撰文:小饼|深潮 TechFlow

十二月的贵金属市场,主角不是黄金,白银才是那道最刺眼的光。

从 40 美元,跃升到 50、55、60 美元,它以几乎失控的速度穿过一个又一个历史价位,几乎不给市场喘息的机会。

12 月 12 日,现货白银一度触及 64.28 美元/盎司的历史高位,随后再急转大跌。年初至今,白银累计上涨了近 110%,远超黄金 60% 的涨幅。

这是一次看起来“极其合理”的上涨,却也因此显得格外危险。

上涨背后的危机

白银为什么涨?

因为它看起来值得涨。

从主流机构的解释看,这一切都合理。

美联储降息预期重燃贵金属行情,近期就业与通胀数据疲软,市场押注 2026 年初进一步降息。白银作为高弹性资产,反应比黄金更激烈。

工业需求也在推波助澜。太阳能、电动车、数据中心和 AI 基础设施的爆发式增长,让白银的双重属性(贵金属+工业金属)得到充分体现。

全球库存持续下降更是雪上加霜。墨西哥与秘鲁矿山四季度产量不及预期,主要交易所仓库的银锭一年比一年少。

……

如果只看这些理由,银价上涨是“共识”,甚至是迟来的价值重估。

但故事的危险之处在于:

白银的上涨,看起来合理,但不踏实。

原因很简单,白银不是黄金,它没有黄金那样的共识,缺少"国家队"。

黄金之所以足够坚挺,是因为全世界央行都在买。过去三年,全球央行买入超过 2300 吨黄金,它们挂在各国资产负债表上,是主权信用的延伸。

白银不同。全球央行黄金储备超过 3.6 万吨,而官方白银储备几乎为零。没有央行托底,当市场出现极端波动时,白银缺乏任何系统性稳定器,是一种典型的“孤岛资产”。

市场深度的差异更加悬殊。黄金日交易量约 1500 亿美元,白银仅 50 亿美元。把黄金比作太平洋,白银顶多是鄱阳湖。

它体量小,做市商数量少,流动性不足,实物储备有限。最关键的是,白银的主要交易形式不是实物,而是“纸白银”,期货、衍生品、ETF 主导市场。

这是一种危险结构。

浅水易翻船,大资金进入一下子就会搅乱整个水面。

而今年恰恰发生的,就是这种局面:一股资金突然涌入,一个本来就不深的市场被迅速推起,价格被拉离地面。

期货逼仓

让白银价格脱离轨道的,不是上述看似合理的基本面理由,真正的价格战争在期货市场。

正常情况下,白银的现货价格应该略高于期货价格,这很好理解,持有实物白银需要仓储成本、保险费用,而期货只是一张合约,自然便宜一些,这种价差一般称之为“现货升水”。

但从今年第三季度开始,这个逻辑颠倒了。

期货价格开始系统性地高于现货价格,而且价差越来越大,这意味着什么?

有人在期货市场疯狂推高价格,这种“期货升水”现象通常只会在两种情况下出现:要么是市场极度看涨未来,要么是有人在逼仓。

考虑到白银基本面的改善是渐进式的,光伏和新能源需求不会在几个月内指数暴增,矿山产量也不会突然枯竭,期货市场的激进表现更像后者:有资金在推高期货价格。

更危险的信号来自实物交割市场的异常。

全球最大的贵金属交易市场 COMEX(纽约商品交易所)的运营历史数据显示,贵金属期货合约中的实物交割比例不足 2%,其余 98% 通过美元现金结算或合约展期来完成。

然而过去几个月,COMEX 的白银实物交割量激增,远超历史平均水平。越来越多的投资者不再信任“纸白银”,他们要求提取真正的银锭。

白银 ETF 也出现了类似现象。大量资金涌入的同时,部分投资者开始赎回,要求获得实物白银而非基金份额。这种“挤兑式”赎回,让 ETF 的银锭储备承压。

今年,白银的三大市场,纽约 COMEX,伦敦 LBMA,上海金属交易所先后出现了挤兑风潮。

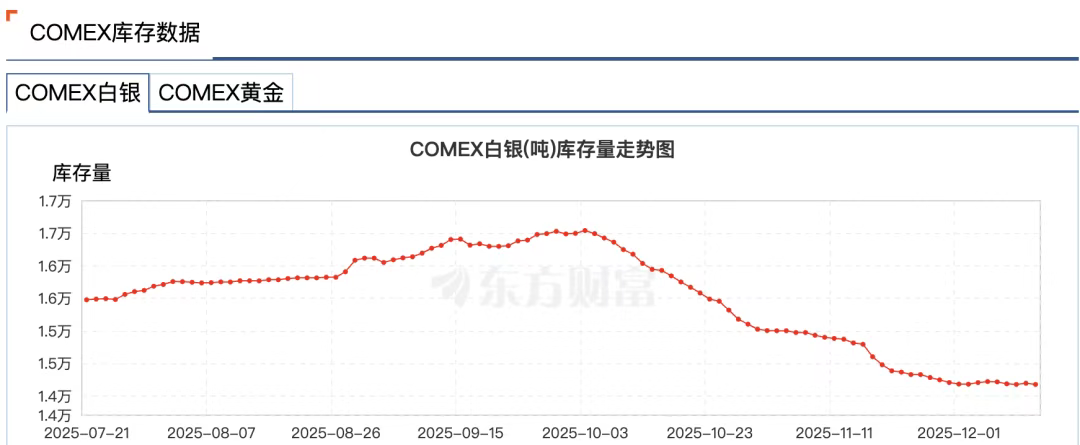

Wind 数据显示,11 月 24 日当周上海黄金交易所白银库存下降 58.83 吨,降至 715.875 吨,创下 2016 年 7 月 3 日以来新低。CMOEX 白银库存从 10 月初 1.65 万吨骤降至 1.41 万吨,降幅达 14%。

原因也不难理解,美元降息周期下,大家不愿意以美元交割,另一个隐形的担忧是,交易所可能拿不出那么多白银用于交割。

现代贵金属场是一个高度金融化的体系,大部分“白银”只是账面数字,真正的银锭在全球范围内反复抵押、租借、衍生。一盎司实物白银,可能同时对应着十几张不同的权利凭证。

资深交易商 Andy Schectman 以伦敦为例,LBMA 仅有 1.4 亿盎司浮动供应,但日交易量高达 6 亿盎司,在这 1.4 亿盎司上却存在超过 20 亿盎司的纸面债权。

这种“分数准备金制度”在平时运行良好,但一旦大家都想要实物,整个体系就会出现流动性危机。

当危机的阴影浮现,金融市场似乎总会出现一个奇怪的现象,俗称为“拔网线”。

11 月 28 日,CME 因“数据中心冷却问题”宕机近 11 小时,创史上最长纪录,导致 COMEX 金银期货无法正常更新。

引人注目的是,宕机发生在白银突破历史高点的关键时刻,现货银当日攻破 56 美元,白银期货更是突破 57 美元。

有市场传言猜测,宕机是为了保护暴露在极端风险中,可能出现大额亏损的商品做市商。

后来,数据中心运营商 CyrusOne 表示,此次重大中断源于人为操作失误,更让各种“阴谋论”甚嚣尘上。

简而言之,这种由期货逼仓主导的行情,注定了白银市场的剧烈波动性,白银实际上已经从传统的避险资产变成了高风险标的。

谁在坐庄?

在这场逼仓大戏中,有个名字无法绕过:摩根大通。

原因无他,他是国际上公认的白银庄家。

在至少 2008 年到 2016 年的八年时间里,摩根大通通过交易员操纵黄金白银市场价格。

手法简单粗暴:在期货市场上大量下单买入或卖出白银合约,制造供需假象,诱导其他交易者跟风,然后在最后一秒取消订单,从价格波动中获利。

这种被称为欺骗交易(spoofing)的操作手法,最终让摩根大通在 2020 年吃下了 9.2 亿美元的罚款,一度创下 CFTC 单笔罚款纪录。

但真正的教科书级市场操纵不止于此。

一方面,摩根大通通过期货市场的大量卖空和欺骗交易压低银价,另一方面,在自己制造的低价位上大量收购实物金属。

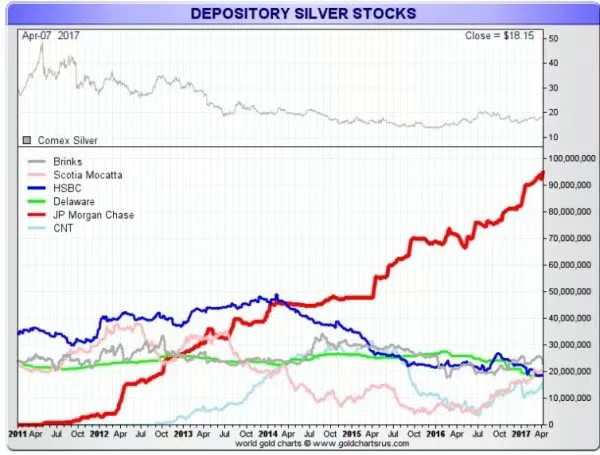

从 2011 年银价接近 50 美元的高点开始,摩根大通开始在其 COMEX 仓库中囤积白银,在其他大型机构减仓白银的时候,一路加持,最多占到了 COMEX 总白银库存的 50%。

这种策略利用了白银的市场结构性缺陷,纸银价格主导实物银价,而摩根大通既能影响纸银价格,又是最大的实物银持有者之一。

那么在这轮白银逼仓中,摩根大通扮演什么角色?

从表面上看,摩根大通似乎已经“改过自新”。在 2020 年的和解协议后,进行了系统性的合规改革,包括雇佣数百名新的合规官员。

目前也没有任何证据表明,摩根大通参与了逼空行情,但在白银市场,摩根大通依然拥有拥有着举足轻重的影响力。

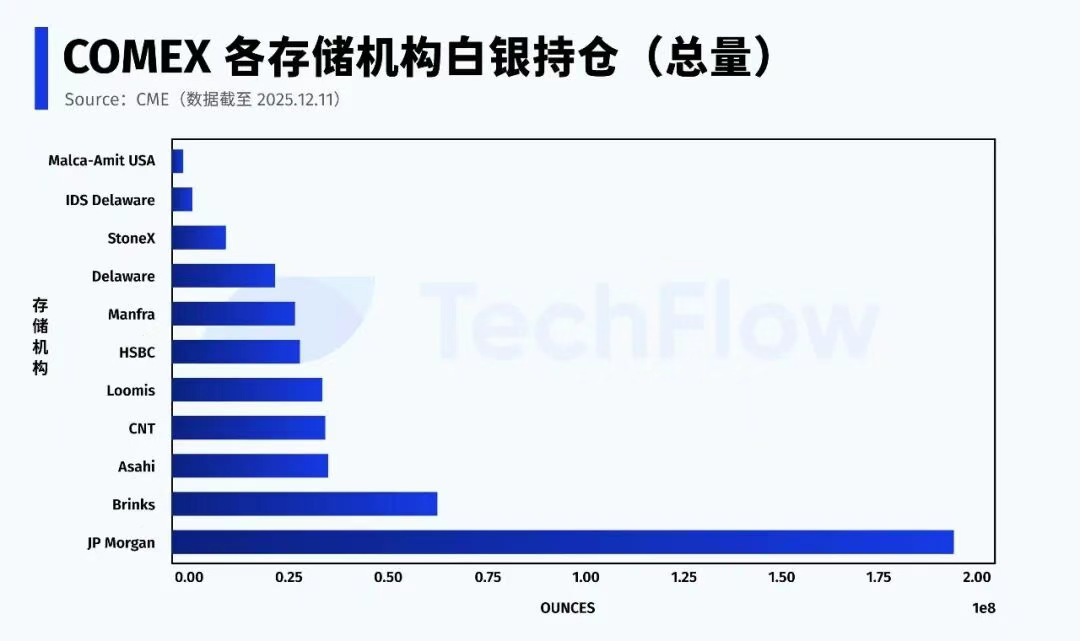

根据 12 月 11 日 CME 的最新数据,摩根大通在 COMEX 体系下白银总量约 1.96 亿盎司(自营+经纪),占交易所全部库存的近 43%。

此外,摩根大通还有一个特殊的身份,白银 ETF(SLV)的托管方,截止 2025 年 11 月,托管了 5.17 亿盎司白银,价值 321 亿美元。

更关键的是,在 Eligible 白银(即具备交割资格、但尚未登记为可交割)的部分,摩根大通控制了超过一半的规模。

在任何一轮白银逼仓行情中,市场真正博弈的无非两点:一,谁能拿出白银实物;二,这些白银是否、以及何时,被允许进入交割池。

和曾经作为白银大空头不同,如今的摩根大通坐在了“白银闸门”的位置。

目前可交割的 Registered 白银仅占总库存约三成,而 Eligible 的大头高度集中于少数机构时,白银期货市场的稳定性,实际上取决于极少数节点的行为选择。

纸面体系逐渐失灵

如果只用一句话来形容当下的白银市场,那就是:

行情还在继续,但规则已经变了。

市场已经完成了一次不可逆的转变,对白银“纸面体系”的信任正在瓦解。

白银并不是个例,在黄金市场,同样的变化已经发生。

纽约期货交易所的黄金库存持续下滑,注册金(Registered )屡次触及低位,交易所不得不从原本并不用于交割的“合格金(Eligible)”中调拨金条完成撮合。

在全球范围内,资金正在悄然进行一次迁徙。

过去十多年,主流资产配置的方向是高度金融化的,ETF、衍生品、结构化产品、杠杆工具,所有东西都可以被“证券化”。

现在,越来越多的资金开始从金融资产中撤离,转而寻找不依赖金融中介、不依赖信用背书的实物资产,典型的就是黄金和白银。

央行持续、大规模增持黄金,几乎无一例外选择实物形式,俄罗斯禁止黄金出口,连德国、荷兰等西方国家都要求运回海外存放的黄金储备。

流动性,正在让位于确定性。

当黄金供应无法满足巨大的实物需求时,资金开始寻找替代品,白银自然成为首选。

这场实物化运动的本质,是弱美元,去全球化背景下货币定价权的重新争夺。

据彭博社 10 月报道,全球黄金正在从西方向东方转移。

美国 CME 和伦敦金银市场协会(LBMA)的数据显示,自 4 月底以来,已有超过 527 吨黄金从美国纽约和英国伦敦这两个最大的西方市场的金库中流出,与此同时,中国等亚洲黄金消费大国的黄金进口量增加,中国 8 月黄金进口量创下了四年来的新高。

为了应对市场变化,2025 年 11 月底,摩根大通将其贵金属交易团队从美国转移到了新加坡。

黄金白银大涨背后,是“金本位”概念的回归。短期内或许不现实,但可以确定的是:谁掌握更多实物,谁就拥有更大定价权。

当音乐停止时,只有拿着真金白银的才能安然入座。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。