作者:Canton Network

很多人看到 Canton Coin (CC) 的发行曲线,往往会认为其最大供应量固定为 1000 亿枚。但其实这是一个误区,本篇文章将详细解释这一问题。

动态供应,而非固定上限

Canton Coin (CC) 的供应机制与以太坊的 ETH 或 Solana 的 SOL 非常相似:理论上无限,但实际上相当稳定。

Canton Coin (CC) 的发行量没有硬性上限,但每一笔交易都会销毁 CC,从而抵消新增的发行量。随着时间的推移,发行和销毁这两种力量会围绕网络活动和市场价格达到平衡。

这意味着,当销毁率随使用量的增加而上升,总供应量将稳定在远低于理论发行曲线的水平。

FDV 和市值

对于 Canton Coin 而言,FDV 和市值实际上相同:

FDV = 市值 = 当前总供应量 × 当前市场价格

未来的供应量取决于销毁量与发行量之间的比率,取决于网络需求。

短期内,CC 通胀率将高于以太坊或 Solana,但随着发行率减半以及销毁量增加,通胀率将稳步下降。

供应如何调整

Canton 费用以 USD 计价(每 MB 交易数据),但通过销毁 CC 代币以链上兑换率支付。

当网络需求高时(即 CC 价格相对于使用量较低),销毁的 CC 代币数量增加,供应增长放缓,甚至出现通缩。

当网络活动较低时,销毁速度减慢,供应量增加。

这种动态机制形成了一种自然的销毁-发行平衡(BME),即使用量、价格和供应量之间的反馈循环。

长期均衡

一旦市场在 BME 下达到均衡,发行量和销毁量应大致平衡。

届时,总供应量应保持相对稳定,并根据长期需求缓慢调整。

由于供应量会动态调整,因此市值(而非理论上的最大供应量)才是衡量价值的正确方法。

示例说明

场景:网络在验证者和应用程序池之间达到均衡

假设:所有分配给验证者和应用程序的代币都会在一个区块内销毁

超级验证者 (SV) 奖励是唯一的通胀来源

那么,如果到 2026 年年中达到均衡,总供应量可能如下所示:

预计总供应量

2026 年 7 月: 420 亿 CC

2029 年 7 月: 480 亿 CC

2034 年 7 月: 500 亿 CC

这些估计值可能偏高。目前已有超过 10 亿 CC 代币被销毁,并且网络每天销毁价值约 90 万美元的 CC 代币。

在这种情况下,如果 SV 是唯一的发放来源,则年通胀率约为 3250 万 CC,或以 400 亿 CC 为基准,年通胀率低于 0.1%。

关键发行里程碑

Canton 代币动态供应中最重要、且即将到来的事件是 2026 年 1 月 1 日的减半,这将导致超级验证者 (SV) 的代币数量的双重减半。

首先,每个区块的总发行量将减半。

其次,由于更多奖励将分配给验证者和应用程序,SV 在该发行量中所占的份额将从 48% 下降到 20%。

三年后,类似的「双重减半」将再次发生:

总发行量再次减半,并且 SV 的份额再次下降,从 20% 下降到 10%。

这种叠加效应意味着,一旦网络在验证者和应用程序之间达到销毁-铸造平衡 (BME),SV 池将成为主要的、并且迅速萎缩的新发行来源。

到 2030 年代初,SV 的发行量将仅占总供应量的一小部分,这使得 Canton Coin 的通胀率成为主流 Layer 1 网络中最低的通胀率之一。

结语

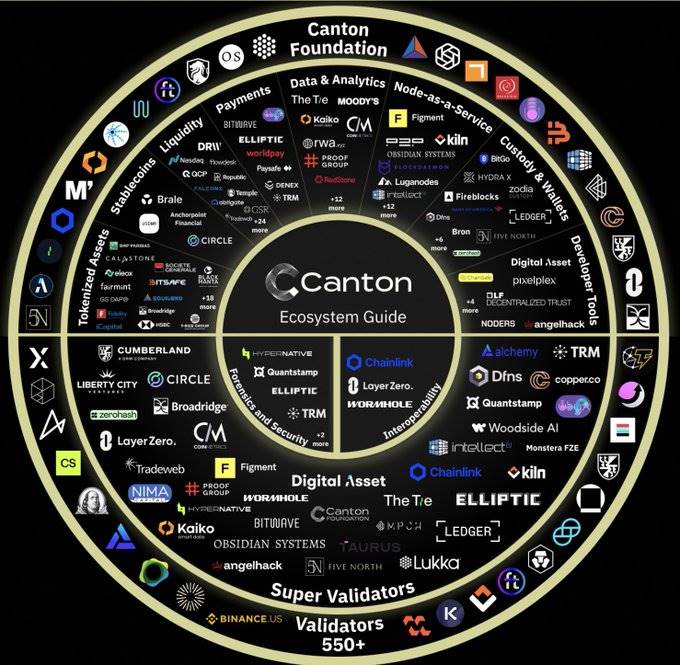

与任何具有弹性的网络一样,价值会随着效用而增加。通过费用消耗机制,每笔交易都会促进资源的稀缺性和一致性。Canton 生态系统正在生动展示这种动态过程。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。