Coinbase的2025年第四季度报告《投资的代际转变》基于Coinbase委托Ipsos Research对4300多名美国成年人进行的研究,详细探讨了年轻投资者如何通过行为、风险承受能力和资产偏好重塑市场。

根据Coinbase研究人员的说法,年轻一代越来越认为传统的财富积累路径,如股票、房产和长期被动投资,已不足以建立财富。报告发现,73%的Z世代和千禧一代受访者认为他们这一代人通过传统方式积累财富更为困难,Coinbase研究人员表示,这种情绪有助于解释他们愿意探索替代方案的原因。

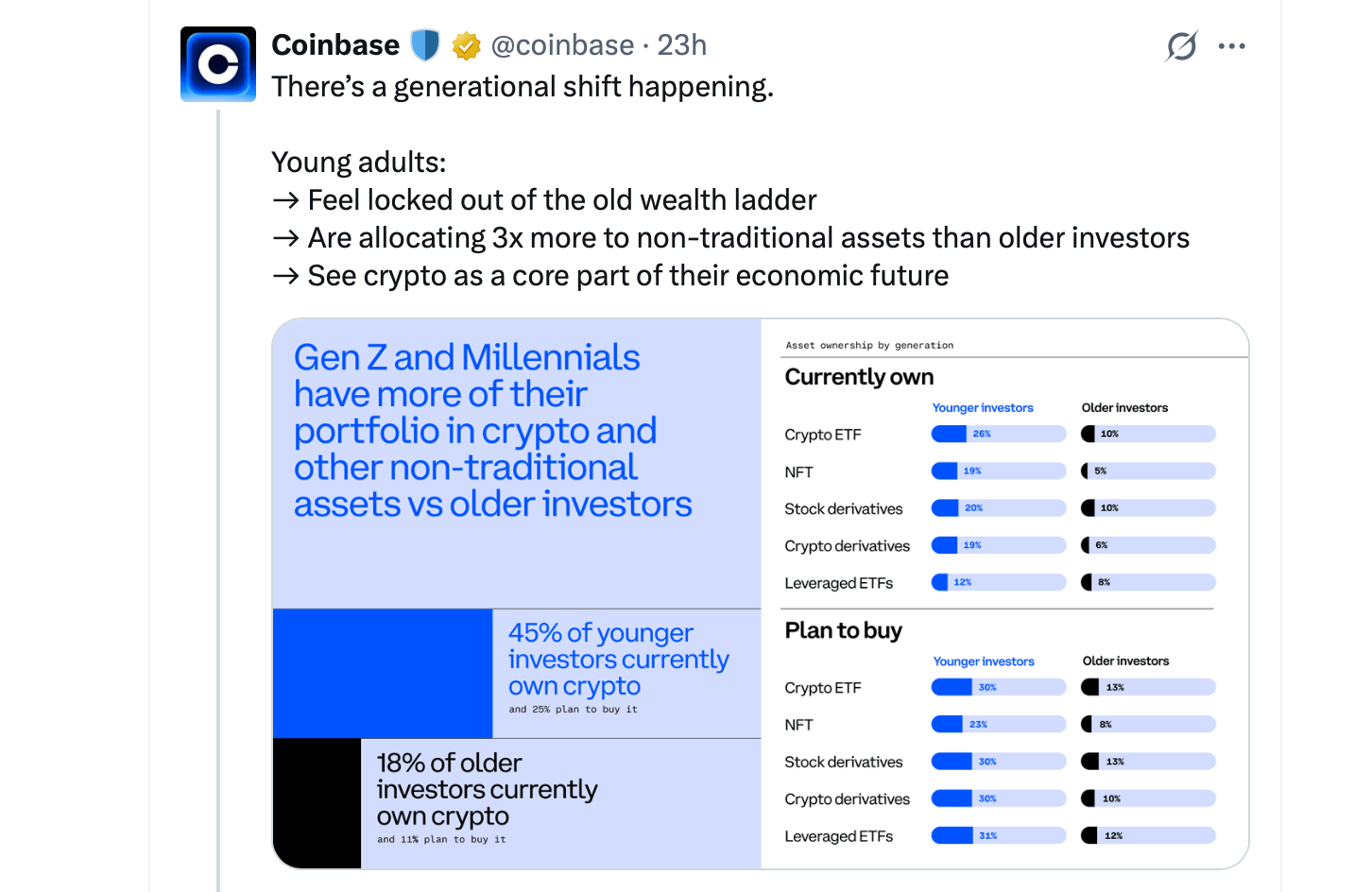

尽管股票拥有率在各年龄组之间大致相当,但Coinbase的数据表明,年轻投资者更有可能寻求超越股息的回报,这使他们更倾向于加密货币、衍生品和新兴金融工具。Coinbase的分析还强调了风险偏好的显著差异。根据报告,年轻投资者的交易频率更高,使用保证金的比例更高,且通常期望回报率超过15%。

另请阅读: 纳斯达克警告比特币国库公司KindlyMD,因其股价徘徊在1美元以下

Coinbase研究人员指出,年轻投资者每周交易的比例几乎是老年群体的三倍,反映出他们对市场采取了更为积极和战术性的方式。在建议方面,Coinbase表示年轻投资者越来越倾向于自我指导和社交信息获取。他们不再依赖传统的财务规划师,而是转向朋友、在线社区、社交平台,甚至人工智能(AI)工具来指导决策。

报告显示,年轻投资者对复制交易和社交交易表现出强烈兴趣,进一步强化了Coinbase的观点,即投资已变得参与性强而非委托性。根据Coinbase的说法,加密货币处于这一转变的中心。报告发现,年轻投资者拥有加密货币的可能性是老年投资者的两倍,近一半的人表示有兴趣在更广泛的市场之前投资新的加密资产。

Coinbase研究人员补充说,年轻投资者将大约25%的投资组合分配给非传统资产,而老一代仅为8%。展望未来,Coinbase的研究得出结论,这种代际差异不是一个短暂的阶段,而是一种结构性变化,年轻投资者预计加密货币和非传统资产在未来金融体系中的作用将远大于今天。

- Coinbase的“投资的代际转变”报告是什么?这是Coinbase委托Ipsos Research进行的2025年第四季度研究,考察年轻投资者和老年投资者的差异。

- 根据Coinbase,年轻投资者为什么偏爱非传统资产?Coinbase研究人员表示,年轻一代感到被排除在传统财富积累路径之外,寻求替代方案。

- 在报告中,加密货币对年轻投资者的重要性如何?Coinbase发现,年轻投资者拥有加密货币的可能性是老年投资者的两倍,并且将更多的投资组合分配给加密货币。

- Coinbase认为这一趋势会持续吗?是的,Coinbase得出结论,这一转变代表了未来投资者对市场的持续变化。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。