在比特币市场持续震荡、多数投资者选择观望之际,一家公司却在短短两周内豪掷近20亿美元,增持超过2.1万枚比特币,这个大胆举动背后是一个在生存与扩张之间走钢丝的故事。

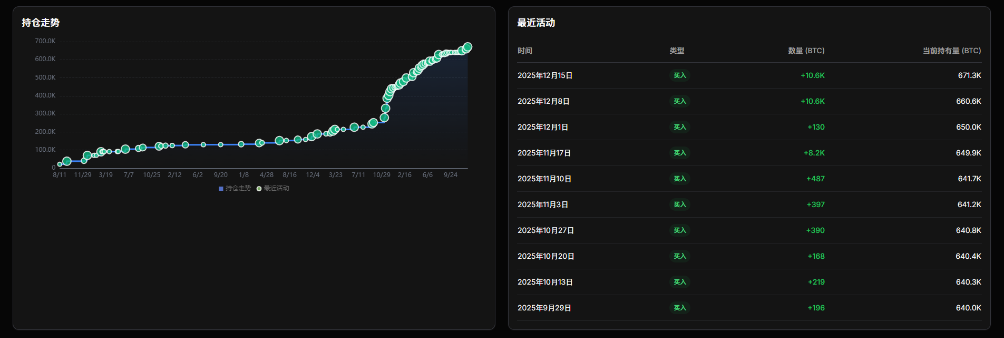

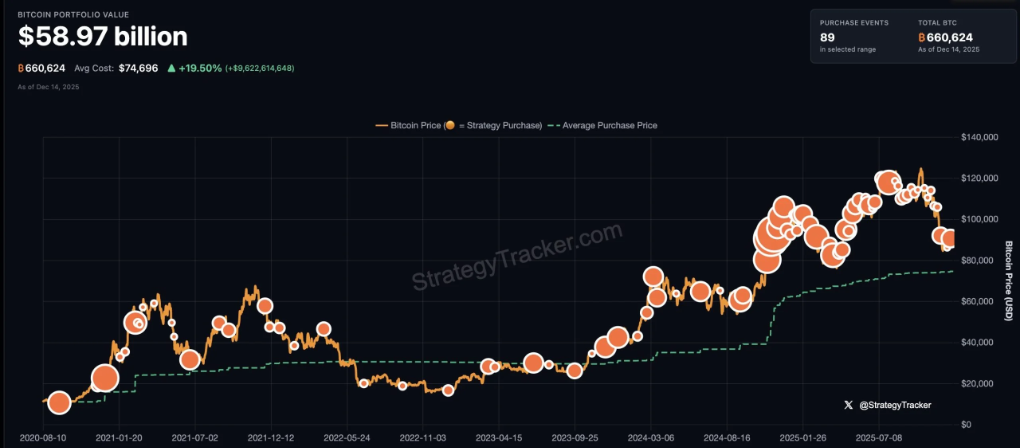

Strategy在12月8日至14日的一周内,以约 9.803亿美元 的价格收购了10,645枚比特币,平均每枚价格为92,098美元。就在前一周(12月1日至7日),该公司已花费约 9.627亿美元 购买了10,624枚比特币。

一、逆势增持:市场震荡中的激进之举

● 当多数市场参与者还在犹豫观望时,Strategy已开启了它的“疯狂购买模式”。这家全球最大的企业比特币持有者在12月的前两周内,总计增持了 21,269枚比特币,投入资金近20亿美元。

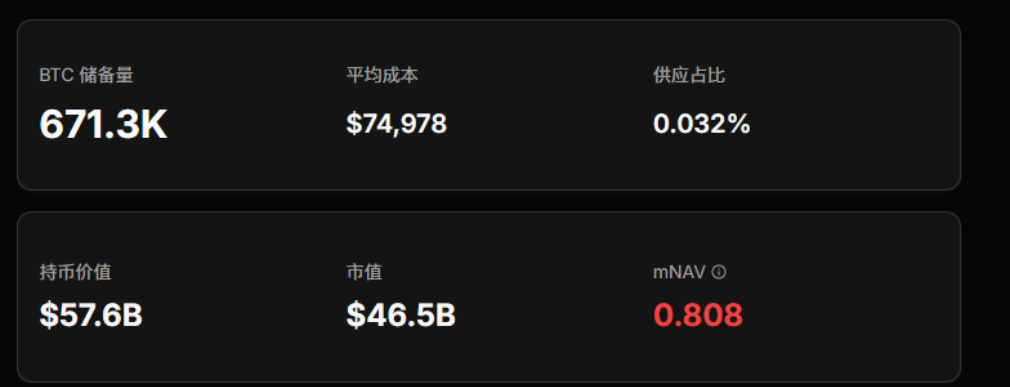

● 这一增持规模创下了自2025年7月以来的新高,甚至略微超过了前一周的购买量。Strategy的比特币总持有量已经达到671,268枚,占比特币总供应量的超过 3%。

● 截至12月15日,这些比特币的总成本约为 503.3亿美元,平均每枚成本约为74,972美元。按当前价格计算,这意味着约 97亿美元 的账面收益。

● 比特币仍处于结构性脆弱的区间内,上边界为短期持有者成本基础(10.27万美元),下边界为真实市场均值(8.13万美元)。

二、资金策略:股票发售支撑的购买力

● Strategy此次大规模购买比特币的资金主要来源于其股票发售计划。在截至12月14日的一周内,Strategy出售了 4,789,664股 MSTR普通股,筹集了约 8.882亿美元。

● 此外,公司还通过出售优先股筹集了额外资金。根据该公司的“42/42”计划,其目标是到2027年通过股权发行和可转换票据筹集 840亿美元 用于比特币收购。这一数字已从最初的“21/21”计划(420亿美元)上调,原因是股权方面已经耗尽。

● Strategy的融资计划显示,截至12月15日,仍有价值 125.6亿美元 的MSTR股票可用于根据该计划发行和销售。公司的优先股计划也仍有大量额度可用:STRK为203.4亿美元,STRD为40.1亿美元。

三、现金储备:防御姿态下的战略缓冲

● 在激进增持比特币的同时,Strategy在12月初采取了另一项关键财务举措——建立了 14.4亿美元 的现金储备。这一储备专门用于支付优先股股息和债务利息,旨在将股东回报与比特币价格波动“解绑”。

● 公司表示,这一现金储备足以覆盖至少 12个月 的股息支付义务,并计划在未来将其扩充至24个月或更长时间。

● 从公司整体估值来看,这笔14.4亿美元现金储备约占Strategy企业价值的 2.2%,占其股本的 2.8%,也约为其比特币资产价值的 2.4%。

四、MSCI挑战:指数准入的生存之战

● 当Strategy忙于增持比特币时,一项潜在威胁正在逼近。全球指数提供商MSCI正在考虑制定一项新规,可能将数字资产占其总资产 50% 以上的公司排除在其主要指数之外。

● 对于比特币占其资产绝大多数的Strategy而言,这一提案构成了直接威胁。如果实施,可能导致被动型基金被迫出售价值高达 28亿美元 的Strategy股票。

● Strategy已向MSCI股票指数委员会提交了一封长达 12页 的反对信函。公司在信中辩称,如果将数字资产持有量超过50%的公司排除在外,将导致这些公司因为比特币价格变动或会计准则不同而“反复进出”主要指数。

MSCI预计将在 1月15日 之前做出最终决定,早于其2月份的指数重新调整。

五、市场反应:股价疲软与行业低迷

● 尽管Strategy在增持比特币方面表现激进,但其股价却呈现疲软态势。截至12月13日,Strategy的普通股上周整体下跌 3.8%,年初至今已下跌 41.2%。

● 这与比特币自身的表现形成对比,比特币在2025年迄今的损失仅为3.8%。截至12月15日,Strategy的市值与净资产价值比率(mNAV)约为 0.808,这意味着其股票交易价格低于其比特币持有量的价值。

● Strategy并非唯一面临挑战的比特币财库公司。根据比特币财库数据,目前有 192家 上市公司采用了某种形式的比特币收购模式。包括Strategy在内,许多这类公司的股价已从夏季高点大幅下跌,其市值与净资产价值比率也大幅收缩。

六、市场背景:比特币的困境与机遇

● Strategy的增持行动发生在比特币市场面临多重挑战的时期。链上分析显示,市场未能重新夺回关键阈值,特别是短期持有者成本基础,反映了近期高位买入者和资深持有者持续的卖出压力。

● 已实现损失也在上升,30日简单移动平均线实体调整后已实现损失达到每天 5.55亿美元,为FTX崩溃以来的最高水平。

● 美国比特币ETF经历了平静的一周,三天平均净流入量持续为负。这延续了自11月下旬开始的降温趋势,标志着与今年早些时候支撑价格上涨的强劲流入机制明显不同

七、财务调整:降低预期的现实考量

● 面对市场变化,Strategy也不得不调整其财务预期。该公司最初制定2025年业绩指引时,比特币价格预计在年底达到 150,000美元。由于比特币近期价格下跌,Strategy大幅下调了财务预期。该公司现在假设比特币在2025年底的价格将在 85,000美元至110,000美元 之间。

● 基于这一新的价格区间,Strategy更新了几个关键目标:比特币收益率目标从之前的30%降至 22%至26%;比特币兑美元涨幅目标从之前预期的20亿美元降至 8.4亿美元至12.8亿美元。

● 营业收入方面,公司预计亏损约7.0亿美元至盈利约9.5亿美元。这种大幅波动反映了新的会计准则要求Strategy每个季度按市值计价其比特币持有量。

八、行业展望:比特币财库模式的未来

● Strategy的激进增持行动和财务策略调整反映了比特币财库公司在当前市场环境中的两难处境。一方面,它们希望通过持续购买来增加比特币储备;另一方面,它们又必须应对比特币价格波动带来的财务挑战。

● 这种情况只会发生在公司股价跌破净资产值,导致Strategy失去进入新资本市场的渠道时。冯乐称此举纯粹是出于“数学”考量,旨在保护股东利益。

● 比特币财库模式正面临市场重新定价。许多数字资产财库公司股价已从夏季高点大幅下跌,市值与净资产价值比率大幅收缩。随着更多美国公司建立加密资产财库,如何界定这些公司的性质将成为指数提供商和监管机构面临的重要问题。

Strategy的比特币储备已膨胀至 67万枚,如同一座由数字代码堆砌的金山,在纳斯达克的交易屏幕上静静闪烁。

当比特币价格在90,000美元附近徘徊时,这家全球最大的比特币上市公司在短短两周内完成了近 20亿美元 的押注。

市场分析师看着Glassnode的链上数据摇头,ETF资金持续流出,期货市场兴趣缺缺,而Strategy的股票却像被遗忘的角落,市值与净资产价值比率缩水至0.85。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。