币圈资讯

11月9日热点;

1.巴基斯坦拟考虑发行卢比支持的稳定币,正在开发CBDC试点

2.Hourglass:Stable预存款金库二阶段KYC链接将于明日发布

3.加密恐慌与贪婪指数跌至20“极度恐慌”状态,创过去7个月最低水平

4.Coinbase官方发文暗示或将推出 Launchpad 平台

5.因陪审团未达成一致,纽约涉 2,500 万美元以太坊 MEV 案宣告审判无效

交易心得

交易的胜负手:技术之外,是“人”的修行 一、技术是工具,人是核心 多数人执着于“稳赚系统”“精准指标”,却忽略了关键:技术(术)只是交易的工具,在道、法、术、器、气五层体系中,它是最易复制的部分。EMA、趋势突破、VWAP等方法,网上教程随处可寻,但懂技术≠能盈利——问题不在技术本身,而在人能否驾驭技术。 二、执行力差,是交易亏损的根源 同样的技术,有人盈利有人亏,核心差距在执行力: 1、自称趋势交易者,却止损不舍、盈利不敢拿;2、做突破策略,价格突破时却因怕回踩而不敢进场。本质是控制不住自己——知道该做什么,却做不到。 三、生活的执行力,映射交易的潜力 交易中的纪律性,与生活细节高度一致: 1、说每天练琴,是否坚持?说控制糖分,是否做到?2、连生活小事都难以执行,何谈交易中比他人更自律?生活中的松散,就是交易中纪律差的缩影。 四、反人性,是交易的“内功” 交易的关键是“反人性”,这与生活中锤炼的意志力一脉相承: 1、交易中,该止损时立刻止损,不该交易时坚决空仓,想重仓时克制仓位;2、生活中,不想健身却坚持,不想看书却翻开,不想早起却起身——这些小事,都是在修炼交易“内功”。 五、超越他人,在于做别人做不到的事 信息时代,技术和资源差距缩小,能否脱颖而出,看谁能坚持别人做不到的事: 1、别人看盘烦躁时,你耐心盯盘;2、别人扛不住回撤时,你坚守系统;3、别人娱乐时,你默默复盘、研究图表。这才是交易员的分水岭——不是指标或系统,而是人本身。 六、技术的尽头,是人的磨炼 市场从不缺技术、信号或老师,稀缺的是: 1、每天坚持复盘的人;2、情绪波动仍能坚守计划的人;3、明知可能亏损,仍严格执行系统的人。技术可复制,但极致自律的交易者,无可替代。交易的终极较量,从来是“人”的较量。

LIFE IS LIKE

A JOURNEY ▲

下方是大白社区本周实盘群单子,恭喜跟上的币友,如果你操作不顺,可以来试试水。

数据真实,每一单都有当时发出的截图。

搜索公众号:大白论币

BTC

分析

虽然凌晨关于因为停摆发放工资的提议没有通过,但对于周末的情绪并没有太大的影响,Bitcoin的价格只有小幅的变动,主要是因为虽然是周未但美国参议院罕见地召开周末会议,讨论结束政府停摆的方案,虽然目前还未正式安排新的投票。不过,多数党领袖 John Thune 表示,周六晚些时候可能出现投票机会,特别是针对推进众议院通过的继续决议,本质的目的都是为了结束政府的停摆。截止到目前停摆已进入第39天,为了结束停摆参议院决定取消退伍军人节休会,继续开会直到问题解决。

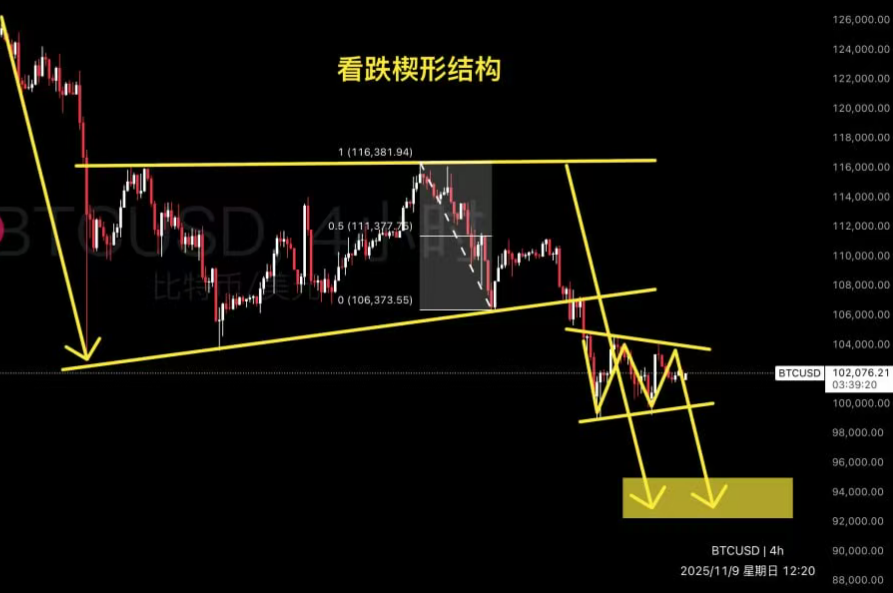

比特币上涨通道跌破,第一个目标:94200美元。看跌楔形结构!下跌延续,目前也在中继调整。小目标也是94000-92000区间

ETH

分析

回到的数据来看,周末流动性大幅消减后换手率也在下降,投资者的情绪开始回归正常,目前对于大饼来说最大的影响可能还是来自于美国的停摆,虽然现在美国民众对于停摆已经有了不错的预期,但如果继续延期不论是实际的经济影响还是对投资者信心的影响都会有不良的反应。

从 URPD的数据来看,目前筹码结构还算是稳定,虽然低于支撑价格,但差距并不是很大,当前的支撑位也没有破坏的迹象,先等停摆结束吧。

以太坊三角形调整中,短期目标2900-3000。

免责声明:以上内容均为个人观点,仅供参考!不构成具体操作建议,也不负法律责任。市场行情瞬息万变,文章具有一定滞后性,如果有什么不懂的地方,欢迎咨询

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。