The global cryptocurrency market is entering a new phase defined by macro trends, regulatory evolution, and technological breakthroughs. Grayscale's analysis of the top ten investment themes for 2026 reveals the core drivers and structural opportunities that may dominate the market direction in the coming year.

1. Fiat Currency Risks Catalyze Demand for Value Storage

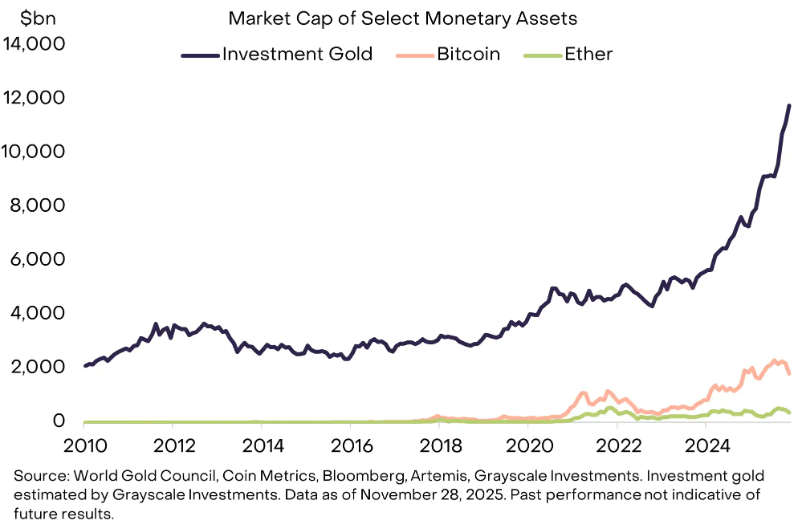

The long-term debt and inflation pressures faced by major fiat currencies like the US dollar continue to undermine their value storage function. This creates a historic opportunity for crypto assets that possess ultimate scarcity, decentralization, and widespread recognition.

● Core Assets: Bitcoin (BTC) and Ethereum (ETH) are the primary representatives under this theme. Bitcoin's fixed supply of 21 million coins and its predictable issuance mechanism provide a digital gold attribute against currency devaluation. Ethereum, with its vast ecosystem and robust network, is also seen as an important value storage container.

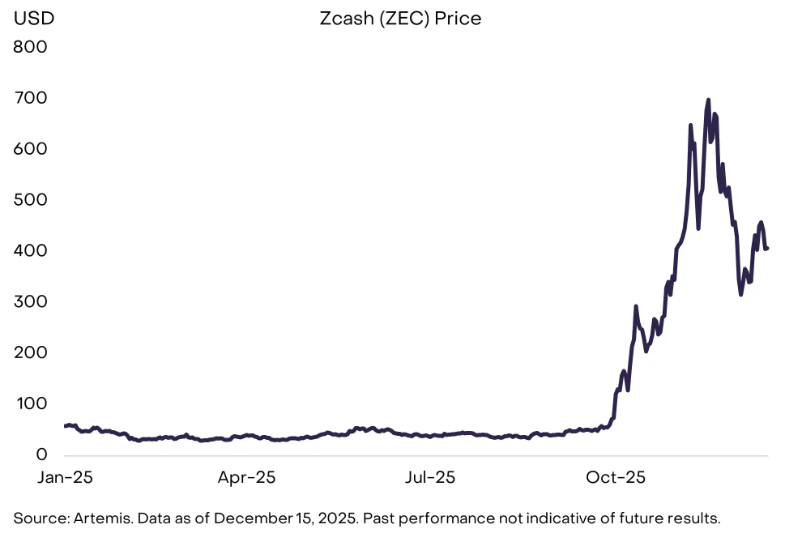

● Privacy Supplement: Digital assets with enhanced privacy features, such as Zcash (ZEC), offer alternatives for value storage needs seeking higher anonymity.

2. Regulatory Clarity Lays the Foundation for Widespread Adoption

The United States is clearing some obstacles for the integration of crypto assets into the mainstream financial system through key legislation and policy adjustments in 2025. In 2026, the final implementation of market structure legislation will become a decisive step for industry development.

● Core Progress: A bipartisan-supported crypto market structure bill is expected to pass, establishing asset classification, disclosure requirements, and conduct norms, aligning with traditional financial regulatory frameworks.

● Far-reaching Impact: Clear regulatory rules will encourage more regulated institutions to incorporate digital assets into their balance sheets, promote on-chain capital formation, and overall enhance the legitimacy and valuation of the asset class. Significant setbacks in the legislative process could pose key downside risks.

3. Stablecoins Become a New Pillar of the Financial System

The stablecoin market, which has surpassed $300 billion, is accelerating its expansion beyond the crypto-native realm following the provision of a regulatory framework by the GENIUS Act.

● Application Explosion: In 2026, stablecoins will be more deeply embedded in cross-border payments, corporate treasury management, derivatives collateral, and online consumption scenarios, with trading volume and application scope continuing to expand.

● Beneficiary Ecosystem: Public chains that support major stablecoin transactions (such as ETH, SOL, BNB, TRX) and their related infrastructure (such as the oracle LINK) will directly benefit. Stablecoins are the key fuel driving the growth of decentralized finance (DeFi) activities.

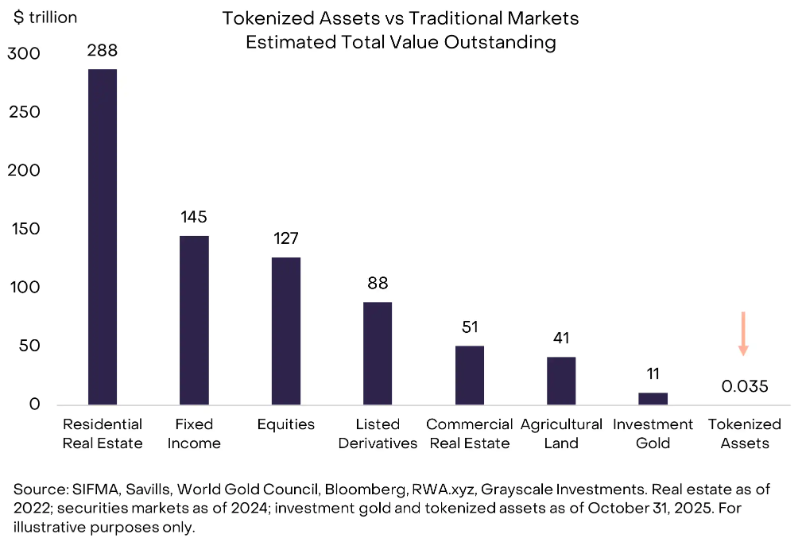

4. Asset Tokenization Reaches a Scale Inflection Point

Currently, the tokenization ratio of the global equity and debt markets is minimal, but the growth potential is enormous. Improved regulatory clarity and technological maturity will jointly drive tokenized assets into a rapid growth phase.

● Huge Space: It is expected that by 2030, the scale of tokenized assets could see a thousandfold increase. This will create significant value for underlying blockchain and supporting services.

● Infrastructure First: Ethereum, Solana, and BNB Chain are the current main battlegrounds. Middleware like Chainlink (LINK), which provides critical data and verification services, is seen as the core infrastructure supporting the tokenization wave.

5. Mainstream Applications Drive Demand for Privacy Solutions

As the integration of blockchain and traditional finance deepens, the contradiction between the transparency of public chains and the privacy required for financial activities is becoming increasingly prominent. Privacy protection has become a necessity.

● Privacy Assets: Digital currencies focused on transaction privacy, such as Zcash (ZEC), are gaining attention. Projects like Aztec and Railgun provide privacy solutions at the smart contract level.

● Protocol Layer Upgrades: Mainstream public chains may widely integrate "confidential transactions" features (such as the Ethereum ERC-7984 standard). The growing demand for privacy will also drive the development of compliant identity verification tools.

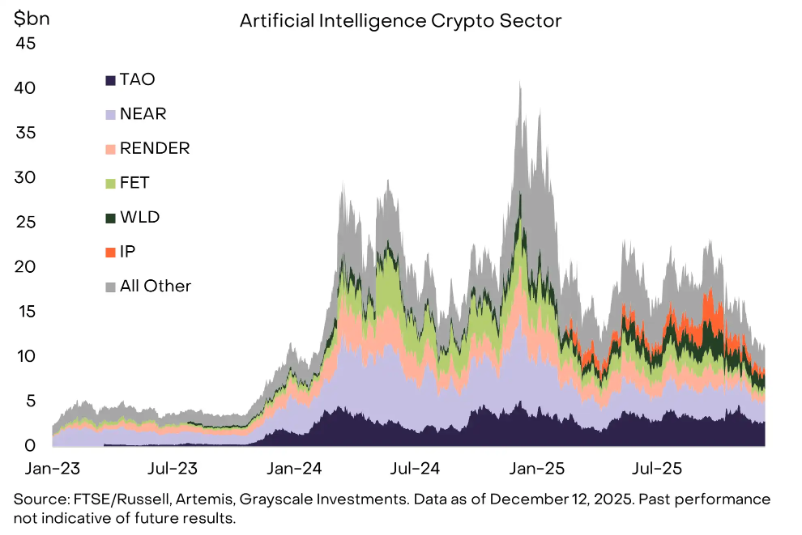

6. Countering AI Centralization, Blockchain Provides Solutions

The increasing centralization of artificial intelligence raises concerns about trust and ownership, while cryptographic technology offers decentralized, verifiable solutions. The integration of both fields is full of imagination.

● Core Use Cases: Decentralized AI computing platforms (such as Bittensor/TAO), verifiable human identity proofs (such as Worldcoin/WLD), and on-chain intellectual property management (such as Story Protocol/IP) are building the infrastructure for the "agent economy."

● Payment Layer Innovations: Open layers like X402, which provide zero-fee stablecoin payments, offer possibilities for micro-payments between AI-driven human-machine or machine-machine interactions.

7. DeFi Development Accelerates, Lending and Derivatives Lead the Way

With favorable conditions from both technology and regulation, decentralized finance is moving from the experimental stage to practical application, with lending and derivatives sectors performing prominently.

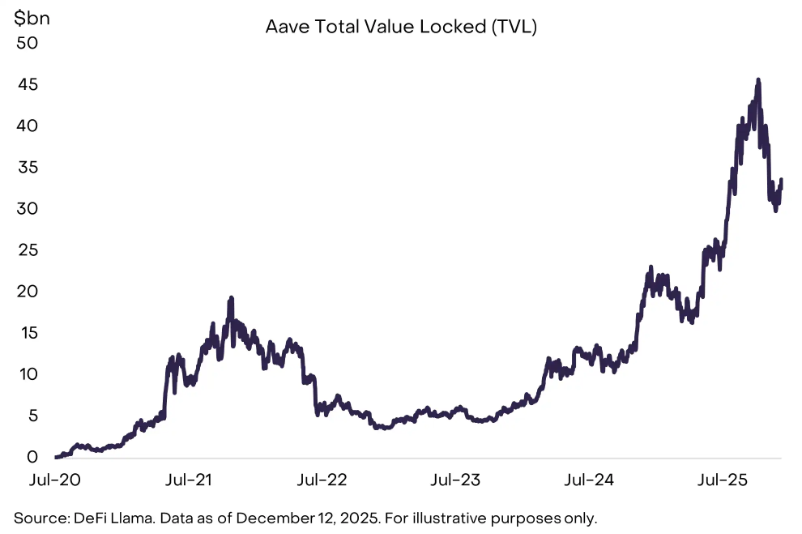

● Lending Expansion: Protocols like Aave, Morpho, and Maple are leading substantial growth in the on-chain credit market.

● Derivatives Competition: Decentralized perpetual contract exchanges like Hyperliquid are already comparable in trading volume to some centralized exchanges.

● Overall Beneficiaries: Core DeFi protocols (AAVE, UNI, HYPE), underlying public chains (ETH, SOL), and infrastructure (LINK) will continue to benefit from this trend.

8. Next-Generation Infrastructure Supports Future Applications

Although the existing public chain capacity is not yet saturated, next-generation high-performance blockchains are actively being developed to address future scenarios such as AI micro-payments and high-frequency trading.

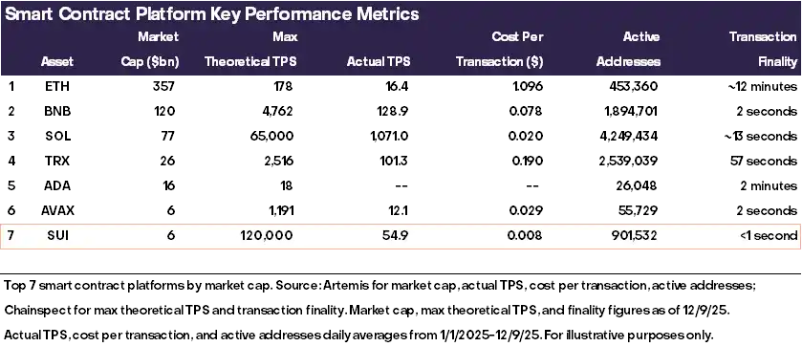

● Performance Breakthroughs: Projects like Sui, Monad, MegaETH, and Near are pursuing faster transaction speeds and lower costs through innovations in parallel processing and extreme optimization.

● Application-Driven: Exceptional technology alone is not enough for success; the ability to attract explosive applications (as Solana once experienced) will be a key test. These networks have architectural advantages in specific emerging scenarios.

9. Fundamental Investment Focuses on Sustainable Income

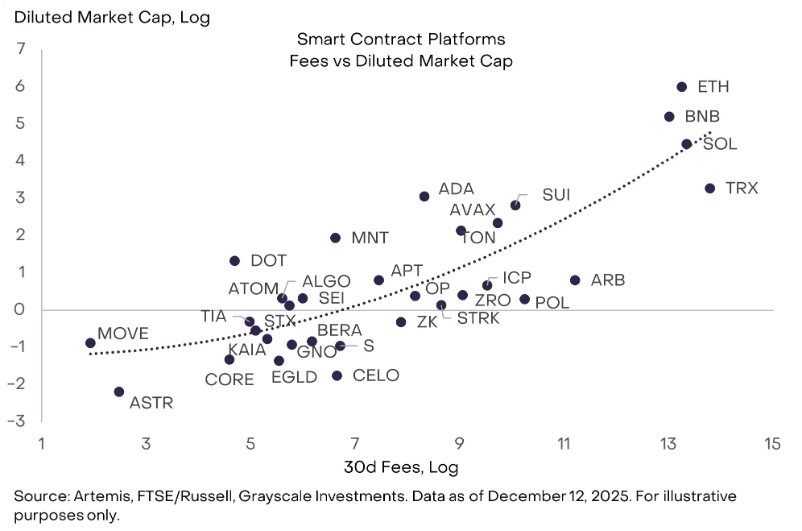

Increased allocations by institutional investors will prompt the market to pay more attention to the "fundamentals" of blockchains and protocols, with sustainable fee income becoming a core metric.

● Income is King: Transaction fees are comparable to traditional company revenues, difficult to manipulate, and can be compared horizontally. Assets with high or clearly growing income levels are more favored.

● Current Leaders: Among public chains, TRX, SOL, ETH, and BNB lead in fee income. At the application layer, some decentralized exchanges (such as HYPE) have already demonstrated strong revenue capabilities.

10. Staking Becomes the Default Yield Strategy

The clear recognition of staking (especially liquid staking) by US regulators and the policy allowing ETPs to participate in staking are changing the holding patterns of proof-of-stake (PoS) assets.

● Trend Formation: For PoS tokens, "staking is default" is becoming the standard investment strategy, likely boosting overall staking rates.

● Dual Track Coexistence: Custodial staking through ETPs is convenient for ordinary investors; on-chain liquid staking through platforms like Lido (LDO) and Jito (JTO) retains composability advantages within the DeFi ecosystem. Both will coexist in the long term.

Beware of "Interference Factors": Quantum Computing and Digital Asset Trusts (DATs)

The market's hot discussions about the threats of quantum computing and the evolution of DATs are not expected to become core factors driving prices in 2026.

● Quantum Computing: Although a shift to post-quantum cryptography is needed in the long term, experts generally believe that the likelihood of quantum computers capable of breaking encryption emerging before 2030 is very low. 2026 will still be a research and preparation phase.

● Digital Asset Trusts (DATs): These tools holding large amounts of crypto assets have seen their market premiums significantly converge, with behavior patterns resembling closed-end funds. They are neither a major source of new demand nor likely to become a source of large-scale selling pressure.

In 2026, the crypto market will progress under the resonance of macro risk aversion and regulatory clarity. The deep involvement of institutional capital will strengthen the connection between blockchain finance and traditional finance.

Assets that meet compliance requirements, have clear use cases, and sustainable income models will gain more favor. The industry is entering a new phase where entry barriers are raised, and asset performance will show significant differentiation, with not all projects able to smoothly transition into this new wave driven by institutionalization and substantial applications.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。