本文不作为投资建议。请读者严格遵守当地法律法规。

CoinShares发布了年度数字资产展望报告,以下是「Conclusion:新兴趋势与新前沿」部分值得关注的几个核心观点:

1.加密VC融资强势复苏:2025年加密VC融资额已超越去年,证实了加密投资是宏观流动性的“高贝塔”表现。在预期宽松的宏观环境下,资金流入将持续,支撑2026年的增长。

2.VC投资聚焦“大单”与效用:投资风格正从分散转向“大单集中化”,资本向少数头部项目倾斜,且更加注重项目的实际效用和现金流,而非空泛的概念炒作或迷因币。

3.2026四大投资赛道:展望明年,VC重点关注RWA(稳定币为核心)、AI与加密结合的消费应用、面向散户的链上投资平台,以及提升比特币实用性的基础设施。

4.预测市场升格为信息工具:以Polymarket为代表的预测市场已跨越小众阶段,成为主流信息基础设施。其交易活跃度在大选后仍保持高位,且其市场赔率被证实具有高准确性。

5.预测市场的机构化:预测市场正加速机构化,纽交所母公司ICE的战略投资是关键信号。这表明传统金融机构认可其价值,预测市场有望在竞争和整合中继续扩大影响力,创造新的交易记录。

6.矿企向HPC(高性能计算)转型提速:比特币矿企正经历业务模式的根本转变,转向更高利润的HPC/AI数据中心。预计到2026年底,转型公司的挖矿收入占比将降至20%以下,动力在于HPC利润率是挖矿的约3倍。

7.短期算力增长滞后:尽管战略转向HPC,但由于2024年的大额订单在2025年集中交付,全网算力仍处于强劲增长期。这是短期现象,以Bitdeer和IREN等公司为主要增长点。

8.未来挖矿模式分化:传统工业级挖矿将被取代,未来挖矿将分化为四种模式:ASIC厂商自挖、模块化(临时)挖矿、间歇式(电网平衡)挖矿,以及主权国家挖矿。长期看,算力将由主权国家和ASIC厂商主导。

加密VC融资:资金流向何处?

Jérémy Le Bescont—— 首席内容经理

总体而言,2025年标志着加密资产重新回到VC投资逻辑之中,结束了此前近两年几乎停滞甚至可以说低迷的时期。

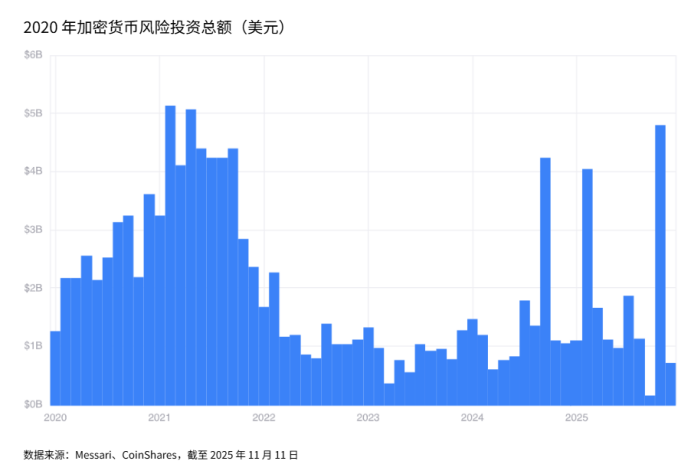

2023年,加密领域融资总额为115.3亿美元,较前一年的349亿美元大幅下降;2024年,数字资产行业虽有回暖,但融资规模仍仅为165.4亿美元。截至2025年11月11日,全年融资总额已达188亿美元,超过了2024年。

“这是过去三年来交易数量最多的一年。”Ledger Cathay的VC投资人Marguerite de Tavernost向我们表示。

这一增长也印证了整体交易环境的回暖——截至2025年第三季度,全球交易总额已达2502亿美元,超过了2022至2024年的水平。

向超大规模交易集中

今年最显著的特征,是资金向超大单笔交易集中。预测市场Polymarket与ICE达成了20亿美元的战略投资交易,其后是Stripe对Layer-1项目Tempo的5亿美元投资,以及对预测市场Kalshi的3亿美元投资。

这些标志性融资轮次体现了资本在单一项目中的高度集中。类似趋势也出现在其他领域,尤其是AI。

“过去我们通常以较小金额入场,然后在后续轮次中逐步加仓,”Marguerite de Tavernost继续说道——该1亿欧元规模的基金已投资于Flowdesk、Ether.fi、Crypto和Midas等项目。“现在,我们正在更早阶段就投入更大的资金。”

主要的资本提供方依然是熟悉的名字:Coinbase Ventures、Pantera和Paradigm在与稳定币、预测市场、网络层以及DeFi应用相关的战略轮中尤为活跃。

相比之下,迷因币(不包括表现突出的Pump.fun)和NFT在今年几乎消失,显示出市场对这些主题的疲劳,以及行业整体的成熟。

另一个值得注意的趋势是隐私赛道:Canton Network完成了1.35亿美元的E轮融资,随后是Mesh(9200万美元)和Zama(5700万美元B轮),成为该投资逻辑中最引人注目的案例。

如果美国政府继续推行有利于加密创新的政策,这一主题有望延续,尤其是在Zcash(最早的隐私币之一)拥有了由Winklevoss兄弟控股的上市金库公司之后。

宏观背景:流动性的联系

在讨论2026年之前,理解塑造2025年复苏的宏观背景至关重要。加密VC融资与全球流动性环境的变化高度相关,而这种变化主要由各国央行推动。

虽然并非始终呈现一一对应关系,但我们的数据持续显示,加密VC是宏观流动性周期中“高贝塔(High Beta)”的体现。

在紧缩阶段,尤其是2022至2023年,更高的政策利率、上升的实际收益率以及量化紧缩,显著压制了市场风险偏好。依赖长期资本、且通常缺乏短期现金流的风险投资首当其冲。

加密VC活动从2021–2022年单月超过50亿美元的高点,下降到2023年全年的远低于10亿美元。

随着2023年末金融环境开始缓和,风险情绪逐步改善。美联储暂停加息、通胀回落,市场开始计入降息预期。这些变化推动了全球流动性的逐步回升,并与2024–2025年加密VC融资的复苏相互呼应。

尽管流动性仍是最核心的驱动因素,但比特币价格走势、监管进展,以及RWA、基于闪电网络的基础设施、稳定币结算层等新主题,也会影响短期动态。然而,整体规律非常清晰:

当流动性扩张时,加密VC融资加速;当流动性收紧时,融资便会回落。这凸显了加密VC作为全球货币环境最纯粹体现之一的特性。

因此,2026年流动性大概率不会成为瓶颈,支持2025年复苏的有利宏观条件似乎仍将延续。

此外,与传统基金不同,加密基金通常能够更早向LP提供DPI,这得益于代币的高流动性与快速变现能力。如果美联储继续保持宽松立场、全球流动性环境依然友好,2026年有望在2025年的基础上迎来更加亮眼的募资表现。

“总体而言,在特朗普政府推动亲加密政策的背景下,美国市场情绪非常积极,”Ledger Cathay的投资人确认道。

即便在流动性再次收紧的情景下,投资策略也未必会受到影响。Coinbase Ventures高级经理Jonathan King补充道:“我们在所有市场周期中都有投资。当市场情绪更乐观时,项目数量会明显增加;但我们一些最好的投资,反而是在市场放缓、变得安静的时候完成的。根据周期不同,融资轮次可能需要更长时间才能敲定,但总体而言,我们的大门始终是敞开的。”

2026年值得关注的四大趋势

在明确了上述宏观背景之后,有四个领域在2026年尤其值得持续观察:AI与加密结合、RWA(真实世界资产)、比特币基础设施,以及面向散户的投资平台。

RWA(真实世界资产)

首先,代币化赛道在明年无疑将继续扩张。Republic对Centrifuge的投资、稳定币初创公司Agora的A轮融资(由Paradigm和Dragonfly领投,规模5000万美元),以及尤为引人注目的Securitize SPAC上市相关公告,都引发了市场关注,也印证了资金雄厚的投资者(包括摩根大通、Clearstream、瑞银、法国兴业银行等银行机构)对数字化真实世界资产的强烈兴趣。

在这一垂直领域中,稳定币再次成为最具主导地位的板块:

“如果你看稳定币,其市值同比增长了50%。预测认为,未来几年它将成为一个2万亿美元规模的资产。

我们已经在基础设施层面做了大量工作,从B2B跨境支付、本地化稳定币(例如印度的p2p.me),到像Sphere这样的稳定币网络(编者注:用于跨境支付的出入金通道)。

“这进一步延伸到链上信贷和新的融资形式。稳定币将继续成为Coinbase Ventures以及Coinbase整体战略中的旗舰重点。”Jonathan King解释。

值得注意的是,这一领域可能会加剧不同司法辖区之间的竞争。MiCAR使欧洲在代币化落地方面具备先发优势,相关规则已在整个欧洲经济区(EEA)内正式生效;而美国的GENIUS法案 虽然近期已经通过,但仍处在具体实施阶段。

与加密相连接的AI

过去两年里,连接加密与AI的公链和应用不断涌现,涵盖了资源消耗的计价与变现、支付自动化、用户身份验证,以及AI智能体的自主运行等方向。根据VC的判断,这一趋势正在明显加速。

“此前我们主要关注加密与AI的底层基础设施。明年,我们希望看到更多构建在加密轨道之上的消费级AI应用。例如,融合自然语言交易与操作的新型DeFi界面,以及逐渐具备资产管理能力、类似财富管理顾问的智能体。”Jonathan King解释道。

Marguerite de Tavernost也补充道:“这是一个我们原本没有计划重点投资的领域,但最终我们确实做了两笔与AI和区块链相关的投资。”

面向散户的投资平台

一个可能在明年对VC活动产生冲击的因素,是原生加密消费者投资应用的崛起,最具代表性的就是Echo和Legion。

由知名加密人士Jordan“Cobie”Fish创立的Echo,在2025年10月被Coinbase以3.75亿美元收购,引发广泛关注。该平台的核心在于去中心化天使投资:通过白名单策展人机制,向用户开放股权融资和ICO,本质上是一个“原生在链上的VC基金”。

在较为突出的案例中,Layer-2项目MegaEth和Plasma去年分别募集了1000万美元和5000万美元。

其竞争者Legion则与加密交易所Kraken合作,推出了面向公众发行的新平台。与此同时,MetaDAO(由6MV、Paradigm和Variant投资)在Solana上推出了一个带有链上治理机制的融资平台,可防止违约问题,迄今已完成8次超额认购的ICO。

在经历了数年的流动性枯竭之后,这类平台自然受到欢迎,成为新的融资渠道,并开始直接与早期VC展开竞争。

比特币基础设施

最后,VC对比特币相关领域的兴趣正在升温。这在某种程度上颇具讽刺意味,因为比特币作为最重要的数字资产,长期以来反而被忽视。

由于无法“凭空”发行代币,比特币生态除了挖矿行业之外,历来并不是LP的首选方向,尽管挖矿仍在持续吸引大量资金(例如Auradine在2025年4月完成的1.53亿美元C轮融资)。

随着比特币Layer-2项目的早期融资取得成功,包括Arch Labs(由Pantera领投的1300万美元)、BoB(Build on Bitcoin,Coinbase Ventures与Ledger Cathay的共同投资项目),以及BitcoinOS(2025年10月完成1000万美元融资),市场关注点似乎正在转向更具实体意义、直接提升比特币实用性的投资逻辑,而非在其之上发行新代币。

这一点与Lightspark的案例颇为相似:

“两年前,市场对比特币L2的关注度非常高。现在,我们看到的是对扩展比特币效用,尤其是其安全属性的重新关注,并以此在其之上构建新的市场。”Jonathan King指出。

从高投机走向高实用的投资逻辑转变

过去几个月的变化以及对明年的展望都表明,资金正在越来越多地寻找能够影响现有金融基础设施、并为新体系提供“基础构件”的项目,而逐渐远离那些只有概念、缺乏落地价值的代币与公链。

以太坊Layer-2已不再是市场追逐的焦点,通用型Layer-1同样降温,“Web3”“NFT” 等词汇被提及的频率也在持续下降。

当然,每一轮周期都会伴随一些微型泡沫,这一轮中最终能存活下来的稳定币公司数量仍有待观察。但整体而言,一个以现金流和/或真实效用为核心优先级的时代,显然更值得期待。

Polymarket的崛起

Luke Nolan—— 高级研究助理

尽管预测市场的概念诞生已近五年,但真正获得使用和流行,其实主要发生在过去两年,而2024年的美国大选成为最强有力的催化剂。

以Polymarket为代表的平台,已经从加密领域中的小众产品,成长为主流的实时情绪乃至“事实”来源,吸引了大量并不关心加密本身、只希望获得比新闻媒体或社交平台更干净信号的用户。

大约18个月前,我们曾撰文讨论Polymarket。当时我们判断它可能会停留在爱好者产品层面,使用量稳定但有限。事实证明,这一判断过于保守。此后,Polymarket的流动性和文化影响力都达到了几乎无人预料的高度。

在2024年美国大选周期中,与总统和国会选举相关的市场,单周成交量经常超过8亿美元,且持续稳定,往往超过传统投注平台,甚至在公众关注度上超过了一些民调聚合平台。

美国大选后的持续活跃

在部分观察者看来,大选结束后,随着公众注意力转移,预测市场的活跃度可能会迅速下滑。但事实并非如此。

成交量依然强劲,未平仓头寸也维持在远高于大选前的水平,这表明预测市场可能已经跨过了某个“临界点”,不再只是一次性的爆发,而是进入了长期存在的阶段。

比活跃度更重要的问题,是准确性。预测市场的本质在于将分散的信息汇聚为单一概率,而金融激励机制迫使参与者尽可能接近真实结果。文中图表展示了Polymarket的赔率在不同时间点与实际结果的对比。

解读并不复杂。例如,被定价在60%区间的事件,最终约有60%的概率以“是”收场;被定价在80%区间的事件,根据截止时间前剩余小时数的不同,大约有77%–82%的概率最终实现。

换言之,Polymarket的表现就像一个校准良好的预测系统,当市场给出80%的发生概率时,它通常真的会发生。这正是一个“犯错就要付出金钱代价”的系统所应有的表现。

预测市场开始被机构采纳

这种准确性与流动性并未被忽视。2025年10月,纽约证券交易所母公司 洲际交易所(ICE) 对Polymarket进行了战略投资(最高可达20亿美元),这相当于全球金融体系中最传统、最核心的机构之一,对预测市场投下了信任票。

与此同时,Polymarket在美国的合规竞争对手Kalshi,也通过与券商平台、媒体伙伴和数据提供商的整合,不断扩大影响力,形成了一种推动整个赛道前进的竞争格局。

这些整合揭示了一个非常重要的事实——预测市场并不只是给投机者赚点零花钱的交易场所,它们正在融入更广义的信息基础设施之中。许多从不下单交易的人,依然会查看Polymarket,因为它给出的概率比新闻标题更“干净”。

而对交易者来说,吸引力同样明显。这里没有庄家优势,平台只对盈利交易收取少量费用,这意味着在统计意义上,长期盈利是可能的。而在传统博彩公司中,赔率设计本身就确保了平台必然获利。

所有这些因素指向一个简单的结论——预测市场很可能会持续增长,因为它同时解决了多个群体的需求:

交易者获得了高效市场,旁观者获得了“真实信号”,机构获得了几乎免费的社会学或经济研究数据(以概率形式呈现),而平台本身也因规模扩大而变得更强大,流动性越深,预测就越精准。

过去两年的轨迹表明,Polymarket正逐渐成为人们理解世界的一种方式。随着builder code的推出,我们预计2026年Polymarket的单周成交量有望创下新高,甚至在某一周突破20亿美元。

HPC之后的挖矿:下一步是什么?

Alexandre Schmidt—— 指数基金经理

长期以来,比特币矿企一直是通过上市股票获取区块链和加密资产敞口的核心渠道之一。在经历了一段投资与扩张、并达到工业化挖矿规模的阶段后,这一市场再次发生转向。

2024年,多家矿企宣布计划转型进入AI与HPC(高性能计算)领域;而到2025年,大多数矿企已经在全面推进其HPC数据中心的建设。

本文试图回答两个问题:为什么会出现这次转型?以及在不再新建大规模工业级挖矿设施的背景下,挖矿行业接下来将走向何方?

2025:全行业的扩张

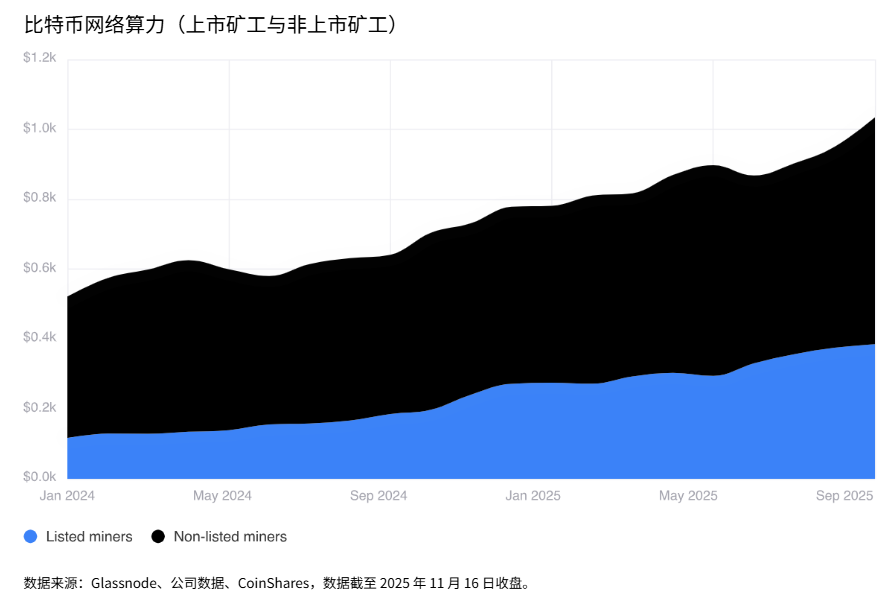

2025年,比特币矿企展现出强劲的增长势头。截至9月的九个月内,上市矿企的总算力增长约为110 EH/s,而2024年同期仅约70 EH/s。

尽管这些数据似乎与矿企“将挖矿降级、转而建设HPC设施”的表述相矛盾,但原因在于,这些公司实际上是在2024年向ASIC制造商下了多笔大额订单,而相关设备在2025年陆续交付。

今年算力增长的一半来自三家公司:Bitdeer(+26.3 EH/s)、HIVE Digital(+16 EH/s)以及Iris Energy(IREN)(+15 EH/s)。

HPC转型开始落地

除了可观的算力增长,向HPC转型终于在今年体现为实际合同和收入。

对比特币矿企而言,建设并改造设施以承载HPC负载极具吸引力:不仅能实现业务多元化,获得更稳定、可预测且每兆瓦(MW)利润率高出约3倍的收入来源,还能让矿企参与到超大规模云服务商(hyperscalers)和半导体公司宣布的数十亿美元级交易中。

截至2025年10月底,矿企已宣布与hyperscalers和新型云服务商(neoclouds)签署总额约650亿美元的合同。

这些公告显著推动了相关公司的股价上涨。上述合同将从根本上改变这些公司的业务结构:一方面缓解比特币全网算力持续增长带来的压力,另一方面显著提升企业的利润率水平(多数公司预计这些合同可带来80%–90%的运营利润率)。

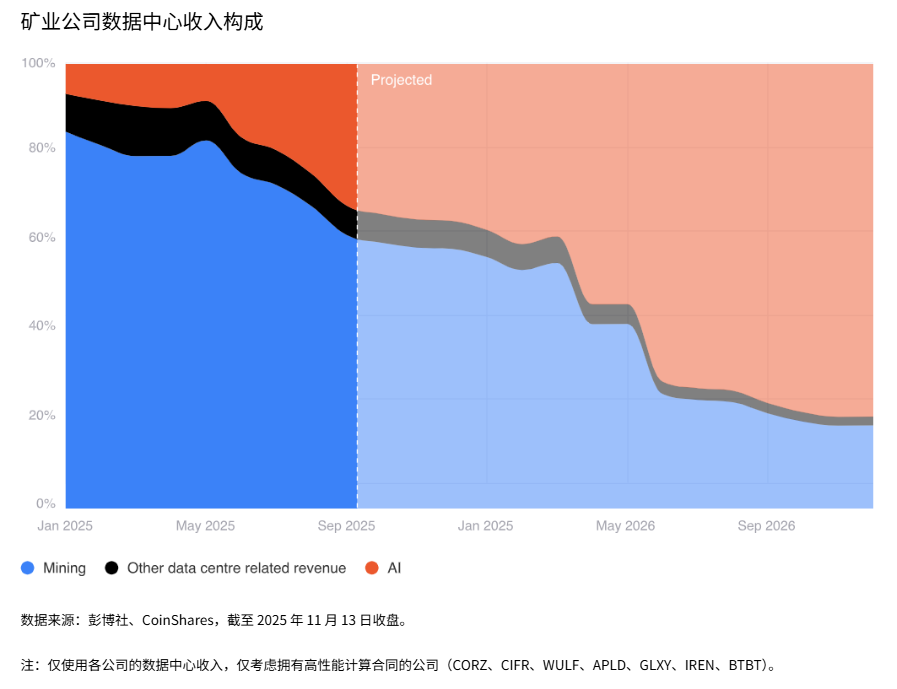

因此,在目前已宣布HPC合同的六家公司中,我们预计,比特币挖矿收入在总收入中的占比将从2025年初的约85%,下降到明年年底的20%以下。

展望2026年

首先需要明确一点——矿企仍然是矿企。

多数已经转向HPC的公司,目前其绝大部分收入和现金流仍然来自比特币挖矿业务。

在可预见的阶段内,HPC更多是对现有业务的增量补充,而非直接替代比特币挖矿产能,尽管随着新合同的签署以及电力容量需求的增加,我们确实预计这些公司会逐步、缓慢地退出部分挖矿业务。

到2026年,仍可能有少数矿企继续增加挖矿算力。根据与管理层的交流,CleanSpark表示其挖矿业务仍具备再增加约10 EH/s的选择权;而Canaan最近宣布了一笔5万台矿机的交易,这表明其他矿企也可能在显著扩张其挖矿规模。

从更长周期来看,比特币挖矿的形态很可能会与当前的运营模式大不相同,可能包括以下几种形式:

ASIC制造商:ASIC厂商最有可能继续维持接近或达到工业级规模的挖矿。为了保留在晶圆代工厂(尤其是台积电TSMC)的产能配额,厂商必须下达最低订单量。如果这些矿机未能售出,很可能会被部署在ASIC厂商自有的矿场中。

此外,ASIC厂商还可以为自用目的进行专门设计和生产,成本显著更低,从而支撑更大规模的挖矿运营。

模块化挖矿:一些公司正在提出一种模式,将临时、可移动的挖矿模块引入正在为其他用途开发的场地。一旦电力基础设施到位,这些模块即可接入并开始挖矿,并持续运行,直到电力外壳建设完成、场地正式对外出租。

间歇式挖矿:这是可以与HPC并存的一种替代模式:挖矿设施与HPC并行建设,但只在电价接近零时运行,从而帮助平衡电网负载。在这种情况下,矿企更可能使用已经完全折旧的老旧设备,因为其负载率通常会非常低。

主权主体(国家):我们认为,主权国家已经占据了大量非公开挖矿算力。国家参与挖矿的动机多种多样,包括获取外汇、将电力资源变现、以及直接接入比特币网络等。鉴于主权国家在资金实力和资源获取方面的优势,我们认为,在可预见的未来,国家层面的挖矿仍将维持工业级规模。

上述哪种模式最终占据主导,将取决于比特币网络自身的激励机制,以及各类参与者对挖矿经济性的敏感度。

我们的判断是,在中期内,主权国家与ASIC制造商将主导算力分布;而在更长期的视角下,挖矿可能会重新回归到规模更小、更分散的形态,依托廉价的“搁浅电力”,且很可能主要来自可再生能源。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。