【警告】你的财富密码,可能只是巨头收割的陷阱!

在这个充斥着 “十倍神话” 和 “一夜暴富” 传说的加密货币市场,散户投资者永远是那批最兴奋,却也是结局最惨烈的人。

现货 ETF 批准了又如何?当华尔街巨头带着万亿资本入场时,他们瞄准的不是技术革命,而是你口袋里那一点点 FUD(恐惧)和 FOMO(追高)驱动的资金。

本文将血淋淋地揭开一个币圈的惊天秘密:散户 90% 的亏损,不是败给了技术,而是败给了被精心设计的“情绪放大器”。 如果你不警惕,你正在成为这场资本盛宴中,巨头和 KOL 镰刀下的下一茬“韭菜”。

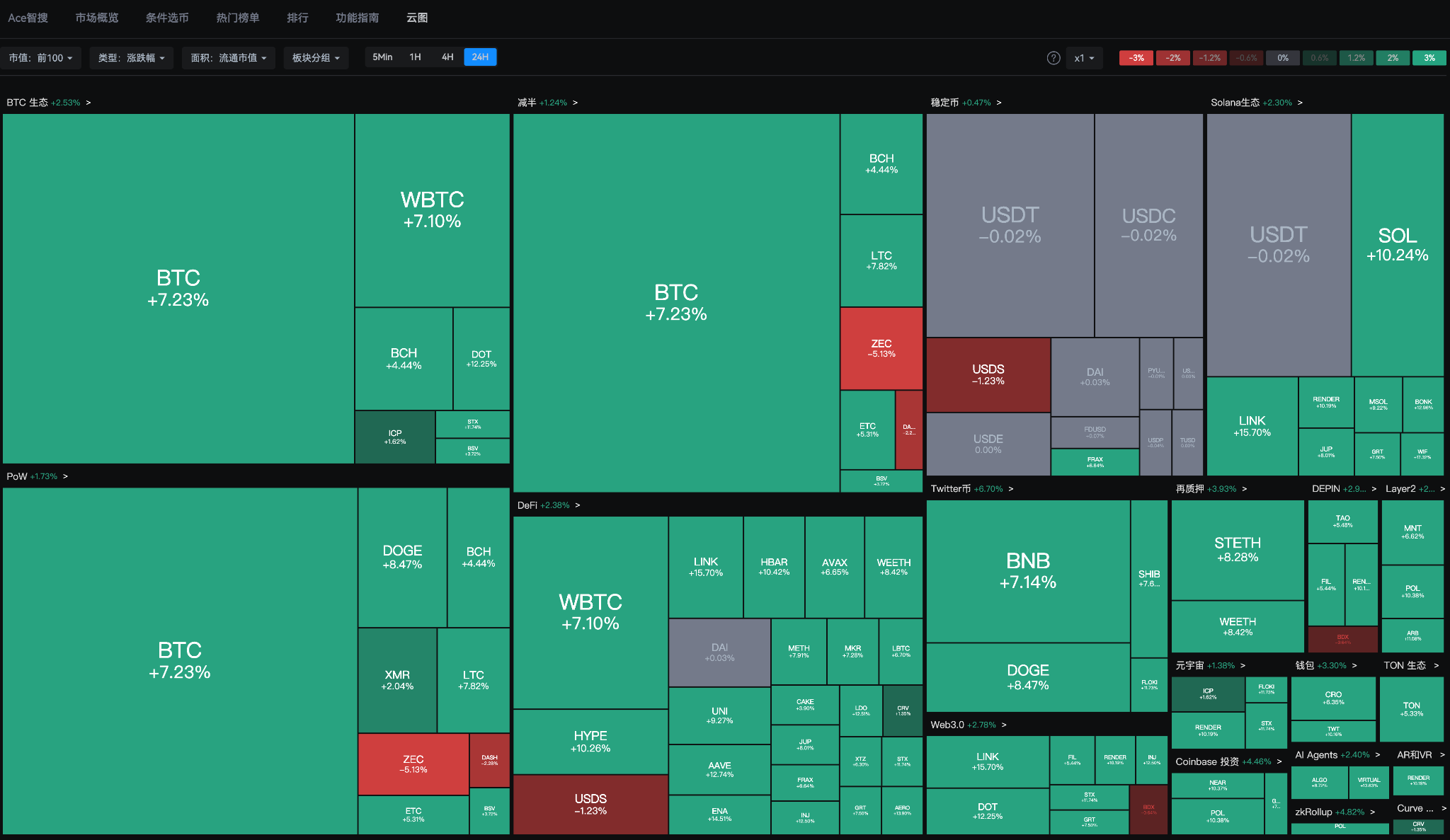

第一章:数据背后的谎言:情绪指标正在成为“杀猪盘”的掩护

你相信的那些指标,正在帮你走进陷阱!

1. 资金费率的死亡陷阱:一分钟蒸发数亿的血腥教训

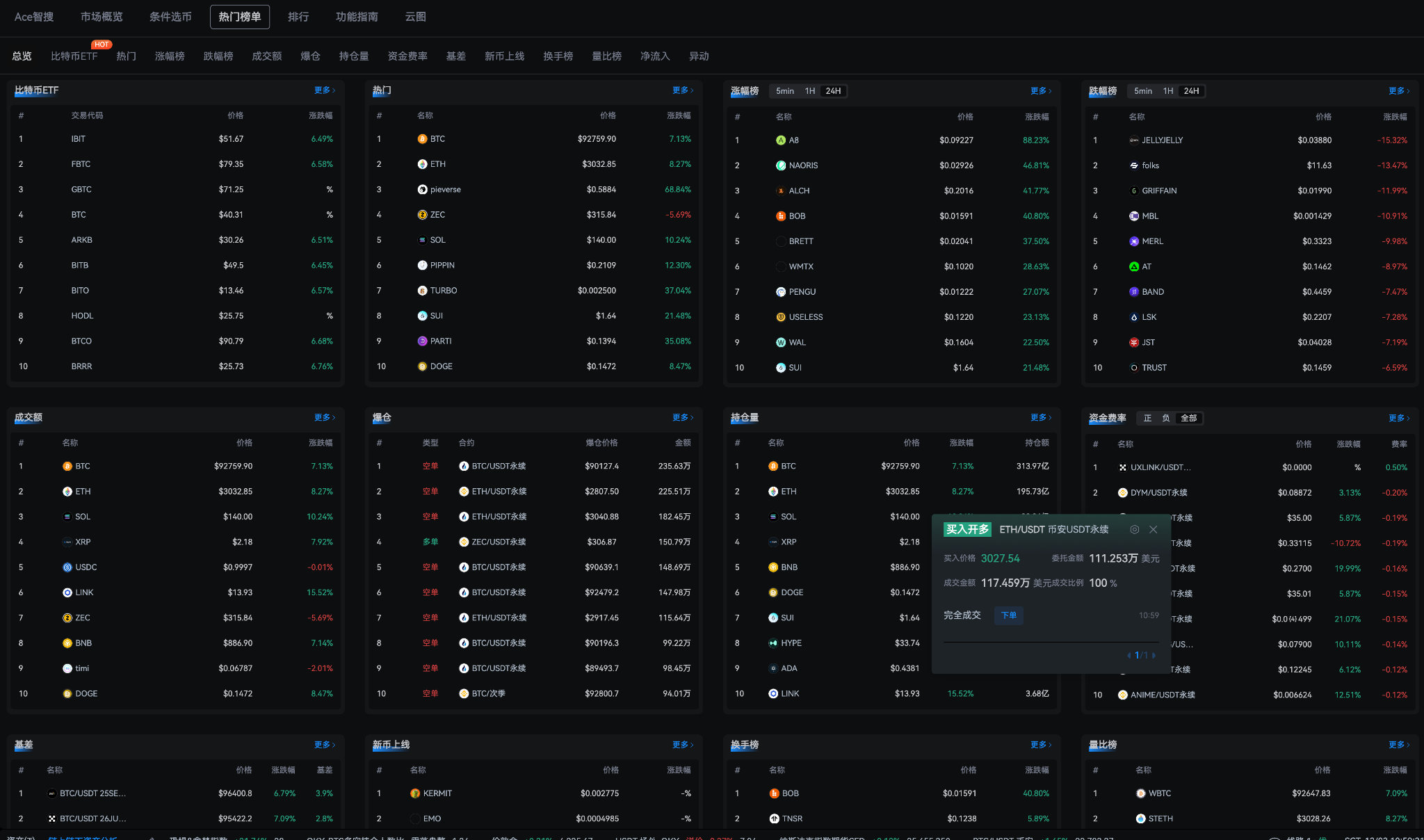

散户进入市场的唯一“优势”就是勇气,但这勇气往往被用来开了高倍杠杆。当市场一片狂热,资金费率(Funding Rates)被推高至不合理的极限时,这已经不是看涨信号,而是空头巨鲸为你设下的“定点爆破”陷阱!

- 内幕揭秘: 巨头们只需要在流动性最低的时刻,投入少量资金在市场上制造恐慌,就能瞬间引爆连锁清算,将散户的持仓在极短时间内归零——而你付出的利息,正是他们收割的利润!

2. 恐惧贪婪指数:专为“接盘侠”定制的信号灯

当指数飙升至“极度贪婪”(90+)时,你以为是全民狂欢,其实是 “主力出货” 的最后烟火。这个指标在机构化时代已经严重滞后,它更像是为散户设置的“接盘信号灯”。它让你在市场最热的时候,用最高的成本,买下了鲸鱼们准备抛售的筹码!

第二章:情绪放大器:从“财富密码”到“精准收割”的产业链

在这个信息碎片化的时代,信息源不再是指导,而是精准的情绪控制工具。

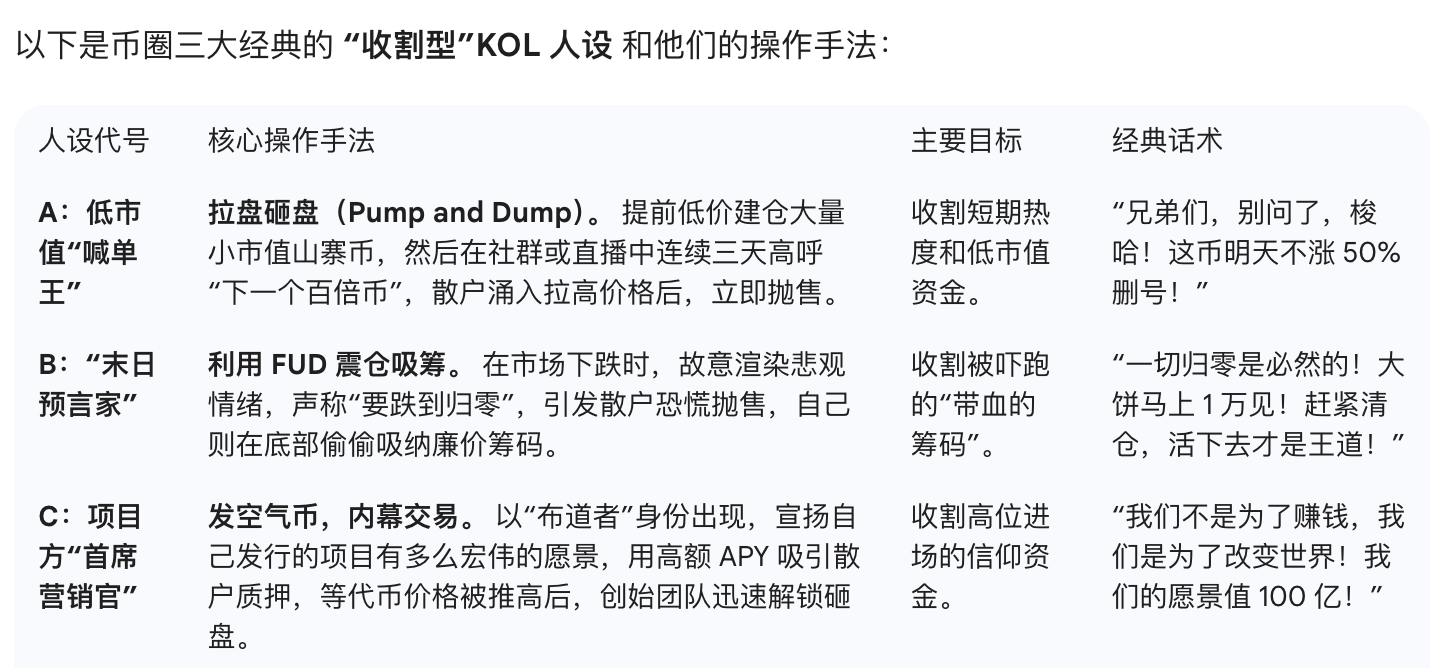

1. 部分KOL的财富逻辑:他们靠喊单赚钱,不是靠交易赚钱!

不要天真地以为那些号称“带你暴富”的头部 KOL,真的是想让你赚钱。他们的收入大头往往来自于:

- 项目方高额推广费: 为劣质、高风险的土狗项目站台,让你成为高位接盘侠。

- 交易所的返佣: 鼓励你高频交易、开高杠杆,你的每一次爆仓,都是他们账户里跳动的利润。

他们的目标不是让你成功,而是让你保持兴奋、焦虑、高频交易,从而确保他们的镰刀能持续高效地挥舞。

2. 社区共识的定价权:叙事如何在一夜之间超越技术效用?

Meme 币现象并非简单的欺骗,它代表了社区情绪和集体共识对资产的超速定价能力。

它证明了:在一个高流动性的市场中,一个病毒式传播的、引发强烈情感共鸣的叙事(Storytelling),其价值可以瞬时超越复杂的技术效用(Utility)。这种叙事估值模式极易被放大,使得价格与实际价值严重脱钩,为后来的高位崩塌埋下伏笔。

第三章:血淋淋的教训:为什么你总是“买在天花板,卖在地板”?

这无关运气,这是人性固有的两大缺陷被市场无情利用的结果。

1. 永远拿不住的盈利:处置效应的诅咒

你是否经历过:一个币赚了 20% 就赶紧跑了,生怕利润跑掉;但另一个币跌了 50% 你却死死拿着,心想“等回本就卖”?

这就是处置效应:你急于兑现小额盈利,却对巨额亏损视而不见。这种心理最终让你错过真正的百倍币,却被深度套牢在垃圾资产中。

2. 跟风的本能:巨额亏损的起源

当你在微信群、推特上看到一片“梭哈”(All-in)的狂热声时,你的理性防线会瞬间崩溃。这种羊群效应让你在市场最危险、最昂贵的顶部集体涌入,成为最后的接盘侠。

结语:逃离“情绪机器”的唯一自救指南!

如果你不想成为下一个被收割的韭菜,请立刻停止以下行为:

- 停止关注 24 小时内喊单超过 3 次的 KOL。 他们在制造热度,不是在帮你赚钱。

- 远离一切“只讲信仰、不讲逻辑”的社区。 信仰不能支付账单。

- 制定强制性交易纪律: 设定好止盈和止损点,然后像一个冷血的机器人一样执行! 你的情绪是你最大的人。

只有将情绪从你的交易决策中彻底剥离,你才能真正看清市场本质,有机会成为幸存下来的那 10%!

币圈从来没有变过:

它永远是一场概率游戏,赢的人从来不是最激进、最有信仰、最能熬的,而是最冷静、最尊重数据的人。

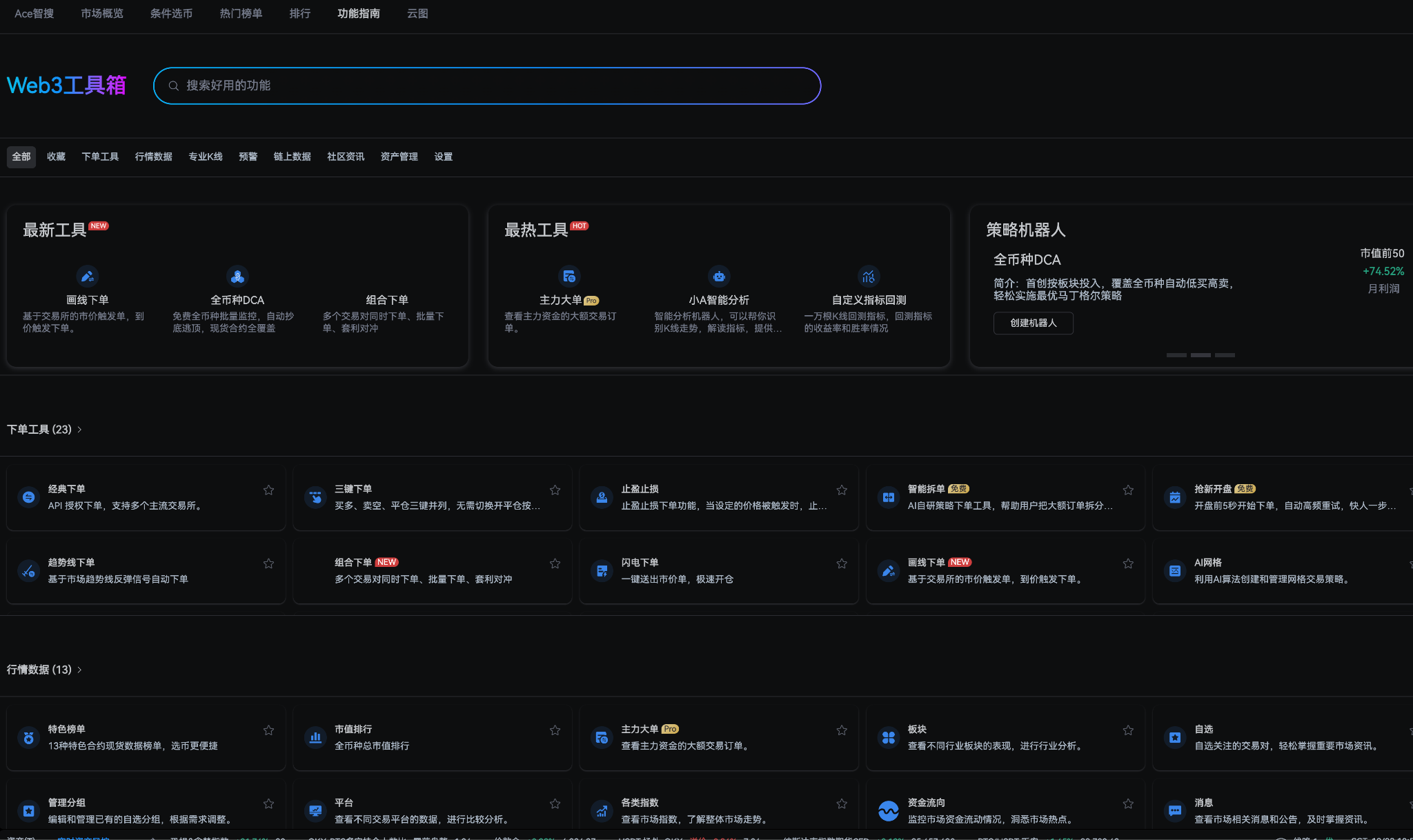

AiCoin这些年活下来,靠的从来不是营销话术,而是把最干净、最实时的链上数据、资金费率矩阵、巨鲸追踪、AI走势解读,一键摆在用户面前。

我们从不告诉你“该买什么”,

我们只帮你看清“现在到底发生了什么”。

如果你也累了,累于追热点、累于被情绪牵着走、累于一次次在高点接盘,

那就在AiCoin 沉下心来看看数据和使用它的功能吧。

这里没有喊单,没有月亮,没有梭哈。

只有冷冰冰的数据、实时预警、和一句永远不变的提醒:

市场永远是对的,错的永远是我们自己。

加入社群获取更多圈内消息

官方电报(Telegram)社群:t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

以上信息基于网上信息整理,不代表AiCoin平台观点,不构成任何投资建议,请读者自行甄别,自行把控理财风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。