编译:Block unicorn

金库是加密货币领域中人人都自以为理解的概念之一,这主要是因为它们看起来简单易懂。然而,简单往往具有欺骗性。在表面之下,金库已悄然成为整个生态系统中最容易被误解却又最具战略意义的基础要素之一。

在 DeFi 夏季,「金库」只不过是围绕自动化收益耕作的一个巧妙的UI。Yearn 将繁琐且需要大量人工干预的操作——例如在不同收益农场之间切换、复利管理治理代币——包装成一种近乎魔法般的体验。只需存入资金,策略就会自动完成所有工作。这是一种互联网原生的抽象概念,而且行之有效。

但 2025 年已截然不同。

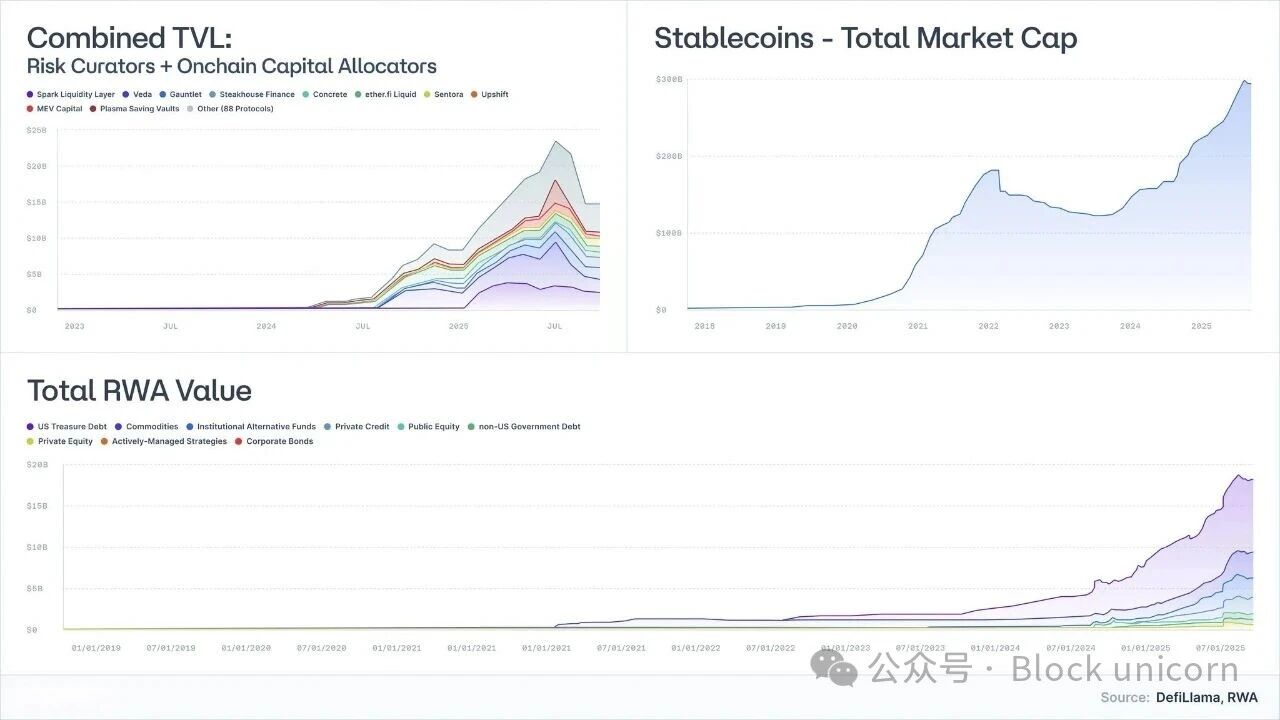

代币化国债已从数千万美元规模的实验演变为近 90 亿美元的资产管理规模,贝莱德、富兰克林和法国兴业银行等机构也已成为其积极参与者。

不包括稳定币的风险加权资产 (RWA) 规模已达数百亿美元。

稳定币本身的市值已超过3000 亿美元,发行方的成熟度也大幅提升。

风险管理机构和链上资产分配机构(Risk Curators and Onchain Allocators)这个几年前还几乎无人问津的行业,如今已由近百家公司管理着超过 200 亿美元的资产。

认为金库仅仅是「收益机器」的观点已经过时。金库正在演变为基金包装器,作为货币市场基金、结构化信贷以及(日益增长的)对冲基金策略的可编程模拟工具。

而这里存在一个危险的误解:

大多数金库被宣传为收益率工具。但从经济本质上看,它们是风险产品。

Stream、Elixir 等项目的崩盘清楚地表明了这一点。当行业将结构化信贷视为等价于美元的产品时,其结果可想而知:风险管理不善、连锁脱钩以及借贷协议的系统性脆弱性。

本文旨在重塑人们对金库的认知:金库究竟代表什么,它们如何映射到现实世界的资产类别,以及为什么「低风险 DeFi」并非昙花一现,而是全球金融普及的下一个前沿领域。

1. 金库本质上是带有 API 的投资组合

剥去 UI 和营销元素,金库的概念其实很简单:

一个封装在 API 中的投资组合构建引擎。

资产存入金库(稳定币、以太坊、风险加权资产)。

策略运行(借贷、抵押、套保、杠杆、挖矿、卖出波动率、承销信贷)。

可编程接口用于存取款;有时具有可预测的流动性,有时则不然。

这就是金库的全部。

如果传统金融从业者递给你一份基金投资意向书,你会立即问:

这是现金?信贷?股权?还是其他什么稀有资产?

流动性特征是什么——每日、每周还是每季度?

如果发生极端事件,我的本金会怎样?

加密货币完全跳过了这一步。我们谈论的是年化收益率(APY),而不是风险等级。

在去中心化金融(DeFi)前端,五种截然不同的策略最终都归结为同一张看似美好的卡片:

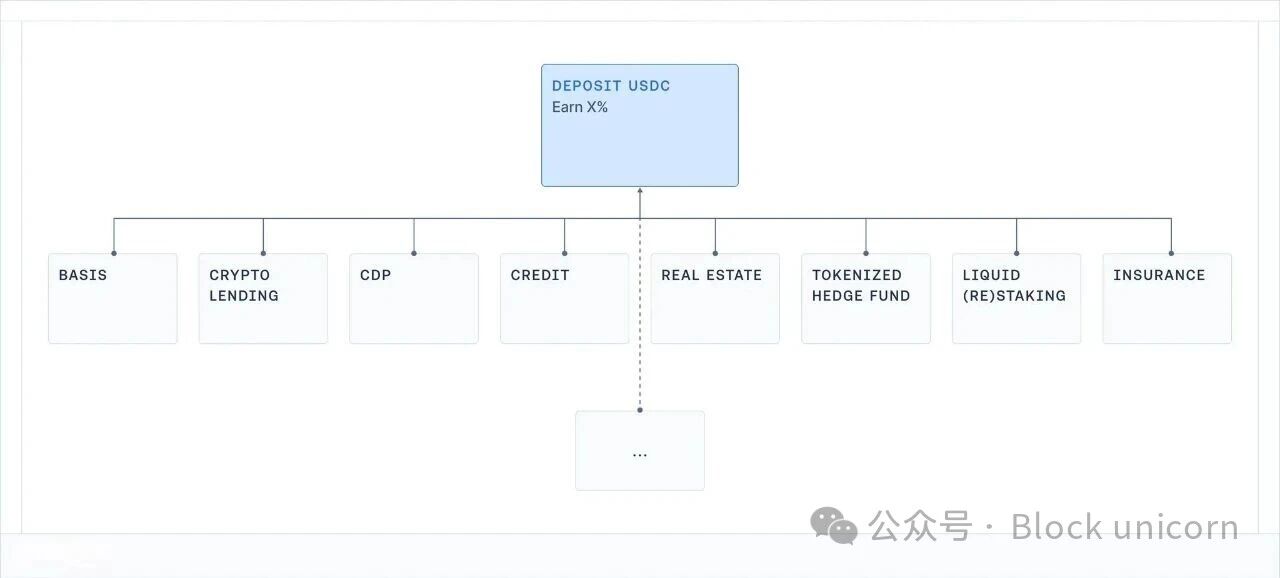

金库是通往链上任何事物的入口。

缺失的是最关键的部分:我究竟承担了哪些风险?

合约风险?交易对手风险?基差风险?杠杆风险?信贷风险?还是以上所有风险?

最终,这种不透明性是有代价的:散户用户可能会承担他们不了解或不理解的风险,并遭受意想不到的损失(甚至可能引起监管机构的注意);机构投资者只需看一眼就会放弃,因为他们对缺乏专业性和透明度标准感到失望。

此外,将收益率作为唯一的竞争基准对风险管理产生了另一个毁灭性的影响:协议和风险管理者为了相互竞争,承担了越来越多的风险。

随着加密货币进入机构化时代,这种情况必须改变。

2.你实际获得的收益是什么?现实世界的基准

如果我们想要了解 DeFi 金库的收益,我们需要一个基准:

历史上,现实世界中不同类型的风险究竟能获得怎样的回报?

近一个世纪以来,研究人员一直在收集关于核心金融资产类别的数据。

阿斯瓦特·达莫达兰 (Aswath Damodaran) 维护着一套可追溯至 1928 年的美国股票、债券和短期国债的权威数据系列,而《全球投资回报年鉴》(Global Investment Returns Yearbook)则追踪了自 1900 年以来主要国家的长期回报率。

在这些数据集中,情况出奇地一致:

股票(标普 500指数):约 9.9%

小盘股:约 11.7%

高收益公司债券:约 7.8%

投资级债券:约 4.5%

现金 / 短期国债:约 3.3%

房地产:约 4.2%

黄金:约 5%

在此期间,通货膨胀率平均约为3%,因此实际回报率比预期低约 3 个百分点。这些数字并非对未来的精确预测,但它们大致反映了长期经济中可能出现的趋势。

每一种收益都伴随着一系列风险和权衡,而这些风险和权衡是由相应的持有者承担的。

2.1 现金/短期国债:因等待而获得报酬

定义

在实践中,它是金融体系中最接近「无风险」基准的投资标的(短期美国政府债券、货币市场基金)。

历史回报

名义收益率约为3.3%(扣除通货膨胀后实际收益率为0-1%)。

投资回报:本质上,由于信用风险几乎不存在,期限风险也极低,投资收益仅基于货币的时间价值。

权衡取舍:通货膨胀会悄然侵蚀收益和购买力;在扣除费用和摩擦后,长期实际收益接近于零。

本质上,这些投资非常适合存放现金,而非实现财富复利增长。

2.2 债券:因借出资金而获得报酬

定义

由政府和企业发行的债务,质量参差不齐。你借出资金以换取利息和本金偿还。

历史回报

投资级债券的名义收益率约为4-4.6%;

高收益债券(「垃圾债券」)的名义收益率约为6-8%。

投资回报:

信用风险:借款人违约或受损的可能性(「垃圾债券」的风险更高);

期限风险:对利率变化的敏感度;

流动性风险,尤其是在非主流债券或低评级债券中。

权衡取舍:当利率上升时,债券投资组合的表现可能大幅下滑(周期性敏感性,例如 2022 年债券收益率的历史低迷);当通胀飙升时,实际收益率可能很低甚至为负;信用事件(重组、违约)可能导致永久性资本损失。

「债券」一词涵盖了一系列风险和收益各异的金融工具:评估债务人的经济状况是确定确切风险状况的基础。

2.3 股票:因增长波动而获得报酬

定义

持有企业股份。受益于盈利、创新和长期经济增长。

历史回报

美国股票(标普 500 指数):名义收益率约为9.9-10%,实际收益率约为6.5-7%。

投资回报:

商业风险:公司可能倒闭;

盈利周期:利润随经济波动,股息对整体回报的贡献可能会减少;

波动性和回撤:即使在发达经济体,较大的逐日市值波动也是正常的。

权衡取舍:尽管从长远来看,全球股票通常优于债券和短期国债,但长达数年的 30% 至 50% 的调整并非异常现象(例如日本的失落十年,或 2000 年至 2018 年的欧洲),尤其是在考虑通货膨胀因素后。

2.4 房地产:收入 + 杠杆 + 本地风险

定义

产生、收益的房地产:住宅、商业、物流等。

历史回报

美国房地产指数的长期平均名义收益率约为4%至 4.5%,实际收益率约为 1% 至 2%。

投资回报:

收入风险和经济周期:收益取决于租户能否持续按时支付租金,而租金收入会随着经济周期波动而减少;

本地经济风险:投资于特定城市、地区和行业的风险敞口;

杠杆和波动性风险:抵押贷款和债务融资会放大收益和损失;

流动性风险:房地产及许多房地产相关工具的交易速度慢且成本高,尤其是在压力时期。

权衡取舍:

你无法立即「挂牌出售」房产;出售或再融资需要数周/数月时间,即使是上市的房地产投资信托基金(REITs)在市场承压时也可能出现大幅下跌;

利率、信贷或本地需求(例如,居家办公导致办公楼需求下降)的下滑可能会同时影响收入和估值;

当利率上升或贷款机构收紧贷款时,滚动债务的成本可能会很高;

投资组合通常会过度集中于特定地区或特定类型的房产。

实际上,尽管房地产历来是抵御通胀的有效投资,但它是一个复杂且流动性差的领域,不能像现金等价物一样进行交易或支付。

2.5 私募股权与风险投资:流动性不足 + 复杂性溢价

定义

对私人公司和项目进行流动性差、期限较长的投资,例如收购和成长型股权投资;早期风险投资或困境及特殊情况投资。

历史回报

私募股权:许多年份的净内部收益率 (IRR)为 15% 左右(但周期性很强)

风险投资:顶级四分位的基金经理的回报率为20-30% 以上

然而,数据呈现出极大的波动性:一旦考虑费用和幸存者偏差后,中位数的实际回报率将更接近个位数。

投资回报:

长期流动性不足:资金锁定 7-12 年

复杂性:定制交易、治理和结构

管理者技能:不同管理者和不同投资年份之间的差异巨大

信息不对称:需要专业渠道和尽职调查

更高的本金风险:风险投资高度依赖执行和经济周期;存在较高的本金损失风险。

权衡取舍:资金长期锁定;通常没有二级市场。此外,尽管风险较高,但许多基金在扣除费用后,其表现逊于公开市场。

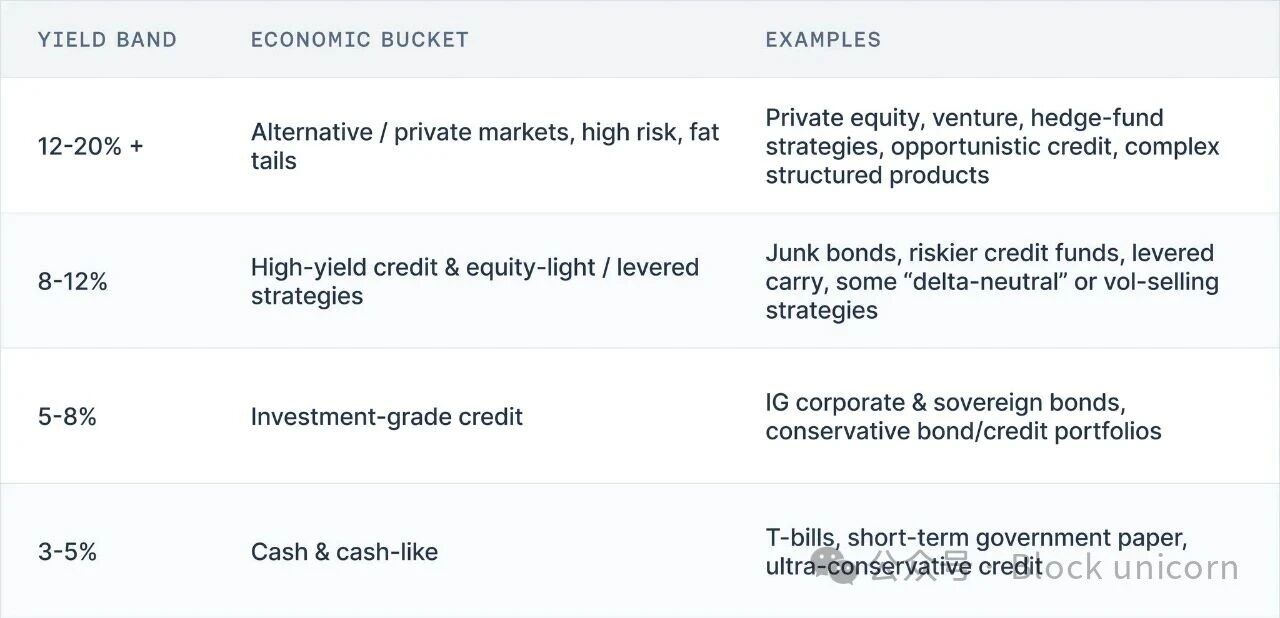

3.天下没有免费的午餐:收益益率阶梯

当你把所有这些历史数据汇总起来时,一个简单的事实浮现出来:

现实世界中没有任何一种资产类别能够在不承担高风险的情况下提供高收益。

解读金库收益率的一个实用方法是使用收益率阶梯模型:

3-5%→ 现金、国债、短期政府债券、超保守型信贷

5-8%→ 投资级债券、保守型信贷组合

8-12%→ 高收益债券、风险较高的信贷、轻股权策略、部分杠杆套利

12-20%+→ 私募股权、风险投资、对冲基金策略、机会主义信贷、复杂结构化产品

一个多世纪的市场数据显示,这一收益阶梯在战争、恶性通货膨胀、科技繁荣和利率体系的变迁中都展现出了惊人的韧性。

将投资组合上链并不会使其失效。因此,每当你看到一个 DeFi 金库时,请问自己两个问题:

所宣传的风险是否与所宣传的收益相符?

收益率来自哪里?

4. 结论:金库收益率的正确思维模型

抛开营销和UI,事实其实很简单:

金库不再是自动复利的「农场」,而是一个带有API 的投资组合;

其收益率是它所承保风险的价格;

一个多世纪以来的市场数据显示,在特定风险下,合理的收益率范围一直保持着惊人的稳定性。

类现现金的工具名义收益率仅为个位数,实际收益率几乎为零。

投资级信贷的收益会因期限和违约风险而略高一些。

高收益信贷和股票的收益率可达个位数高位甚至十几。

私募股权、风险投资和对冲基金策略是历史上唯一能够持续提供十几中位及以上收益率的投资选择,但它们也伴随着流动性不足、信息不透明以及永久性损失的现实风险。

将这些投资组合上链并不会改变风险与回报之间的关系。在如今的 DeFi 前端,五种截然不同的风险等级可能都以同一张友好的广告形式呈现:「存入 USDC,赚取 X% 收益」,却几乎不会显示你承担的是现金、投资级信贷、垃圾级信贷、股票还是对冲基金的风险。

对于个人用户而言,这已经够糟糕了,他们可能在不知情的情况下为自己不了解的复杂信贷产品或杠杆组合投资。

但这还会带来系统性后果:为了保持收益率的竞争力,特定「类别」中的每个产品都会倾向于选择该类别中风险最高的配置。更安全的配置看起来「表现不佳」,因而被忽视。那些悄悄地在信贷、杠杆或基差方面承担更多风险的托管商和协议会获得奖励,直到类似 Stream 或 Elixir 的事件提醒所有人,他们实际承担的是什么。

因此,收益率阶梯不仅仅是一个教学工具。它是目前行业所缺失的风险语言的开端。如果我们能够始终如一地回答每个金库这两个问题:

这个金库属于阶梯的哪一级?

这种收益率会让我承担哪些风险(合约风险、信用风险、期限风险、流动性风险、方向性风险)?

这样我们就可以按风险等级来评估表现,而不是将整个生态系统变成一场单一的、不加区分的年化收益率(APY)竞赛。

在本系列的后续部分,我们将采用这一框架直接应用于加密。首先,我们将当今的主要金库和崩盘映射到阶梯上,看看它们的收益率真正告诉我们什么。然后我们将拉远视角,讨论需要改变什么:标签、标准、策展实践和系统设计。

在本系列的后续文章中,我们将把这个框架直接应用于加密货币领域。首先,我们将把当今主要的金库和崩盘案例映射到这个框架上,看看它们的收益率究竟反映了什么。然后,我们将跳出框架,探讨哪些方面需要改进:标签、标准、策展人实践以及系统设计。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。