In the market window where Bitcoin's price has retraced nearly 30% from its historical high, the world's largest publicly traded Bitcoin treasury company, Strategy, announced a nearly $1 billion investment to buy the dip. However, Metaplanet, dubbed the "Asian version of MicroStrategy," unexpectedly pressed the pause button on its accumulation.

Since completing its last purchase at the end of September 2025, this Japanese listed company has not increased its Bitcoin holdings for several consecutive weeks. This move sharply contrasts with the company's previous aggressive accumulation of Bitcoin.

The company, which transformed from a struggling hotel business, currently holds over 30,000 Bitcoins, with a total value of approximately $2.75 billion. The decision to pause accumulation is not merely a strategic shift but a result of Metaplanet weighing risks among stock price pressure, accounting standards, and financing structure.

1. Industry Background: Strategic Differentiation in the DAT Sector

● As the crypto market enters a correction window, the actions of Bitcoin treasury companies (DAT) show significant differentiation. Industry giant Strategy continues to increase its holdings, recently announcing an investment of $962.7 million to acquire 10,624 Bitcoins.

In contrast, several DAT companies, including Metaplanet, have noticeably slowed their pace.

● The entire DAT industry is undergoing severe tests. Data shows that the total market capitalization of digital asset treasuries shrank dramatically from $150 billion in the fourth quarter to $73.5 billion, with most companies' market value to net asset ratio falling below 1.

● The median stock price of DAT companies listed in the U.S. and Canada has dropped 43% this year, with some companies experiencing declines of over 99%. Analysts warn that Bitcoin treasury companies are entering a "Darwinian phase," where the core mechanisms of once-thriving business models are undergoing stress tests.

2. Financial Dilemma: Stock Price Pressure and Accounting Risks

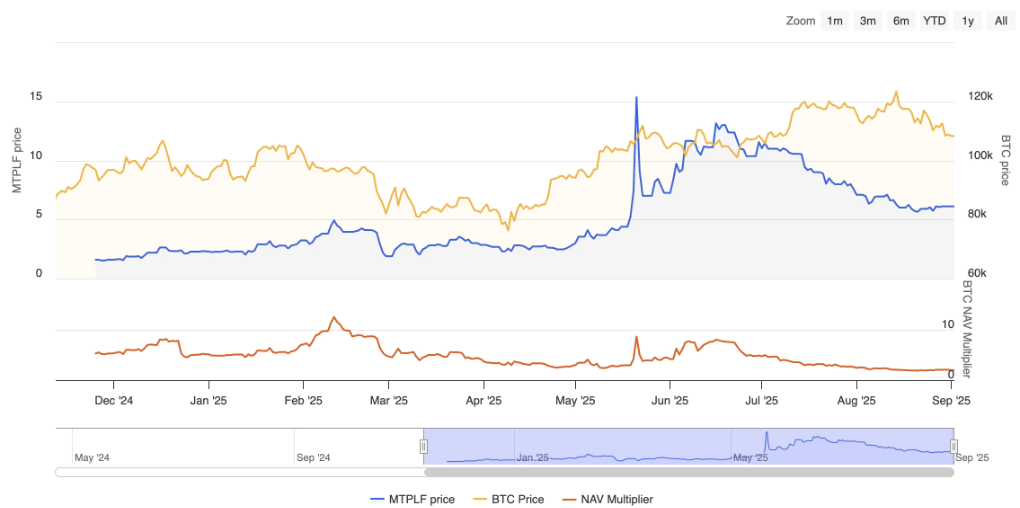

● Metaplanet's pause in accumulation primarily stems from changes in its own financial metrics. The company's market value to its Bitcoin net asset value ratio once fell to 0.99, indicating a "break-even" situation.

● Previously, influenced by its Bitcoin holding strategy, Metaplanet's stock price soared from $20 in April 2024 to a peak of $1,930 in June 2025. Although the stock price has significantly retraced over 70% since the second half of the year, it still recorded an overall increase of over 20% this year.

● In response to the continued decline in stock price, Metaplanet's CEO Simon Gerovich publicly addressed the stock price fluctuations in early October, emphasizing that fundamentals and stock prices often diverge and reaffirming that the company will continue to accumulate Bitcoin.

● He stated in September that if the net asset value falls below the market value, continuing to issue new shares would "mathematically destroy value," which would be detrimental to the company's Bitcoin yield. This statement hinted at a potential adjustment in the company's strategy. The halt in purchases is also to avoid risks posed by Japan's conservative accounting standards. According to data, Metaplanet's average Bitcoin cost is approximately $108,000.

● Due to the retracement in Bitcoin prices, the company has accumulated over $500 million in unrealized losses on its books. To prevent excessive short-term impacts on the profit and loss statement, the company has chosen to proactively avoid exacerbating this book impairment risk.

3. Strategic Upgrade: From Equity Financing to Innovative Debt Instruments

On the surface, the pause in accumulation appears to be a defensive posture, but in reality, Metaplanet is actively upgrading its capital structure, attempting to build a more sustainable financing "moat."

● The company's third-quarter financial report shows sales of 2.401 billion yen, a quarter-on-quarter increase of 94%; operating profit of 1.339 billion yen, up 64%. Among these, the options business contributed $16.28 million in revenue, a year-on-year increase of 115%, which can cover daily operations and interest costs.

● Based on this, Metaplanet is attempting to emulate Strategy by planning to issue preferred shares similar to STRC to acquire capital more efficiently. The company plans to launch two new digital credit instruments, "Mercury" and "Mars," with "Mercury" offering a 4.9% yen yield, about ten times the yield on Japanese bank deposits. This financing strategy is highly attractive to yield-seeking Japanese investors.

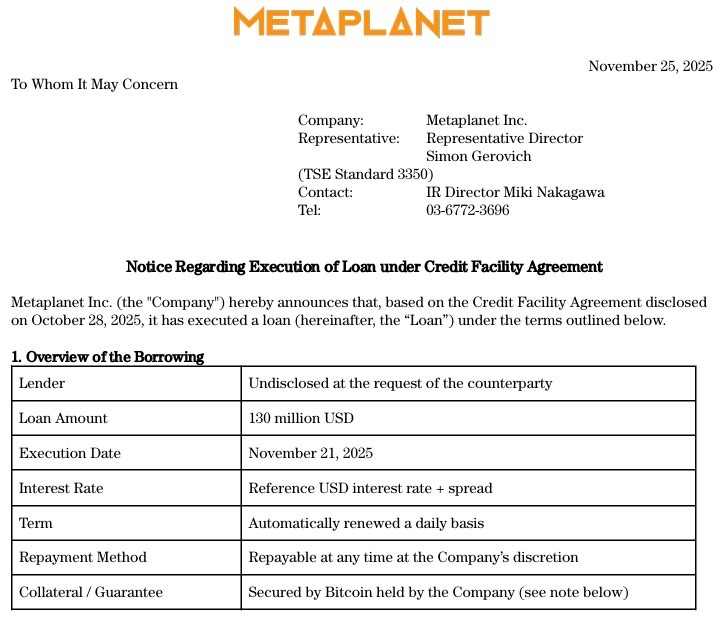

● Meanwhile, Metaplanet continues to advance its debt financing strategy. The company has raised an additional $130 million to purchase more Bitcoin, which is part of the company's $500 million credit line.

Table: Comparison of Metaplanet and Strategy Strategies

Strategy Dimension

Metaplanet

Strategy

Current Accumulation Status

Paused accumulation (since the end of September)

Continued accumulation (increased 10,624 BTC last week)

Main Financing Tools

Preferred shares, Bitcoin collateral loans

Convertible bonds, stock issuance

Market Positioning

Building a moat using Japan's low-interest environment

Global leader in Bitcoin treasury

Accounting Treatment

Facing constraints of Japan's conservative accounting standards

Relatively flexible U.S. accounting standards

4. Local Advantages: Unique Opportunities Provided by the Japanese Ecosystem

Despite facing challenges, Metaplanet still enjoys unique advantages provided by the Japanese market environment.

● The continued depreciation of the yen has strengthened Bitcoin's role as an inflation hedge, and Metaplanet's Bitcoin reserves provide a viable way for Japanese domestic investors to combat the decline in the yen's purchasing power.

● On the other hand, the tax-exempt advantage of Japanese personal savings accounts has attracted 63,000 domestic shareholders to Metaplanet. Compared to the 55% capital gains tax on directly holding crypto assets, purchasing Metaplanet stock through this account allows investors to gain Bitcoin exposure at a lower cost.

● As a result, Metaplanet has gained recognition from international institutions, with Capital Group increasing its stake to 11.45%, becoming Metaplanet's largest shareholder.

● Currently, the top five shareholders also include MMXX Capital, Vanguard, Evolution Capital, and Invesco. An industry observer pointed out that companies like Metaplanet must prioritize financial resilience during downturns to maintain long-term accumulation goals.

5. Potential Risks: Index Review and Tax Reform

Despite being favorable for structural health in the long run, Metaplanet still faces significant potential risks.

● The MSCI index review affecting Strategy has also impacted Metaplanet, which was included in the MSCI Japan Index in February this year. If it is removed due to a high proportion of Bitcoin assets, it could trigger a wave of passive fund sell-offs.

● Another risk comes from the potential impact of Japan's tax reform. Previously, Japanese investors preferred to buy crypto concept stocks rather than directly hold crypto assets, partly due to tax differences.

● Japan imposes a heavy tax burden on crypto assets, while stock investments enjoy a more favorable tax regime. However, recent developments indicate that the Financial Services Agency of Japan plans to adjust the tax rate on crypto assets from the highest progressive rate of 55% to a unified rate of 20%, consistent with stocks, in the 2026 tax revision.

● Once implemented, the tax difference between holding spot crypto assets and holding related concept stocks will significantly narrow, reducing the motivation to buy stocks as a substitute for holding coins. This could affect the attractiveness of Metaplanet's stock.

6. Future Outlook: Strategic Accumulation and Industry Differentiation

● Overall, Metaplanet's pause in Bitcoin accumulation should not be viewed as a failure of strategy or capitulation to the market, but rather as a strategic accumulation based on risk and efficiency considerations. This also marks a maturation of the DAT sector, shifting from aggressive accumulation to risk control prioritization.

● Industry experts have pointed out that evaluating DAT companies based on market value to net asset ratio is not entirely accurate, as this valuation method does not fully consider the lifecycle of listed companies. Looking ahead, the price differences among treasury companies will become more pronounced, and Metaplanet may be in the process of reconstructing its valuation system.

Table: Key Financial and Strategic Indicators of Metaplanet

Indicator Category

Specific Data/Status

Description

Bitcoin Holdings

Over 30,000, valued at approximately $2.75 billion

The fourth largest Bitcoin treasury company globally

Average Cost

Approximately $108,000/each

Currently has over $500 million in unrealized losses on the books

Financing Innovation

Launching "Mercury" and "Mars" digital credit instruments

Offering a 4.9% yen yield, attracting domestic investors

Stock Price Performance

Retraced over 70% from this year's peak, but still up over 20% for the year

Market capitalization of approximately $3 billion, previously exceeding 1 trillion yen

Shareholder Structure

Capital Group as the largest shareholder (11.45%)

Increased recognition from international institutions

Notably, Metaplanet has announced a special shareholders' meeting on December 22 to discuss the preferred share issuance proposal. The outcome of this meeting will have a critical impact on the company's medium to long-term strategic direction.

As of December 15, Metaplanet's market capitalization has surpassed that of Japanese storage chip manufacturer Kioxia Holdings, soaring nearly 400% in less than two months. Its market value even exceeds that of chip manufacturer Screen Holdings and one of the world's largest subway operators, Tokyo Metro.

The company's stock price has significantly retraced from its historical high in June this year but remains well above pre-transformation levels. The market is now waiting to see whether this strategic pause is a temporary defense or the beginning of a long-term strategic shift.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。