作者:Jasper De Maere

编译:深潮 TechFlow

说在前面

流动性推动加密货币周期,而通过稳定币、ETF和DAT(数字资产信托)的资金流入已明显放缓。

全球流动性依然强劲,但较高的SOFR(担保隔夜融资利率)使资金流向国债而远离加密货币市场。

加密货币目前处于自我融资阶段,资本在内部循环,等待新的资金流入回归。

流动性决定着每一个加密货币周期。虽然长期来看,技术应用可能是加密货币故事的核心驱动力,但真正推动价格变化的却是资金流动。过去几个月,资金流入的势头有所减弱。在资本进入加密生态系统的三个主要渠道——稳定币、ETF和数字资产金库(DATs)中,资金流动的势头都在减弱,使得加密货币目前处于自我融资阶段,而非扩张期。

尽管技术应用是重要的推动力,但流动性才是驱动并定义每一个加密货币周期的关键。这不仅仅关乎市场深度,更关乎资金本身的可得性。当全球货币供应扩张或实际利率下降时,多余的流动性不可避免地会寻找风险资产,而加密货币在历史上,尤其是2021年的周期中,曾是最大的受益者之一。

在以往的周期中,流动性主要通过稳定币进入数字资产领域,稳定币是核心的法币入场通道。随着行业逐渐成熟,三大流动性渠道逐渐成为决定新资本流入加密货币的关键:

-

数字资产金库(DATs):将传统资产与链上流动性连接起来的代币化基金和收益结构。

-

稳定币:作为法币流动性的链上表现形式,为杠杆和交易活动提供基础抵押品。

-

ETF:传统金融中为被动投资和机构资本提供BTC和ETH敞口的接入点。

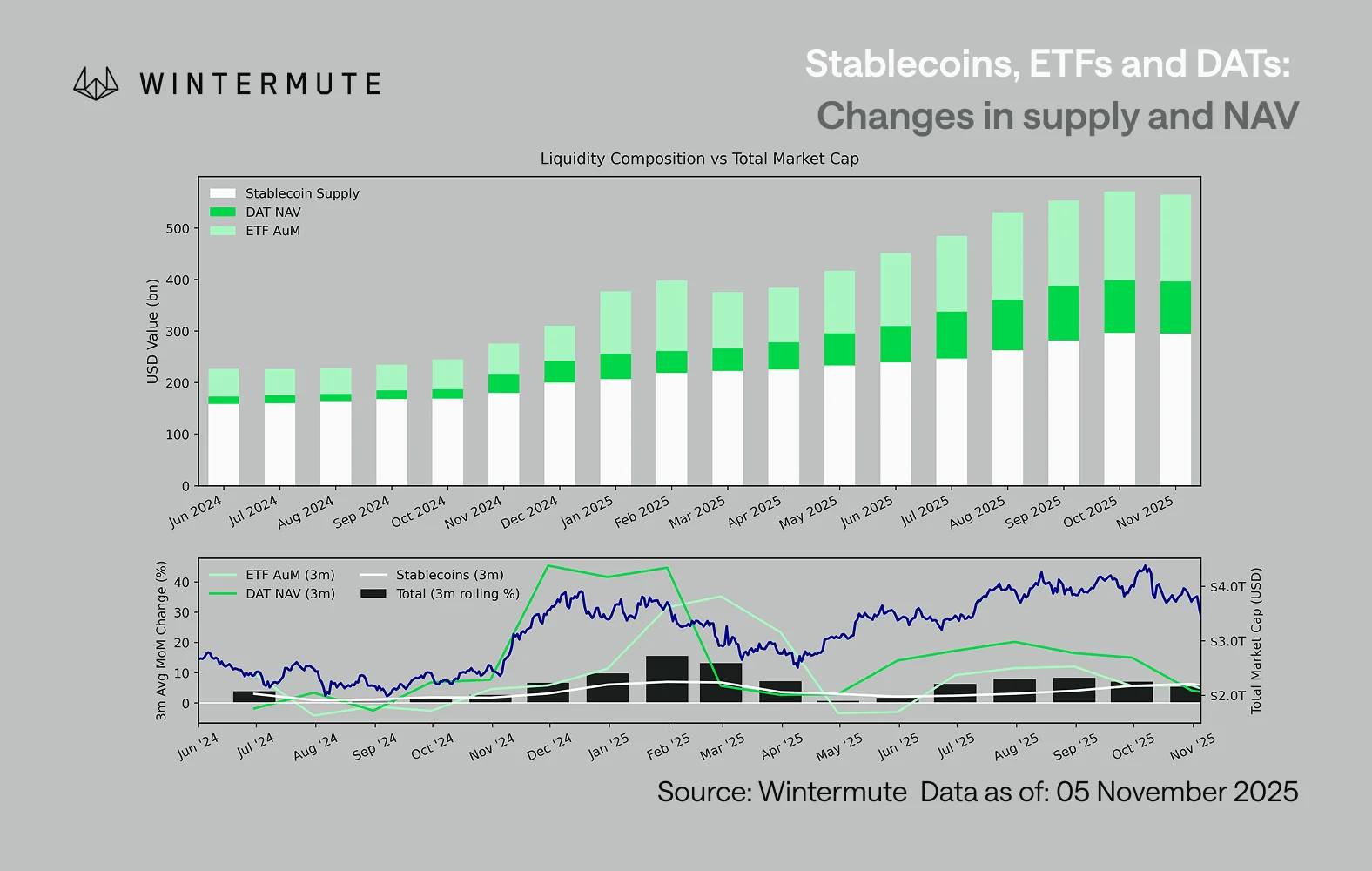

结合 ETF 资产管理规模(AUM)、DAT净资产价值(NAV)和发行的稳定币数量,可以合理地估算流入数字资产的总资本。下图展示了过去18个月中这些组成部分的变化趋势。图表底部清晰地显示,总量变化与数字资产总市值密切相关,当资金流入加速时,价格随之上涨。

关键的观察点是,DAT 和 ETF 的资金流入势头显著放缓。两者在2024年第四季度和2025年第一季度表现强劲,夏季初曾短暂回升,但这一动力随后逐渐减弱。流动性(M2货币供应量)不再像年初那样自然地流入加密生态系统。从2024年初开始,DAT和ETF的总规模从约400亿美元增长到2700亿美元,而稳定币的规模则从约1400亿美元翻倍至约2900亿美元,虽然显示出强劲的结构性增长,但也呈现出明显的增长停滞。

这种放缓至关重要,因为每个渠道反映了不同的流动性来源。稳定币反映了加密行业内部的风险偏好,DAT 则捕捉了机构对收益的需求,而 ETF 则反映了更广泛的传统金融(TradFi)配置趋势。三者同时趋于平缓,表明新资本的部署整体放缓,而不仅仅是产品之间的资金轮换。流动性并未消失,而是仅在系统内部循环,而非扩展。

从加密货币之外的更广泛经济来看,流动性(M2货币供应量)也并非停滞不前。虽然较高的SOFR利率在短期内对流动性形成一定约束,使现金收益率具有吸引力并将资金锁定在国债中,但全球仍处于宽松周期,美国的量化紧缩(QT)已正式结束。整体结构性背景仍然具有支持性,只是目前流动性选择了其他风险表达方式,例如股票市场。

随着外部资金流入减少,市场动态变得愈发封闭。资本更多地在主流币种和山寨币板块之间轮换,而非新增净流入,形成了这种“玩家对玩家”(PVP)局面。这也解释了为何市场反弹持续时间短暂,以及为何市场广度缩窄,即使总资产管理规模(AUM)保持稳定。当前的波动性高峰主要由清算连锁反应驱动,而非持续的趋势形成。

展望未来,任何一个流动性渠道的显著复苏,例如稳定币的重新铸造、新的ETF创建或DAT发行的增加,都将表明宏观流动性再次回流至数字资产领域。在此之前,加密货币仍处于自我融资阶段,资本只在内部循环,而未实现增值扩展。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。