撰文:JW,Techub News

今天想借 Coinbase 最新发布的《加密货币行业报告》来聊一聊。表面看,它讲的是加密市场,如果把这份报告往大了看,其实它讲的不是币,而是一件反复发生的事:每一代人,都会遇到属于自己的「致富路径」和红利时代。

在美国,过去几十年几乎只有一条固定路线,好好读书,找份稳定工作,买套房,投点股票,然后交给时间慢慢发酵。这条路曾经真的有效,所以上一代人走得很踏实,也很笃定。

但对今天的年轻人来说,失去说服力。

不是因为他们不努力,也不是因为他们更贪心,而是因为时代变了。房子越来越贵,学费和贷款越背越久,工资涨得却很慢。很多年轻人一边工作,一边心里很清楚,就算什么都按部就班来,也很难再复制父母那一代的生活轨迹。

这其实不只是美国年轻人的感受,中国人也并不陌生:「改革开放初期,机会在下海经商;90 年代,胆子大一点的人靠批文、靠信息差;2000 年以后,买房成了最稳妥的选择;再往后,理财、基金、炒股,成了「普通人也能参与的金融」。你会发现,每一代人都会遇到同样的困惑,上一代走得通的路,到自己这里,忽然就走不动了。不是方法错了,而是当一条路径被写进教科书时,它往往已经不属于普通人了。

在这样的背景下,越来越多的年轻人开始重新思考:如果传统的路不再适合自己,那有没有别的选择?

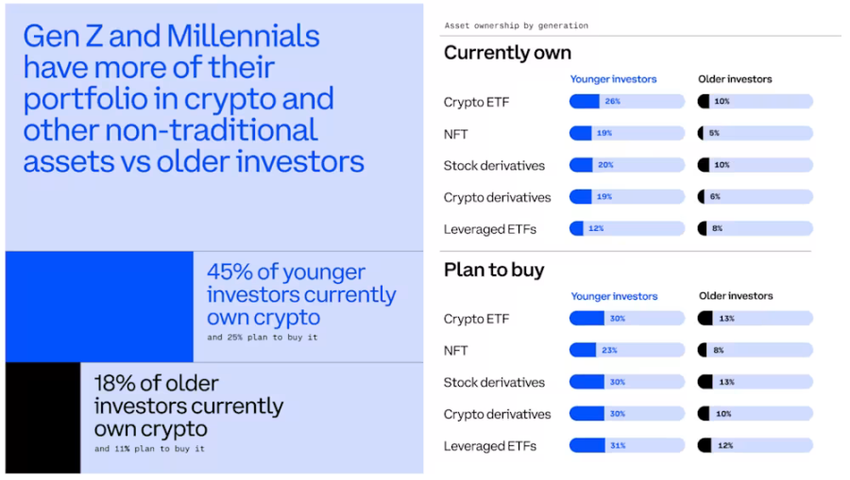

于是,他们开始更主动地参与投资。不是把钱交给别人打理,也不是完全照着「标准答案」来,而是自己去看、去试、去判断。他们依然会买股票,但不再把全部希望押在上面,而是愿意把一部分钱,拿去尝试新的东西,比如加密货币。

很多人一听到加密货币,就下意识觉得这是「赌」「投机」。但对不少年轻人来说,它更像是一种新的机会。一个不用等别人点头、不用满足太多门槛,就能参与的金融世界。你可以随时进出,不用被时间和地域限制,也不用非得先有一大笔本金。

重要的是,年轻人并不觉得现有的金融体系会站在自己这边,所以他们更愿意去探索体系之外的可能性。他们想更早一点看到新机会,而不是等所有人都认可之后,才被动跟上。如果把这件事放到历史里看,其实一点都不新鲜。过去中国每一次经济环境变化,都会有一批人先去尝试新东西:有人最早做生意,有人最早买房,有人最早开始理财。当时看起来也很「激进」,但事后回看,那往往是旧规则开始松动的信号。

对今天的年轻人来说,加密货币并不一定是终点,它更像是一条岔路。有人走得深,有人走得浅,有人最后可能会离开。但至少,它给了他们一个重新参与、重新选择的机会。

你会发现,这一代人做投资时,有几个很明显的特点:他们更频繁地操作,更愿意承担波动,也更习惯把钱分散放在不同地方。他们不太相信「一次选择管一辈子」,而是更接受不断调整、不断试错。对很多年轻人来说,加密货币也许不是答案本身,但它至少是一个信号:当旧路径走不通时,就去探索、冒险新路径。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。