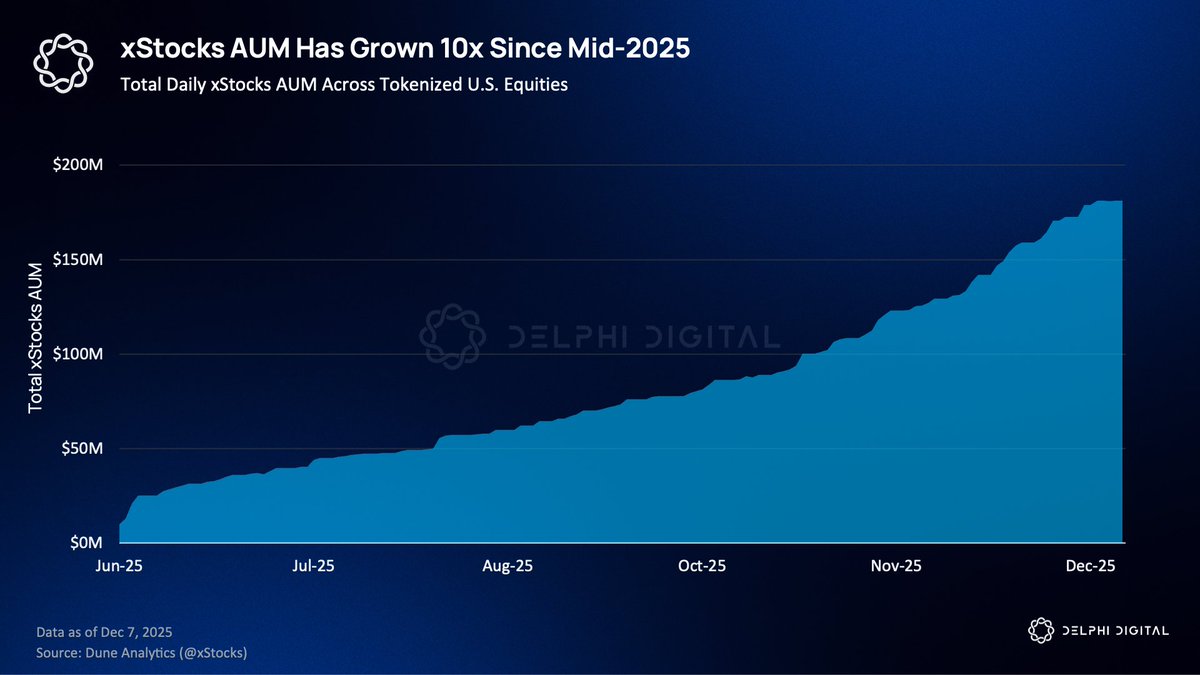

Tokenized stocks went from $15 million to over half a billion this year.

You can now swap stablecoins for stocks in the same Jupiter app you use for everything else. All you need is a wallet.

But equity perps could be the real battleground.

Hyperliquid, Ostium, Vest, and many more are all competing for what could be a massive market.

With the perps format, there are no expiries or strikes to choose and no Greeks to sort out. For most people, this is a more intuitive way to trade stocks and macro than other TradFi derivatives.

The open design question is CLOBs versus RFQ-style execution. The RFQ model resembles CFDs, which already do tens of billions in daily volume outside the U.S.

With onchain settlement and no accounts to close if you are too profitable, these products could take meaningful share from offshore CFD brokers by the end of 2026.

Then comes prediction markets. These are moving from a fringe product associated with sports betting to a serious institutional instrument.

Eventually the brokerage account could become self custodied.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。