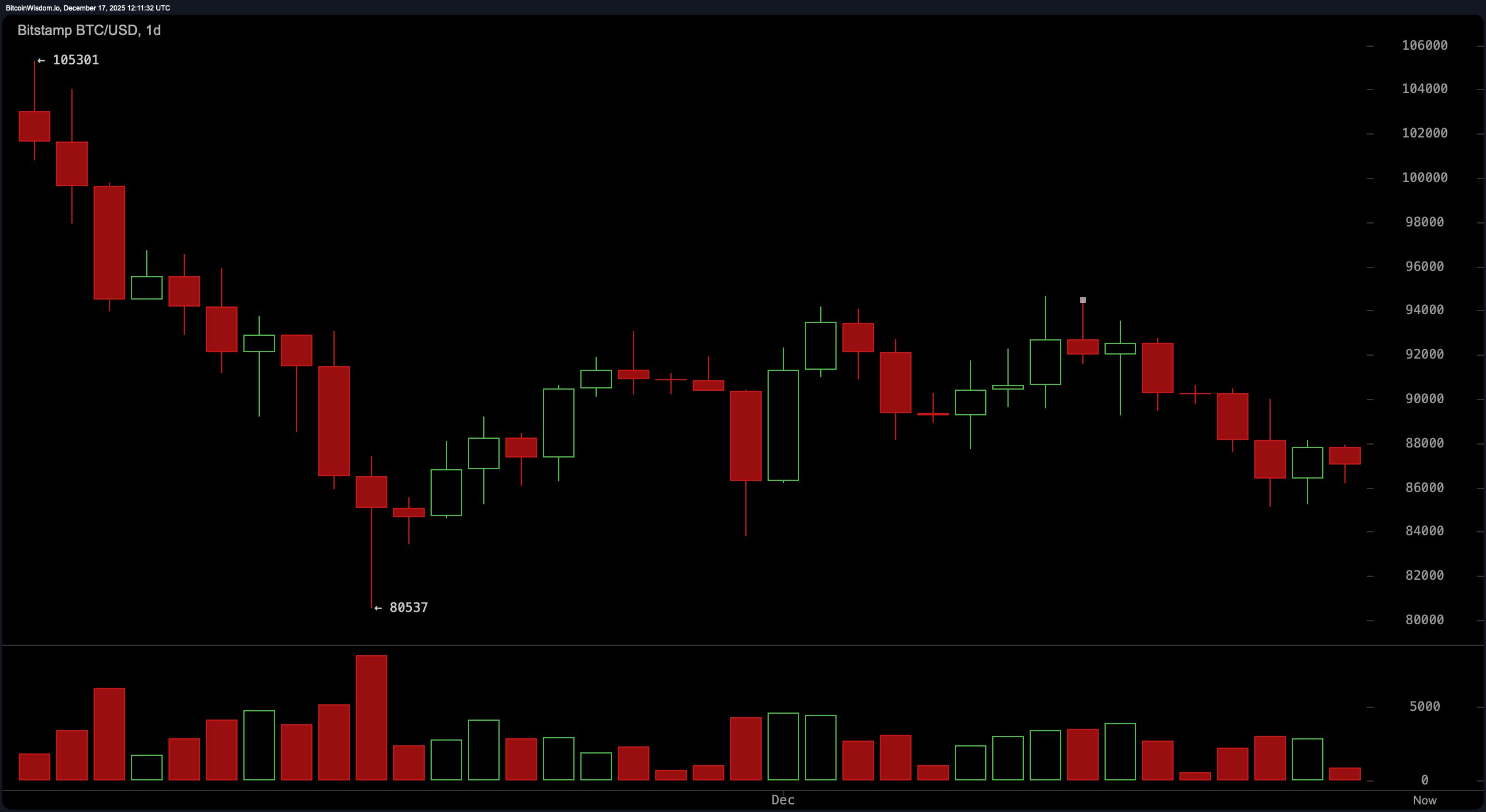

From a daily chart standpoint, the broader trend remains defined by damage control rather than celebration. Bitcoin is still retracing from the $105,301 peak down to the $80,537 low, and while the price is now hovering in the $87,000 range suggests stabilization, it stops well short of signaling renewed dominance.

Momentum has thinned, participation has cooled, and the market appears content to drift sideways while reassessing risk. The $80,500 area continues to function as the structural floor, and its relevance grows with every session that fails to reclaim higher ground.

BTC/USD 1-day chart via Bitstamp on Dec. 17, 2025.

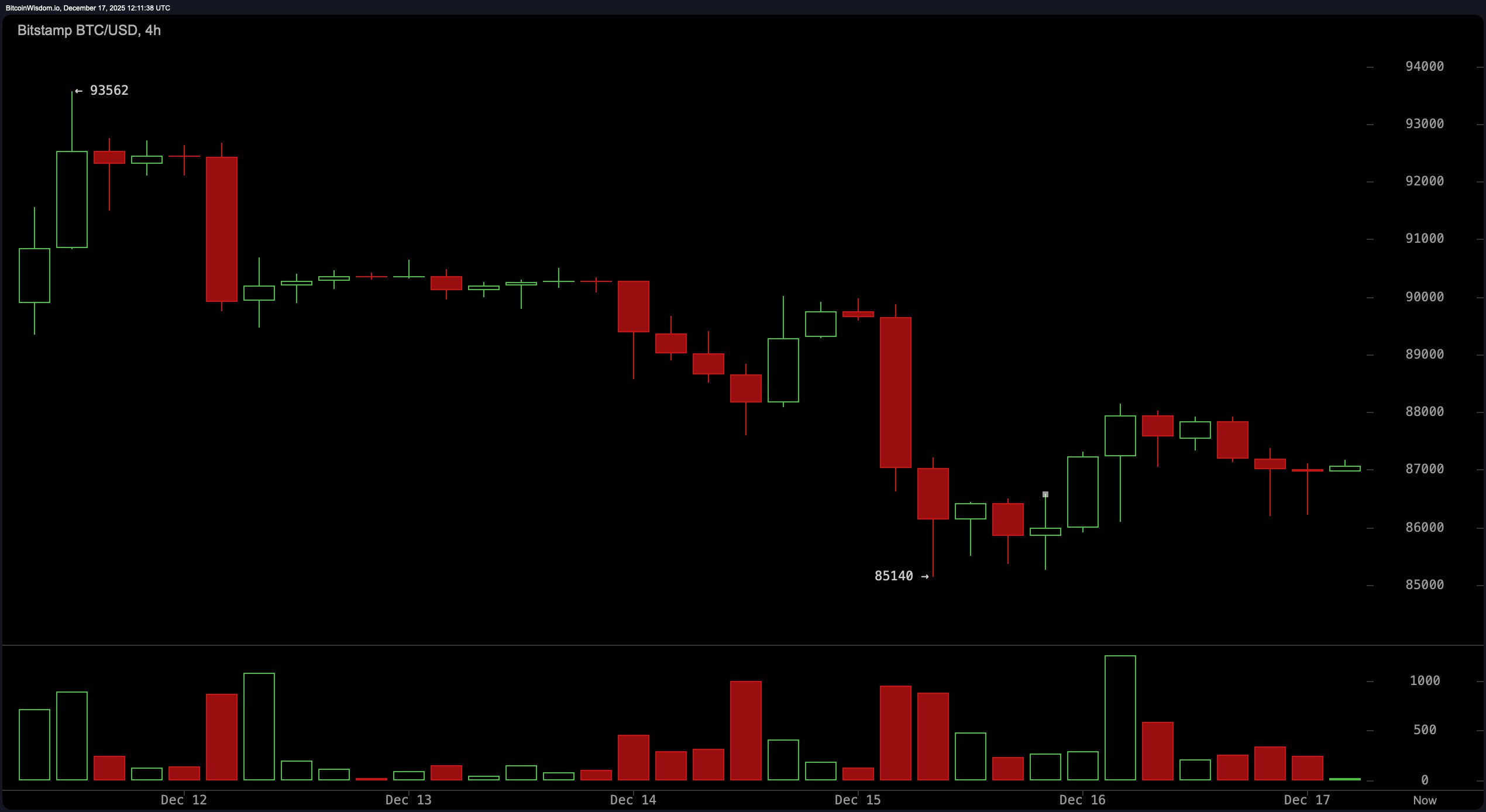

The four-hour chart strips away any lingering optimism and replaces it with range-bound realism. Price action is confined between the $85,140 low and the $93,562 ceiling, with repeated failures near the $88,000 zone reinforcing overhead pressure. Lower highs remain intact, a subtle but persistent signal that upside attempts lack conviction. This timeframe captures a market locked in indecision, where neither side has seized control, and every bounce looks more like a test of patience than a statement of intent. Sideways may not be exciting, but it is brutally honest.

BTC/USD 4-hour chart via Bitstamp on Dec. 17, 2025.

On the one-hour chart, bitcoin’s mood turns restless and irritable. A recent push toward $88,135 fizzled, sending the price back toward the $86,000 area as short-term volatility flickered without follow-through. Immediate support between $85,140 and $85,260 remains critical, while the sequence of lower highs keeps short-term pressure alive. Volume continues to fade, pointing to a lack of urgency from participants. This is not panic, nor is it confidence; it is a market pacing the room, waiting for a catalyst to break the monotony.

BTC/USD 1-hour chart via Bitstamp on Dec. 17, 2025.

Oscillators echo that uncertainty with impressive consistency. The relative strength index (RSI) at 40 and the stochastic at 21 both register neutral readings, while the average directional index (ADX) at 28 confirms that trend strength is lacking. The commodity channel index (CCI) at minus 136 hints at downside exhaustion, but momentum at minus 3,273 and the moving average convergence divergence (MACD) at minus 1,722 continue to reflect lingering weakness. The message is clear: signals are mixed, conviction is scarce, and clarity remains elusive.

Moving averages (MAs), by contrast, show no interest in nuance. Every tracked exponential moving average (EMA) and simple moving average (SMA), from the 10-period through the 200-period, sits firmly above the current price. The exponential moving average (10) at $88,970 and the simple moving average (10) at $89,800 highlight just how much ground bitcoin must reclaim to shift near-term tone. With longer-term averages stretching well into six figures, the technical landscape reads less like a launchpad and more like a ceiling, stacked neatly and unapologetically overhead.

Bull Verdict:

If bitcoin has a case to make for upside resolution, it rests on stabilization rather than strength. Price continues to respect the $85,140 to $85,260 support zone, the commodity channel index (CCI) at minus 136 suggests downside pressure may be tiring, and the daily structure shows no violation of the critical $80,537 floor. Consolidation after a sharp correction is not inherently bearish, and a sustained hold above short-term support keeps the door open for a rotation back toward the upper end of the four-hour range near $93,562. In short, the bull argument hinges on a great deal of patience, not momentum, and assumes the market is coiling rather than capitulating.

Bear Verdict:

The bear case is louder, less polite, and backed by more indicators. Bitcoin remains pinned below every major exponential moving average (EMA) and simple moving average (SMA), from the 10-period through the 200-period, reinforcing a structurally heavy market. The one-hour and four-hour charts continue to print lower highs, momentum is negative at minus 3,273, and the moving average convergence divergence (MACD) at minus 1,722 confirms downside pressure is still very much clocked in. Until price can reclaim the $88,000 zone with authority, the prevailing tone favors continuation of consolidation with a downward bias, where gravity, not optimism, does most of the talking.

- What is the current bitcoin price today?

Bitcoin is trading at $87,106, consolidating within a 24-hour range of $86,282 to $87,918 amid subdued momentum. - Why is bitcoin consolidating near $87K?

Bitcoin is stabilizing after a sharp correction from $105,301 as buyers and sellers remain locked in a low-conviction standoff. - What do technical indicators say about bitcoin right now?

Oscillators such as the relative strength index (RSI) and stochastic are neutral, while momentum and the moving average convergence divergence (MACD) remain negative. - What are the key support and resistance levels for bitcoin?

Immediate support sits near $85,140 to $85,260, while resistance remains stacked near $88,135 and higher at $93,562.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。