Veteran futures trader Peter Brandt has affirmed his long-term bullish stance on bitcoin ( BTC), stating he is unfazed by the current price slide, which has erased all of the cryptocurrency’s 2025 gains. In a Nov. 21 post on X, Brandt declared that the current “dumping is the best thing that could happen to bitcoin,” and he projects the cryptocurrency to eventually reach $200,000 sometime in the third quarter of 2029.

Brandt’s bullish reaffirmation comes amid a prevailing bearish sentiment that has driven BTC’s price down significantly in recent weeks. The slide has fueled fears that the bull rally has run its course, prompting many investors, including long-term holders, to liquidate their holdings.

As reported by Bitcoin.com News, BTC tumbled to $80,537 on Nov. 21 as the sell-off continued, pushing the cryptocurrency down over 10% for the week and reducing its market capitalization to $1.67 trillion. Analysts attribute the decline to factors such as massive outflows from spot Bitcoin ETFs and the collapse of the macro narrative that had sustained its rally this year.

Read more: The BTC Narrative Collapse: Why Bitcoin’s Price Drop Was ‘Inevitable’ Despite ETF Hype

With BTC now more than 30% below its Oct. 6 peak of $126,080, panicking holders are adding to the selling pressure. Brandt, however, questioned the logic of “bailing out” only to wait for the next market top:

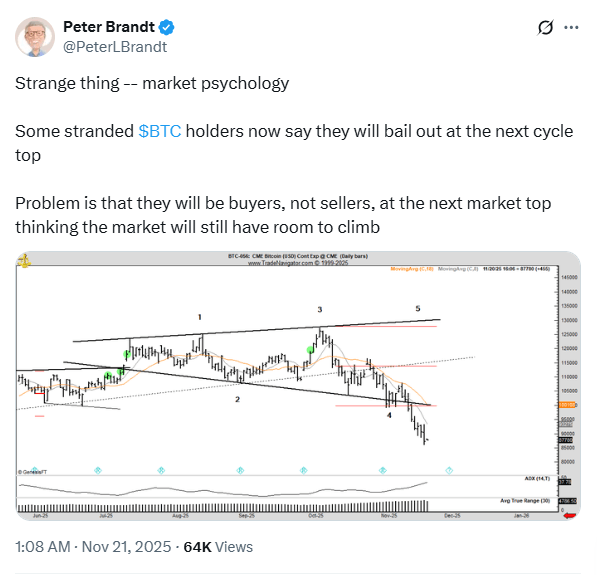

“Strange thing — market psychology. Some stranded BTC holders now say they will bail out at the next cycle top. [The] problem is that they will be buyers, not sellers, at the next market top, thinking the market will still have room to climb,” Brandt explained.

The veteran trader also reiterated his long-standing criticisms of Michael Saylor and his company’s (Strategy, MSTR) BTC accumulation model. Brandt argued that if BTC continues to slide, MSTR could be forced to offload its holdings, which would likely create “some selling pressure.”

When challenged by an X user regarding the unlikelihood of “liquidation” due to MSTR having no margin loans backed by BTC, Brandt pointed to the company’s debt levels versus its asset holdings:

“MSTR has debt to own assets. Assets are wealth. Wealth can only be turned into money when sold. His debt and BTCs represent huge supply over the market. Don’t be fooled,” the veteran trader said.

- What is Peter Brandt’s BTC forecast? He projects bitcoin could reach $200,000 by Q3 2029.

- How is BTC performing now? BTC fell to $80,537 on Nov. 21, down over 30% from its October peak.

- What factors drove the recent sell-off? Analysts cite ETF outflows and the collapse of the macro narrative.

- What criticism did Brandt make of MSTR? He warned its debt and BTC holdings could add selling pressure if prices slide.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。