撰文: Web3 合规君

2025 年 12 月 17 日,随着港交所现场的一声锣响,HashKey Group 正式完成了从合规交易所向公众上市公司的身份转变。在经历了两年的行业深耕与政策磨合后,HashKey 的上市不仅为香港「加密中心」的建设交出了答卷,也给身处严监管环境下的国内加密圈带来了剧烈的震荡与深远的思考。

一、 破冰:从「离岸身份」到「主流资产」的跨越

长期以来,国内加密圈从业者一直背负着「身份焦虑」。再加上自从 2021 年以来,内地对虚拟货币业务的严厉清退,大量 web3 人才和资金处于游离态。而 HashKey 作为香港较有影响力的虚拟货币交易所,其上市至少有两大影响:

第一,合规资产的「锚点」:HashKey 的上市,标志着加密平台在华语地区不再是「草台班子」或「灰色地带」。它首次在港股市场建立了一个清晰的合规价值锚点。

第二,估值逻辑的重塑:过去,国内投资者看加密项目多看「赔率」和「流量」;现在,随着 HashKey 财报的公开化,市场将开始学习如何用传统金融的视角(如 P/E 倍数、日均交易量、托管资产规模 AUC 等)来衡量 Web3 企业的价值。

二、 政策边界:香港「试验田」与内地的「防火墙」

HashKey 的上市,并不意味着内地政策的转向,而是进一步明确了「境内严控风险,境外有序探索」的格局。

(一)严格的「内港隔离」

根据目前香港和内地对于虚拟货币的监管框架,HashKey 即使上市,其核心交易业务依然严格执行 KYC 限制,大陆居民无法直接参与其平台上的二级市场加密交易。这道「防火墙」确保了内地的金融稳定(封闭生态),同时也让 HashKey 成为专门吸纳海外资金与国内出海机构的「离岸金融枢纽」。

(二)RWA(现实世界资产)的北向借鉴

HashKey 上市的一大核心动力是其在 RWA(Reality World Assets) 领域的布局。通过将内地的优质债权、供应链金融资产在香港进行代币化并挂牌,HashKey 实际上打通了一条「技术南下,资本西来」的路径。这为国内苦于无法出海的优质实体项目提供了一种全新的融资思路。虽然说在 12 月 5 日,中国互联网金融协会、中国银行业协会、中国证券业协会、中国证券投资基金业协会、中国期货业协会、中国上市公司协会、中国支付清算协会(以下简称「七协会」)联合发布的《关于防范涉虚拟货币等非法活动的风险提示》中,似乎是对 RWA 判了「死刑」,但是我们认为这其实是 RWA 向死而生的一次机会 —— 七协会更多是强调不能在境内参与 RWA 活动,这就给了香港进行 RWA 业务的利好机会。

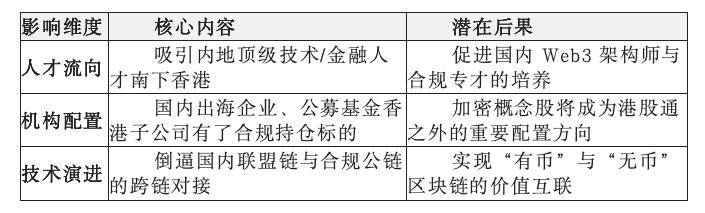

三、 对国内加密生态的三大实质影响

我们从三个角度来分析,HashKey 上市后,对内地加密生态的影响:

(一)资本流向的「正规军化」

过去,国内资金参与加密市场往往通过 C2C 等高风险渠道,资金安全与反洗钱压力巨大。HashKey 上市后,其股票成为一种「映射资产」。国内资本可以通过合规的 QDI I等渠道间接分享加密行业成长的红利,显著降低了法律风险。

(二)开发者生态的「应用转型」

HashKey 的成功证明了:在合规框架下,Web3 的核心不再是单纯的「炒币」,而是底层基建与金融效率的提升。这将引导国内开发者从「纯协议层」转向更具实用价值的「中间件」和「合规科技(RegTech)」开发。

四、 挑战与博弈:上市后的「金鱼缸」效应

但是,上市并非终点,而是接受更严苛审视的起点。对于HashKey 来说,其必须要迎接以下挑战:

第一,透明度的双刃剑:作为上市公司,HashKey 必须公开其资产储备、盈利状况和监管合规细节。这虽然增强了信任,也可能暴露其在极端市场波动下的脆弱性。

第二,流动性的争夺:面对美股 Coinbase 的先发优势,HashKey 能否利用其深耕亚洲的背景,吸引东南亚及中东的增量资金,是其股价能否挺住的关键。

第三,监管的持续演进:香港证监会(SFC)对牌照的要求极高,如何在保持高压合规的同时不牺牲用户体验,是 HashKey 必须面对的长期博弈。

五、 结语:华语加密圈的新征程

HashKey 在港交所的这一记锣声,宣告了「野蛮生长」时代的彻底结束。对于国内加密圈而言,它提供了一个「中间地带」的完美范本:在不触碰内地政策红线的前提下,利用香港的法律体系,深度参与全球数字资产的定价权竞争。

未来,我们可能会看到更多优秀的国内 Web3 企业通过「香港上市」的方式回归主流视线。HashKey 不是第一个,也绝不会是最后一个。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。