整理 & 编译:深潮TechFlow

播客源:Taiki Maeda

原标题:Why I’m Shorting $1M of ETH (Again)

播出日期:2025年12月18日

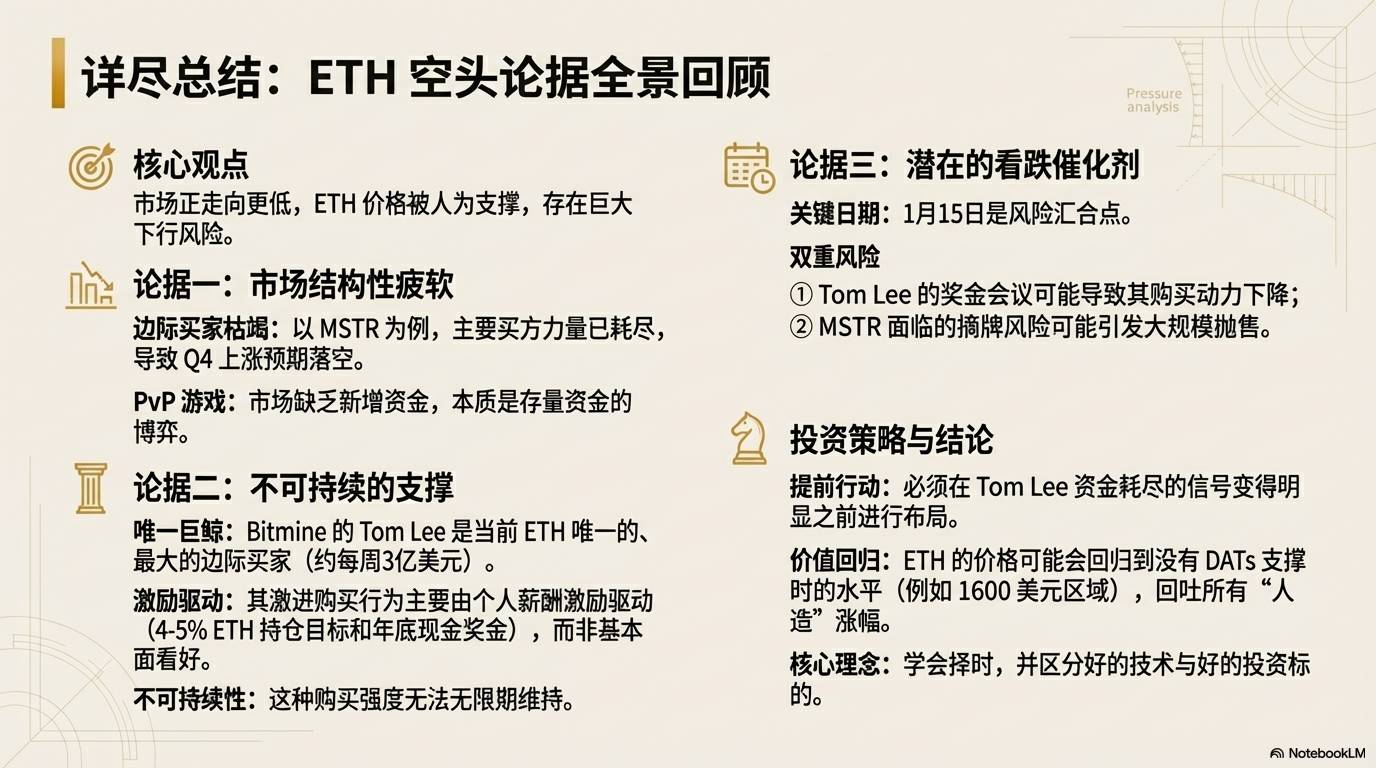

要点总结

Taiki 重返市场,做空价值 100 万美元的 ETH。在这段视频中,Taiki 回顾了过去几个月有关 ETH 的熊市论点,并解释了为什么决定重新进入做空市场。

精彩观点摘要

-

我们应该欢迎熊市,因为这才是赚钱的机会,真正的财富是在低点买入时积累的。

-

当 Tom Lee 向 ETH 投入大量资金时,你可以选择卖出资产;而当他们可能停止购买时,你则可以开始做空。

-

每当 ETH 价格出现上涨时,OG 往往会选择抛售,ETH 更像是主要的退出流动性工具,而非适合长期持有的资产。

-

我认为 ETH 的实际公允价值可能是 1,200 至 2,200 美元。

-

加密货币市场当前缺乏新的边际买家,泡沫已经破裂,市场正处于兴奋期过后的不稳定阶段。

-

部分投资者并不真的想长期持有 ETH,只是希望快速获利。

-

加密市场目前呈现出一种 PvP(玩家对玩家)的竞争状态,缺乏明显的优势。

-

Tom Lee 的操作策略不仅是为了推动 ETH 的价格上涨,也是为了实现个人和公司利益最大化。

-

一旦资金耗尽或市场需求减弱,ETH 的价格可能会迅速下跌。

-

Tom Lee 的目标是在六个月内将 ETH 的市场份额提升至 4% 或 5%。

-

2026 年 1 月 15 日不仅是 Bitmine 董事会决定奖金的日期,同时也是 MSTR 可能面临摘牌的截止日期。如果 MSTR 被摘牌,将引发数十亿美元的资金外流,对市场造成巨大的抛售压力。

-

我曾妄想 ETH 的价格会涨到 10,000,并一直持有,结果它从 4,000 跌到了 900 美元。

-

我分析市场的方式更多是基于数字和资金流动的基本面,而不是简单地画图表或线条来预测价格走势。

-

几乎没有人在真正使用 ETH。

-

加密货币市场的成熟在于理解:技术上可能是非常优秀的,但这并不意味着它们是好的投资。

-

现在的市场阶段可以总结为:DATs 推高了价格,而人们正在逐渐意识到,这种狂热可能已经过头了,ETH 的实际价值可能要低得多。这正是我目前的押注方向。

-

做空 ETH 是一种简单且有效的策略。

做空价值 100 万美元的 ETH

-

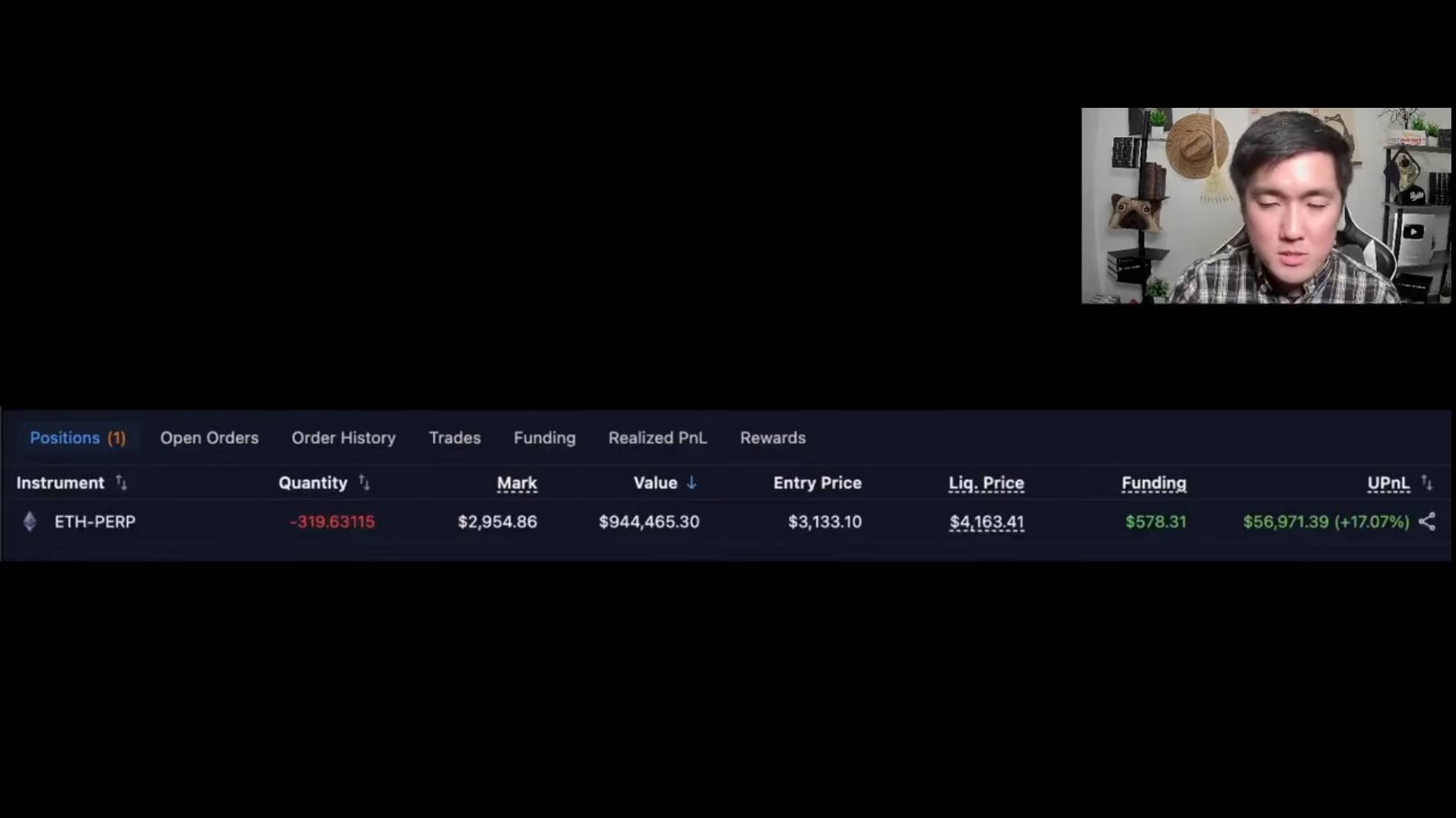

在过去的两个月里,我通过在市场高点做空 ETH 和山寨,赚取了超过 50 万美元。在本期视频中,我将解释为什么我决定再次做空价值一百万美元的 ETH,因为我认为 ETH 的价格将进一步下跌。

-

在过去的两个月里,我对市场一直持非常悲观的看法。我通过做空 ETH 和山寨表达了我的观点,并且已经重返了交易场。大约十天前,我重新建立了我的 ETH 空头仓位。几周前,当 ETH 价格跌至 2,650 美元左右时,我曾平仓过一次,但价格出现反弹后我再次做空

-

自从我在 Twitter 上发布了那条帖子以来,我已经增加了我的仓位。目前,我的平均入场价是 3,133 美元,总价值大约是一百万美元,未实现盈亏约为 56,000 美元。

回顾看跌 ETH 的论点

-

现在来回顾一下我对 ETH 看跌论点的总结。我做空 ETH 的第一部分基于以下理解:MSTR 和 Michael Saylor 资金已经耗尽,因此在第四季度出现上涨的可能性很低,尤其是在 10 月 10 日的清算事件之后。因此,在 4000 美元上方做空 ETH 是合理的,这是一个相当简单的交易。

-

MSTR 的净资产价值(MNAV)持续缩水,这让人想起上一个周期接近市场顶部的情形。如果 Saylor 无法购买,我们就失去了一位最大的比特币边际买家,这不是好事。我向观众提出的问题是:如果保证的第四季度上涨未能实现,ETH 和山寨会发生什么?一切都会下跌对吧?这正是实际发生的情况。

-

10 月 10 日是一个很好的催化剂。一旦山寨下跌,你就应该预见到 ETH、Solana 和所有这些信息币的基本面会变得更糟。这是因为链上部署资金的目的是为了获得收益,而收益来自山寨,因此预期 DeFi TVL 将会减少。从某种意义上说,山寨的下跌就像是链上采用的一个先行指标,因为在大型清算事件之后,人们会撤回资金。

-

-

现在我认为我们处于第二部分,这和第一部分有些相似。Tom Lee 一直是我做空 ETH 的一个原因,因为我认为他将价格推高到了公允价值之上。因此,将价格做空回落是有道理的。但我仍然认为他正在支撑着 ETH,这提供了一个有趣的机会。因为我认为一旦他资金耗尽或开始用完钱,ETH 就会真正回归到公允价值。

-

我确实认为 ETH 回跌得更低,但 Tom Lee 正在阻止它继续下跌,但是在某个时候他会耗尽资金。关于 DATs 的问题是我不喜欢它们,没有人进入加密领域是为了研究 DATs。但在我看来,它们控制着市场,控制着加密货币的边际资金流,所以我们必须研究它们。

-

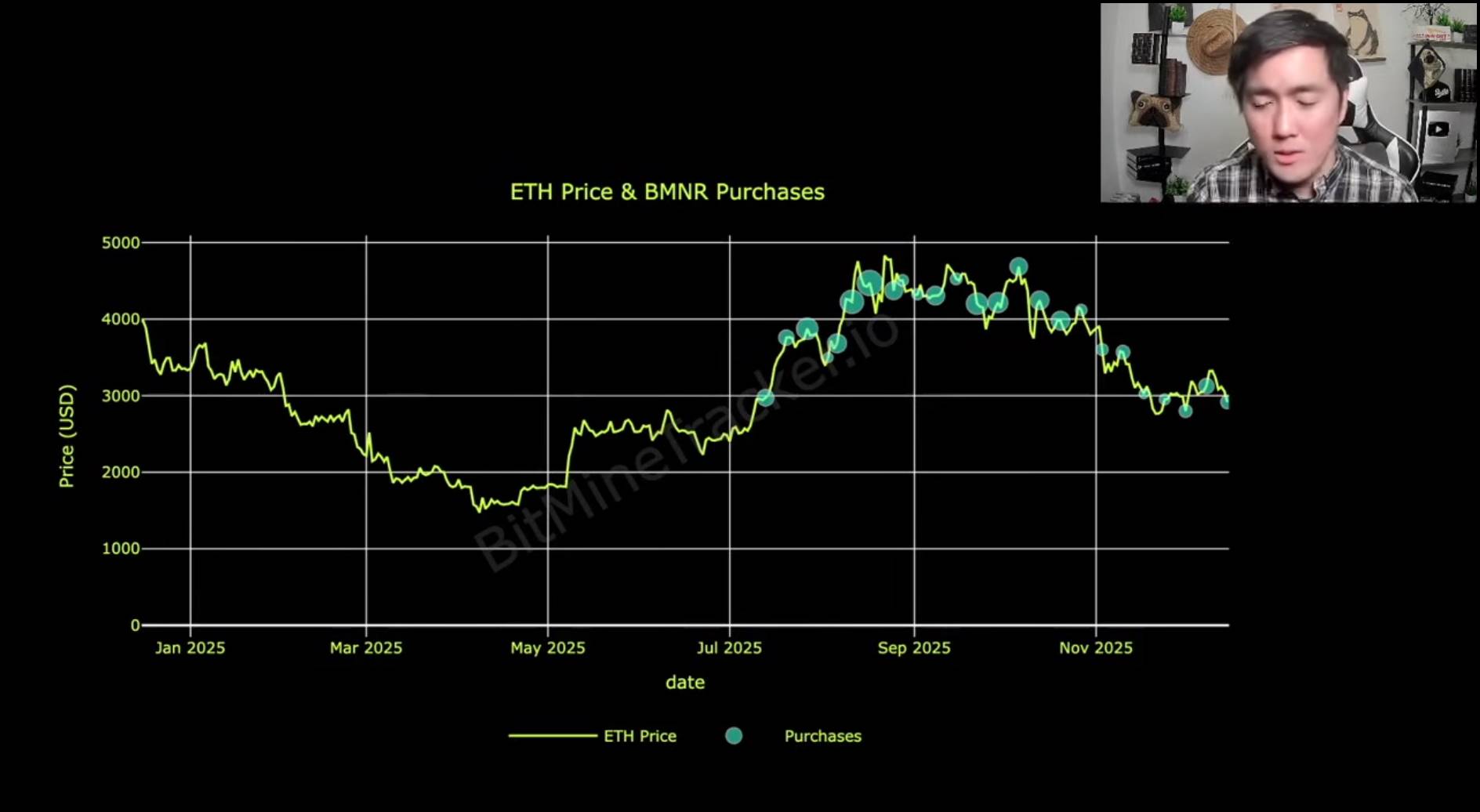

我认为 Tom Lee 将 ETH 的价格炒高了很多,现在他购买 ETH 的数量随着时间推移越来越少。我认为 ETH 将会收敛到公允价值。我不知道公允价值是多少,但它可能会低得多。你可以看到,这是 Tom Lee 的活动,他在 4,000 美元以上买入了很多,但如果你理解 DATs 的运作方式,当加密货币上涨时,人们会涌入这些资产,因为市场具有反身性。所以这些 DATs 在上涨过程中大量买入,然后一旦行情持续下跌很长一段时间,他们就无法持续购买了。

-

-

Saylor 在过去 5 年间累计购买了超过 3% 的比特币,这一举措使比特币价格从约 10,000 美元一路飙升至 85,000 美元。而相比之下,Tom Lee 在短短 5 个月内集中购买了超过 3% 的 ETH,但在此期间 ETH 的价格仅从 2,500 美元微涨至 2,900 美元。每当 ETH 价格出现上涨时,OG 往往会选择抛售,这使得 ETH 更像是主要的退出流动性工具,而非适合长期持有的资产,这也是我过去几个月一直在强调的观点。

Tom Lee 对 ETH 的影响

-

在加密市场中,持有逆向观点通常能带来回报,因为你可以通过资金交易来验证自己的判断。如果你的预测正确,市场会奖励你更多资金,你可以将这些资金重新分配到其他领域。

-

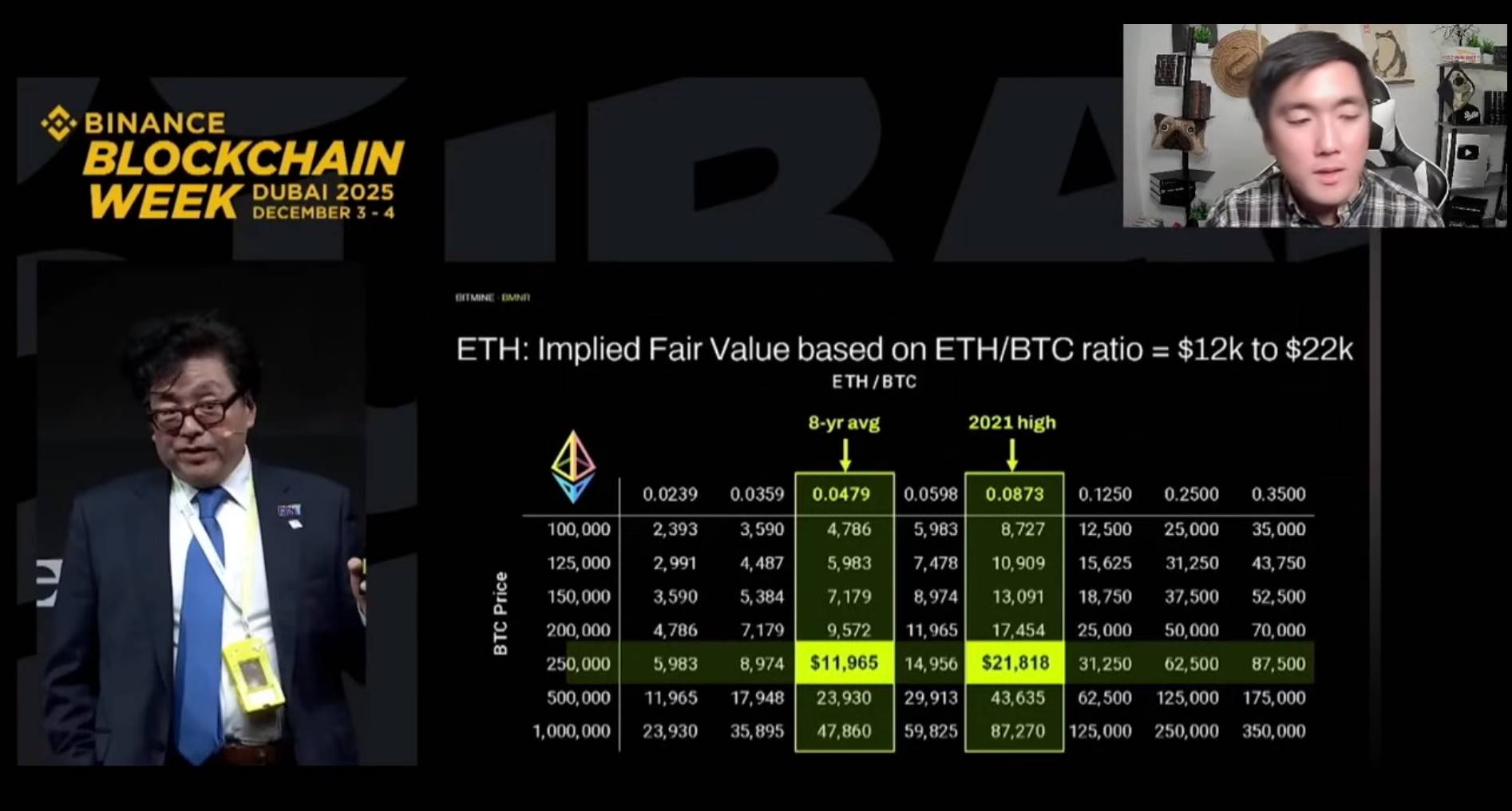

最近,Tom Lee 每周投入约 3 亿美元购买 ETH,这在当前市场环境中显得尤为惊人。他在币安区块链周公开表示,ETH 的价格已经触底,并且他正在加大购买力度。他的原话是:“我们认为 ETH 已经触底,所以我们正在购买更多。”为了精准把握买入时机,他们还聘请了 Tom Demar——一位收费昂贵但能力突出的顾问。Tom Lee 预测 ETH 的价格可能涨到 22,000 美元左右,并给出了一个公允价值区间:12,000 至 22,000 美元。不过,我个人认为这个预测可能存在错误,实际公允价值可能是 1,200 至 2,200 美元。

-

在过去几周里,Tom Lee 的公开声明表明他们正在大量增持 ETH,这使得 ETH 的表现优于其他缺乏边际买家的山寨币,例如 Solana。从图表来看,ETH 的价格走势明显更强劲。然而,从市场博弈论的角度来看,我认为加密货币市场当前缺乏新的边际买家。大多数潜在买家早已入场,市场正处于兴奋期过后的不稳定阶段,泡沫已经破裂,我们正在试图弄清这些资产可能会跌到什么水平。

-

如果 Tom Lee 短期内持续每周购买两到三亿美元的 ETH,市场可能会受到他的影响。在这种情况下,每当 ETH 价格下跌时,短期交易者可能会选择买入,因为他们预期 Tom Lee 的资金会推高价格,然后再卖出获利。对于短期交易者来说,Tom Lee 的购买行为无疑提供了流动性支持。从心理角度来看,我称之为“感知到的 Tom Lee 安全效应”。知道他正在购买会让人们在短期内更愿意持有 ETH,而不是比特币或 Solana。如果你在等待市场反弹进行交易,持有 ETH 可能是更合理的选择。

-

尽管我目前做空 ETH,但我仍然认为在短期内 ETH 比其他资产更适合持有,仅仅因为 Tom Lee 的持续购买行为。然而,我们需要意识到,一旦 Tom Lee 的资金耗尽,ETH 的价格可能会出现大幅下跌。这种现象类似于当 Saylor 宣布购买价值 10 亿美元的比特币时,比特币价格反而暴跌。市场明白,他无法无限制地持续购买,因此每次购买都会带来未来购买能力的下降。

-

此外,有一位名叫 Garrett Bullish 的中国巨鲸,据称他管理着他人的资金。在 10 月 10 日市场崩盘前,他一直做空,但随后在链上 Hyperliquid 平台购买了超过五亿美元的 ETH,目前亏损约 4000 万美元。我认为他的投资逻辑可能部分受到 Tom Lee 的影响。然而,这种行为更像是为了赚“快钱”,这些投资者并不真的想长期持有 ETH,只是希望快速获利。

-

加密市场目前呈现出一种 PvP(玩家对玩家)的竞争状态,缺乏明显的优势。尽管市场中仍有资金流动,但总体趋势是资金正在逐步流出生态系统。这可能也是我们最近看到价格波动的原因。作为市场参与者,了解 Tom Lee 的购买能力、购买规模以及可能停止购买的时间点非常重要。我个人认为,他的资金可能很快就会耗尽,而这正是我最近增加反向仓位的原因。

Tom Lee 的 ETH 操作策略

-

让我们来分析 Bitmine 目前的资金状况。一个月前,他们持有约 350 万到 360 万枚 ETH,以及 6 亿美元的现金。而根据昨天的最新公告,他们的 ETH 持仓已增至近 400 万枚,现金储备也增长到约 10 亿美元。显然,Tom Lee 的操作非常大胆且高效。他通过购买 ETH 不断扩大持仓,同时还筹集了更多现金。

-

Tom Lee 的策略包括利用媒体宣传来吸引投资者关注 Bitmine 和以太坊。他通过展示公司的资产和市场潜力,吸引人们购买 Bitmine 的股票。随后,他发行更多股票,并将部分资金用于购买 ETH。据悉,他最近向 Bitmine 的股东出售了约 5 亿美元的股票,其中约 3 亿美元被用于购买 ETH。这种方法维持了 Bitmine 的市场需求和交易量,使他能够持续进行资金筹集。

-

然而这种策略也存在风险。尽管 Tom Lee 的品牌效应和市场声誉可能会吸引投资者,但从 Bitmine 的股价走势来看,情况并不乐观。我个人认为,这种模式难以长期维持,最终可能因为资金耗尽而中止。毕竟,筹集资金并非无限可能,市场也不会永远保持非理性。

-

Tom Lee 作为一位市场知名人物,过去十年间一直是加密货币的多头,并且大多数时候他的预测都很准确。他的商业模式也非常成功,例如出售新闻简报等服务。然而,他为何冒着声誉风险将 ETH 的价格推向高点?我认为答案在于激励机制。正如查理·芒格所说:“告诉我激励,我会告诉你结果。”如果我们分析 Bitmine 的激励结构,就可以更好地理解他的行为。

-

根据 Bitmine 向 SEC 提交的附表 14A 文件,Tom Lee 的薪酬与公司表现紧密挂钩。他的绩效奖励与比特币收入、ETH 持仓比例、比特币价格以及公司市值挂钩。此外,董事会每年还可以投票决定是否授予他 500 万到 1500 万美元的现金奖励。更重要的是,股权激励机制规定,如果 Bitmine 的 ETH 持仓达到 4%,Tom Lee 将获得 50 万股股票,按当前股价估算价值约为 1500 万到 2000 万美元;而当持仓达到 5% 时,他将获得 100 万股股票,奖励翻倍。

-

值得注意的是,Bitmine 的收入主要来自资产管理费用。例如,如果 Tom Lee 购买了价值 100 亿美元的 ETH,并支付 2% 的管理费用,公司收入将达到 2 亿美元。这种模式虽然简单,但却非常有效。

-

Tom Lee 的操作策略不仅是为了推动 ETH 的价格上涨,也是为了实现个人和公司利益最大化。然而这种策略的可持续性值得关注,一旦资金耗尽或市场需求减弱,ETH 的价格可能会迅速下跌。作为市场参与者,了解他的资金规模、购买计划以及可能停止购买的时间点非常重要。

2026年1月15日的利空因素

-

Tom Lee 的目标是在六个月内将 ETH 的市场份额提升至 4% 或 5%,这一举措非常大胆且值得关注。他的激励机制使他有动力在年底前持续投入资金购买 ETH,因为每年都存在潜在的现金奖励机制。他希望在 1 月 15 日的董事会会议上能够展示优异的业绩,例如:“我买了这么多 ETH,给我 1500 万美元奖励。”这种奖励机制解释了为什么他在年底前会加速购买 ETH。

-

一旦 Tom Lee 达到 4% 或 5% 的市场份额目标,他的购买动力可能会减弱,因为激励机制的边际效益减少。当然,他可能仍然需要继续购买以维持 ETH 的价格,但推动价格上涨的动力会有所下降。可以看出,他在年底前有更强的动力推高价格。

-

Tom Lee 的策略确实让 ETH 持有者受益匪浅。他通过大胆的资金投入将 ETH 的价格从 2,500 美元推高至 4,900 美元,并且仍在持续购买。然而,这种策略也存在风险。如果在未来 ETH 的价格出现大幅回落,散户投资者可能会感到失望,尤其是那些因 Tom Lee 的言论而购买 Bitmine 股票的投资者。

-

值得注意的是,2026 年 1 月 15 日不仅是 Bitmine 董事会决定奖金的日期,同时也是 MSTR 可能面临摘牌的截止日期。如果 MSTR 被摘牌,将引发数十亿美元的资金外流,对市场造成巨大的抛售压力。MSTR 的领导层显然对此感到担忧,他们甚至在官网上设置了一个页面,呼吁投资者支持他们避免摘牌。若摘牌事件发生,可能会导致市场恐慌,因为 MNAV 可能跌破 1。虽然 Saylor 曾表示,如果 MNAV 跌破 1,他可能会卖出比特币回购股票,但市场可能会对此进行压力测试。

-

Tom Lee 在 1 月 15 日之前的激励机制让他有动力继续购买 ETH。但如果 MSTR 被摘牌,而 Tom Lee 已经耗尽资金用于购买 ETH,市场可能会出现崩盘的局面。这种情况虽然极端,但值得关注。研究激励机制可以帮助我们更好地理解市场参与者的行为逻辑。

情况可能会变得更糟

-

我认为在加密货币交易中,我们应该始终问自己两个问题:谁是边际买家?谁是边际卖家?几个月前,我也提出过这个问题。当时市场普遍认为第四季度会迎来上涨,并且会出现“山寨季”。但我继续追问:如果大家都已经准备好迎接上涨,那么谁还会是边际买家呢?很显然,他们无法回答这个问题。于是我意识到,这些人其实就是边际卖家。因为如果市场没有如预期上涨,他们就会转而卖出,这反而为做空提供了绝佳机会。

-

最近,我不得不承认一个事实:当前的加密货币市场并没有真正的“结构性买家”。虽然未来可能会有所变化,但目前来看,市场更像是一场 PvP(玩家对玩家)的博弈。数字资产金库公司(DATs)在一定程度上支撑着市场,但他们的资金毕竟有限。如果你认同这一观点,那么过去几个月的市场走势就相对容易理解了。比如,当 Tom Lee 向 ETH 投入大量资金时,你可以选择卖出资产;而当他们可能停止购买时,你则可以开始做空。

-

以 Tom Lee 为例,他可能会在 12 月集中进行大规模购买,但到了新年,他可能会减缓购买速度,同时留出部分现金用于保护股票,因为他迟早需要建立现金储备。目前的市场情况有些类似,资金主要流向 ETH,导致其价格被支撑在较高水平。一旦 Tom Lee 减缓购买,市场的多头仓位可能会迅速解除。正如我之前提到的,ETH 的价格本可以更低,但 Tom Lee 的操作暂时阻止了这一情况。一旦他退出市场,ETH 的价格可能会迅速下跌。

-

Tom Lee 的 Bitmine 是在 ETH 价格为 2,500 美元时宣布的。我认为这一涨幅最终可能会被完全回撤。上次比特币交易在 85,000 美元时,ETH 的价格是 1,600 美元左右。虽然可以认为这是由于关税等因素导致的价格异常,但事实是,在类似的比特币价格水平下,ETH 的价格曾经更低。我认为目前 ETH 的价格仍维持在 2,900 美元左右,主要是因为 DATs 的持续购买。这些资金确实起到了支撑作用,但显然它们终会耗尽。如果你只是等待资金耗尽再去做空,那可能为时已晚。你需要提前判断市场趋势,因为到资金耗尽时,ETH 的价格可能已经大幅下跌了。

-

虽然我的观点听起来悲观,但如果你熟悉我的交易风格,你会知道我通常是偏向看涨的。我过去曾犯过错误,总是把所有收益重新投入市场。每当市场出现明显的风险时,我都会选择止盈。做空是我最近才加入的策略,通常我还是更倾向于做多。如果仔细思考,我们应该欢迎熊市,因为这才是赚钱的机会。很多人只想着在第四季度的“山寨季”里获利,但真正的财富是在低点买入时积累的。比如,任何在比特币价格约 20,000 美元时买入的人,现在价格是 85,000 美元,那可是 4 倍的收益。

-

我希望大家能明白,市场总是可能变得更糟。而且,除非你卖出,否则你无法真正实现收益。你需要现金储备,并且在市场冷清时果断卖出。我不是说现在必须卖出,只是分享我的交易思路。在上一个市场周期的熊市中,ETH 曾连续 11 周下跌。当时我认为第六周后市场应该会反弹,但事实并非如此,又连续出现了五周下跌。所以市场总是可能更糟。

-

我想提醒大家,不要满足于简单持有加密货币,因为它们可能在短时间内迅速下跌。即使是最近的市场,没有人预见到它会跌得如此之快,但它确实发生了。除非你卖出,否则无法在加密货币市场中获利。当然,你可以选择长期囤积比特币或 ETH。我个人认为 ETH 并不是一个好的投资,但如果你的投资周期足够长,比如 20 年,而且完全不在乎短期波动,那也许可以接受。但大多数人并没有成为富有的比特币或 ETH 巨鲸的条件,我们至少需要通过交易抓住市场的顶部和底部,否则只能承受资产缩水的风险。

Taiki vs ETH 支持者

-

最近我收到了一些 ETH 极端主义者的攻击,这在某种程度上是可以理解的。对于这些人来说,他们的身份认同似乎完全围绕着自己早期购买 ETH 的行为,而我却在 YouTube 上坦诚地指出,ETH 的价格可能会进一步下跌,并且还提供了数据和事实支持我的观点。不过,我尊重像 Ryan Burkeman 这样的 ETH 支持者,因为他确实相信 ETH 的价值。当然,有时候我也会纠正他的一些数学错误。

-

我想澄清一点,我并不是一个对 ETH 盲目崇拜的人。事实上,如果你查看我的链上交易记录,我使用 ETH 的生态系统(比如 ETH L2s)的频率比绝大多数 ETH 极端主义者都要高。无论是在 Twitter 还是 YouTube 上,我可能是链上活动最多的人之一,我经常使用区块链,也参与过挖矿。。

-

很多人对 ETH 的态度其实并不够批判。他们可能只是简单地购买 ETH,然后期待价格上涨,但我制作这些视频并不是为了攻击 ETH,因为我认为 ETH 是一个很棒的技术产品,但我们必须学会区分“资产”和“技术产品”,它们是两回事。虽然技术的优越性可能会影响资产价格,但这并不意味着 ETH 的价格会永远上涨。我们至少需要批判性地思考,是什么因素在推动 ETH 的价格变化。

-

2022 年的熊市让我损失惨重。虽然我曾在接近市场顶部时卖出,但后来却不断买入更低的低点,因为我当时坚信 ETH 的价格最终会涨得更高。四五年前,我是一个妄想的 ETH 多头。我相信 DeFi 会改变世界,ETH 是金融的未来,甚至认为 ETH 会超越比特币,成为更好的货币。但现在,我发现持有这些观点的人已经少了很多。我曾妄想 ETH 的价格会涨到 10,000,并一直持有,结果它从 4,000 跌到了 900 美元,这种经历非常残酷。

-

在我的频道里,我一直努力分享自己的交易策略,我并不是每次都能做对交易,但至少我会努力做到诚实和真实。我分析市场的方式更多是基于数字和资金流动的基本面,而不是简单地画图表或线条来预测价格走势。例如,ETH 的上涨是因为 Tom Lee 的大规模购买,而 ETH 的下跌可能是因为资金耗尽。如果 Tom Lee 还在购买,我会选择做空他的买入,并提前布局,以应对他资金耗尽后的市场变化。

好技术,坏资产?

-

或许我的观点是错的,但我正在用自己的资金来验证它,而且我的所有交易都可以通过链上数据进行验证。看看当前的情况,几乎没有人在真正使用 ETH。当然,ETH 主网正在扩展,链上交易成本变得更低,用户活动可能转向 L2(Layer 2),但仅凭这些数据,你无法简单地得出“全球正在采用 ETH”的结论。至少在我看来,这样的解读并不成立。

-

ETH 的市值目前约为 3,500 亿美元,这种估值更多像是一种空中楼阁般的假设,比如“如果全球金融活动都迁移到 ETH 上,那么 ETH 的市值就会继续上涨”。但这个逻辑真的站得住脚吗?技术再优秀,也未必能推动资产价格上涨。有人一直标记我,说:“摩根大通正在链上发行稳定币,ETH 的市值会涨到 10 万亿美元。”但我认为,加密货币市场的成熟在于理解:技术可能非常优秀,甚至对某些企业和地区来说是净积极的,但这并不意味着它们是好的投资。

-

举个例子,像 Robinhood,他们正在使用 Arbitrum Orbit 堆栈来构建自己的区块链。或许这个决定对 Robinhood 的股权是有利的,但对 Arbitrum 的代币却未必有利。那么,是否有可能使用区块链技术的企业都能获利,而底层基础设施却没有显著收益?它可能受益一点,但不会太多。这种情况同样难以接受,但至少值得我们去思考。

总结

-

一旦 Tom Lee 停止购买或退出市场,情况可能会变得更加糟糕。正如我之前提到的,上次比特币价格处于类似水平时,ETH 的价格要低得多。我认为当前市场的高估主要是受到数字资产金库公司(DATs)的推动,而这些多头仓位需要时间来解除。同时,市场参与者也需要时间来认识到,这种价格可能并不合理。

-

现在的市场阶段可以总结为:DATs 推高了价格,而人们正在逐渐意识到,这种狂热可能已经过头了,ETH 的实际价值可能要低得多。这正是我目前的押注方向。当然,我并不是一个末日论者,而是一个加密货币的长期支持者。我的忠实观众都知道,我现在只是以现金计价。我认为积累更多现金的方式是通过做空 ETH、参与空投挖矿,同时保持冷静。我最近还参加了一场交易比赛,为了打发时间,我选择做空 Solana 和 ETH,最终赢得了比赛,并赚了 5 万美元。

-

我认为,做空 ETH 是一种简单且有效的策略。尽管有时候 ETH 的价格会因为像 Tom Lee 这样的随机因素而上涨,但一旦他们的购买量达到高峰,随着市场对他们的依赖逐渐减弱,ETH 的价格就会开始慢慢下跌。不幸的是,我认为当前的市场正处于这样的阶段。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。