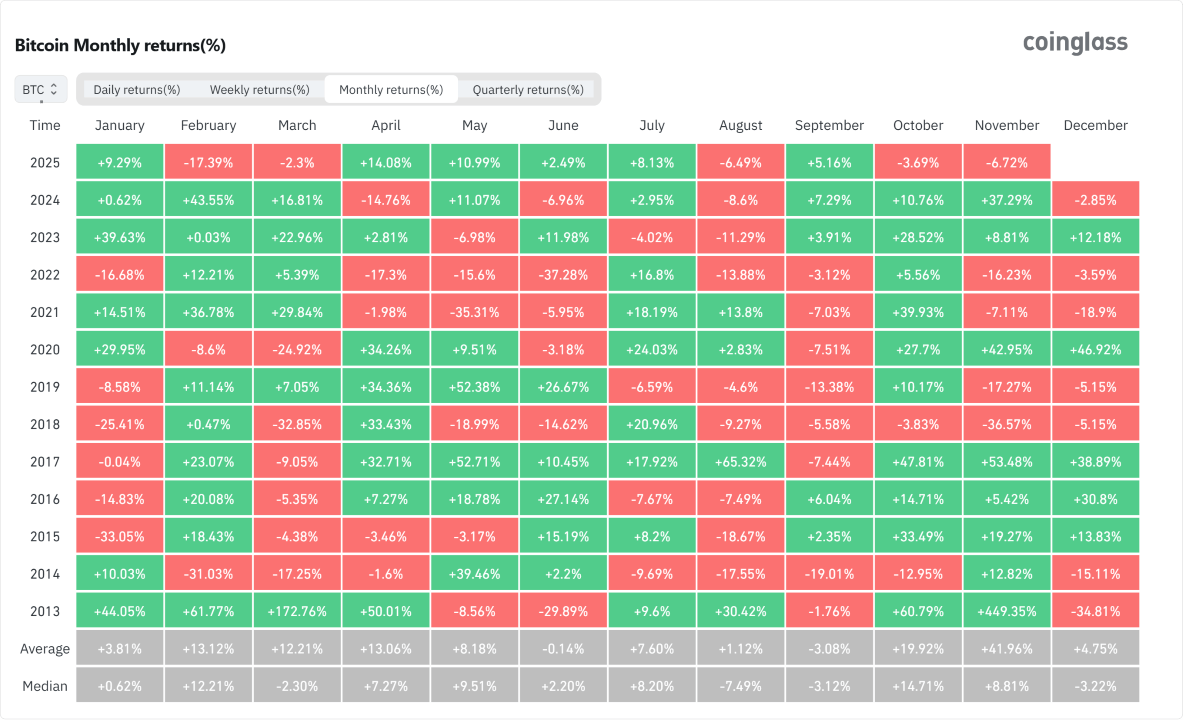

11月通常是比特币的好月份。根据Coinglass的数据,从2013年到2024年,这种加密货币在66%的时间里实现了正的月度回报。但今年11月却有所不同。由于运气不佳、贪婪和不切实际的高期望的结合,BTC已经下跌了6.72%并且还在继续。

(比特币自2013年以来的历史月度回报 / Coinglass)

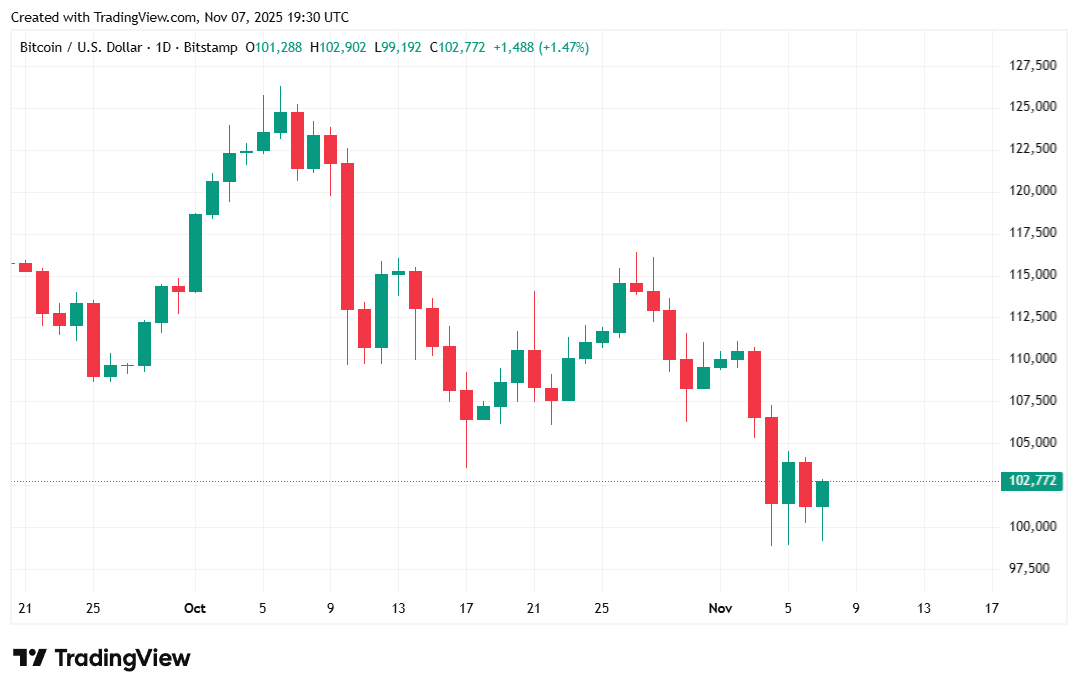

在10月6日,这种数字资产达到了126K美元的峰值。看涨的交易者在对200K年末价格的呼声越来越高时,纷纷加杠杆。Glassnode的指标显示,当时99.8%的比特币处于盈利状态。“我们预计BTC将在第三季度末上涨到约135,000美元,并在第四季度末达到200,000美元,”渣打银行在夏季的一份报告中预测。

但一切在10月10日发生了变化,当时明显激动的唐纳德·特朗普对中国发起攻击,指责北京采取阴险的贸易手段,并威胁对中国商品实施“大幅增加”的关税。结果是加密货币历史上最大的清算事件。超过190亿美元的保证金被清算,比特币在随后的混乱中跌破了110K美元。BTC的价格波动不定,时而上涨,时而下跌,但从未完全恢复。

随后,由于所谓的AI泡沫、劳动力市场担忧和美国联邦政府的长期停摆,股票市场的骚动对比特币施加了更大的下行压力,使其首次跌破100K美元,自2025年6月以来首次。该数字资产现在横盘交易,专家们正在激烈讨论未来的价格走势。

一个被问到的问题是,$100K是否是新常态。大多数分析师并不这样认为。预测已被下调,但大多数专家仍然看好比特币的未来反弹。“由于市场表现和其他因素,我们将看涨的比特币目标从185,000美元下调至120,000美元,”Galaxy的全公司研究负责人亚历克斯·索恩在周三给客户的报告中表示。

Coindesk周四报道,摩根大通预测比特币价格“在接下来的六到十二个月内可能高达170,000美元”,这是基于与黄金的定量比较。“最近的稳定性传达的信息是,永续期货的去杠杆化可能已经过去,”摩根大通在Coindesk文章中提到的报告中表示。换句话说,10月的清算事件可能是一个异常,数字货币很快将重新回到上升轨道。

比特币在周五下午上涨了1.2%,在报道时交易价格为102,879.05美元,但周度表现仍然下跌了6.24%,Coinmarketcap的数据表明。该数字资产在99,257.06美元和102,912.61美元之间波动。

(比特币价格 / Trading View)

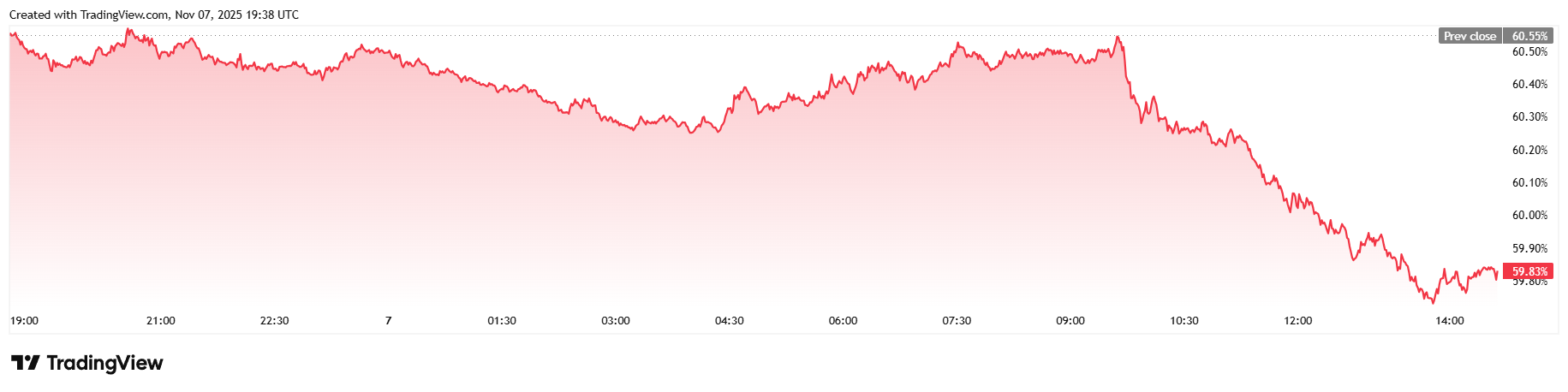

24小时交易量跃升47.42%,达到911.5亿美元,市值小幅上升至2.05万亿美元。同时,比特币的主导地位显著下降,减少了1.2%,降至59.80%。

(BTC主导地位 / Trading View)

根据Coinglass的数据,比特币期货未平仓合约的总价值上升了5%,达到713亿美元。清算在周五终于有所缓解,过去24小时内降至1.4837亿美元。多头和空头的损失接近更均匀的分布,但多头仍然损失更多,损失了8486万美元。空头的清算保证金略少,为6352万美元。

- 为什么比特币停留在$100K左右?

全球不确定性、AI股票动荡和美国政府的长期停摆使价格保持平稳。 - 导致从$126K大跌的原因是什么?

特朗普在10月10日对中国的关税威胁引发了190亿美元的加密货币清算,抹去了数月的涨幅。 - 分析师们仍然看好比特币吗?

Galaxy将目标下调至$120K,但摩根大通仍然认为BTC在一年内可能达到$170K。 - $100K是新常态吗?

大多数专家表示不是,他们认为横盘趋势是下一次反弹前的暂停,一旦宏观压力减轻。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。