家人们晚上好呀!开局先跟大家说个超大福利

这周是咱们 AiCoin 的年度会员活动,新老用户都能享福利,年度会员 6.8 折、季度会员 7.8 折,明天还有限时快闪活动,大家一定要蹲好!一年就这么一次,既能帮大家省成本,还能顺带赚大钱,这波错过真的要等明年。

欢迎来到币安钱包拉新专场!今天不光教大家怎么注册币安钱包、搞定全流程实操,还会给新人宝子们精准推荐可参与的项目标的,跟着咱们把币安 Alpha 的赚钱机会牢牢抓在手里。

好啦,话不多说,咱们的币安 Alpha 发财之旅正式开启!

现在请大家跟着提示打开币安钱包,待会咱们同步实操!yu

另外提前跟大家说下,开始前可以先准备好 USDT,后续实操会用到

大家看这个数据,主播在 RAVE 200 刀的时候就止盈离场了,不过分数一直稳在 220-250 之间。最近 Alpha 撸毛行情明显回温,恭喜一直在坚持刷分的伙伴们!

有没有宝子发现,最近 OKX 和币安的 Alpha 收益都在往上走?主播之前就跟大家说过,过年前应该还有一波机会,建议大家两个平台都试试刷起来。

放心,在院长直播间,所有实操问题都能帮大家解决,待会就给大家上详细教程,新手宝子们认真听就能学会!

对了,有没有宝子留意过 night 这个代币呀?大家可以重点看看这种有做市商的标的,24 小时交易量简直夸张到离谱

其实不管是看 night 还是其他 Alpha 标的,核心都在于做好资金分配和时间规划。

为了让大家及时拿到空投时间和优质标的信息,大家可以看看咱们 AiCoin 给大家准备的专属信息源。

顺便给宝子们安利下咱们的新产品 —— 空投合集,直接点链接就能看:https://www.aicoin.com/zh-Hans/airdrop

还能订阅预警,空投消息一出来就会弹窗提醒,再也不怕错过机会!像这类 Alpha 代币,其实能明显看出有操盘痕迹,极端的费率加上反常的 24 小时交易数据,都是很直观的信号。

主播其实一直在盯二级数据,最近 Beat 的表现也超猛,做市商在合约市场特别活跃。跟大家分享个小知识点,没想到 $RAVE 竟然是 Token2049 的举办方,收入主要靠各种 Web3 活动的门票,而且没有 VC 参投,全靠自身 300 万收入自筹,实力是真的扎实。

先跟大家浅聊几个最近 Alpha 上有赚钱效应的代币,大家当个乐子听就行,重点还是待会的刷分实操教程。主播前两周一直稳定刷 15 分,现在行情起来了,大家可以试试 16+2 的刷分方法。还不知道什么是 16+2 刷分的宝子别着急,待会给大家详细拆解,保证新手也能听懂。

用大白话跟新手宝子们拆解下,Alpha 空投其实就是币安搞的一场 “流量游戏”—— 你手里的积分就是入场券,靠积分就能免费领新项目的代币。咱们从三个角度把这事说透:

对币安平台来说,一方面是靠空投奖励鼓励大家用钱包、做链上交易,提升平台活跃度;另一方面把 Alpha 当成 “试验田”,看项目的交易量和社区反应,再决定要不要上主站现货,这样能降低上币风险。

对项目方来说,就是想借币安的流量蹭曝光,靠漂亮的交易量数据争取上主站的机会,但代价是要拿出 2.5%-5% 的代币分给 Alpha 用户,可能会牺牲早期社区利益,吸引来的也多是短期投机者。

对咱们参与者来说,好处是能以低成本拿早期代币,早期参与者月入几千美元都有可能;但风险也得注意,比如代币价格波动、刷分的交易损耗,还有规则变了导致门槛提高的可能。所以大家别只看到收益,也要衡量好成本和精力,这不是稳赚不赔的买卖,是高门槛、高竞争的游戏。

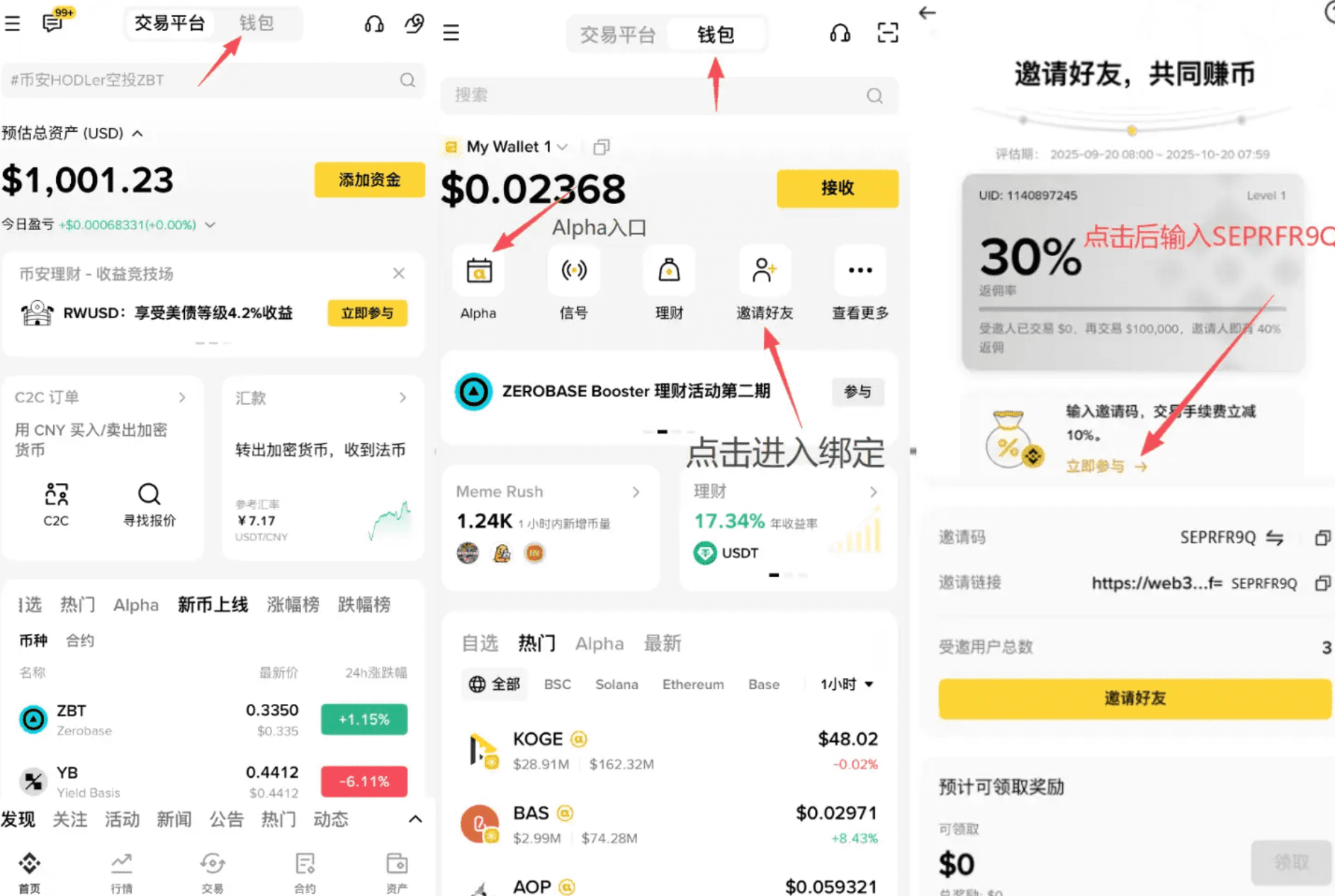

好啦,现在请大家打开币安钱包跟紧咱们!大家看,打开钱包后点右边的钱包入口,左边就能看到 Alpha 板块,还有邀请好友的按钮。

点进去选择 “立即参与”,输入咱们的专属邀请码 SEPRFR9Q,就能减免 10% 的手续费!

别看 10% 不多,日积月累下来能省不少钱,刷分的成本也能少一点

实操开始前,先跟新人宝子们说清楚币安 Alpha 的成本问题,避免大家盲目入场。到底要花多少钱?答案很灵活,少则几百 U,多则几万 U 都能玩。主播建议大家币安余额尽量准备 1100U,资金太少的话太费时间

比如要完成 65536 的交易量,我每次转 1050U,16 个来回就搞定;但如果每次只转 105U,就得 160 个来回,光操作就要耗半天。

另外余额分的规则大家一定要记好:100-1000U 余额每天加 1 分,1000-10000U 每天加 2 分,10000-100000U 每天加 3 分。余额超过 1000U,每天就能多拿 1 分,一个月下来就多 30 分,刷分效率直接翻倍。

接下来重点讲怎么刷 Alpha 积分

积分就靠两部分:余额分和交易量分。余额分只要账户有钱就自动给,交易量分则看你完成的交易量多少,这两个是决定积分速度的关键。简单说就是,余额越多每天能拿的基础分越多,交易量达标才能拿到额外积分。

给大家算个直观的例子:每天保持 1000U 以上余额,再完成 65536 的交易量,就能拿到 2 分余额分 + 16 分交易量分,每天共 18 分。咱们目标是 250 分,250 除以 18 差不多 14 天,也就是连续刷两周就能达标,效率超高。

然后是大家最关心的标的选择问题,咱们按这个思路来选就不会错。

核心就是解决 “选哪个币、什么时候刷、怎么刷” 这三个问题。首先下跌趋势绝对不能刷,越刷越亏,纯粹白扔手续费;最好等价格稳定的时候操作,比如 10U 买、10U 卖,只亏点手续费就行,这就是咱们说的 “正常磨损”。

按万 2 的手续费算,每天刷 16 分、完成 65536 交易量,大概只会磨损 3-4U,成本很低。选标的要盯紧三个关键点:交易量大、价格稳定、带 4 倍标志。交易量大,你的单子能快速成交,不耽误时间;价格稳定,磨损才能控制住;带 4 倍标志最关键,能实现 “刷一次抵四次”,用少量交易量拿高分,但要注意这类标的波动可能大,一定要等稳定了再动手。

大家看图片里的指标,稳定度、价格基点、四倍天数这几个是核心,选的时候重点对比。给新人宝子们分享个实用工具网站:https://alpha123.uk/

能直接查标的稳定度,记得收藏好,这可是咱们刷分的百宝工具!

跟大家说下真实收益情况,正常一次空投能拿 30-100U,行情好的时候能到 200U 以上,一个月下来 3-4 次空投很常见,扣除每月 100U 左右的磨损成本,纯收益也很可观。

如果想多赚点,也可以试试多号参与,后续有详细的多号操作技巧,我再收集大家的反馈后专门开一期讲。当然也有运气好的情况,单币空投能冲到 500-800U,但这就纯靠命了,不建议大家赌这个,稳健刷分拿确定收益才是王道。

最后跟大家解读下币安昨天刚发的两个重要公告,这直接关系到咱们后续的赚钱机会。第一个是明确了 Alpha→合约→现货的三阶段上币路径,以前这是潜规则,现在变成明规则了。也就是说项目得先在 Alpha 证明自己的叙事、社区和活跃度,才能进合约、上现货,整体是逐级筛选的逻辑。这意味着 Alpha 的机会变多了,但想直接赌上现货的难度变大了。

第二个是币安主系统完成了 UTF-8 编码测试,支持中文等多语言字符作为资产标识,简单说就是中文概念的代币能上现货了!把这两个公告放一起看,结论很清晰:币安在强化 Alpha 的筛选作用,BSC 生态不是没机会,关键要找能打破流程惯性的标的,而最有可能的就是中文叙事。要是后续真有中文叙事代币上现货,那中文板块、BSC 生态都会起飞,BNB 也会跟着涨,咱们 Alpha 的空投自然也会更值钱。

最近市场波动这么大,主播越来越觉得稳健才是王道。看着很多人跟风冲二级新币,其实不如安安稳稳刷分 —— 每天磨损就 3 刀左右,一个月成本 100 刀,却能稳定拿 3-4 次空投,纯赚 160 刀左右,这种稳稳的幸福不香吗?贪婪容易被收割,赚到自己能力范围内的钱才最踏实。

临近过年,币安钱包大概率还会有惊喜活动,大家可以多留意。今天的实操教程和 Alpha 机遇解读就到这里,新手宝子们有任何不懂的地方,都可以打在公屏上,我一一给大家解答!

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。