卖压依然牢牢控制着市场,随着加密货币交易所交易基金(ETF)进一步走低,市场情绪谨慎。开盘时,投资者继续从比特币和以太坊的投资中撤资,同时对一些特定的山寨币基金保持较小的、有针对性的配置。

比特币ETF的总流出额达到了2.7709亿美元,损失遍及大部分基金。黑石的IBIT以2.1068亿美元的流出额领先,紧随其后的是Bitwise的BITB,流出额为5093万美元,而Vaneck的HODL则减少了1796万美元。Ark & 21Shares的ARKB流出1687万美元,Grayscale的比特币迷你信托又增加了737万美元。

富达的FBTC成为唯一的亮点,吸引了2672万美元的资金,尽管这不足以抵消整体的疲软。交易量达到了42.6亿美元,总净资产保持在1142.8亿美元。

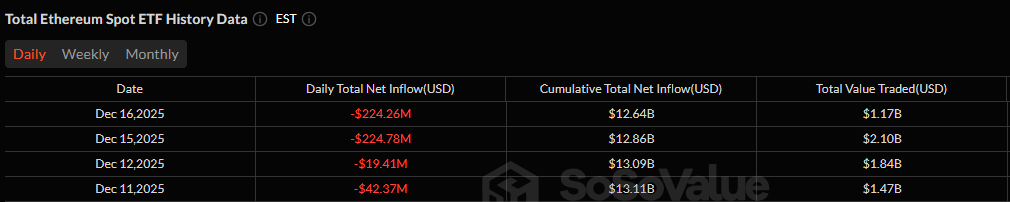

以太坊ETF连续四天流出

以太坊ETF几乎与比特币的下跌同步。该组的净流出额为2.2426亿美元,主要是由于黑石的ETHA流出了2.2131亿美元。富达的FETH则以294万美元的流出额占据了剩余的压力。总交易价值为11.7亿美元,而净资产略微下降至181.7亿美元。

尽管整体市场回调,索拉纳ETF仍然悄然吸引资金。该类别的净流入额为364万美元,主要由Grayscale的GSOL增加了188万美元和Bitwise的BSOL增加了135万美元。Vaneck的VSOL又贡献了41.5万美元。交易量总计为3953万美元,净资产保持在926.33万美元。

阅读更多:比特币、以太坊ETF重现大规模流出,索拉纳和XRP保持上涨

XRP ETF当天也以盈利收盘,吸引了854万美元的资金。Bitwise的XRP以626万美元的流入额领先,其次是Franklin的XRPZ,流入209万美元,以及21Shares的TOXR小幅增加了18.8万美元。净资产在1675万美元的交易量下攀升至11.6亿美元。

总体而言,本次交易会强化了一个熟悉的模式。比特币和以太坊ETF仍然面临持续的赎回压力,而索拉纳和XRP则继续在数字资产ETF市场中充当相对安全的避风港,表明投资者正在进行轮换而非完全退出。

常见问题📉

- 为什么比特币ETF今天会出现大规模流出?

投资者减少了风险敞口,大规模赎回以IBIT为首主导了本次交易。 - 在抛售期间,是什么导致以太坊ETF的损失?

黑石的ETHA的一次大规模赎回几乎占据了所有以太坊ETF的流出。 - 为什么索拉纳ETF仍然吸引资金流入?

尽管市场整体谨慎,选择性投资者仍然继续转向索拉纳基金。 - 是什么解释了XRP ETF的持续流入?

稳定的需求反映了投资组合的多样化,而不是完全退出加密货币ETF。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。