South Korea’s premium has been on a tear, and based on market data pulled from major centralized exchange (CEX) platforms in the country, BTC is sitting 2.57% higher in value.

At exactly 12:20 p.m. Eastern time, bitcoin (BTC) price metrics show a spot value of $93,810, but on Upbit, the exchange rate is $96,223 per coin. Bithumb is riding the same wave, and at that exact moment, the going rate for bitcoin on the South Korean CEX clocks in at $96,121.

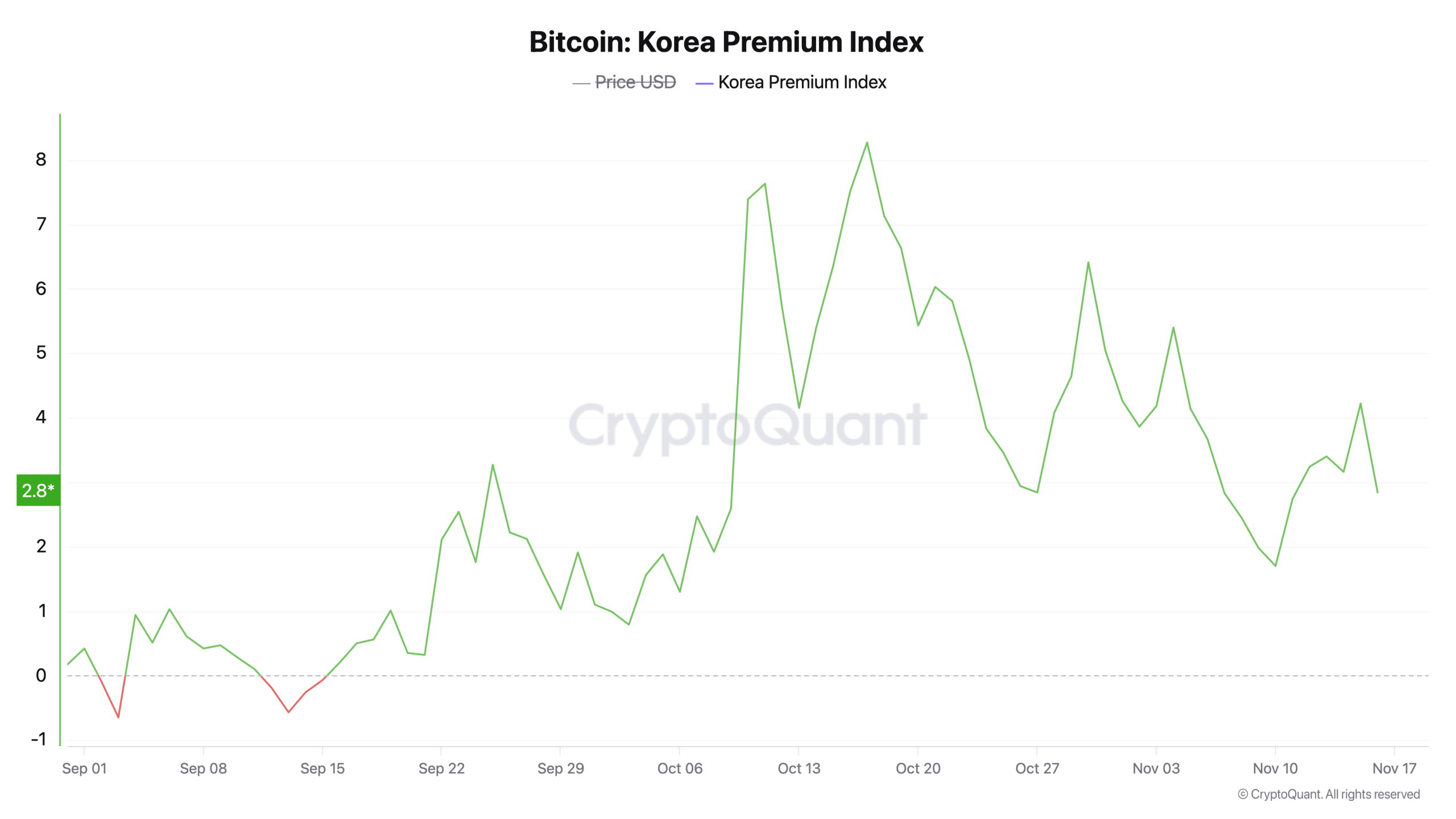

Cryptoquant.com data shows that South Korea’s bitcoin premium has been alive and kicking since Sept. 16, 2025. By the 25th, BTC’s markup in the country was sitting 3.27% above the weighted average. It continued to climb, and on Oct. 17, 2025, the price was a whopping 8.27% higher than the global rate.

Cryptoquant data shows bitcoin’s premium in South Korea has been steady for 62 consecutive days.

That means while BTC was going for $108,076 per coin that day, traders in South Korea were seeing it hit $116,949. Just two days ago, the premium pushed past the 4% mark, and even though it’s sitting at 2.57% today, it looks like this pricing heat has no plans to cool off anytime soon.

Also read: Strategy Nears 650,000 Bitcoin After Its Latest 8,178 BTC Grab

Altogether, South Korea’s bitcoin pricing has become its own spirited subplot, consistently running hotter than the global average and refusing to fall back in line. Moreover, besides the U.S. dollar, the South Korean won is bitcoin’s second-largest fiat trading pair.

With premiums bouncing between eye-catching highs and still holding firm today, the trend suggests local demand isn’t fading — and traders worldwide are keeping a close eye on the gap to see just how long this pricing fire keeps burning.

- What is the South Korean bitcoin premium? It’s the price difference where BTC trades higher on South Korean exchanges than the global average.

- Why is bitcoin more expensive in South Korea? Strong local demand and limited arbitrage channels often push prices higher.

- How high did the BTC premium recently climb? It peaked above 8% and has hovered between 2% and 4% in recent days.

- Does the premium affect global bitcoin prices? It doesn’t set global pricing, but it can signal regional demand shifts traders watch closely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。