TRM Labs, a global blockchain forensics and analytics firm, has discussed the current state of the cryptocurrency ecosystem in Venezuela against a backdrop of increased sanctions.

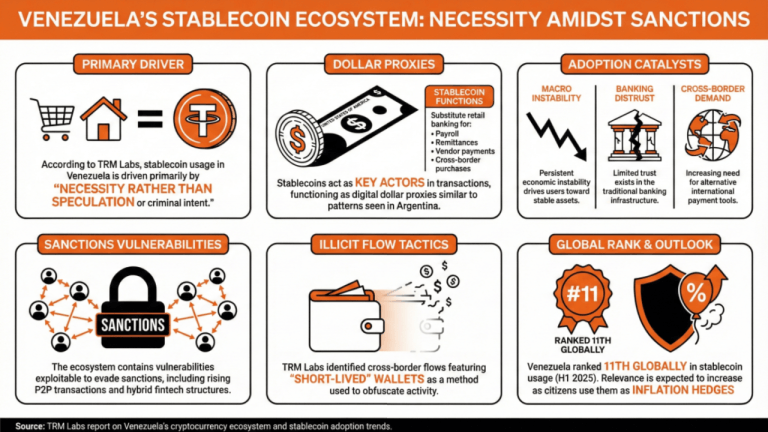

In a recent article, the firm acknowledged that, even with renewed global compliance concerns, the usage of stablecoins remains primarily driven by “necessity rather than speculation or criminal intent.”

TRM Labs found that stablecoin adoption in Venezuela follows a similar pattern observed in countries like Argentina, becoming key actors in both household and commercial transactions as dollar proxies.

For the firm, three elements act as drivers of stablecoin adoption in the current Venezuelan economic context: persistent macroeconomic instability, a limited trust in traditional banking infrastructure, and an increasing demand for alternative cross-border payment tools.

TRM Labs stated:

Stablecoins now operate as a substitute for retail banking — facilitating payroll, family remittances, vendor payments, and cross-border purchases in the absence of consistent domestic financial services.

Nonetheless, TRM Labs also identified several vulnerabilities within the Venezuelan ecosystem that might be exploited to avoid unilateral sanctions. These include the rising popularity of P2P (peer-to-peer) transactions, the use of hybrid fintech structures that combine banking services with blockchain wallets, and the existence of cross-border flows featuring “short-lived” wallets.

The TRM Labs’ report comes as the U.S. government recently confiscated a tanker containing Venezuelan oil, an action that was labeled as “piracy” by Venezuelan authorities.

Previous reports have linked the sale of Venezuelan oil to third parties to stablecoin transactions, though no official statements have been made, neither confirming nor denying these allegations.

Finally, TRM Labs concludes that, if nothing changes, the relevance of stablecoins in Venezuela is expected to keep increasing, as everyday citizens continue to rely on these tools as inflation and devaluation hedges.

The firm’s own stablecoin crypto adoption report ranked Venezuela as the 11th country with the most stablecoin usage during the first half of 2025.

Read More: Economist: USDT Leveraged to Settle Crude Oil Sales in Venezuela

What recent insights did TRM Labs provide about cryptocurrency usage in Venezuela?

TRM Labs highlighted that stablecoin usage in Venezuela is primarily driven by necessity due to increased sanctions and economic instability.What patterns of stablecoin adoption were observed?

Stablecoin adoption in Venezuela mirrors trends in Argentina, serving as a dollar proxy in both household and commercial transactions.What factors are driving stablecoin usage in Venezuela?

Three key drivers include macroeconomic instability, a lack of trust in traditional banking, and growing demand for alternative cross-border payment methods.What future trends are expected for stablecoins in Venezuela?

TRM Labs anticipates that stablecoins will become increasingly relevant as Venezuelans continue to rely on these digital assets to hedge against inflation and devaluation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。