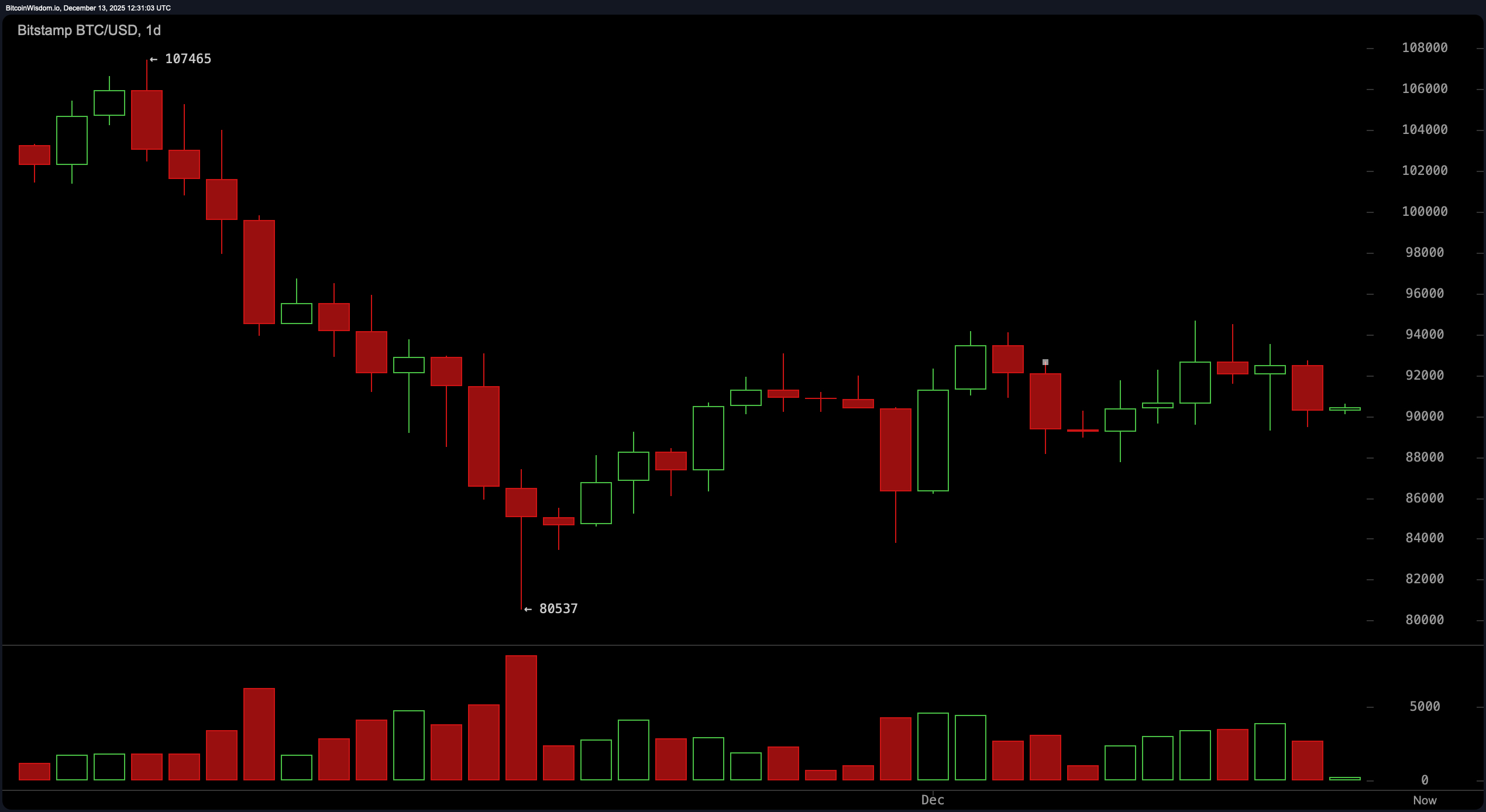

从日线图来看,比特币似乎在$88,000到$96,000的舒适区间内徘徊,此前在接近$94,000时遭遇了强烈的拒绝。该资产从$107,465的高点回落,进入了一个横盘整理的状态。这种市场的不确定性似乎在暗示着整合,尤其是在接近$80,537底部的高峰后,交易量逐渐减少——这是大玩家买入回调的明显迹象。然而,如果没有新的买入压力,比特币有可能再次滑落回旧的支撑水平。

BTC/USD 1日图,数据来源于Bitstamp,日期为2025年12月13日。

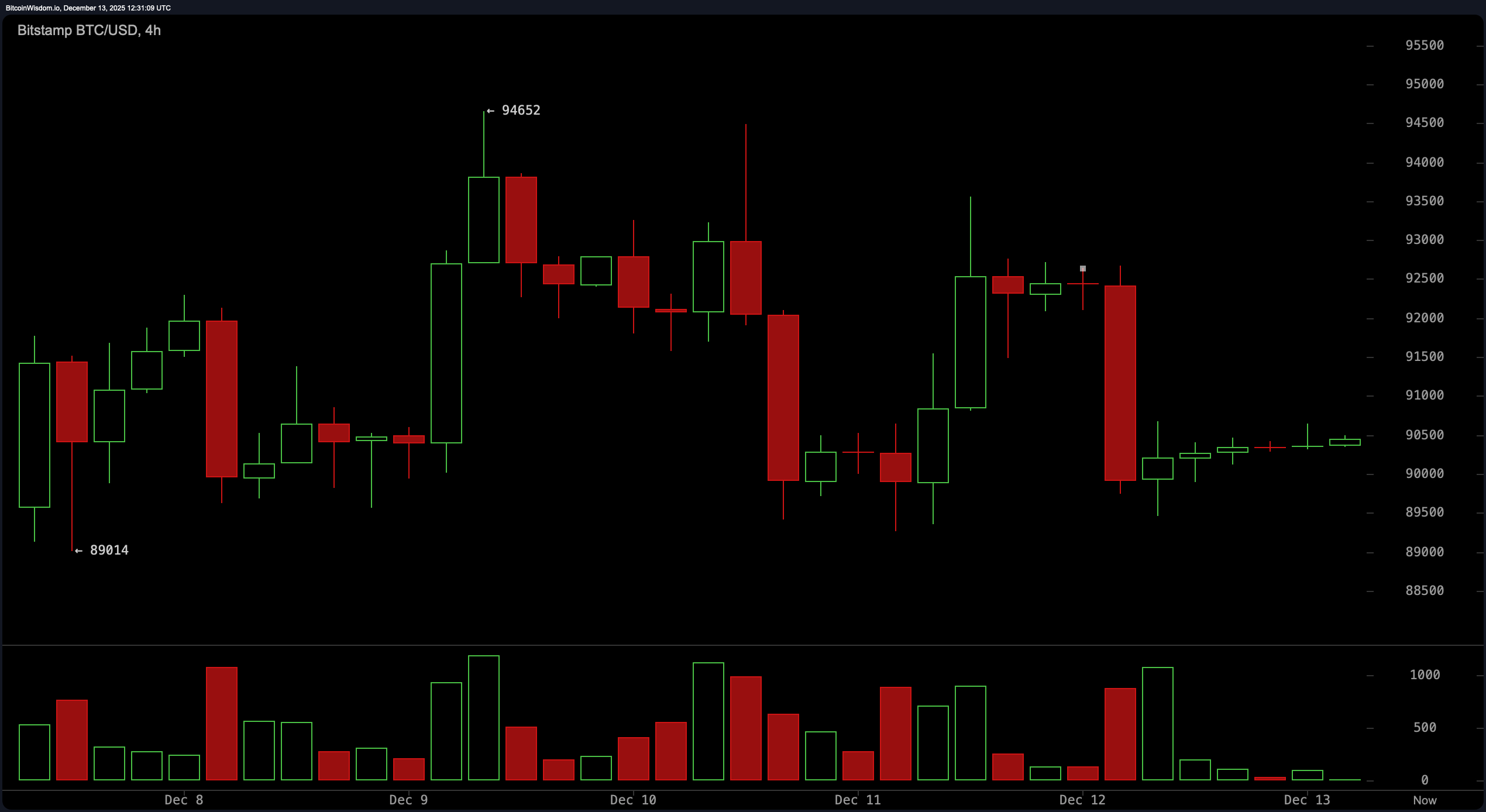

放大到4小时图,情况变得更加波动。比特币最近在一根高成交量的红蜡烛中,从$92,500暴跌至$89,000。现在它在$90,500附近徘徊,像一个疲惫的游泳者。几根十字星蜡烛信号显示出不确定性,而逐渐减少的交易量似乎为挤压做好了准备。如果突破$92,500——假设成交量没有休假——可能会解锁短期的上涨空间。但如果比特币在$94,500处形成双顶,那拒绝可能会变得非常明显。

BTC/USD 4小时图,数据来源于Bitstamp,日期为2025年12月13日。

如果你在寻找信心,1小时图并没有提供太多帮助。蜡烛图紧凑,交易者的目光充满怀疑,反映出市场陷入决策瘫痪。价格结构在$90,000上方压缩,这几乎总是预示着某个方向的扩张。如果它以热情突破$91,000,那么$92,500可能会迅速浮现。如果没有,跌破$89,000可能会毫无仪式感地回到$88,000的底部。

BTC/USD 1小时图,数据来源于Bitstamp,日期为2025年12月13日。

振荡器的表现也不尽如人意。相对强弱指数(RSI)为45,显示中性。随机振荡器为67,仍然犹豫不决。商品通道指数(CCI)为-2,平均方向指数(ADX)为26,显得昏昏欲睡。强势振荡器为-433,显然没有表现出兴趣,而动量为-3,080,指向持续的疲软。然而,移动平均收敛发散(MACD)在-1,236处保持了一丝希望,略显看涨——在一群墙花中唯一的乐观者。

移动平均线(MAs)?现在对比特币没有任何好处。所有主要的指数和简单移动平均线——从10日到200日——都坚决处于“下行拖累”类别。10日指数移动平均线(EMA)和简单移动平均线(SMA)分别徘徊在$90,986和$90,968,略高于当前价格,增加了压力。至于200日EMA和SMA在$103,348和$108,667,比特币现在需要翅膀才能达到这些水平。

底线:比特币被困在$90,000上方,整合中既没有牛市也没有熊市掌控叙事。图表暗示着突破——或下跌——但尚未对任何方向做出回应。这是一场等待游戏,下一根大蜡烛可能正是打破僵局的那根。

牛市判决:

如果比特币保持在$90,000上方,并且成交量支持突破$91,000–$92,500,动量可能会向$94,000–$96,000的阻力区倾斜。请关注由上升成交量和增强的移动平均收敛发散(MACD)支持的确认移动——这是目前唯一闪烁乐观信号的振荡器。

熊市判决:

如果比特币在增加的卖出量下失去$89,000的支撑,下一站可能是$88,000——如果熊市动能加速,甚至可能会重新测试$80,500的支撑。由于所有主要的移动平均线都对价格施加压力,且动能在下降,向下的路径提供的阻力比牛市可能愿意承认的要小。

- 比特币当前价格是多少?截至2025年12月13日,比特币的交易价格为$90,398。

- 比特币今天的市值是多少?比特币的市值为$1.80万亿。

- 比特币现在是处于上升趋势还是下降趋势?比特币在最近从$94,000的下跌后正在横盘整合。

- 今天比特币交易者应该关注哪些价格水平?关键关注水平为$88,000的支撑和$94,000的阻力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。