币政策,不会完全进入到宽松。

而完全看空的用户也有25%,这个数量也并不少,如果在叠加将近 15% 的用户认为保持中性,可以说有将近 40% 的用户对于 2026年的市场并不是很乐观,这说明一件很重要的事情,市场的共识认为 2026年可能并不是“新一轮牛市”,而是“避免了衰退”。

说人话就是大多数机构的核心判断是 2026 年美国经济大概率不会出现深度衰退,但在高利率周期尾声、财政与货币政策空间受限的背景下,指数的上行空间可能是有限的。

这也是为什么看多的主流态度集中在Slightly bullish(略微看多),而不是 Bullish(完全看多),要知道高盛的这个调查针对的是高盛自己的客户,而不是完全的散户调查,甚至可以说代表了一部分机构的看法。机构愿意站在多头一侧,但并不愿意为此押上激进仓位。

总的来说,这份调查反映的并不是 2026 年会有多好,而是机构已经逐步排除了2026年可能会有最坏的情况,如果叠加2026年的中期大选,不排除2026年年底可能会有一波行情。

这也意味着,接下来市场的主要矛盾,很可能不在经济会不会出问题,而重新回到了美联储的货币政策,政策会不会带来更好的流动性,如果还处于流动性受限的环境下,风险资产还能给出多高的回报。

再说人话一些就是,市场基本否认 2026 年出现衰退,但同样也不认为会迎来新一轮强增长周期。

如果放在 Bitcoin 上理解,就是在流动性尚未明显改善的前提下, $BTC 更可能维持高位区间震荡,偶尔会受风险偏好或阶段性流动性变化推动出现拉升,但要持续突破并站稳新高,仍然需要更明确的货币政策转向作为支撑。

Bitget VIP,费率更低,福利更狠

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。