撰文:邓通,金色财经

2025年接近尾声,金色财经值此辞旧迎新之际,推出「回望2025」系列文章。复盘加密行业年内进展,也愿行业在新一年里凛冬散尽,星河长明。

2025年,加密行情曾一度辉煌,创下历史新高,随后回归平淡,迎来震荡筑底行情。本文回顾加密市场在今年的表现。

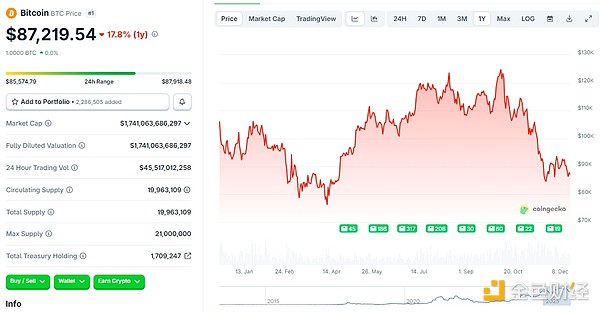

BTC价格2025年走势图

ETH价格2025年走势图

一、1-2月:宽松信号+特朗普重回白宫助力BTC冲上10万美元

2025年1月1日,BTC价格报93507.88美元,随后BTC价格逐渐上涨,直到2月初,BTC价格基本都徘徊在10万美元以上。BTC在开年即迎来喜人行情,整个行业此时喜气洋洋,投资者对于全年的加密行情走向普遍持看多观点。

美联储在1月和2月的议息会议中均维持利率不变,但释放出「谨慎观望、宽松可期」的信号,推动市场提前布局流动性红利。1月末到2月初,两次议息会议均将联邦基金利率目标区间稳定在4.25%至4.5%之间。从政策信号来看,1月会议声明删除了此前「通胀向2%目标回落并取得进展」的表述,新增对「再通胀风险」的关注,美联储主席鲍威尔明确表示,需看到「通胀真正取得进展或劳动力市场出现疲软」才会考虑降息,但强调「加息反转门槛极高」,排除了重启加息的可能性。2月会议纪要进一步透露,官员们一致认为当前限制性货币政策为评估经济留出时间,同时担忧特朗普关税政策可能推高通胀,但普遍认可「2025年降息仍是大方向」,高盛、巴克莱等机构据此预测年内将有2次25个基点降息。

另外,美国前总统特朗普于1月20日重回白宫,成为美国历史上首位「加密总统」,与美联储的宽松预期形成共振,一同成为加密市场上涨的催化剂。

二、3-4月:关税大棒+美联储宽松节奏放缓致BTC回调

自特朗普确定重回白宫后,市场其实一直在消化其高举关税大棒的预期。

2月末,特朗普宣布:原计划对加拿大和墨西哥征收的关税将在延期后下月按计划生效——给予两国额外时间解决边境安全问题后,关税将于3月4日之后正式生效。

美国正式推进对加拿大、墨西哥加征关税的政策预期落地,市场开始重新评估全球贸易环境。3月4日关税措施生效预期引发全球贸易摩擦担忧,避险情绪升温导致资金从风险资产撤离,短期资金偏向美元与现金类资产。

3月23日,美联储议息会议结束,美联储维持利率不变但上调通胀预期,释放「宽松节奏或放缓」的信号,打破市场此前对快速降息的乐观预期。多重利空叠加下,加密市场出现短期抛售潮。

三、5-10月:政策利好+重启降息助力BTC双顶新高

美国的加密监管政策和降息举动着实让加密市场迎来了「加密之夏」。受此影响,BTC价格一路高歌猛进,在8月14日达到123561美元的历史高点,10月7日再度冲至124774美元的历史高点。

7月14-18日,美国「加密周」拉开帷幕,三大加密监管法案均落地。

6月17日,美国参议院通过《指导与建立美国稳定币国家创新法案》(《GENIUS 法案》),推动了美国联邦政府对稳定币的监管努力,并向众议院施加压力,要求其规划国家对数字资产监管努力的下一阶段。7月18日,法案经特朗普签署生效。该法案的落地标志着美国首次正式确立数字稳定币的监管框架。

7月17日,众议院以 219 票对 210 票通过《反 CBDC 监控国家法案》。

6月23日,众议院金融服务委员会和农业委员会提交了《数字资产市场清晰法案》(《CLARITY 法案》),该法案将数字商品定义为:其价值与区块链的使用「内在联系」的数字资产。7月17日由众议院通过。

9月18日,美联储宣布降息25个基点,将联邦基金利率降至4%-4.25%,流动性宽松预期回归;同时,全球多个国家央行开始将少量BTC纳入外汇储备多元化配置,荷兰央行披露持有价值15亿美元的BTC资产,增强市场信心。

10月1日,美国联邦政府因资金耗尽陷入长达43天的「停摆」,投资者对经济不确定性的担忧推升避险资产需求。BTC成为大机构和散户投资者的青睐对象,因此在10月7日再度冲上历史新高。虽然此后走势乏力,但10月BTC价格基本都维持在11万美元以上。

另外,6月5日的Circle IPO、8月1日生效的香港《稳定币条例草案》、9月1日特朗普家族的WLFI交易、各大公司宣布加密储备等消息也时不时的成为推动行情上涨的催化因素。

就在行情一路走高的同时,危机也暗藏其中,BTC从10月的逾12万美元历史高点之后,开始缓慢下跌,并在年末两个月引发了是否已经身处熊市的广泛讨论。

四、11-12月:对未来经济的担忧使BTC上涨乏力

11月1日,BTC价格报109574美元,此后开启下跌模式。11月23日,BTC录得84682美元的低点,较之月初已经下跌22.71%。虽然此后大部分时间都在9万美元以上震荡,但上涨趋势乏力,引发了业内人士的各种猜测。

美国政府停摆导致关键经济数据缺失,这使市场对经济基本面和未来利率走势存在担忧,从而对风险资产的走势造成负面影响。

另外,尽管此前就已经有美联储将继续降息的预期,但在降息落地之前,美联储发出谨慎信号,市场对未来流动性预期持有分歧。12月10日,美联储进行了年内第三次降息,但市场将其解读为应对经济走弱的「衰退式降息」,反而加剧了悲观预期。投资者对全球利率路径、财政健康等宏观变量正重新评估,在不确定性中倾向更稳健的资产配置。

随着加密市场不景气状态的持续,不少DAT公司难以为继,加之市场剧烈变化导致的清算增加,又会进一步的推动市场走低。

目前,市场正在期待一波「圣诞行情」,这或许是今年「全村的希望」了。

总结

2025年的序幕在一种近乎于「确定性」的乐观情绪中拉开,特朗普的上台让行业充满期待。在经历了关税大棒、美联储宽松节奏放缓之后,市场在蛰伏后再度爆发:政策利好、重启降息、Circle 等加密企业IPO、特朗普家族项目炒作、DAT公司扎堆涌现等都成为BTC两次突破12万美元新高的助推器。但受宏观经济预期影响,BTC在年底难逃震荡筑底行情。

从全年加密市场走势来看,BTC与传统金融市场的关联性显著增强,监管框架的完善与美联储政策节奏或将继续成为影响2026年BTC价格走势的关键变量。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。