原创|Odaily 星球日报(@OdailyChina)

作者|Wenser(@wenser 2010)

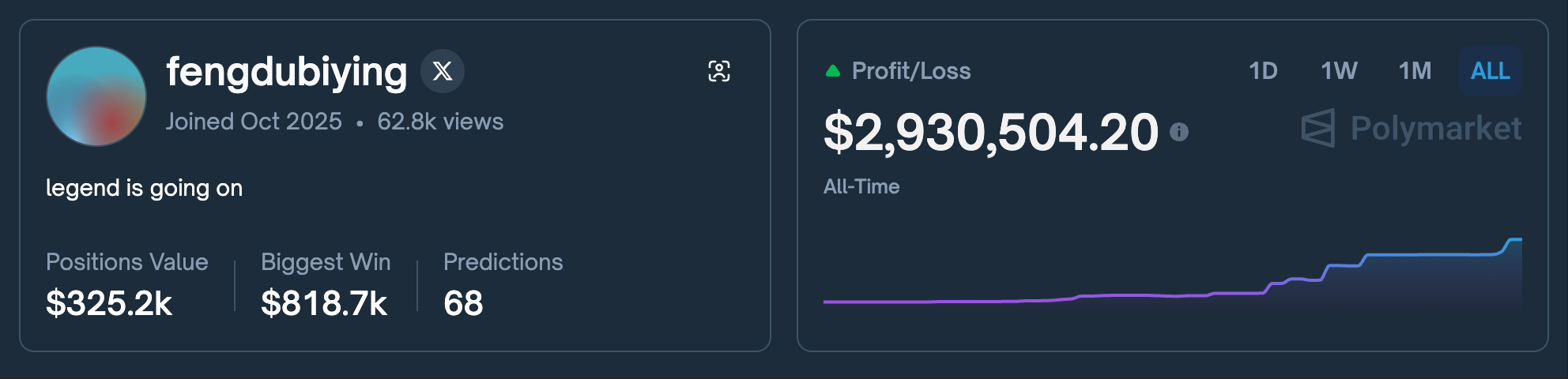

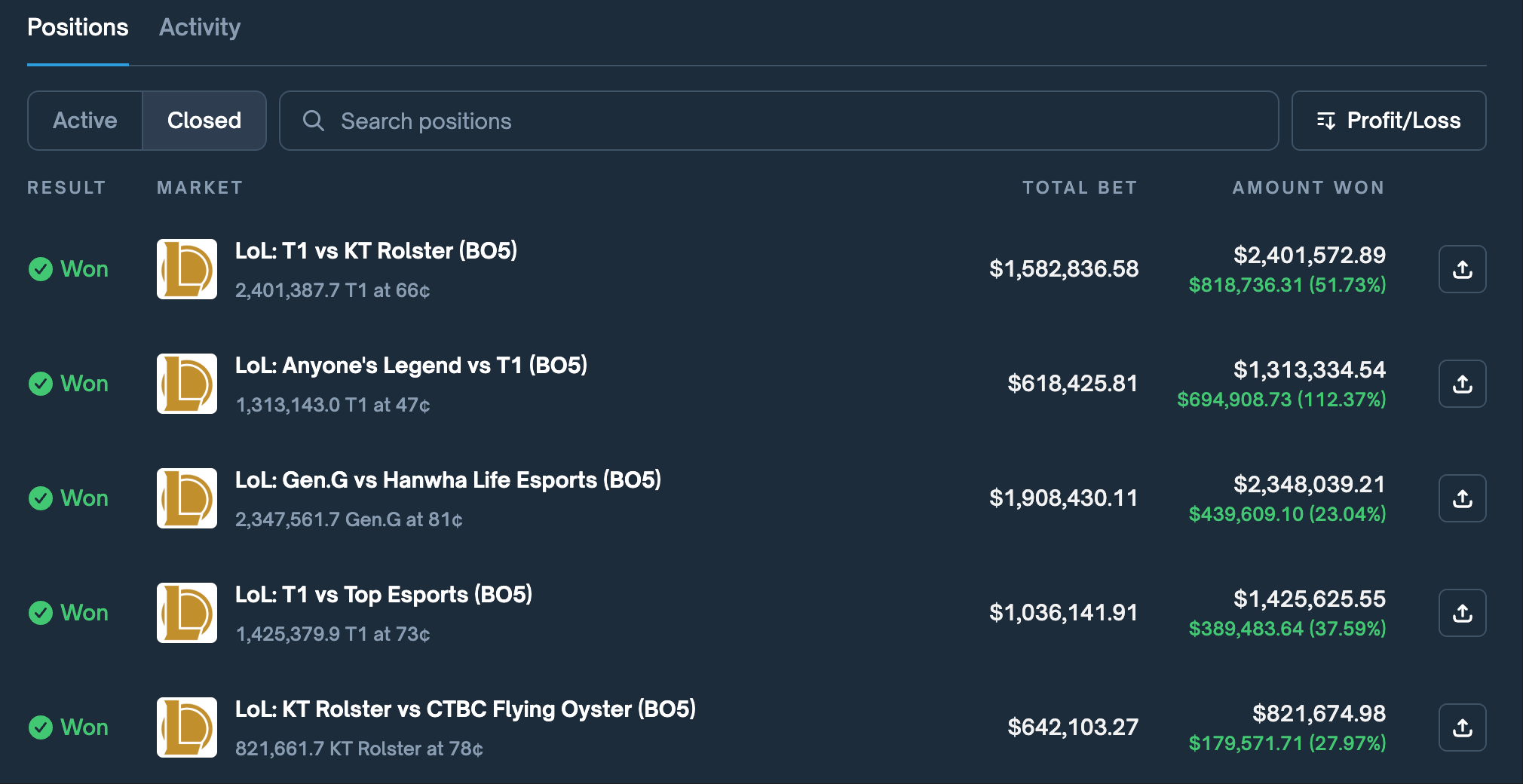

随着代币空投与重返美国市场的消息得到 Polymarket 官方的确认,预测市场成为当下市场为数不多数据仍在猛增的加密赛道。而在这样一个新兴市场上,有一个 ID 名为 fengdubiying(逢赌必赢)的交易员实现了在 25 天内资产翻了超过 225 倍的傲人战绩,从 1.3 万美元的资金开始,一路滚仓到 293 万美元的利润。他是如何在冷淡行情拿到了这样的成绩?又是如何选择押注事件标的?有哪些个人的独特策略?

带着上述疑问,Odaily星球日报 记者 Wenser 对这一 ID 背后的交易员孤狼资本(@AnselFang)进行了一场简短的采访,并将问答整理如下。

加密巨鲸之路:低谷时资产仅剩 5 万美元,一路翻转到只有 BTC 合约能容纳我

Q1:先问读者可能最为关心的问题,出于什么样的契机开始自己的 Polymarket 预测押注之旅的?

A:我个人从 NFT 入圈,完整经历了铭文、符文、Meme 币等等行业热潮,之前也取得了不少行业内的大结果,虽然最低谷时期经历了 ORDI 的波折资产缩水到了 5 万美元,但后续还是凭借自己的努力和行业趋势一步步走到了拿到大结果的程度。所以到今年,我的资金体量决定了其实只有 BTC 合约才能满足我的交易深度。但地狱级行情还是让我之前经历了一波非常大的回撤。

所以在确定 Polymarket 会发币之后,相当于是一步闲棋的心理开始了自己在 Polymarket 上的押注之旅。再加上我本人是英雄联盟世界赛资深关注者,正好赶上今年的世界赛,基于自己以往的认知,我选择了主要的押注事件在英雄联盟世界赛上面,最重要的是,这种电竞赛事的关注度相对较高,押注事件的流动性深度也相对较好,能够容纳一定体量的资金。

另外也有从合约赛道换个思路的意思,这一点我在自己之前的帖子里面也有提到,“(预测市场押注)对我来讲只是合约的保证金换了个战场而已。

(Odaily星球日报注:帖子中也有提及,其 Hyperliquid 地址最高峰利润在 900 万美元左右,避开了 10.11 大跌,空单还通过自动清算赚了约 280 万美元,但 10.11 暴跌之后流动性崩塌,开单接连出师不利。)

Q2:你在英雄联盟世界赛押注的交易策略是什么?你认为能够获取巨额利润的最大原因是什么?

A:其实主要是基于我过往对英雄联盟这款游戏的认知经验。在世界赛开始之前,我只投入了 1.3 万美元进去,然后很快就通过预测 BTC 下跌滚到了 3 万美元。后面就是世界赛瑞士轮开始后,一路从 3 万美元滚仓到 42 万美元。

主要的交易策略其实还是对于各支队伍和选手实力的了解,多数押注我都是只买盘前的,因为盘前的资金容量相对较大,可以达到数十万美元;比赛开始后的流动性就很差,很难买入卖出超过几万美元的单子了。

最主要的是,今年英雄联盟这款游戏采用全局 BP(Odaily星球日报注:即五局三胜制比赛中英雄出场次数限制在一次)机制后,BP(Odaily星球日报注:Ban/Pick,即禁用英雄/选择英雄)基本上就决定了比赛的走势。基本上游戏队伍选择了坦克类英雄就决定了他的阵容有了保底,赢面更大。

另外就是 Polymarket 的筹码买卖机制更为灵活,相当于可以执行合约开单中的止盈止损。我在 Gen.G 对阵 KT 那场比赛的 BO5 中间就有做仓位调整,最后亏损降低到了 2 万美元左右,相对于之前 Gen.G 对阵 HLE 那场赚到的 60 万美元利润来说,约等于没亏。

当然英雄联盟和足球类的体育赛事还是有点区别的,相对而言爆冷的几率会更低一些,毕竟哪只游戏队伍如果能够取得 10000 左右的经济领先,那确实相对来说很难输,不像足球可能 1、2 球就能够在几分钟内翻盘。

Q3:你觉得预测市场的事件押注和二元期权、合约开单的区别有哪些?

A:首先我觉得 Polymarket 开辟的预测市场赛道是一个非常具有创新性的产品,因为和传统的竞猜平台、线下场都不一样,在这里用户的对抗对象不是具有先天优势的“庄家”,而是其他用户与事件真相,在这个过程中,Polymarket 只是提供交易的平台,而不会做出干涉。

其次就是 Polymarket 可以看做是一条最短的认知变现路径。如果你对一件事或者一个领域拥有足够的认知和研究,那你就能够通过对事件的判断来赚钱,这个和方向更加单一的多空开单还不太一样。

再次就是前面也有提到的,Polymarket 的交易方式更为灵活,你可以挂限价单,也可以提前卖出止盈止损,而且这个过程中事件的走向是存在不同可能性的,它不是一个单纯的“Yes or No”的事件(当然,大多数押注事件仍然属于二选一的范畴)。

最后就是 Polymarket 重返美国市场已经是板上钉钉的事情了,所以说美国监管机构对于它的态度也是非常友好的,这也为预测市场之后的增长打下了铺垫和基础。

最主要的是,就英雄联盟世界赛押注来说,某种程度上来说,就我的观察,目前还没有进入主流市场的视野,还是存在一定的非对称性机会的。无论是英雄联盟背后开发商拳头,又或者那些真正资金居多的传统资本大鳄和庄家还没有把手伸到这里来,毕竟现在 Polymarket 的深度还是很难对这些人产生吸引力,投入产出比很不划算。但是随着市场的发展和预测市场的成熟,可能会有人来这里坐庄,操纵比赛或者搞内幕交易等等,所以这也是另外一种形式的“时间套利”。当然,就像我在之前的另外一篇帖子里说的,也有一定的运气成分。还要考虑到对于游戏比赛主办方来说,哪种方式的走向会更有关注度,更有话题性,这也是一个资深合约玩家的常见思路了。

单笔收益超 80 万美元

Q4:对小资金进入 Polymarket 开始押注交易的用户有什么建议吗?

A:简单来说,就是一定要玩自己有认知的事情,不懂不碰。因为押注事件是非常考验一个人的认知的,尤其是也会有内幕抢跑这些事情。所以我选择的事件是自己有一定研究的英雄联盟世界赛,策略也从一开始就决定了采用关注 BP,再加上一些队伍实力对比以及游戏层面的玄学加持(比如 T1 对中国队伍的血脉压制,Gen.G 输给 KT 等等)。

其次就是选择范围可以广一点,不一定要玩电竞比赛,政治类、宏观经济事件等等都可以参与,而且 NFL、NBA 这类体育赛事相对而言流动性会更好一些。

最后就是不要听信别人的判断去进行押注。因为这就和玩 Meme 币一样,如果你跟单别人的话就相当于别人喊单你就买,资金体量、交易策略的区别可能导致别人在这里亏钱但是其他地方赚钱,但对于小资金用户而言可能一次就被带走了。

Q5:是否有使用其他预测市场平台,如 Kalshi、BSC 生态的 Opinion 等等?

A:没有。因为 Polymarket 虽然深度一般,但产品体验确实已经是断档领先了。 Kalshi 需要 KYC,用不了;Opinion 之前也需要对应的使用码,而且和其他 BSC 生态的产品一样,很多东西都是龙头平台的“复制品”,用户体验太差了,就像 Aster 的买卖交易功能就和 Hyperliquid 差很多,这也是包括我在内的很多加密巨鲸会选择 Hyperliquid 的原因,哪怕是在 10·11 大暴跌中交易也很丝滑,这就是差距。

Q6:所有的交易都是手动操作吗?是否有用技术手段或者如押注尾盘的 AI 产品?

A:是的,所有的交易都是手动操作,我没有技术手段,包括之前玩 Meme 打合约也是手动操作。至于尾盘,我几乎不玩,还是和前面说的原因一样,你很难保证一件事情真的有极高的确定性,而有可能你为了押注尾盘获得的那点收益最后导致了自己的本金亏损,这样肯定是得不偿失的。

补充阅读:

Polymarket 前 0.7%赢家自述:如何在 1 分钟内亏损 1.9 万美元

揭发 Polymarket DAO 内部黑手党:裙带关系、双重标准和权力滥用

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。