CoinW Research Institute

Key Points

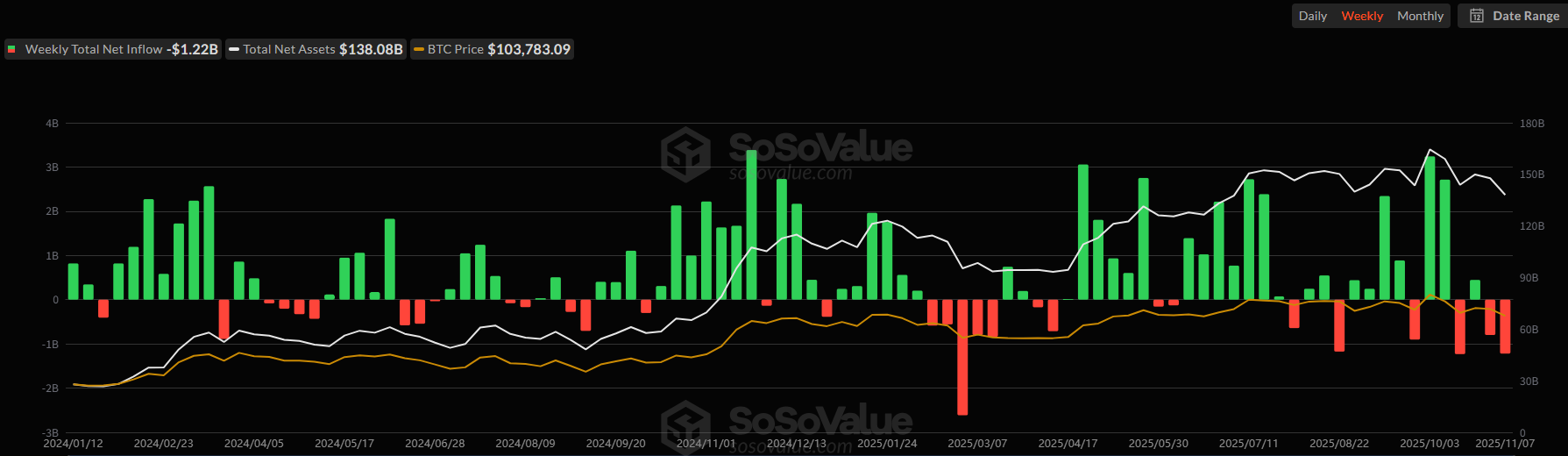

The total market capitalization of cryptocurrencies is $3.63 trillion, down from $3.91 trillion last week, representing a decrease of approximately 7.16% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $59.97 billion, with a net outflow of $1.22 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $13.86 billion, with a net outflow of $508 million this week.

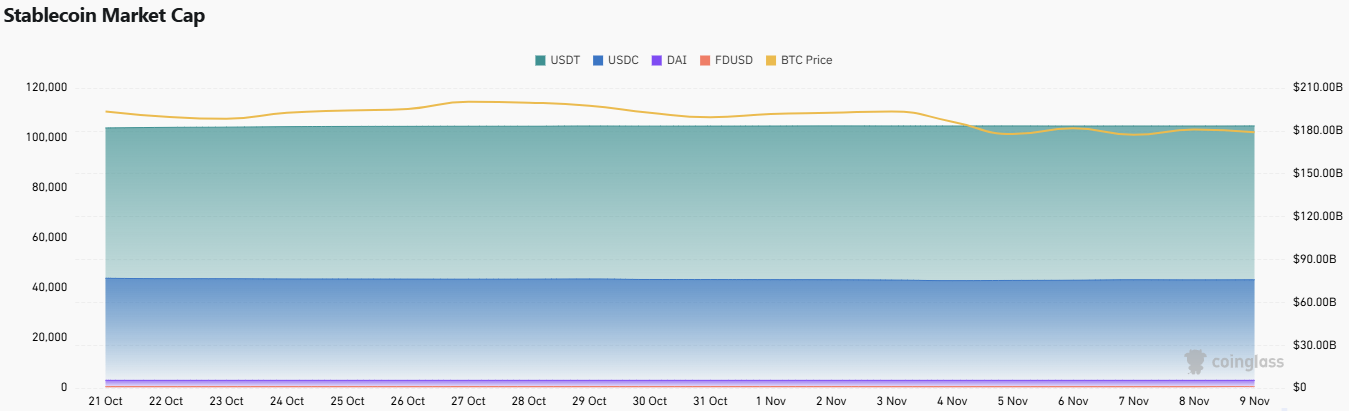

The total market capitalization of stablecoins is $311 billion, with USDT having a market cap of $183.5 billion, accounting for 59% of the total stablecoin market cap; followed by USDC with a market cap of $75.8 billion, accounting for 24.37% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 1.73% of the total stablecoin market cap.

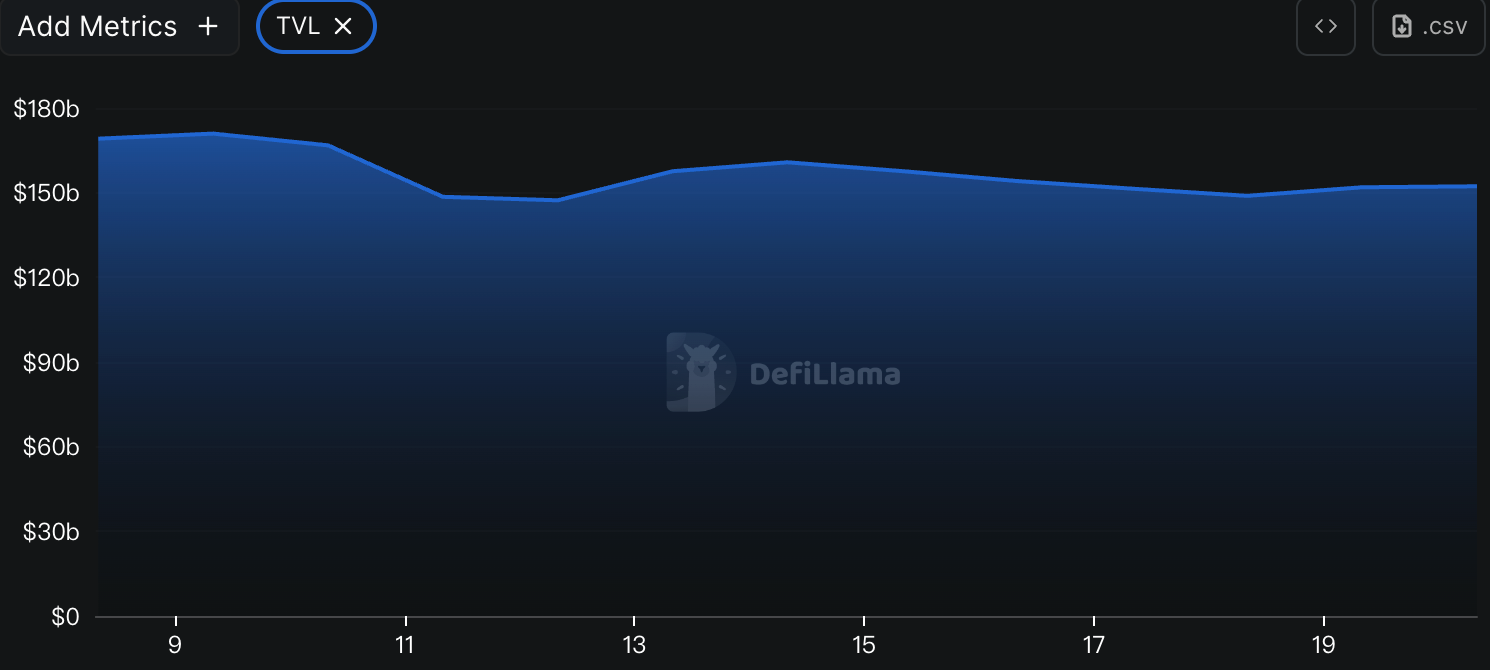

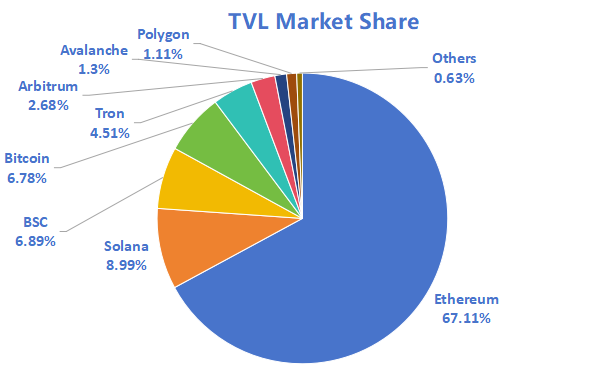

According to DeFiLlama, the total TVL of DeFi this week is $134.4 billion, down from $149.6 billion last week, a decrease of approximately 10.16%. By public chain, the top three chains by TVL are Ethereum, accounting for 67.11%; Solana, accounting for 8.99%; and BNB Chain, accounting for 6.89%.

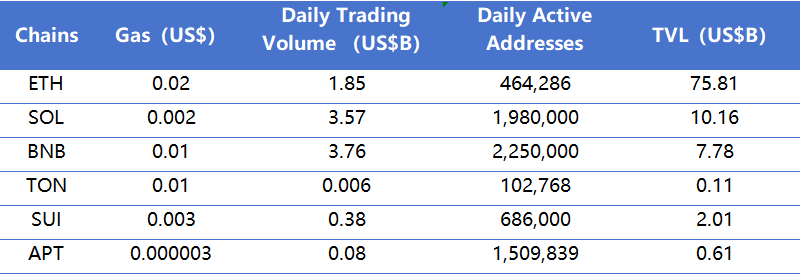

This week, the performance of various public chains has diverged, with overall activity slightly declining. Sui performed the strongest, with daily trading volume increasing by 68.1% and TVL growing by 20.4%. Although active addresses decreased by 5.8%, there was a noticeable inflow of funds. Ethereum performed the weakest, with daily trading volume decreasing by 37.5% and TVL dropping by 11.1%. Despite a 5.4% increase in active addresses, funds continued to flow out. Ton had the largest increase in daily trading volume, rising by 77.5%, but active addresses decreased by 26.2%, and TVL slightly declined by 2.7%. BNB Chain's daily trading volume increased by 45.0%, active addresses decreased by 5.5%, and TVL fell by 7.0%. Solana's daily trading volume grew by 18.6%, active addresses decreased by 2.5%, and TVL dropped by 9.3%. Aptos saw a 13.0% decrease in daily trading volume, a 0.7% decrease in active addresses, and a 6.2% decline in TVL. In terms of transaction fees, Ethereum increased by 100%, Sui decreased by 25%, while other public chains remained stable. Overall, except for Sui, which performed outstandingly in trading, other public chains generally entered an adjustment phase.

New Project Focus: Cypher aims to create a community-owned, open, and transparent capital and liquidity infrastructure, returning financing, token issuance, and trading markets to their decentralized essence; duel.trade attempts to build a user-centric decentralized opinion and market game platform by combining on-chain prediction mechanisms with social incentives, making predictions not just speculative actions but a process of community consensus and information discovery; PolyScalping is a data and analysis tool designed specifically for Polymarket traders, aimed at enhancing trading efficiency and strategy execution in prediction markets.

Table of Contents

Key Points

I. Market Overview

Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-chain Data

Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

The total market capitalization of cryptocurrencies is $3.63 trillion, down from $3.91 trillion last week, representing a decrease of approximately 7.16%.

Data Source: cryptorank

Data as of November 9, 2025

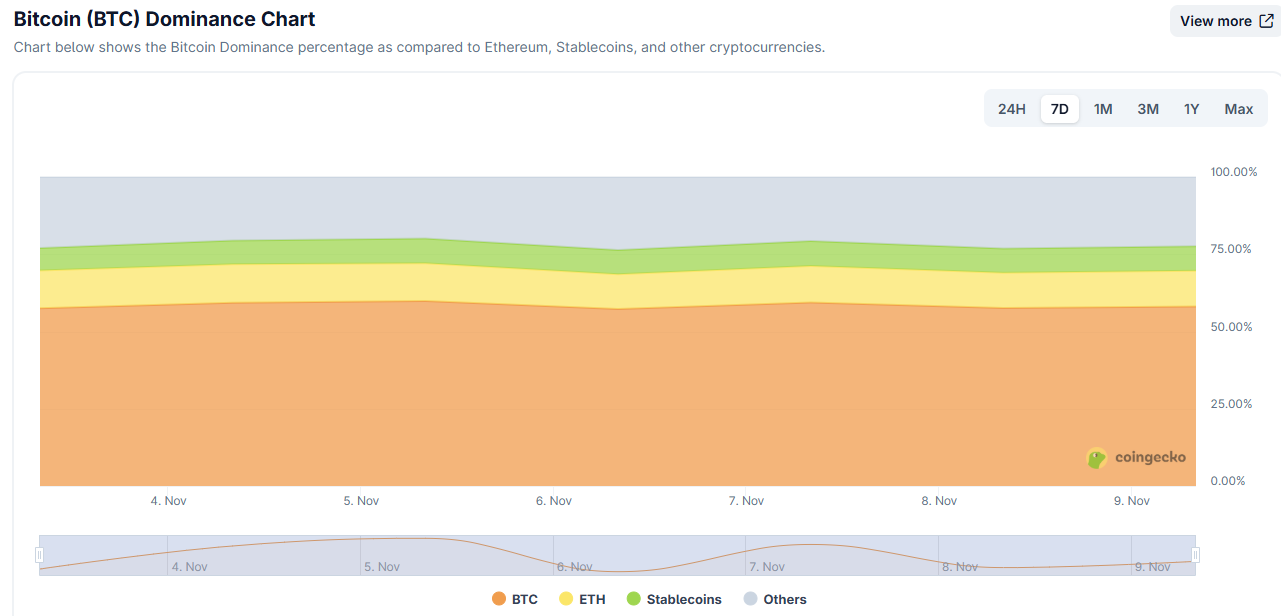

As of the time of writing, the market cap of Bitcoin is $2.12 trillion, accounting for 57.76% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $311 billion, accounting for 8.48% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of November 0, 2025

2. Fear Index

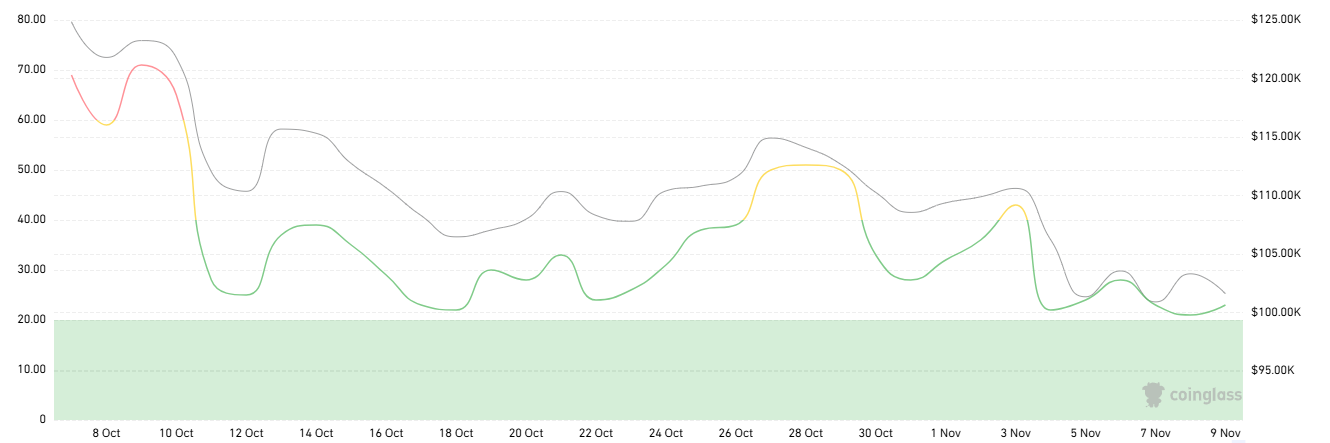

The cryptocurrency fear index is 23, indicating fear.

Data Source: coinglass

Data as of November 9, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $59.97 billion, with a net outflow of $1.22 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $13.86 billion, with a net outflow of $508 million this week.

Data Source: sosovalue

Data as of November 9, 2025

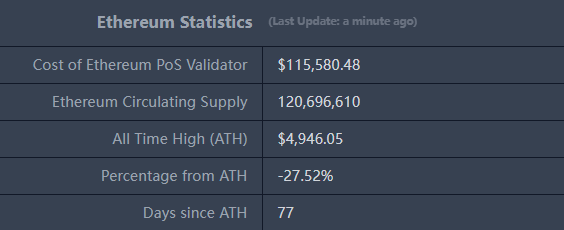

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $3,615, historical highest price $4,946.05, down approximately 27.52% from the highest price.

ETHBTC: Currently at 0.034144, historical highest at 0.1238.

Data Source: ratiogang

Data as of November 9, 2025

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $134.4 billion, down from $149.6 billion last week, a decrease of approximately 10.16%.

Data Source: defillama

Data as of November 9, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 67.11%; Solana, accounting for 8.99%; and BNB Chain, accounting for 6.89%.

Data Source: CoinW Research Institute, defillama

Data as of November 9, 2025

6. On-chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APTOS based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of November 9, 2025

Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, the largest increase in daily trading volume was on the Ton chain, rising by 77.5%; Sui increased by 68.1%; BNB Chain increased by 45.0%; Solana increased by 18.6%; while Ethereum decreased by 37.5% and Aptos decreased by 13.0%. In terms of transaction fees, Ethereum increased by 100%, Sui decreased by 25%, while other chains remained stable compared to last week.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, the Ton chain saw the largest decline, down 26.2%; Sui decreased by 5.8%; BNB Chain decreased by 5.5%; Solana decreased by 2.5%; Aptos decreased by 0.7%; only Ethereum increased by 5.4%. In terms of TVL, Sui had the largest increase, up 20.4%; Ethereum decreased by 11.1%; Solana decreased by 9.3%; BNB Chain decreased by 7.0%; Aptos decreased by 6.2%; and Ton chain decreased by 2.7%.

Layer 2 Related Data

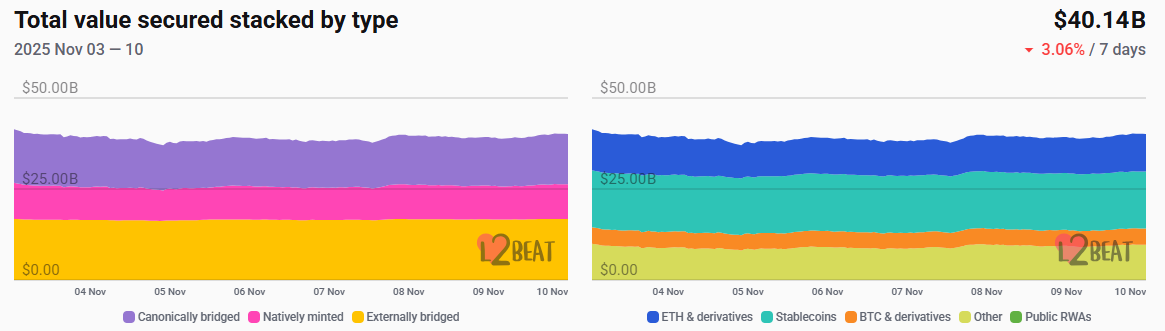

According to L2Beat, the total TVL of Ethereum Layer 2 is $40.14 billion, down from $41.7 billion last week, with an overall decline of 3.06%.

Data Source: L2Beat

Data as of November 9, 2025

Base and Arbitrum occupy the top positions with market shares of 38.26% and 35%, respectively. This week, Arbitrum ranked first in TVL among Ethereum Layer 2.

Data Source: footprint

Data as of November 9, 2025

7. Stablecoin Market Cap and Issuance

According to Coinglass, the total market cap of stablecoins is $311 billion, with USDT having a market cap of $183.5 billion, accounting for 59% of the total stablecoin market cap; followed by USDC with a market cap of $75.8 billion, accounting for 24.37% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 1.73% of the total stablecoin market cap.

Data Source: CoinW Research Institute, Coinglass

Data as of November 9, 2025

According to Whale Alert, USDC Treasury issued a total of 2.077 billion USDC this week, while Tether Treasury did not issue any USDT this week. The total issuance of stablecoins this week is 2.077 billion, down approximately 1.8% from last week's total issuance of 2.115 billion.

Data Source: Whale Alert

Data as of November 9, 2025

II. This Week's Hot Money Trends

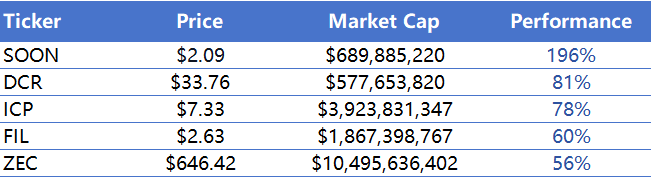

1. Top Five VC Coins and Meme Coins by Growth This Week

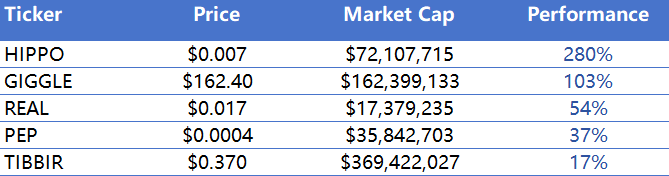

The top five VC coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of November 9, 2025

The top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of November 9, 2025

2. New Project Insights

Cypher is a decentralized capital formation and trading platform designed specifically for Ethereum Layer 1, aiming to reshape the liquidity foundation of Ethereum. Cypher believes that liquidity is the lifeline of any blockchain, and currently, Ethereum's trading volume is still mainly concentrated in fragmented, venture capital-led protocols. It aims to return financing, token issuance, and trading markets to their decentralized essence by building a community-owned, open, and transparent capital and liquidity infrastructure.

duel.trade is a social layer for prediction markets built on the Base and Kalshi protocols. By combining on-chain prediction mechanisms with social incentives, duel.trade aims to create a user-centric decentralized opinion and market game platform, making predictions not just speculative actions but a process of community consensus and information discovery.

PolyScalping is a data and analysis tool designed specifically for Polymarket traders, aimed at enhancing trading efficiency and strategy execution in prediction markets. PolyScalping helps users capture short-term profit opportunities in a rapidly changing market by aggregating real-time market data and arbitrage opportunities, and supporting custom price alerts and yield calculations. Launched in 2025, PolyScalping positions itself as an intelligent auxiliary layer for the Polymarket ecosystem, providing precise and actionable decision support tools for professional traders and data-driven investors, further improving the infrastructure of decentralized prediction markets.

III. Industry News

1. Major Industry Events This Week

On November 5, Intuition officially announced the launch of its token TRUST airdrop. The eligibility for the first season airdrop is determined by two metrics: IQ points and Orbit roles, which measure user activity and community contribution during the testing phase. IQ points include protocol points, launchpad points, portal points, community points, referral points, and relic points, rewarding users for multidimensional participation in product usage, promotion, and interaction. The Orbit role symbolizes the leadership and mission of community members, with levels ranging from 1 to 7; the higher the level, the greater the airdrop weight. This design reflects Intuition's deep practice of the "contribution equals value" concept, promoting ecological growth through incentivizing multi-level participation.

The AI agent project Capx AI completed its TGE on November 4 and announced an airdrop update, but the distribution was temporarily delayed due to a front-end technical issue with Uniswap. The team emphasized that this issue is unrelated to contract and token security, and all funds remain 100% safe. It was confirmed that the issue stemmed from indexing limitations of Arbitrum's native USDC. Currently, Capx AI has reopened the airdrop claim window, which will be available from November 7 to November 20, providing users ample time to complete their claims.

The decentralized project Aster announced that its second phase airdrop claim has officially ended on November 14. This phase primarily targeted early ecosystem participants and testing users, rewarding their support in product development and community building. With the end of the airdrop, Aster is expected to enter the next phase of mainnet incentives and governance deployment, further expanding community activity and promoting the application scenarios of tokens within the ecosystem.

The Solana ecosystem lending protocol Kamino officially announced the launch of its Season 5 incentive program, which will last for three months, with a total distribution of up to 100 million KMNO tokens. Rewards from the previous season (Season 4) will gradually unlock starting November 12, over a period of six months. Kamino continues to attract liquidity and user participation through quarterly incentive mechanisms, forming a stable ecological growth cycle. This new season's activities are expected to further strengthen the protocol's dominant position in the Solana lending market.

On November 8, Hourglass officially announced that the second phase deposit window for its Stable pre-deposit vault has closed. This phase attracted approximately 26,000 wallets, with total deposits reaching $1.8 billion, demonstrating strong market trust and demand for its yield products. Hourglass stated that it will further optimize the vault's yield structure and distribution mechanism in subsequent phases to ensure capital efficiency and long-term sustainable growth.

2. Major Upcoming Events Next Week

Solana officially announced that the submission deadline for the x402 hackathon is set for November 11. This event features five tracks: trustless agents, x402 API integration, MCP servers, x402 development tools, and x402 agent applications, with a maximum prize of $10,000 for each track. The x402 hackathon aims to promote developer innovation within the Solana ecosystem, encouraging more teams to explore the combination of underlying infrastructure and smart agent applications, further expanding Solana's application boundaries and development ecosystem depth.

Reddit announced that it will terminate the avatar creator program and will no longer accept new submissions, while the avatar store will remain open until November 11. Users can continue to use the collectible avatars they have purchased, but profile display and NFT transfer functions will be removed. Reddit emphasized that avatars remain an important way for users to express themselves and promised that all secondary market royalties will be 100% allocated to creators, with contract updates to automatically distribute earnings in the next three weeks. Additionally, Reddit will remove the Vault wallet feature from the app, and users must export their seed phrases to save their assets by January 1, 2026.

The AI data ecosystem project Codatta announced that its second season airdrop is about to launch, introducing new task types and optimized incentive mechanisms to further encourage active participation from data contributors and model evaluators. The project team also revealed that a Codatta mobile application will be released in the next three months, providing users with a smoother experience for data uploading, labeling, and model interaction. As an important part of the KITE AI ecosystem, Codatta aims to build a community-centered decentralized data market, promoting the openness and trustworthiness of AI model training.

Layer 1 blockchain Monad and its native token MON will officially launch on November 24. The Monad Foundation opened the token claim portal from mid-October to November 3 for eligible users to check and claim their allocations. At launch, Monad will integrate with mainstream decentralized applications such as Uniswap, Magic Eden, and OpenSea, and will fully support major wallets like OKX, Backpack, MetaMask, and Rabby. Monad aims to create a new generation of Ethereum-compatible public chains through high-performance architecture and modular design.

The Solana re-staking platform Solayer announced that its self-developed InfiniSVM development network will launch the mainnet Alpha version in the fourth quarter of 2025 after 11 months of secret development. InfiniSVM aims to achieve cross-protocol validation layer abstraction and re-staking shared security mechanisms, introducing more efficient validation computation and decentralized governance capabilities to the Solana ecosystem. This release marks Solayer's transition from the experimental phase to the infrastructure implementation phase, opening new technical space for the expansion of Solana's re-staking ecosystem.

3. Important Investments and Financing from Last Week

Lava completed a new round of financing of $200 million, with participation from well-known angel investors Anthony Pompliano and Eric Jackson, among others. Founded in 2022, Lava is a fintech platform focused on Bitcoin-backed loans, aiming to provide users with dollar liquidity without selling their Bitcoin. Lava ensures the security of collateral and transparency of the loan process through crypto proof and automated liquidation mechanisms, helping users earn interest on their holdings and borrow freely in a self-custody environment. (November 4, 2025)

Tharimmune announced the completion of $540 million in financing, with participation from Liberty City Ventures, DRW Venture Capital, Polychain, and Kraken, among others. This round of financing is Tharimmune's post-IPO private round. Tharimmune is a clinical-stage biotech company focused on developing innovative therapies for inflammatory and immune diseases. The company is also exploring the integration of traditional life sciences and digital assets, aiming to build a new model of research and financing driven by crypto assets. (November 4, 2025)

Ripple completed a $500 million financing round, reaching a valuation of $40 billion, with participation from top institutions such as Pantera Capital, Galaxy Digital, BH Digital, Citadel Securities, Marshall Wace, and Fortress Investment Group. Ripple, founded in 2012, is a provider of international remittance and settlement solutions based in the United States. (November 5, 2025)

IV. Reference Links

Cypher: https://x.com/cypher_ethereum

PolyScalping: https://x.com/PolyScalping

Lava: https://x.com/lava_xyz

Tharimmune: https://tharimmune.com/

Ripple: https://x.com/Ripple

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。