原文标题:Tether Investments: What a $100B stablecoin empire does with its profits

原文作者:Bennett Tomlin, protos

原文编译:律动小工, BlockBeats

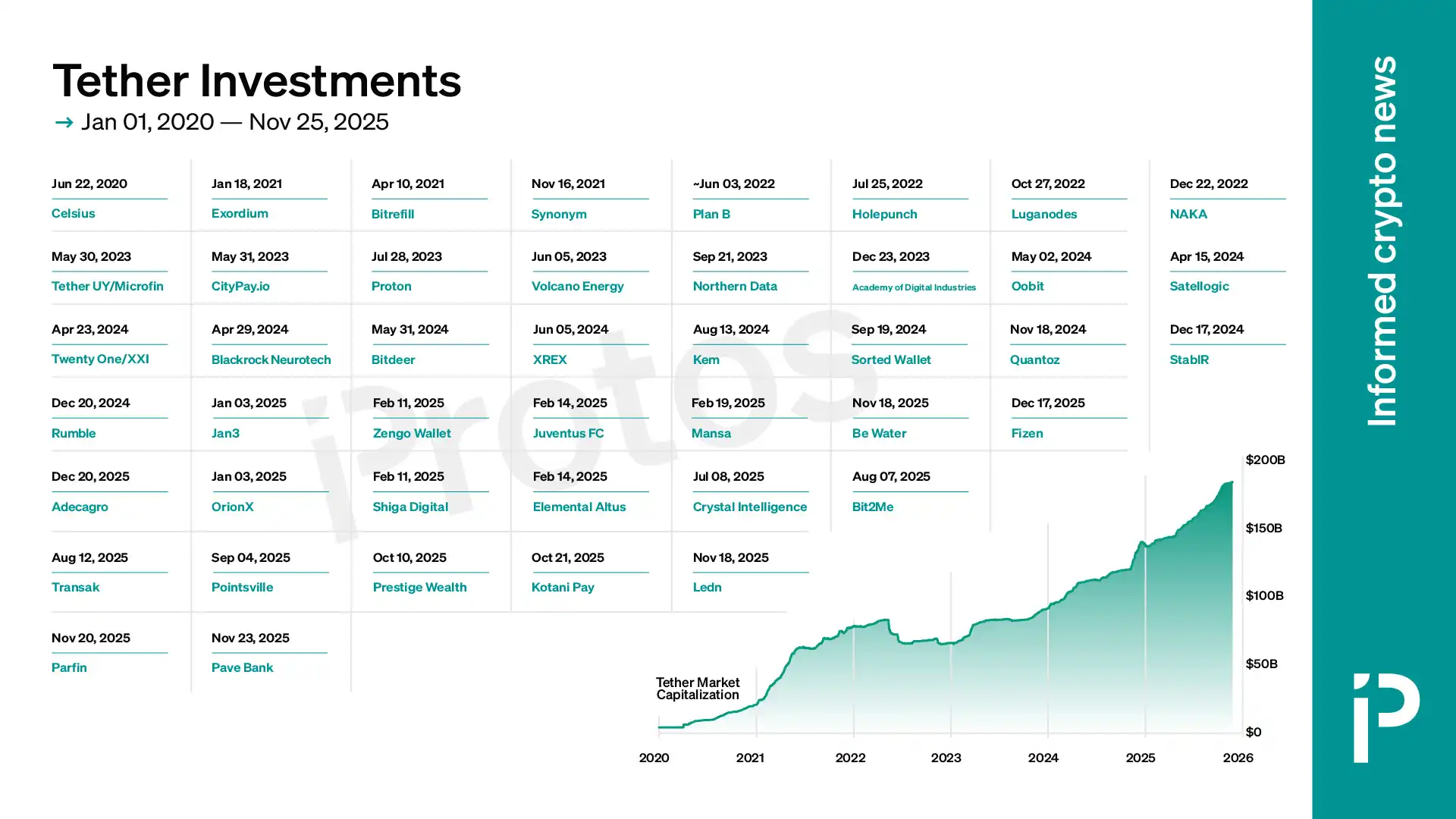

Tether 如今已是全球举足轻重的金融集团之一。它不仅运营着市值最高的稳定币,其投资版图更横跨加密货币、支付处理、视频流媒体、人工智能、脑机接口、农田、卫星、足球等多个领域。

这些投资旨在扩大公司的触角和影响力,如果它们取得成功,想必会在未来带来巨大的财务回报。

Tether 首席执行官 Paolo Ardoino 曾透露,Tether 投资了超过 120 家公司,但其官方网站的「Tether Ventures」页面上仅公开了 24 家。

这份公开名单也随着时间推移发生了变化。据 Ardoino 发布的截图和网络档案证实,在 Tether Ventures 推出之时,名单中曾包含 OrionX。Tether 曾在后来删除的一篇博客文章中称 OrionX 为「智利领先的数字资产交易所之一」。

Protos 曾联系 Tether,询问为何将该公司从网站上移除,但在发稿前未获回应。

实际上,还有许多其他的投资项目曾被媒体报道过——甚至有时也会出现在 Tether 自己的网站上——但出于某种原因,它们并未被收录在这个投资组合页面中。

Samson Mow 的公司

前 Blockstream 首席战略官 Samson Mow 的公司曾多次获得 Tether 的投资。

其中最早的一笔是 Tether 参与了 Exordium 的证券型代币发行(STO)。Exordium 是游戏《Infinite Fleet》背后的发行商,由 Mow 创立。Exordium 使用由 Tether 资助的 Holepunch 技术来分发其游戏客户端。

Exordium 网站声称,其证券型代币仍在 Bitfinex Securities(Tether 的关联公司)上提供。然而,查阅 Bitfinex Securities 网站后发现,当前交易的代码列表中并不包含该代币。

Exordium 并非 Tether 投资的唯一一家 Mow 创立的公司,Tether 还投资了 Jan3。Jan3 从 Tether 筹集资金是为了「加速 AQUA 钱包的开发和扩张」。

此外,Blockstream 也曾获得 iFinex 的资助,iFinex 正是运营 Bitfinex 平台的公司之一。

Celsius

Tether 也是 Celsius 的股权投资方,这是一家现已倒闭且卷入大规模欺诈的加密货币借贷平台。

Celsius 的创始人兼前 CEO Alex Mashinsky 最近被判处 12 年监禁。

这项投资未被列入 Tether Ventures 页面也是情理之中,毕竟在该欺诈平台崩盘后,这笔股权实际上已变得一文不值。

除了股权投资,Tether 还曾向 Celsius 提供贷款,而这些贷款的清算问题曾是 Celsius 破产程序中的一个严重争议点。该诉讼最近以 2.995 亿美元的和解金额告终。

Volcano Energy

Volcano Energy 是萨尔瓦多的一个比特币挖矿项目,最初计划利用火山的地热能为一系列比特币矿机供电。

Tether 将其目标描述为「践行其投资可再生能源的使命,以支持和促进可持续的比特币挖矿」。

据该项目网站显示,自那以后,Volcano Energy 的重心已从火山地热转向了风能和太阳能。目前,该项目尚未开始挖掘任何比特币。

Tether Uruguay / Microfin

Tether 还曾与当地公司 Microfin 合作,投资了乌拉圭的比特币挖矿业务。Tether 称这项投资展示了其「致力于能源创新和加密货币未来的决心」。

今年 9 月,有报道称由于拖欠电费,Tether 正计划放弃该项目。当时 Tether 曾向 Cointelegraph 表示:「Tether 仍然支持这些努力,并将寻求一条建设性的前进道路,这反映了我们在该地区长期致力于可持续发展机会的承诺。」

然而,据《El Observador》援引报道称,自那以后,Tether 已正式放弃了该项目,理由是能源成本过高,在经济上已无利可图。

Tether 的特别项目服务

Tether 还有几个项目归属于其「特别项目服务」部门,该部门由 Davide Rovelli 领导。

其中包括 Plan B,这是一个位于瑞士的加密货币会议,由 Rovelli 领导的 AltKey SA 运营。Plan B 的既定目标是「在卢加诺建立一个欧洲加密中心」。

自称是 Plan B「杰作」之一的是 Luganodes,一家提供「质押即服务」(staking-as-a-service) 的供应商。该服务商主要专注于由孙宇晨创立的 Tron 网络,该链是 USDT 代币发行量第二大的网络。

2040 Energy / Proton

2040 Energy 最初是 Tether 和 Swan 的联合项目。

该项目最终演变为诉讼纠纷,指控 Tether 诱导相关顾问离开 2040 Energy,转而启动与 Tether 关系更紧密的 Proton Management 项目。2040 Energy 和 Proton Management 均由 Tether 资助。

最近,Proton Management 在加州中区法院成功申请了强制仲裁。这些项目仅代表了 Tether 成长为比特币挖矿生态系统主要资助者的一部分。

Satellogic

Tether 甚至将投资触角伸向了太空,投资了 Satellogic,一家运营卫星并销售观测数据的公司。

Satellogic 在宣布投资的新闻稿中指出,这些资金「将有助于推进我们的使命,我们将继续专注于美国的战略布局、国家安全市场以及全球太空系统的机遇。」

10 月,Satellogic 宣布将公开发售其部分股权。

Parfin

Tether 在一篇博客文章中将 Parfin 描述为「拉丁美洲的数字资产托管、代币化、交易和管理平台」。

这项投资是 Ardoino 所描述的 Tether「坚信拉丁美洲将成为全球区块链创新重镇之一」的一部分。

除其他功能外,Parfin 平台宣传其提供面向其他金融机构的「合规即服务」管理工具。Parfin 还推出了一款名为 Rayls 的产品,被描述为「银行专用的区块链」。

根据 CoinMarketCap 的数据,与该项目相关的代币市值约为 4400 万美元。

Ledn

Ledn 是一个比特币借贷平台,Ardoino 称其能「在无需个人出售数字资产的情况下扩大信贷渠道」。

Ledn 是借贷给 Alameda Research 的较小规模贷方之一。在 FTX 和 Alameda 崩盘后,Ledn 声称已「完全消化了与 Alameda 未偿贷款的影响」,并进一步指出「Ledn 在 FTX 上也持有少量资产,但这不会影响客户的资产。」

Ledn 此前也曾依赖 Genesis Global Capital 作为合作伙伴,但据称在 Genesis 倒闭前已终止了该关系。这些问题都发生在 Tether 投资该公司之前。

Kotani Pay

Tether 将 Kotani Pay 描述为「连接非洲各地 Web3 用户与本地支付渠道的出入金基础设施」。

它宣传其能够将各种当地货币兑换成加密货币。此外,它还提供所谓的「稳定币结算解决方案」,旨在促进跨境支付,并宣称比银行更快。

Bit2Me

Bit2Me 在 Tether 的博客中被描述为「领先的西班牙语数字资产平台」。

它提供交易所服务,以及「理财 (Earn)」产品、允许用户进行加密货币抵押贷款的「借贷 (Loan)」产品,以及一个「区块链证券交易所」。

它拥有一个名为 B2M 的平台币。根据 CoinMarketCap 上的自报数据,其市值已从约 5.5 亿美元的峰值跌至仅 5800 万美元。

Pave Bank

Tether 最近的一笔投资投向了 Pave Bank,这是一家受格鲁吉亚监管的银行,承诺提供「全球化、安全的多资产银行业务」和「可编程银行业务」。

该公司声称,在产品设计和构建方面,它是一家「科技公司」;而在风险、资本和监管管理方面,它则是一家「完全受监管的银行」。

Prestige Wealth

Prestige Wealth(或称 Aurelion)是一家奇怪的公司。它与其他数字资产财库(DAT)公司类似,不同之处在于它投资的资产是 Tether Gold,一种所谓的现实世界资产(RWA)的代币化版本。

Tether 投资了这家公司,当时该公司正在筹集资金购买 Tether Gold。其「私募股权投资上市公司股份」(PIPE) 的融资中,很大一部分是以 Tether (USDT) 代币的形式出资的。

在宣布这项投资的新闻稿中,Aurelion 的 CEO Björn Schmidtke 指出:「这不仅仅关乎收益或金融:这关乎重新定义在数字时代如何持有、转移和保存真正的财富。」

新闻稿后文声称,Aurelion 提供「收益、透明度、监管合规以及每日链上验证」。

Pointsville

Pointsville 是另一家专注于代币化现实世界资产(RWA)并提供忠诚度计划的公司。

该公司由 Gabor Gurbacs 领导,其 LinkedIn 个人资料显示他是 Tether 的首席战略顾问。

Ardoino 在描述这次融资的新闻稿中表示:「代币化正迅速成为现实世界资产应用最实用、最具影响力的驱动力之一。Tether 的 Hadron 平台很自豪能支持这一转型,与 Pointsville 经验丰富的团队合作,提供所需的规模和可用性,将现实世界资产和忠诚度计划整合到数字经济中。」

Transak

Transak 自称是「法币到加密货币基础设施的全球领导者」,Ardoino 称其正在「加速新兴市场和发达市场的普及,弥合金融准入差距,并为企业和消费者创造新机遇」。

它提供场外交易 (OTC) 服务以及出入金服务。

与上述投资不同,Tether 还有一些其他重要的投资确实列在网站上。

Rumble 和 Northern Data

当 Tether 最初投资 Northern Data 时,它还是一家数据中心和比特币挖矿公司。

Tether 很快成为大股东。自那以后,Northern Data 将其挖矿业务分拆为 Peak Mining,并开始大力专注于人工智能 (AI)。

Tether 还投资了 Rumble,这是一个在右翼人士中很受欢迎的视频流媒体网站,尤其是那些被 Twitch 封禁的人。

此后,Rumble 收购了 Northern Data,该交易使 Tether 持有了 Rumble 约 30% 的股权。除了将加密货币纳入资产负债表外,Rumble 还引入 Tether 作为主要广告客户,Tether 同意投入 1 亿美元用于广告。

Rumble 最近的财报电话会议讨论了该公司意图转型为一家自称为「自由优先 (freedom-first)」的 AI 基础设施公司。

Ardoino 在电话会议中被重点提及,他一度声称「Rumble 的愿景与我们的完全一致」。

Rumble CEO Chris Pavlovski 也在电话会议上声称,Rumble 本月将向其所有用户群推广其基于加密货币的 Rumble 钱包。由小唐纳德·特朗普 (Donald Trump Jr.) 担任合伙人的风险投资公司 1789 Capital 也投资了 Rumble。

Bitdeer (比特小鹿)

吴忌寒 (Jihan Wu) 在比特币挖矿行业拥有悠久的历史,他是比特大陆 (Bitmain) 的联合创始人兼前 CEO。

现在,他领导着 Bitdeer,这是一家从比特大陆分拆出来的公司,并在纳斯达克公开上市。Tether 投资了 Bitdeer,持股比例最高时超过 20%,随后减持至约 18%。

CityPay.io

CityPay.io 是一家总部位于格鲁吉亚的公司,专注于帮助商家接受加密货币支付。

当 Tether 投资该公司时,曾表示这将是其「在格鲁吉亚扩大影响力」的一部分。Ardoino 表示,Tether「很高兴能与 CityPay.io 合作,为格鲁吉亚的支付行业带来更大的创新和效率。」

Fizen

Fizen 在 Tether 的博客文章中被描述为一家「专注于自托管加密钱包和数字支付的公司」。

Fizen 的网站宣传其能让你「在移动中赚钱」,并推广其「随时随地享受收益」的能力。

Ardoino 表示,这项投资「强调了我们致力于扩大全球对高效、可靠的数字金融解决方案的访问,从而促进在日常生活中明智、负责任地使用数字资产。」

Kem

Kem 在 Tether 的博客文章中被描述为「一个专为汇款和财务管理设计的平台」,主要在中东和北非运营。Ardoino 称这项投资加强了「Tether 对促进金融普惠和稳定的承诺」。

Kem 的网站将其描述为「第一家加密货币银行」。虽然这看起来 Kem 实际上并非银行,而且它肯定不是第一家试图服务加密货币行业的银行。

不过,其网站确实指出,「Kem 通过 Kemfinity s.r.o.(公司编号:221 62 194)运营,这是一家在捷克共和国持有 VASP(虚拟资产服务提供商)牌照的实体。」

Sorted Wallet

Sorted Wallet 被 Tether 描述为一个「提供安全、便捷的加密货币交易,弥合发展中地区无银行账户和银行服务不足人群差距」的平台。

除了提供钱包外,它还宣传可以帮助用户「将 USDT 提现到银行、话费或移动货币账户」。

Ardoino 声称,「通过支持 Sorted Wallet,我们为拥有基础功能手机的个人解锁了参与金融系统的新机会。我们的目标是确保每个人,无论身处何地或使用何种手机,都能安全地管理和使用加密货币,赋予他们建立更安全金融未来的能力,并积极参与不断发展的数字经济。」

Synonym

Synonym 是一家比特币钱包提供商,包含闪电网络功能,其网站上标明是「一家 Tether 公司」。

除钱包外,该公司还是 Pubky 的幕后推手,其网站将 Pubky 描述为一个由「新的去中心化协议驱动,并包含社交标签和社交策展功能」的应用程序。

此外,它还提供 Atomicity,被描述为一种「P2P 互信系统」,旨在实现「超越大银行信用卡的商业和协作」。

Shiga

Shiga Digital 在 Tether 的博客文章中被描述为「一个现代平台,提供通往泛非区块链金融解决方案的途径,可在现实世界中使用且易于访问。Shiga Digital 为非洲企业提供虚拟账户、OTC 服务、资金管理和外汇服务。」

其网站提出「用去中心化银行解决方案为您的业务赋能」。Shiga 声称是欧盟持牌的虚拟资产服务提供商,但似乎并非字面意义上的银行。

XREX

XREX 在 Tether Ventures 页面上被描述为「新兴市场基于 USDT 的跨境 B2B 支付提供商」,而在其官网上则被描述为「正在改变银行业的未来」。

其网站声称它是受 FinCEN 监管的货币服务企业、新加坡持牌的主要支付机构,以及台湾持牌的 VASP 反洗钱注册人。其网站似乎未提及任何银行牌照。

Tether 关于该投资的文章声称,这项投资将使 XREX 能够「在新兴市场促进合规的、基于 USDT 的跨境 B2B 支付」。此外,文章还称「XREX 将与 Unitas 基金会合作推出 XAU1,这是一种与美元挂钩的单位化稳定币,并由 Tether Gold (XAUt) 超额储备支持。」

StablR 和 Quantoz

StablR 正在欧洲推出稳定币,旨在符合《加密资产市场法规》(MiCA) 框架,并依赖于 Tether 创建的 Hadron 代币化平台。

Quantoz 是另一家打算利用 Tether 的 Hadron 平台在欧洲推出符合 MiCA 标准的稳定币的公司。Tether 曾提供自己的欧元挂钩稳定币 EURT,但该项目已被关停。

Blackrock Neurotech

或许 Tether 最奇怪的投资是 Blackrock Neurotech,一家致力于开发脑机接口的公司。

这项投资归属于「Tether Evo」旗下。Tether Evo 网站声称:「Tether 站在创新与人类潜能的交汇点,致力于推动人类进入一个技术与人类能力以前所未有的方式融合的未来。」

Academy of Digital Industries

Tether 还投资了 Academy of Digital Industries,这是一个位于格鲁吉亚的在线培训和教育平台。这项投资据称使该平台增加了关于「比特币、稳定币、点对点技术和人工智能」的课程。

Be Water

Be Water 在 Tether 宣布投资的博文中被描述为「一家专注于制作和发行音频、视频、电影和直播内容的创新媒体公司」。Ardoino 表示,这项投资符合 Tether 关于「独立媒体在塑造知情社会中重要性」的信念。

Crystal Intelligence

Tether 对区块链分析公司 Crystal Intelligence 的投资,似乎与其「通过支持执法部门和建立更安全、更有弹性的数字资产生态系统来打击非法稳定币使用」的愿望相符。Tether 还与 Crystal Intelligence 的竞争对手 Chainalysis 合作,将其整合到 Tether Hadron 平台中。

Elemental Altus

Tether 还投资了 Elemental Altus,一家贵金属特许权使用费公司。Ardoino 称这项投资符合 Tether「长期以来的信念,即像比特币和黄金这样的有形资产将支撑最持久的数字价值形式。」

Holepunch

Tether 及其姊妹公司 Bitfinex 也是 Holepunch 的幕后推手,这是一个加密的点对点通信平台,提供 Keet 视频聊天应用程序。Ardoino 同时也担任 Holepunch 的首席战略官。

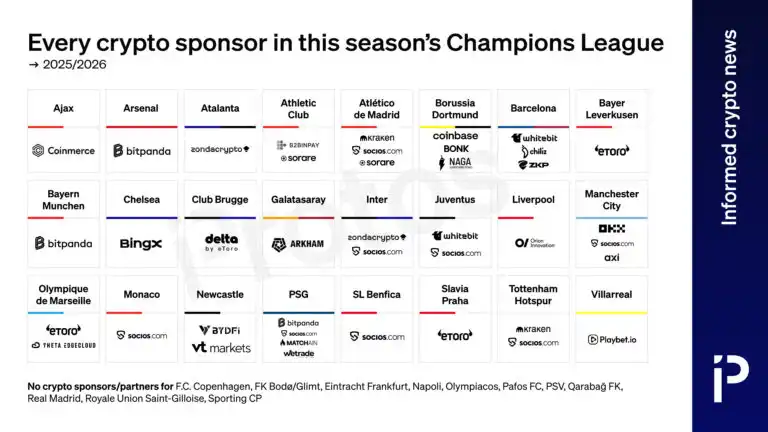

Juventus Football Club (尤文图斯足球俱乐部)

最令人费解的投资之一是 尤文图斯足球俱乐部,Tether 试图将其描述为一个「将其未来主义投资组合融入体育产业领域」的机会。这也表明 Tether 希望借此机会将「稳定币、数字资产和以人为本的技术融入日常生活」。

Zengo Wallet

Tether 将 Zengo 描述为「领先的自托管加密钱包,以注重安全性和易用性著称」,并进一步声称 Zengo 已服务 150 万用户,「未发生过一起钱包被黑客攻击、网络钓鱼或被接管的事件」。

Zengo 是一个多方计算 (MPC) 钱包,它将保护你加密货币的密钥分片存储在你自己的移动设备和 Zengo 的服务器之间。

Mansa

Mansa 声称向支付公司提供循环信贷额度,以帮助促进交易结算和客户账户的快速资金周转。此外,其网站描述了它提供的其他服务,包括场外外汇交易和「虚拟卡处理」。

Oobit

Tether 将 Oobit 描述为「一款移动支付应用程序」。Ardoino 表示,Tether 的投资是 Tether 和 Oobit「推动加密货币在全球范围内广泛采用的共同愿景」的一部分。

Adecoagro

Adecoagro 是一家农业集团,同时也投资能源生产。在 Tether 收购了该公司的多数股权后,它宣布了一项谅解备忘录,「以探索专注于比特币挖矿的战略合作」。

NAKA

NAKA 是一家声称致力于开发「自托管支付卡」的公司。Crunchbase 的数据表明 Tether 已对其进行了投资。

Twenty One

最后是 Twenty One,这是一家由 Jack Mallers 领导、Tether 拥有的数字资产财库 (DAT) 公司,它是与 Tether 最重要的托管方 Cantor Fitzgerald 合作推出的。

Twenty One 的网站声称目前持有 43,514 枚比特币。

结语

Protos 仅能确认 Tether 所作投资的大约四分之一(假设 Ardoino 所说的「120+」仍然准确)。

已确认的投资显示出这是一家触角深远、涉足加密货币行业内外的金融公司,而其余绝大部分投资仍不为人知,这使得外界几乎无法评估 Tether 的完整影响力和覆盖范围。

「原文链接」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。