What to know : Bitcoin's early rally Wednesday seems a faint memory as the price has returned to the week's lows. Precious metals continue to get bid, with silver rushing to yet another new record and gold closing in on an all-time high. One analyst cautioned against reading too much into the current bitcoin price action due to year-end positioning and tax considerations.

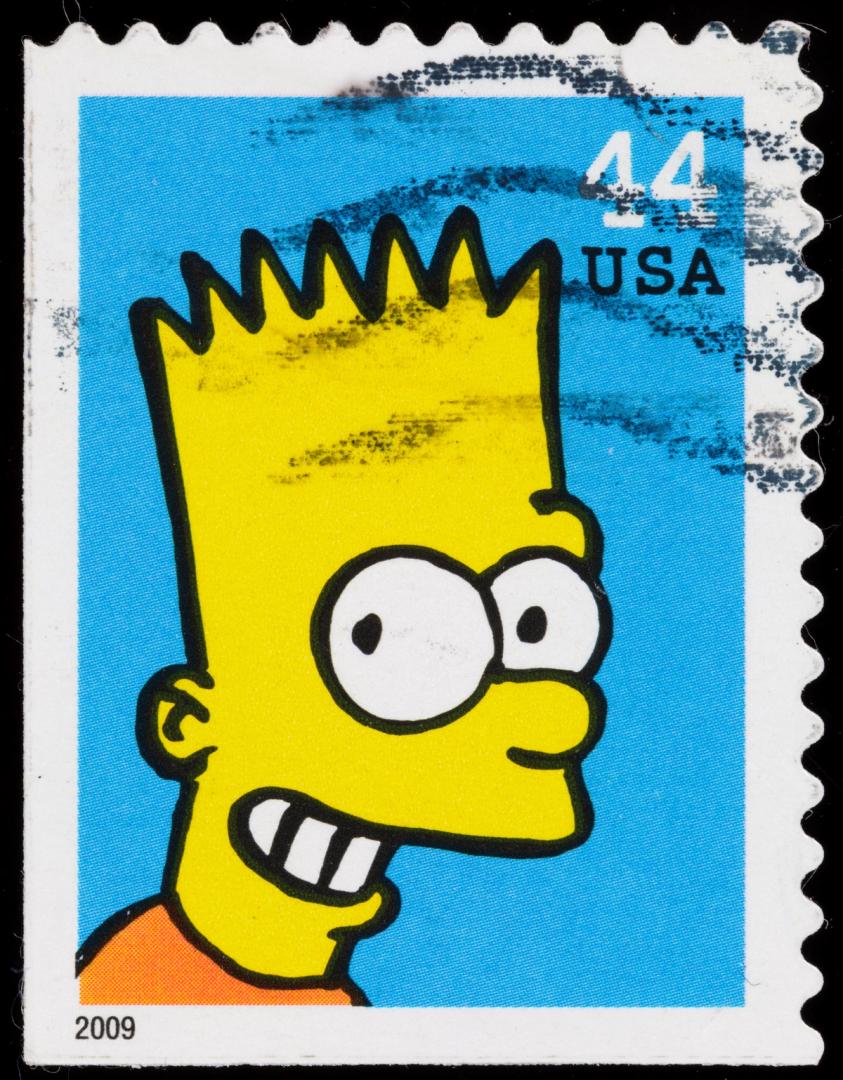

Bitcoin has returned to its week low of $85,500 after suffering the dreaded "Bart Simpson pattern" earlier on Wednesday in which the price quickly runs higher flattens out for a few minutes and then just as quickly plunges to its previous spot. The resulting shape on the charts ends up looking similar to the head of the famous cartoon character.

The crypto market again appears to be stuck the troublesome scenario of not being at all correlated with stocks when they're headed higher, but having a 1:1 correlation with stocks when things turn south.

Indeed, this morning's sharp rally crumbled alongside the Nasdaq, which began to turn lower amid further diminished enthusiasm for the artificial intelligence trade. Roughly ninety minutes before the close, the tech-heavy index is down 1.5%, led by far steeper declines for much of the chip sector.

Maybe more frustrating to crypto bulls, however, is the continued sharp upward trajectory in the precious metals — silver surging another 5% to another new record and gold up 1% and just shy an all-time high. There once was a time when bitcoiners expected BTC to be the asset of choice as the Fed eased monetary policy or as a flight to safety when stocks ran into trouble. Instead its gold, silver and even copper catching that bid.

The week's scoreboard in crypto isn't a pretty one. Bitcoin is lower by 8%, ether by 15%, solana by 12% and XRP by 12%.

Where's the floor?

Bitcoin is likely to be stuck in the range between $86,000 and $92,000, according to Jasper De Maere, desk strategist at Wintermute. He added that because the current consolidation range is experiencing high volatility, today's sudden price movements aren't that out of the ordinary as traders suffer liquidations.

De Maere cautioned against reading too much into technical indicators at the moment and expects more profit-taking over the next two weeks, driven by year-end portfolio adjustments and tax considerations. "People are winding down positions to take a breather ... short-lived rallies are being sold into quickly."

He expects bitcoin's sideways moves to continue until fresh catalysts, with one of them possibly being large options expirations in late December.

While not suggesting a bottom just yet, De Maere said the market is beginning to show those signs. "I feel like we're at max pain," he said. "In the short term, I would say we're definitely oversold."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。