撰文:Glendon,Techub News

预测市场发展迅猛,它正在加速朝着主流金融市场迈进,已然成为当下炙手可热的「巨大风口」。

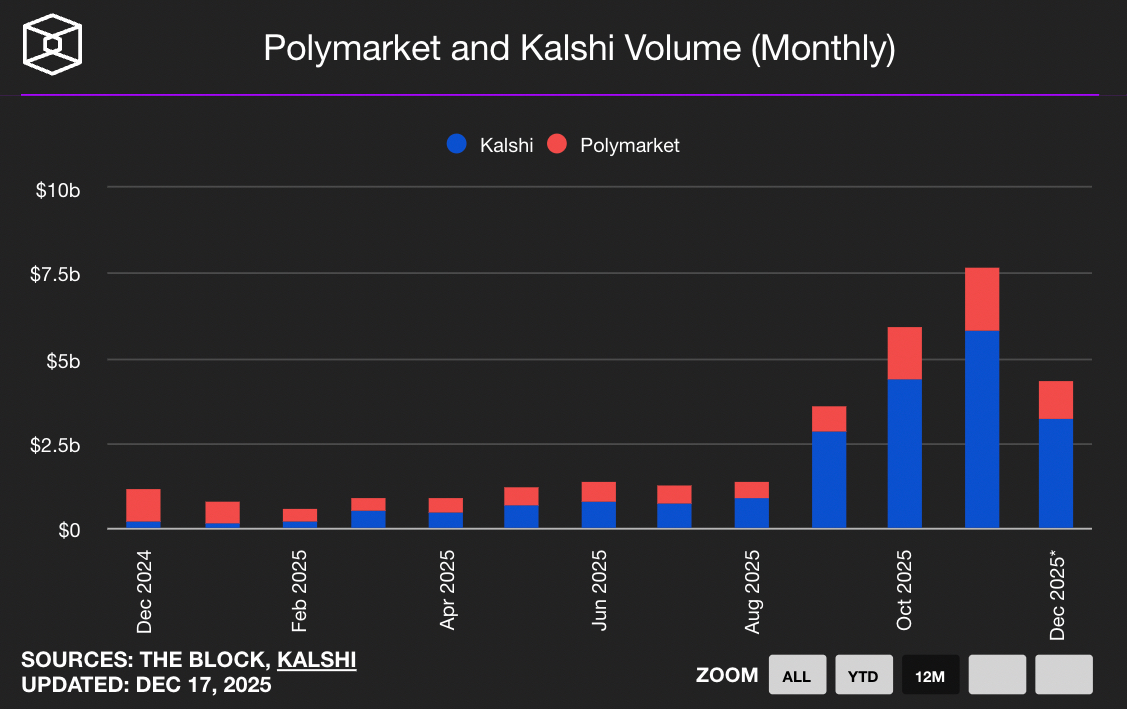

据 The Block 数据,Kalshi 在 11 月的交易量高达 58 亿美元,较 10 月增长了 32%,再次创下历史新高;Polymarket 11 月的交易量也攀升至 37.4 亿美元,创下历史新高,环比增长 23.8%。

今日,BNB Chain 上预测市场 Probable 正式上线,该平台由 PancakeSwap 和 YZi Labs 共同孵化,支持用户预测加密货币、全球事件、体育赛事等事件,且无需任何手续费。与此同时,Coinbase 也在积极布局,其在 System Update 发布会上表示将大幅扩展其平台交易资产范围,主要包括股票交易、预测市场等多项新服务,以巩固其「全能交易所」的市场定位。

可以看到,前有预测市场「双巨头」Kalshi 和 Polymarket 引领行业爆炸式增长,后有加密原生预测市场 Probable 和 Coinbase 等交易平台奋起追赶。即便当下市场行情较为低迷,该领域依然呈现出一副欣欣向荣的景象。而在热闹的背后,当下预测市场领域的发展现状如何?

Kalshi:稳坐「王座」,剑指链上预测市场

现阶段,Kalshi 稳稳占据着预测市场领域的霸主之位,并且正在努力巩固其市场地位。

作为美国首家受商品期货交易委员会(CFTC)监管许可的预测市场平台,Kalshi 并非是加密原生应用。但如今,Kalshi 积极求变,已将数千个预测市场通过 Solana 实现上链,以推动其全球流动性池的开放式货币化。同时,Kalshi 也启动了一项总额超过 200 万美元的开发者资助计划,鼓励新兴应用集成链上功能。此举瞄准了规模高达 3 万亿美元的加密资产市场,其目的十分明确,就是要吸引那些高频交易的加密用户,进一步扩大自身的用户群体。这似乎表明,Kalshi 正准备在链上金融领域与 Polymarket 展开正面交锋。

在融资方面,Kalshi 于本月初完成了由 Paradigm 领投的 10 亿美元 E 轮融资,参投方包括 a16z、红杉资本、ARK Invest 等,最新估值达到 110 亿美元。而为了在市场竞争中占据更有利的位置,12 月 12 日,Kalshi 与 Crypto.com 联合 Robinhood、Coinbase 及 Underdog 成立了预测市场联盟(the Coalition for Prediction Markets,CPM),以强化其合规护城河。该联盟旨在维护预测市场安全、透明且受联邦监管的准入环境。值得注意的是,这一联盟将其竞争对手 Polymarket 排除在外,其背后的意图不言而喻。

除了 Robinhood、Coinbase 等金融平台以外,Kalshi 目前已与 CNN 和 CNBC 等新闻频道达成合作,其提供的实时概率数据将整合进相关节目,供媒体使用。

截至撰稿时,The Block 数据显示,Kalshi 本月交易量已达 32.2 亿美元,其每周交易量均突破 10 亿美元。目前,该平台已建立逾 3500 个交易市场,并将不断拓展产品种类、寻求更多合作媒体以及集成更多券商。

Polymarket:重返美国市场,全力抢占份额

Polymarket 已于上月获得美国商品期货交易委员会(CFTC)对修订指定令的批准,允许其通过中介渠道进入美国市场。当前,Polymarket 的重点工作仍是在美国市场上启动交易。本月初,Polymarket 已经开始向等候名单用户分批开放其全新移动应用,首发功能聚焦体育预测,未来计划将功能扩展至各类市场。

在此期间,Polymarket 也在积极拓展合作渠道。12 月 5 日,Polymarket 已正式上线 MetaMask 移动应用中上线,推出由 Polymarket 提供支持的 MetaMask 预测市场。12 月 9 日,Polymarket CEO Shayne Coplan 在接受 AXIOS 采访时透露了一个重要信息:目前 Polymarket 处于亏损运营状态。在这样的情况下,占有尽可能多的市场份额已成为 Polymarket 的最优先事项。

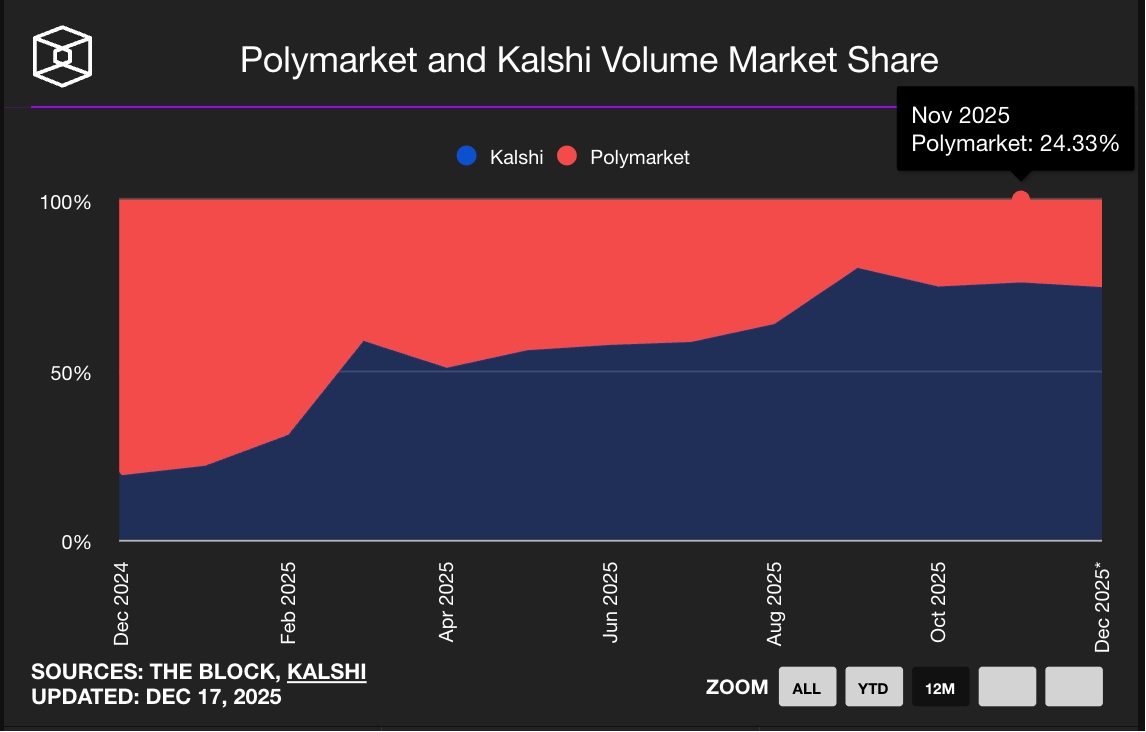

从市场数据来看,Polymarket 目前面临着不小的竞争压力。截至撰稿时,Polymarket 相较于 Kalshi 的市场份额仅为 24.33%,而这两大平台几乎占据了整个预测市场约 95% 的份额。具体而言,Polymarket 本月交易量约为 11.1 亿美元,月度活跃用户数量当前约为 33.47 万人。不过,随着美国市场的正式开放,Polymarket 将迎来新的发展契机,其与 Kalshi 的较量也即将拉开帷幕。

Opinion 加速崛起,BNB Chain 已成重要创新阵地

从行业生态看,BNB Chain 已然成为重要的创新阵地。目前,已有多个预测市场在 BNB Chain 上运行。其中,BNB Chain 生态预测市场 Opinion 脱颖而出,成为了一颗耀眼的新星。

Opinion 于 10 月 23 日正式上线,一经推出便展现出了惊人的增长势头,一度成为增长最快的预测市场。其在公开上线一个月内交易量便突破了 50 亿美元大关,上线 50 天内累计名义交易量突破 64 亿美元,单日交易量则多次逾 2 亿美元。其优势在于将通胀、利率、就业等宏观经济指标标准化为可交易资产,使其成为宏观导向型预测市场的代表案例。

在本月初,Opinion 团队在活动中透露了一个重要消息:其近期已获得数千万美元的融资支持,资金将用于推进基于 BNB Chain 的预测市场生态建设、用户增长计划以及基础设施的发展。而为了进一步推动生态建设,Opinion 于 12 月 10 日宣布设立 100 万美元激励计划,面向全球开发者推出 Builders Program。

目前,Opinion 已支持移动端交易,用户可通过币安钱包等方式进行登陆及交易。

从持仓数据上,Opinion 的表现同样可圈可点。据 DefiLlama 数据,预测市场 Opinion 总持仓量曾突破 7200 万美元,创下历史新高,位居链上预测市场第二,仅次于 Polymarket(约 2.86 亿美元)。截至目前,该平台总持仓量有所回落约为 6493 万美元。

值得注意的是,币安对预测市场赛道展现出了相当看好的态度,并且正在大力押注。除了前文提到的由 PancakeSwap 和 YZi Labs 共同孵化的预测市场 Probable 上线 BNB Chain 外,不久以前,BNB Chain 还上线了另一个备受瞩目的预测市场平台 Predict。该平台由前币安员工创立,YZiLabs 孵化与投资,其独特之处在于支持资金生息。该平台支持资金生息,用户在参与预测时,其资金不会闲置,可以同时产生收益。

不仅如此,币安创始人赵长鹏旗下的自托管加密货币钱包 Trust Wallet 也推出了预测市场,它首先整合了 Web3 预测市场协议 Myriad,并计划很快扩展至 Kalshi 和 Polymarket 等主要平台。从这一系列动作不难发现,币安对预测市场的重视程度之高,以及其在这个赛道上全面布局的决心。

其他预测市场:多点开花,各有进展

除了上述预测市场头部平台以外,其余预测市场也有一些值得关注的新进展:

- Base 生态预测市场 Limitless 本月已完成第三次 5 万美元 LMTS 代币回购,过去三周累计从二级市场回购 15 万美元,其总持仓量约为 67 万美元;

- Myriad 已集成加密钱包 Trust Wallet,其总持仓量涨至 96 万美元;

- Solana 生态预测市场 worm.wtf 于 10 月中旬上线后,近日已完成 450 万美元 Pre-Seed 轮融资;

- 杠杆预测市场 Space 完成 300 万美元种子轮及战略融资,拟在 Solana 区块链上构建首个 10 倍杠杆的预测市场,并于今日凌晨开启 SPACE 代币公售。

而在加密预测市场项目在各自发展的同时,越来越多的加密交易平台也发现了预测市场的潜力,陆续推出相关预测市场产品或功能,进一步丰富了市场生态。

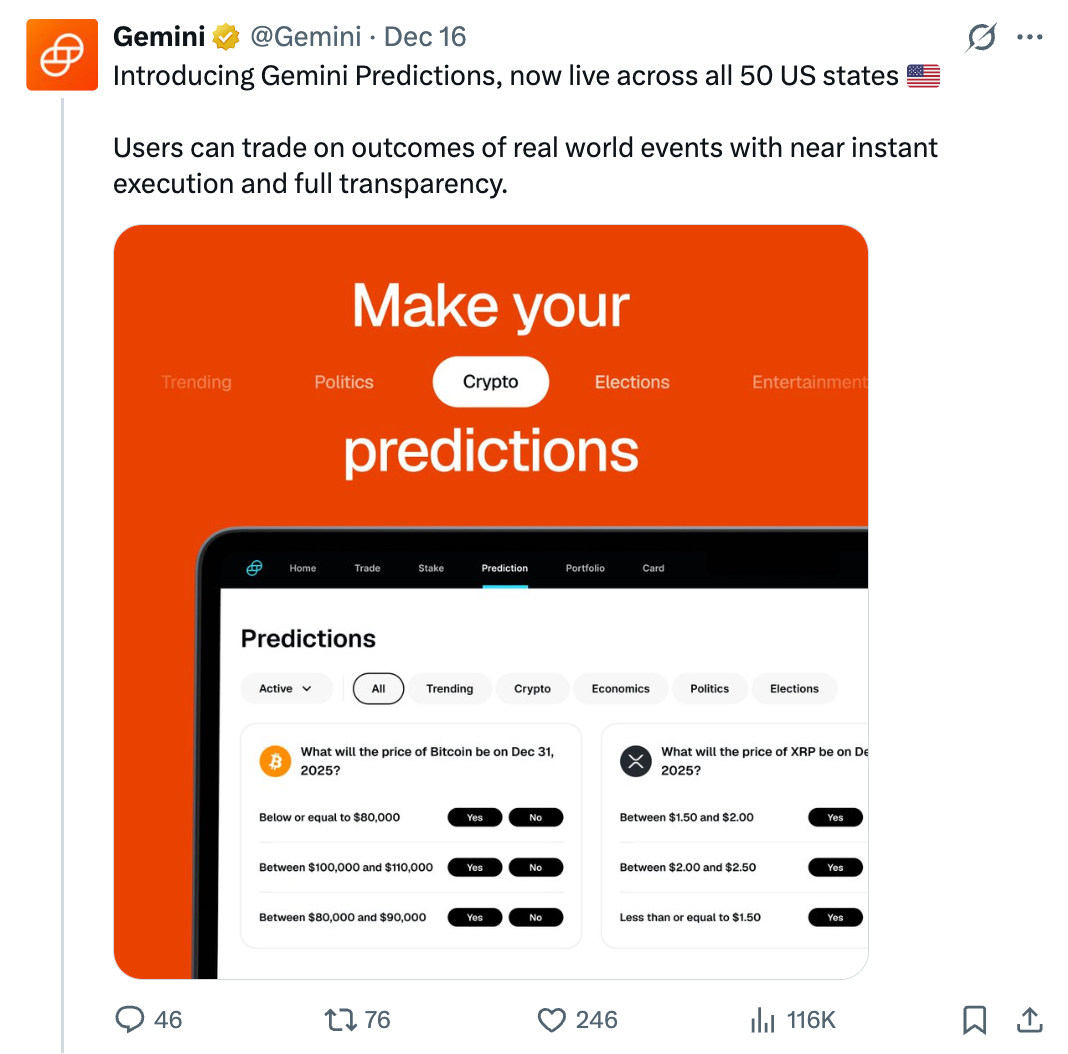

加密交易所 Gemini(股票代码 GEMI)本月已获美国商品期货交易委员会(CFTC)批准进入预测市场领域。随后,它迅速推出了预测市场产品 Gemini Predictions,并已在美国 50 个州全面上线。该产品支持用户基于现实事件结果进行交易,提供近乎即时成交与完全透明度。

加密钱包 Phantom 则是与 Kalshi 合作推出了预测市场功能,用户可在钱包内使用 Solana 代币交易二元事件合约,覆盖体育、政治、加密及文化等热门事件。其预测市场今日已向符合条件的用户开放。

此外,Coinbase 同样在紧锣密鼓地布局,正准备推出由 Kalshi 提供技术支持的内部预测市场,预计于下周发布。需要注意的是,双方并非独家合作,但产品上线后,Kalshi 将成为 Coinbase 唯一一家与预测市场合作的运营商。

值得一提的是,传统金融科技机构纷纷跨界入场,使得这一领域的竞争愈发激烈。前有 Robinhood、谷歌和芝商所等在该领域布局,如今又有体育用品巨头 Fanatics 于本月推出预测市场平台 Fanatics Markets,首批已上线美国 10 个州。Fanatics 与 Crypto.com 合作提供合规交易基础设施,凭借强大的资源与实力,其计划至 2026 年将业务扩展至加密价格、IPO、科技进展与电影结果等品类。Fanatics 明确表态,其目标是与 Polymarket、Kalshi 竞争,以抢夺市场份额。

总结

从当前的竞争格局来看,美国市场已然形成了 Kalshi 与 Polymarket 的「双巨头」垄断局面,新进入者面临极高的合规与流动性壁垒,想要在这片市场中分得一杯羹并非易事。然而,从更宏观的角度审视,事实上整个预测市场行业还处于早期发展阶段,蕴含着巨大的潜力。目前,更多的用户将注意力集中在体育赛事等传统领域,却忽视了更广泛的经济场景。Citizens Financial Group Inc. 的分析师指出,目前该行业年营收约为 20 亿美元,而到了 2030 年,预测市场公司的营收可能会增长至目前的 5 倍,突破 100 亿美元。这意味着该行业或许正处于爆发式增长的临界点,未来有着无限可能。

未来五年,预测市场有望完成从「小众投机工具」到「主流决策基础设施」的华丽转型。机构投资者的深度参与将推动市场效率不断提升,而 AI 驱动的动态定价模型也可能彻底改变传统预测机制,为市场带来全新的变革。对于行业参与者而言,把握「合规化」与「场景化」的双重机遇,或许将成为在这个千亿美元规模的新兴市场中占据一席之地的核心战略。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。