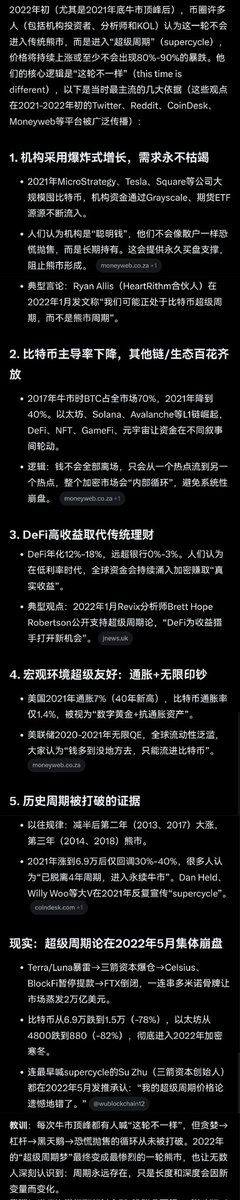

2022年初,尤其是2021年底牛市顶峰后,币圈许多人(包括机构投资者、分析师和KOL)认为这一轮不会进入传统熊市,而是进入“超级周期”(supercycle),价格将持续上涨或至少不会出现80%-90%的暴跌。他们的核心逻辑是“这轮不一样”(this time is different),以下是当时最主流的几大依据(这些观点在2021-2022年初的Twitter、Reddit、CoinDesk、Moneyweb等平台被广泛传播):1. 机构采用爆炸式增长,需求永不枯竭2021年MicroStrategy、Tesla、Square等公司大规模囤比特币,机构资金通过Grayscale、期货ETF源源不断流入。

人们认为机构是“聪明钱”,他们不会像散户一样恐慌抛售,而是长期持有。这会提供永久买盘支撑,阻止熊市形成。

典型言论:Ryan Allis(HeartRithm合伙人)在2022年1月发文称“我们可能正处于比特币超级周期,而不是熊市周期”。

2. 比特币主导率下降,其他链/生态百花齐放2017年牛市时BTC占全市场70%,2021年降到40%。以太坊、Solana、Avalanche等L1链崛起,DeFi、NFT、GameFi、元宇宙让资金在不同叙事间轮动。

逻辑:钱不会全部离场,只会从一个热点流到另一个热点,整个加密市场会“内部循环”,避免系统性崩盘。

3. DeFi高收益取代传统理财DeFi年化12%-18%,远超银行0%-3%。人们认为在低利率时代,全球资金会持续涌入加密赚取“真实收益”。

典型观点:2022年1月Revix分析师Brett Hope Robertson公开支持超级周期论,“DeFi为收益猎手打开新机会”。

4. 宏观环境超级友好:通胀+无限印钞美国2021年通胀7%(40年新高),比特币通胀率仅1.4%,被视为“数字黄金+抗通胀资产”。

美联储2020-2021年无限QE,全球流动性泛滥,大家认为“钱多到没地方去,只能流进比特币”。

5. 历史周期被打破的证据以往规律:减半后第二年(2013、2017)大涨,第三年(2014、2018)熊市。

2021年涨到6.9万后仅回调30%-40%,很多人认为“已脱离4年周期,进入永续牛市”。Dan Held、Willy Woo等大V在2021年反复宣传“supercycle”。

现实:超级周期论在2022年5月集体崩盘Terra/Luna暴雷→三箭资本爆仓→Celsius、BlockFi暂停提款→FTX倒闭,一连串多米诺骨牌让市场蒸发2万亿美元。

比特币从6.9万跌到1.5万(-78%),以太坊从4800跌到880(-82%),彻底进入2022年加密寒冬。

连最早喊supercycle的Su Zhu(三箭资本创始人)都在2022年5月发推承认:“我的超级周期价格论遗憾地错了。”

教训:每次牛市顶峰都有人喊“这轮不一样”,但贪婪→杠杆→黑天鹅→恐慌抛售的循环从未被打破。2022年的“超级周期梦”最终变成最惨烈的一轮熊市,也让无数人深刻认识到:周期永远存在,只是长度和深度会因新变量而变化。

来自于 Grok 的总结。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。