买!就现在!比特币的“最后一跌”与流动性拐点已至

市场恐慌之际,巨鲸正在抄底。当流动性潮汐转向,机遇之窗不会长久开启。

“Buy Now”(现在就买)——11月8日,MicroStrategy创始人迈克尔·塞勒用简洁有力的两个单词,向市场传递了明确信号。这条推文迅速获得5.6M浏览量、43K点赞,市场情绪悄然生变。就在同一天,SoSoValue研究报告指出,比特币可能正处于“最后一跌”阶段。

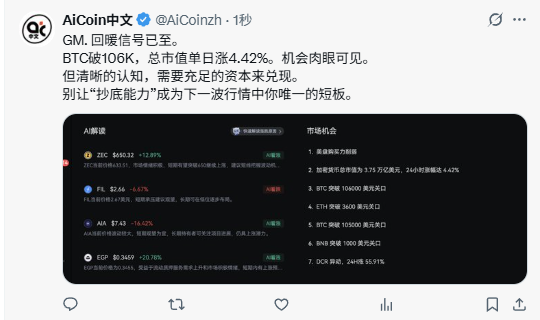

而到11月9日,AiCoin数据显示BTC已突破106,000美元,总市值单日涨幅达4.42%。市场回暖信号已经出现,而大多数人还在犹豫。

01 市场信号:从巨鲸喊单到实际突破

迈克尔·塞勒不仅是比特币的长期布道者,更是实践者。他的推文“Buy Now”发布时,其公司持有的比特币投资组合价值已达654.5亿美元,持有641,205枚BTC,平均成本74,058美元,浮盈37.82%。

这不是普通的喊单,而是有真实持仓支撑的市场信心。 塞勒的另一条推文“Best Continue”(最好继续)则发布于投资组合显示强劲回报之时,传递出持续增持的决心。

市场对此迅速响应:11月9日,BTC突破106,000美元关口,ETH突破3600美元,BNB突破1000美元。加密货币总市值单日增长4.42%,达到3.75万亿美元。ZEC等中小市值代币更是出现单日超过12%的涨幅,市场风险偏好明显回升。这些数据印证了塞勒的喊单不是空穴来风,而是有实际资金流入支撑。

02 流动性分析:美国财政部的“抽水机”即将关闭

当前比特币价格波动的核心驱动力并非来自加密货币内部,而是源于传统金融体系的美元流动性变化。美国财政部TGA账户余额已接近1万亿美元,像一台巨大“抽水机”吸走市场流动性。这一异常现象的直接原因是美国政府关门危机:财政部为应对可能出现的政府停摆,提前大规模发债储备现金。流动性紧张的具体表现已经显现:

- SOFR与FDTR利差扩大至+30bp,表明银行间融资成本升高

- 美联储被迫重启隔夜回购操作,向市场注入近300亿美元流动性

- 这是自2019年回购危机以来首次出现此类操作

美元流动性=银行准备金+流通现金=美联储资产负债表总规模-ON RRP-财政部TGA账户。这个平衡方程中,TGA账户的异常高位直接导致可投资于风险资产的美元减少。

03 转折点预测:11月中旬的流动性拐点

流动性紧缩是暂时的,政策缓和与财政支出恢复有望成为比特币反弹的催化剂。美国政府关门天数已刷新历史峰值,财政、经济与民生压力急剧累积。两党对峙出现缓和迹象,市场普遍预期参议院将在11月15日感恩节休会前推动妥协方案。

高盛等机构预测,政府将在11月10日至15日期间重新开门。一旦政府重启,财政部将恢复支出,TGA账户余额会从高位回落,被锁定的流动性将重新涌入市场。历史数据表明,TGA账户下降通常伴随流动性释放和风险资产上涨。

2019年类似情况发生后,美联储不仅进行了定期回购,更开启了新一轮量化宽松。这次的剧本可能重演: 美联储已通过回购操作向市场注入流动性,若政府开门后TGA账户资金释放,将形成双重流动性利好。

04 比特币的敏感性与历史机遇

比特币对流动性高度敏感,这在纳指创新高而BTC承压的背离中表现得尤为明显。作为不生息资产,比特币的价格很大程度上取决于美元流动性的充裕程度。当前BTC的弱势正是对美元流动性紧缩的直接反应。

然而,这种敏感性是一把双刃剑:当流动性恢复时,比特币的反弹力度同样会超过传统资产。历史数据显示,比特币与美元流动性存在高度正相关关系。当前很可能就是市场所说的“最后一跌”阶段——在财政支出恢复与未来降息周期开启的交汇点,新的流动性周期即将重启。截至11月9日的数据显示,回暖信号已经至。

ZEC等代币大幅上涨,BTC突破106,000美元,市场机会肉眼可见。但清晰的认知需要充足的资本来兑现。机构投资者已经布局,散户投资者仍在观望。当政府开门解决方案落地,流动性闸门重新打开,市场不会给犹豫者第二次机会。

买,就现在!

法币入金,0手续费

注册Bitmart,$14,000+迎新豪礼轻松领

https://jump.do/zh-Hans/xlink-proxy?id=13

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

bitmart福利群:https://aicoin.com/link/chat?cid=54wgQno6O

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。