撰文:Nauris Treigys

编译:白话区块链

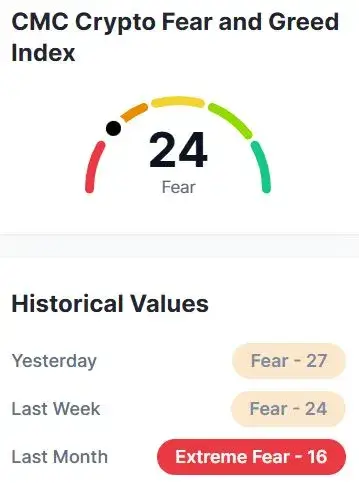

过去24小时,加密市场类似走钢丝。价格小幅走高,但信心明显增长。比特币和以太尝试缓慢攀升,但由于恐惧感悄然控制主导,交易员们的手始终紧扣在「卖出」键上。加密货币恐慌与贪婪指数(加密货币恐惧与贪婪指数)已暴跌至24,这并非是恐慌,而是一种深思熟虑的支撑。历史经验表明,这往往是重大行情的酝酿开始。

过去24小时加密市场动态

市场目前呈现出经典的**「风险偏好但保持谨慎」**模式:BTC 及主流币种尝试走高,但宏观结构和走强的美元限制了涨幅。尽管对2026年第一季度的整体情绪偏向乐观,但交易员在价格冲高时会迅速结利,导致日内波动增强。目前指数接近 24(极度恐惧),释放出强烈的恐慌信号。

比特币与以太坊的价格行为

比特币(Bitcoin):价值仍处于12月的宽幅震荡区间,AI预测的公允区在90,000美元附近。短期预期波动区间为87,500–93,000美元。技术面焦点为:在回踩83,000–85,000美元的关键支撑区后,BTC能否收复并站稳定91,000–93,000美元的阻力位。

以太坊(Ethereum):作为 BTC 的高贝塔(高波动)跟随者,其走势深受 ETF 流入和机构预期影响。短期内,ETH 表现得像 BTC 的杠杆版本,任何 BTC 的突破或破位都会在 ETH 上方产生放大效应。

美元指数 (DXY) 的表现及其影响

美元指数目前在90左右至100整数关口附近交易。虽然短期有所反弹,但美元的结构性趋势依然疲软,这通常对BTC和ETH等风险资产构成支撑。随着美联储政策预期的转变,DXY走或横盘通常会消除加密市场的一大阻力,让技术面和资金流因素在定价中发挥更大作用。

BTC 与 ETH 后市展望:下一步是什么?

锚定点:AI模型将BTC 12月的重心定在90,000美元。分析师强调,83,000–85,000美元是核心支撑带,只有放量突破91,000–93,000美元牵引区,才能重新开启向历史高点的冲击。

路径依赖:ETH的表现将高度依赖于BTC和宏观风险,但受益ETF资金流,2025-2026年的整体预期依然看好。

值得关注的高增长潜力项目

除了大市值币种外,机构名单中目前还有两个突出表现者:

Solana (SOL):凭借速度、低费率和收益的流动性,资金正将其视为「以太坊的β增强版」,结构性回调被视为长期布局的机会。

Sui (SUI):由前Meta工程师打造,在速度和可扩展性上表现出色。如果加密游戏在本轮进入周期主流,Sui已做好捕捉这一流量的充分准备。

结论

加密市场既没有冲向月球,也没有崩盘。相反,它做了最出色的事——让交易员感到焦虑。目前恐惧程度非常严重,表情同样生动,而聪明的钱显然在持续观望。如果历史重演,今天的焦虑可能是明天突破的前奏。请记住:在加密市场,行情往往在每个人都习惯了恐惧之后突然启动。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。