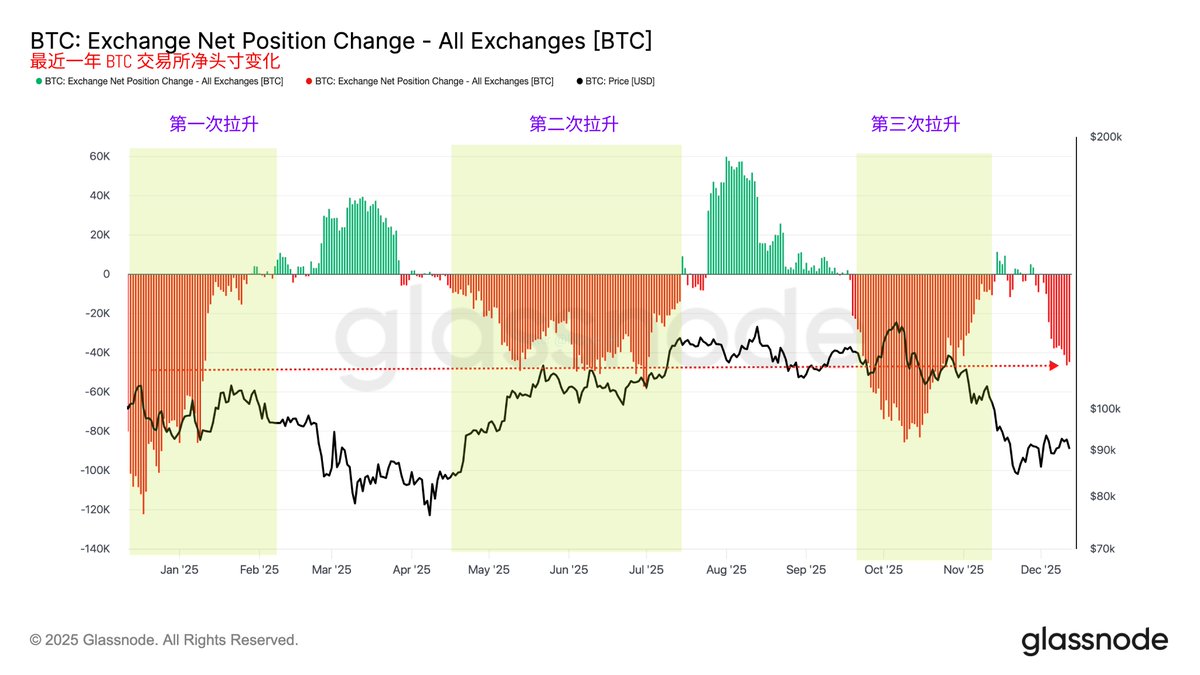

From the changes in the net positions of exchanges for $BTC, although I am not 100% convinced that a large outflow will necessarily lead to a price surge, it is indeed true that when a large number of users buy in, the impact on the price is positive. Moreover, recent data over the past year clearly shows that the volume of Bitcoin purchases far exceeds the volume of sales.

Changes in BTC net positions on exchanges over the past year

On one hand, this indicates that more investors are less concerned about short-term price fluctuations and are shifting BTC from short-term investments to medium- and long-term investments. On the other hand, it also suggests that if this phenomenon continues, the stock on exchanges will decrease, potentially leading to a situation where there is "not enough to sell."

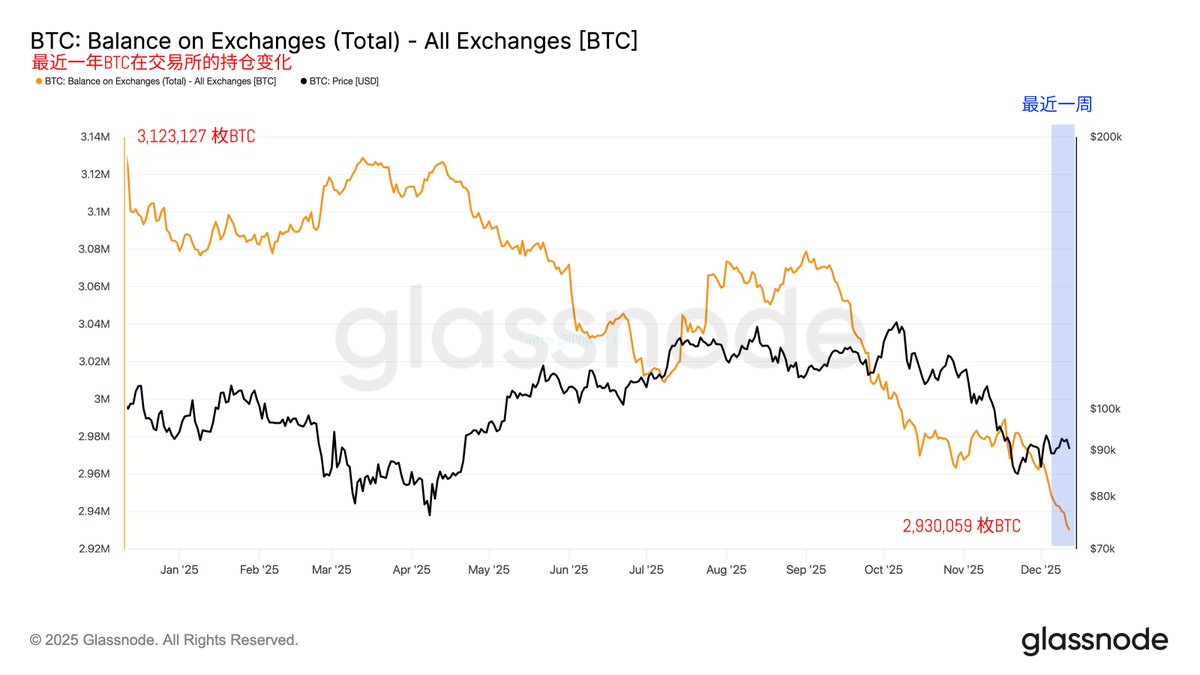

Changes in BTC holdings on exchanges over the past year

From the data on the stock of BTC on exchanges, we can see that a year ago, exchanges held 3.123 million BTC, and today there are 2.93 million left, resulting in a net outflow of 193,000 BTC over the year. If this trend continues, the stock of BTC on exchanges will be completely depleted in less than four cycles.

Of course, this is purely theoretical data, which only indicates that an increasing number of investors view BTC as a long-term investment and believe that its value will be higher in the long run. Especially now, both parties in the U.S. are urging the SEC to advance the inclusion of alternative assets (including cryptocurrencies) in 401(K) pension plans, which could very likely happen by 2026.

At that time, I believe the stock of BTC will be consumed even faster, and more long-term investors will hold it.

At least hold 0.1 BTC. And just leave it untouched; it may yield unimaginable returns in the future.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。